We banked on it

Back in January this year, The Montgomery Global Fund’s Portfolio Manager, and CIO for Montaka Global Fund, Andy Macken wrote a blog here warning investors about the quality of Bendigo and Adelaide Bank’s (ASX:BEN) earnings.

“So why the 70 per cent share price rally over the last nine months? Well, it is true that Bendigo generated profit growth in financial year 2016. Around three per cent pre-tax profit growth, to be precise. And it is also true that the bank increased its full-year dividend by three per cent to 68 cents per share. Dividend growth underpinned by earnings growth is just what investors like.

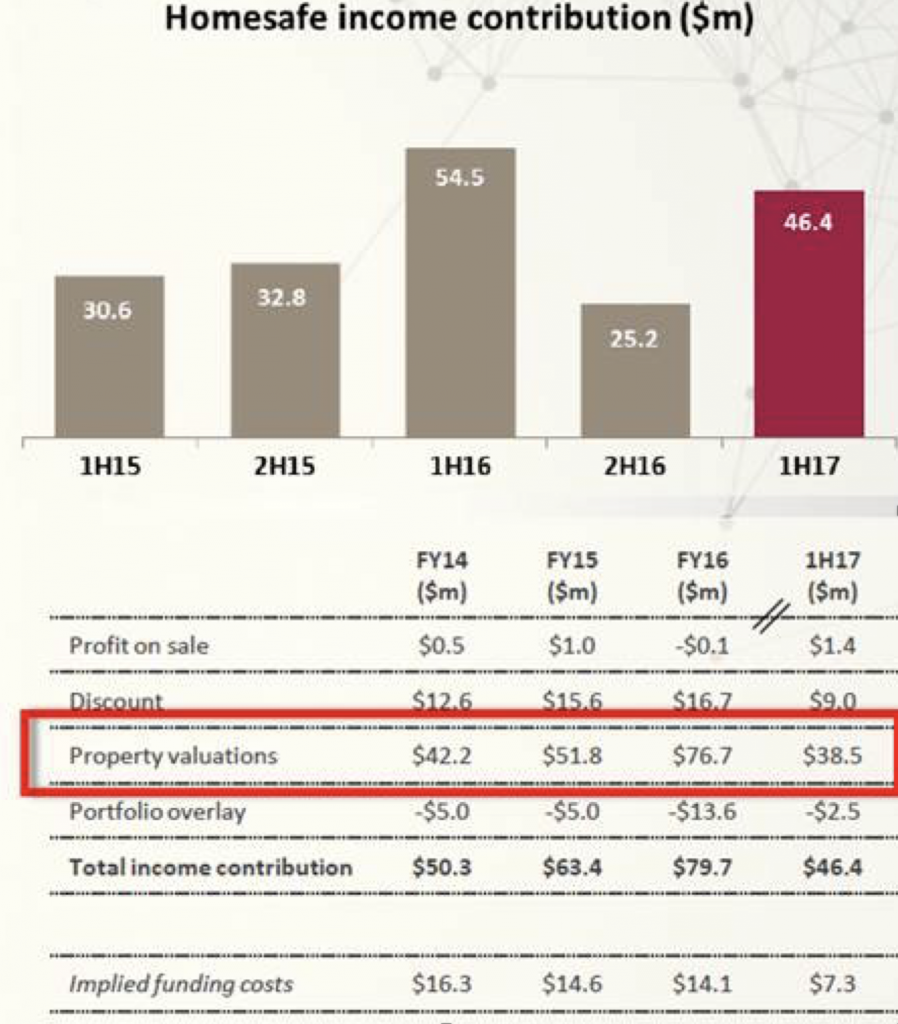

“On the other hand, a closer examination of the source of Bendigo’s earnings growth might lead investors to think again. In 2016, more than 100% of the bank’s earnings growth was driven by a “contribution” from the Homesafe Trust, contained in “Other Income” on Bendigo’s profit and loss statement. (This was also true in 2015). Bendigo’s Homesafe program buys shares in future sale proceeds of residential real-estate. The idea is to release home equity into cash that can be used by homeowners – typically retirees who might be asset-rich but cash flow poor.

“There is an interesting accounting consequence of this program which directly impacts Bendigo’s reported earnings each period. As property prices go up, the bank values its ownership stakes at higher levels – and books the difference as a non-cash gain through its profit and loss statement. In the words of Bendigo: “The increase in the Homesafe Trust contribution was primarily due to the increase in Sydney and Melbourne residential property prices during the first half of the year.” (Of course, if property prices were to fall, the reverse would be true and revaluation losses would need to be run through Bendigo’s profit and loss statement).

“…had it not been for the Homesafe gain in 2016, pre-tax earnings would have declined by almost 11 per cent. And therein lies the concern. Bendigo is growing its dividend by growing its earnings. But its earnings are growing solely because of property price growth. What will become of the bank’s dividend should property prices stop rising at such a fast rate?

And today is the day the rest of the market has woken up. One broker wrote to me this morning; “Amazing to think they’ve gotten away with it for so long.”

It is vital to understand however that Mike Hirst, MD at BEN (and one of the more attentive and passionate bank MD’s I have spoken with) has been challenged by this decision and in particular its timing. You see, as Mike explained, the decision to make the change has been in response to market criticism (including Andy Macken’s) about consolidating Homesafe’s results. Understandably, management must be perplexed today by the market’s reaction after acquiescing to its very demands. And we have some sympathy for them.

While it may be unbelievable to some brokers, it is unsurprising to us that BEN ultimately announced a change to the accounting of its Homesafe product. It’s a change that was some time coming.

It is interesting that the timing of the companys decision coincides with broader market consensus that residential real estate price growth may be flattening and may even turn negative soon. Whether this is actually the view of management and the accounting team, we do not know.

Remembering that historically BEN has booked non-cash, mark-to-market gains from house price growth (in Syd/Melb) through the income statement…then paid dividends from it, it’s always worth questioning why the accounting changes now?

Our friends at UBS have calculated that Homesafe has contributed an aggregate $189.5m income over the past 2.5yrs alone and circa 14% of pre-tax profit in recent periods, concluding; “With NIM under pressure…CET1 sitting at just ~8% as we near “Unquestionably Strong” release…no more “earnings growth” from Homesafe revaluations…and trading at a tighter yield than NAB and WBC…SELL.”

We agree. Keep in mind we could be wrong and we know nothing of your personal financial circumstances or needs, so this is commentary that is general nature and cannot be considered investment advice. Be sure to seek and take personal professional advice.

BEN is a short position in the Montaka Global Fund.

Is BEN required to re-report prior years using their new accounting method or will this be a footnote in their 2017 report?

Great Question Dane. Restating prior year’s earnings may only be optional. If so they may only adjust the prior year for YoY comparison purposes. We’ll see in due course.