Navigating the Victorian rental crisis

In this week’s video insight, I explore the challenging dynamics of the Victorian rental market – a pressing issue that uniquely impacts both renters and investors. Amid a nationwide rental crisis, Victoria stands out due to its plummeting rental vacancy rates and the surprising exodus of investors from the market. Despite what seems like a prime scenario for property investors, with demand high and supply low, why are many opting to leave? I delve into the reasons behind the investor retreat, explore the economic forces at play, including significant tax increases and the broader implications of these changes.

Transcript:

We know a disproportionately large portion of our investors, those in our equity and private credit funds, are also investment property owners across Australia. Many own multiple properties, and so today, we’re diving into a hot topic that’s affecting many of us right now: the rental crisis. And while the issue is a national one, I want to zoom in on Victoria, Australia, where things are getting quite intense for both renters and investors.

So, what’s happening? Well, you’d think property investors with exposure to Victoria would be cheering – Victoria’s rental vacancy rate has plummeted to just 1.01 per cent, so more demand and less supply should make owning a Victorian rental property a very successful endeavour. But here’s the twist – investors are actually leaving the market.

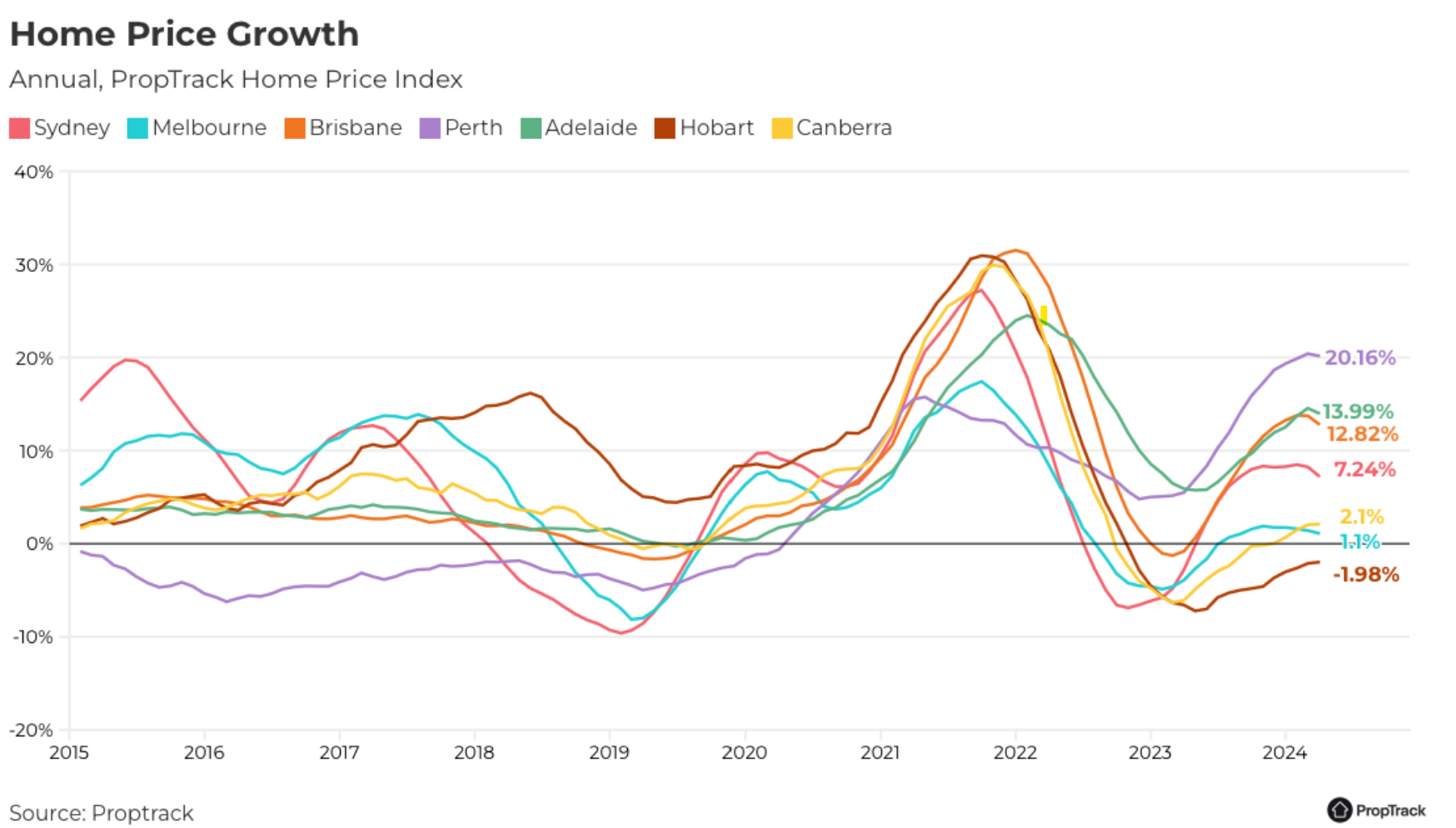

As you can see from the following charts supplied by Proptrack, Melbourne property prices are lagging behind many sunnier cities, and with prices up just 1 per cent in the last twelve months, it seems barista coffee, drizzle and scraping ice of your windscreen has lost some their appeal.

And what is it? Well, two big reasons: there is of course the adverse impact of those higher interest rates we’ve all heard so much about but in Victoria it is being compounded by even higher taxes. That’s right; whenever the labour government has a budget issue, they turn to other people’s money to fix it. Forgetting Margaret Thatcher’s reminder that the problem with socialism is you eventually run out of other people’s money, the Victorian Government recently introduced a slew of new taxes that hit everything from property development windfalls to a tax on Airbnb rentals, equivalent to 7.5 per cent tax of annual revenue.

And just when the market was trying to digest those, more taxes were introduced, expanding a vacant residential land tax to cover the entire state, including holiday homes. It’s no wonder the Real Estate Institute of Victoria reports that one in four Victorian property holders sold their properties last year.

And it looks like they’ve mostly moved to Queensland. Melburnians have long migrated to Noosa for their holidays but with prices for the most desirable properties in Noosa Heads and Sunshine Beach rising about fourfold in the last five or six years, the Melbourne migration has expanded to all Victorians and all of Queensland. In the last twelve months prices in Queensland have risen more than 10 per cent and in Brisbane almost 13 per cent! It seems there are indeed nuances to the socialism implemented among state labour governments.

And what does this mean for renters and the overall housing market? Well, in a reaction that is the opposite of what Victoria’s labour government intended, With investors pulling out, the availability of rental properties is falling, not rising. This isn’t good for anyone looking to rent. And according to the Property Investment Professionals of Australia, the people who supply the majority of rental homes are selling up in droves.

So, what can be done? Well, thanks to really poor spending decisions, Victoria’s budget is cooked with almost $180 billion of debt – that’s $20-$25 million in interest per day. They’re in a tough spot. And property investors – those wealthy elite capitalists – are paying for it. There are better ideas – like the UK’s idea to allow a tax-free amount of revenue to be earned from renting out a room or tweaking capital gains to offset some of the onerous recent changes.

Of course, many Victorian’s aren’t waiting for things to improve, they’ve moved to Queensland.

Thanks for watching and see you next time!

I was over in Melbourne a few weeks ago, and the taxi driver (a wise, senior Fijian man) said to me (when I asked about this very topic) that “yes, the Government has banned people having an investment property (verbatim). Too much tax, too expensive. So many people selling up here, they must hate investors”

This is a cabbie, and so, think of all the businessmen, investors etc. he has in his cab, the things they talk about to him and around him, the things he hears on the radio and reads in the newspaper, and this is probably a good overall snapshot of the public perception in Victoria.

I dare say that it would be worth looking at the various FB and Reddit groups for what they think, and also what other public commentators in the property investment field say (e.g. Propertyology, PropertyBuyer, Adviseable, Proptrack etc.)

Yes, it looks pretty dire there Chris. Thanks for sharing again!