How to profit from short selling

As you likely know, short selling is a trading strategy that involves borrowing and then selling shares in a business, with the aim of buying them back and returning them when the share price falls. What you may not realise is that it’s possible to take advantage when other investors short sell a stock.

Shorters – those who engage in shorting shares – are often blamed for why stock A or B is falling. This may be the case in certain situations, but if there were enough buyers on the other side of the trade at a specific share price – that is, to buy the shares that are being shorted or sold – then the share price has no reason to trade abnormally despite the additional selling pressure.

The practice of shorting creates a short interest, which is the number of shares that have been lent out to shorters who anticipate a share price will fall. The higher the short interest, the more market participants believe the shares are over-valued and will likely fall in the future. Short covering is when you close out a short position and buy back shares to return to the lender.

Shorting is considered riskier than long-only as the potential liability on any trade can increase continuously should the shares keep rising over time, whereas the losses on long-only trades are limited to your initial investment.

Much like traditional long-only investors, there are many times the shorters will be on the wrong side of a trade and the share price rises rather than falls. It is these situations that can lead to a “short squeeze” – where shorters look to cover their positions, which in turn creates additional buying demand for the shares.

Reporting season may provide a trigger for short covering

With reporting season approaching, it’s worthwhile knowing which stocks have a high short interest going in to the results. This is due to the potential for a short-squeeze event, which has a way of exacerbating upward moves in the share price beyond what may seem a reasonable reaction to new developments.

Many of these “shorts” have been there for a long time and are playing structural themes – for example, the longer-term impact on operating margins from Amazon’s launch in Australia on retail stocks. For others, the short interest is more catalyst driven – such as an expectation of an earnings downgrade or a capital raising. Should the company convince the market of a material improvement in the outlook, the share price reaction will be immediate.

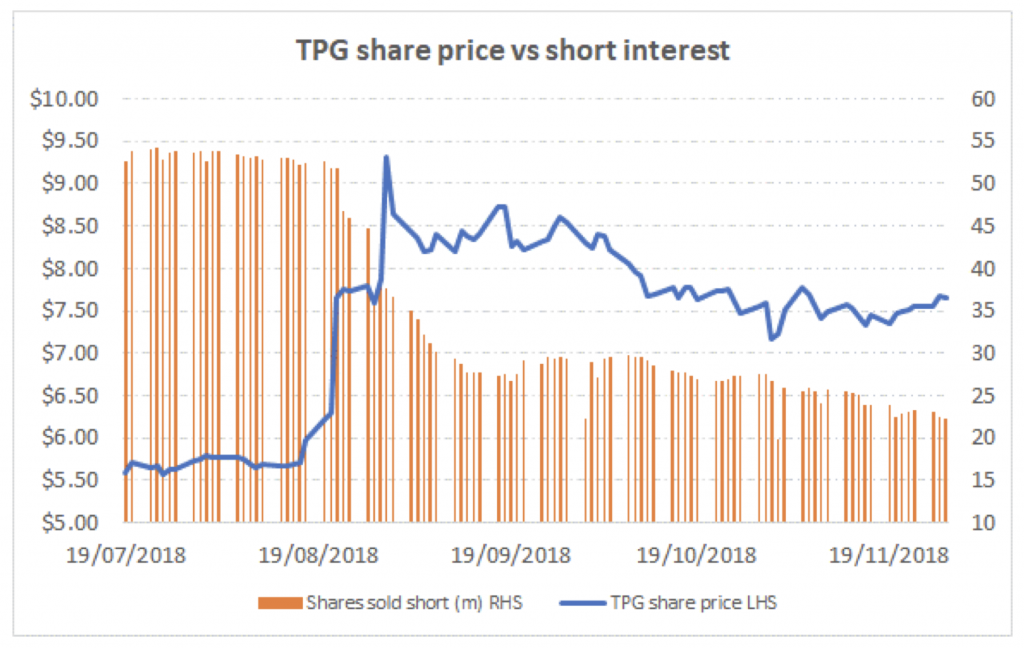

TPG’s announced merger with Vodafone provides a good example.

Source: ASIC, Bloomberg

The chart shows how the short interest prior to the announced merger was almost 55 million shares but started dropping considerably once merger speculation became public on 22 August 2018. Over that time, the share price spiked from around $5.70/share to above $9/share on the day of the announced merger, providing a potential exit for some holders cognisant of deal risk. The short interest in TPG now stands at 6.1 million shares.

While we may not see any developments as significant as the TPG-Vodafone merger announcement in this upcoming reporting season, it does help to explain some of the more significant share price moves during August.

The short interest in a stock is published by ASIC and can be found here.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY