GWA – as close to a bond as you can get – pity about the share price

Portfolio point: Reporting season is in full swing and there have been some excellent results. We always watch GWA because it’s a company that has the potential to regain its crown but the 2012 results didn’t inspire.

GWA is a leader in the design, manufacture, import and distribution of bathroom & kitchen products, door and access systems, and heating & cooling products. Brand names of these three core building fixtures and fittings divisions include Caroma, Dorf, Fower, Brivis, Dux, Gainsborough and Trilock. Analysis of virtually every financial measure over the past five years has seen GWA demonstrate bond like qualities.

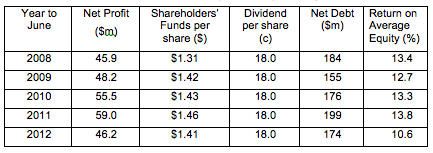

It is difficult to find another ASX listed company, over the 2008-2012 period that has demonstrated such incredibly flat earnings, flat dividends, flat shareholders’ equity per share and flat net debt.

Table 1. GWA – about as close to an ‘equity’ bond as you can get.

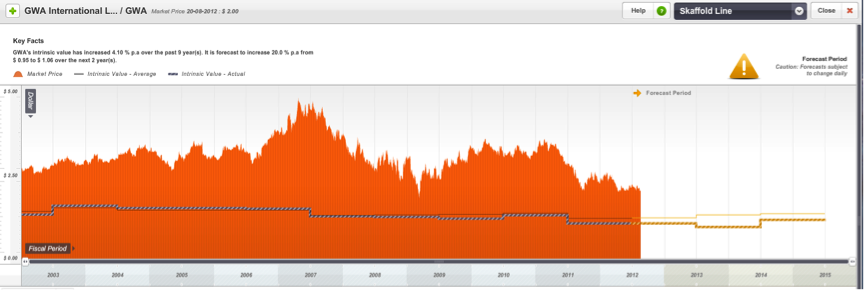

The only problem for shareholders of GWA is their share price has more than halved over the past five years from over $4.00 to under $2.00. This poor share price performance is a function of lack of earnings growth, declining return on equity and a dividend payout ratio exceeding 100% of its earnings. In Fiscal 2012 it was 118%. Fortunately, Skaffold has never suggested anything more than an askance look be paid for GWA shares.

While Montgomery’s estimate of GWA’s intrinsic value has been consistently below its share price throughout the past decade (Figure 3.), there was a further warning when the company’s rating went from the mediocre B3 to the below investment grade rating of B4 in 2008 and again in 2011. It is also forecast to receive a B4 rating for 2013 (see Fig 3.).

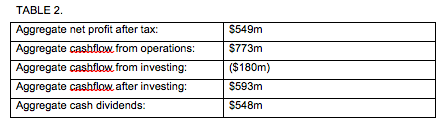

Readers will observe (see Table 2.) the aggregate cash dividends and aggregate net profit after tax over the 2003-2012 period is virtually identical at $548m.

Cashflow generation over the past decade, even after investing activities, at $593m, exceeds net profit ($549m).

GWA is in a classic ‘maturity’ bind. Return on equity exceeded 15% in each financial year 2003 to 2007, inclusively. By 2012 it was down to 10.6%. In trying to find sustainable earnings growth should GWA cut its dividend and invest more aggressively in its business and wait for the home building cycle to recover?

Management continue to streamline the GWA businesses while working hard to boost their market share – 13% of the $5 billion market. In last week’s annual results presentation, Managing Director Peter Crowley said GWA were focused on product innovation, brand management and supporting aligned (distribution) channels. Crowley’s broad ranging strategic review has provided clear priorities for growth including “product and market adjacencies as well as customer and channel development”.

Our best-of-luck wishes go to the company regarding its customer development strategy with respect to Dux. We question the hot water factory upgrade at Moss Vale at a time when there is a clear trend to instantaneous hot water!

GWA’s operational strategy is to focus on market-facing operations including product fabrication and assembly, supply chain management and installation and service.

We are wary of the high staff turnover at the senior management levels; the relocation of the customer care division causing a loss of corporate memory; and the outsourcing of the manufacture of the excellent Caroma bathroom products to China. This has seen some loss of custom from Reece, who also have the ability to manufacture in China.

From a financial viewpoint, Fiscal 2012 saw GWA pay out 18 cents per share in dividends while only earning 15 cents per share. This is not sustainable. The Board has in fact targeted a payout ratio from Fiscal 2013 of 80%-95% and the consensus dividend forecast is for 15 cents per share.

GWA is not a bond and as the market grasps the likely cut in dividends we would expect the share price to remain under pressure.

Andrew Legget

:

Hi Roger,

Just wanted to comment on how i am enjoying the new site, contributors etx and the fact we seem to be getting many more interesting little articles like this. As someone who hopes to join the ranks of institutional or professional value investing one day, I find it really interesting to see the thought process that you guys go through and these types of articles basically do this.