Falling property market could squeeze State budgets

While Australia’s declining housing market is good news for first-time home buyers, it’s bad news for the economy. One big concern is what’s called the reverse wealth effect. Another is the adverse impact that a falling market could have on state budgets which could in turn have an impact on infrastructure spending.

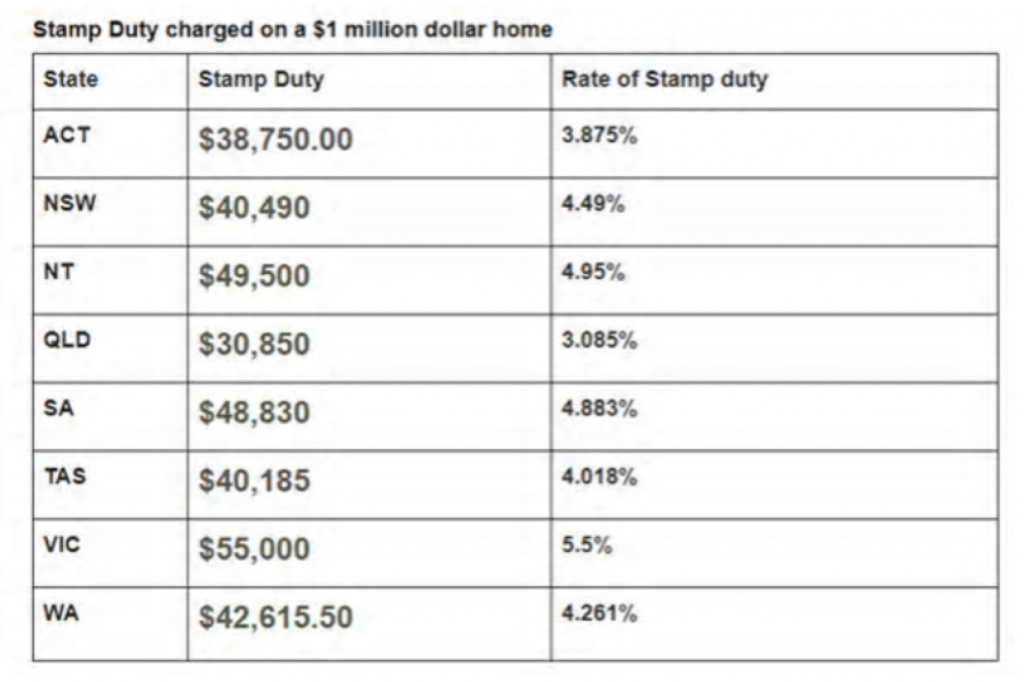

Australia states get a significant portion of their revenues from stamp duty on property transactions. The rate varies between the states but is between 3-5.5 per cent. The table below shows the stamp duty payable on a $1 million property.

Source: Supplied

As you can see, it is substantial sums of money and given the size of the property market, it adds up to significant money overall.

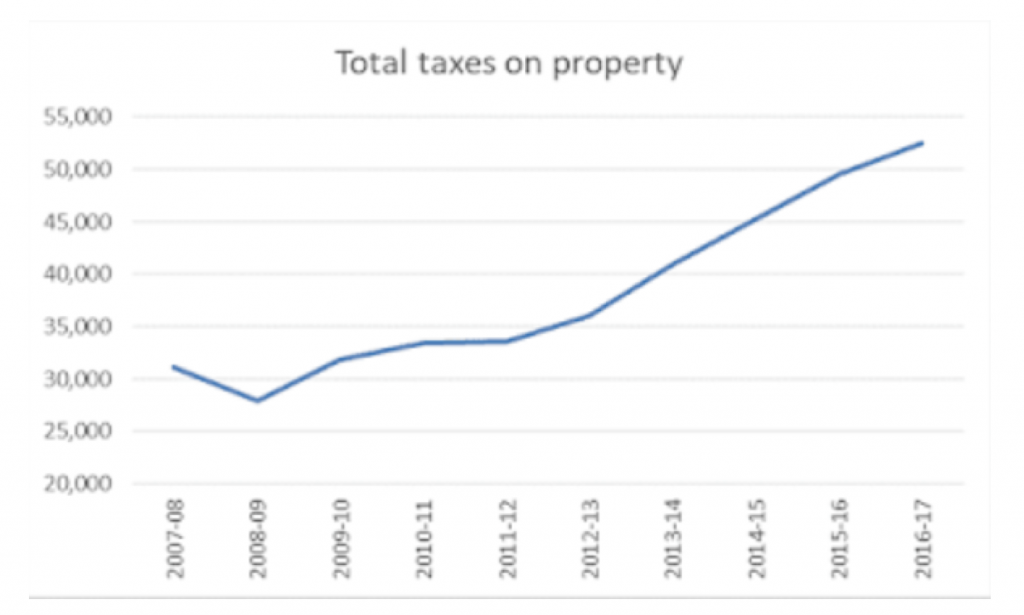

In total, the states around Australia collected a bit over $50 billion in stamp duty in FY2017 which is almost double the amount from 10 years before.

Source: The Pulse

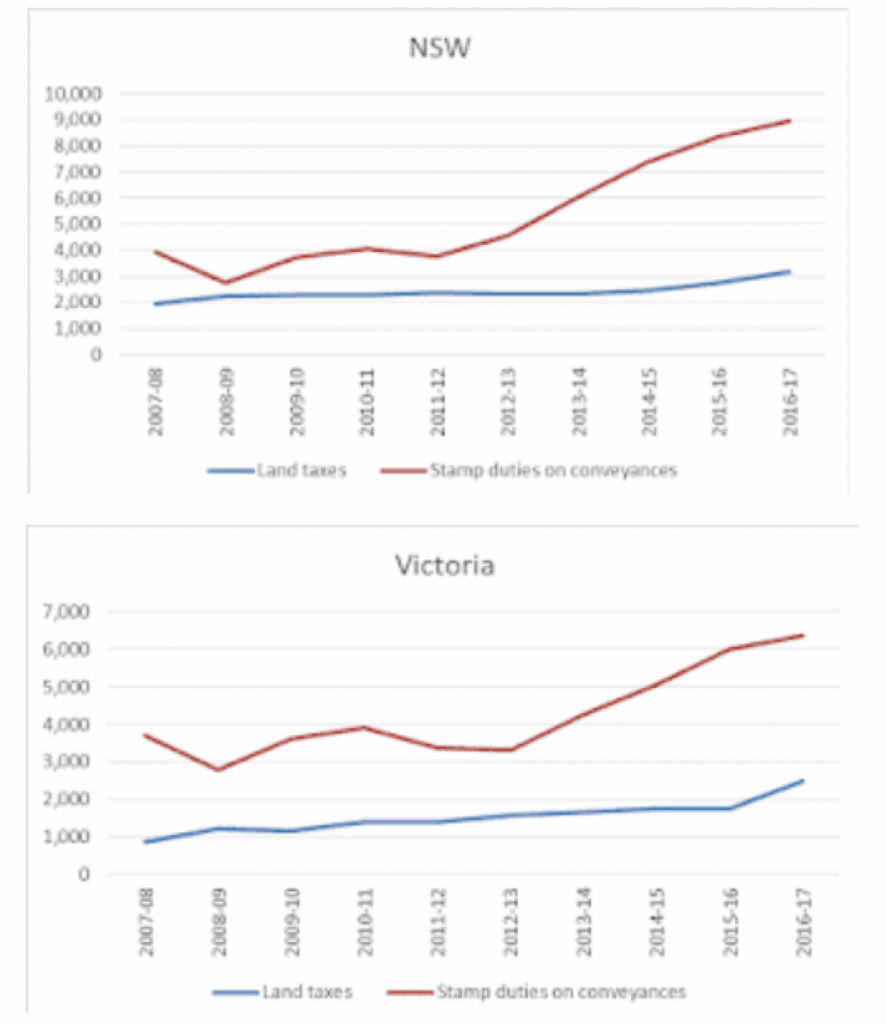

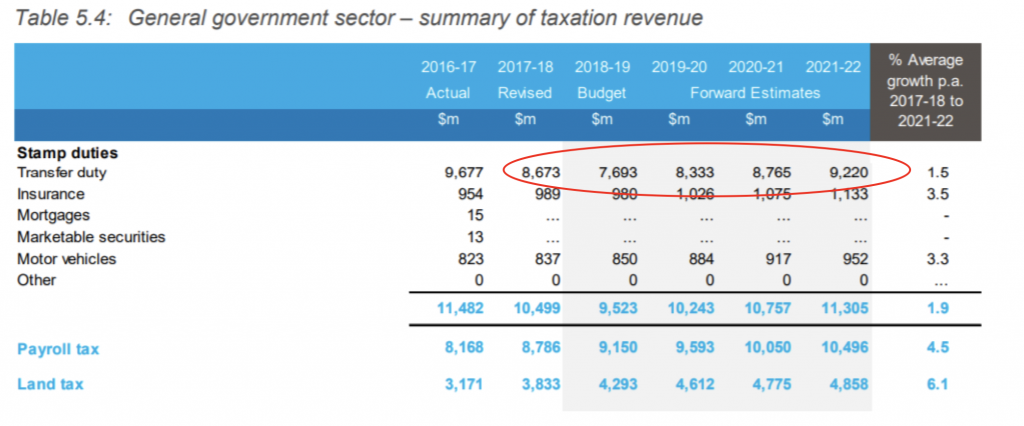

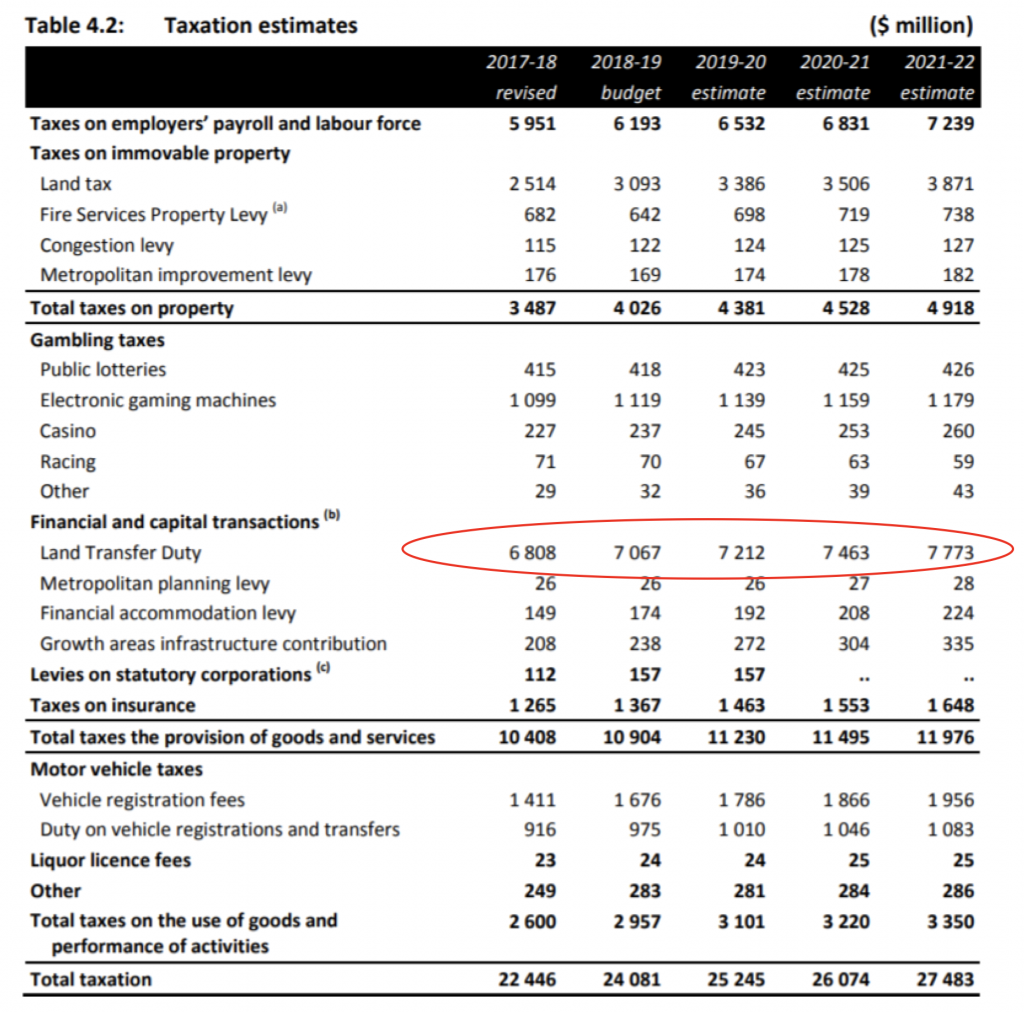

The states of NSW and Victoria have been the biggest beneficiaries of stamp duty due to having seen the highest increases in property prices. In 2017, stamp duty receipts accounted for 10.8 per cent of total NSW state revenues and 10.6 per cent in Victoria.

Source: The Pulse

What is happening in the property market has therefore the potential to have a large impact on state finances.

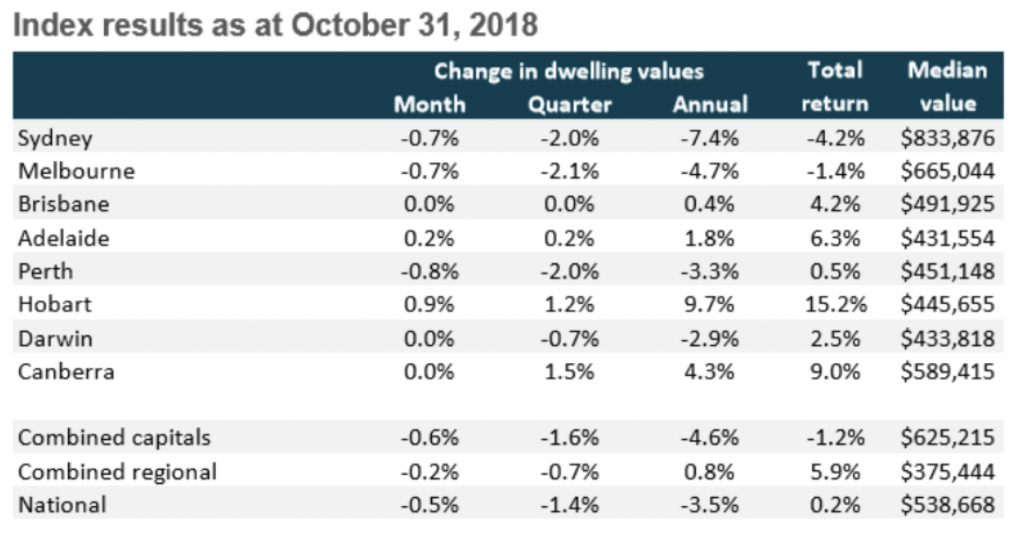

The pricing trends are well known. Sydney is down the most over the last year with a bit over 7 per cent and with Melbourne starting to approach a 5 per cent fall during the last year.

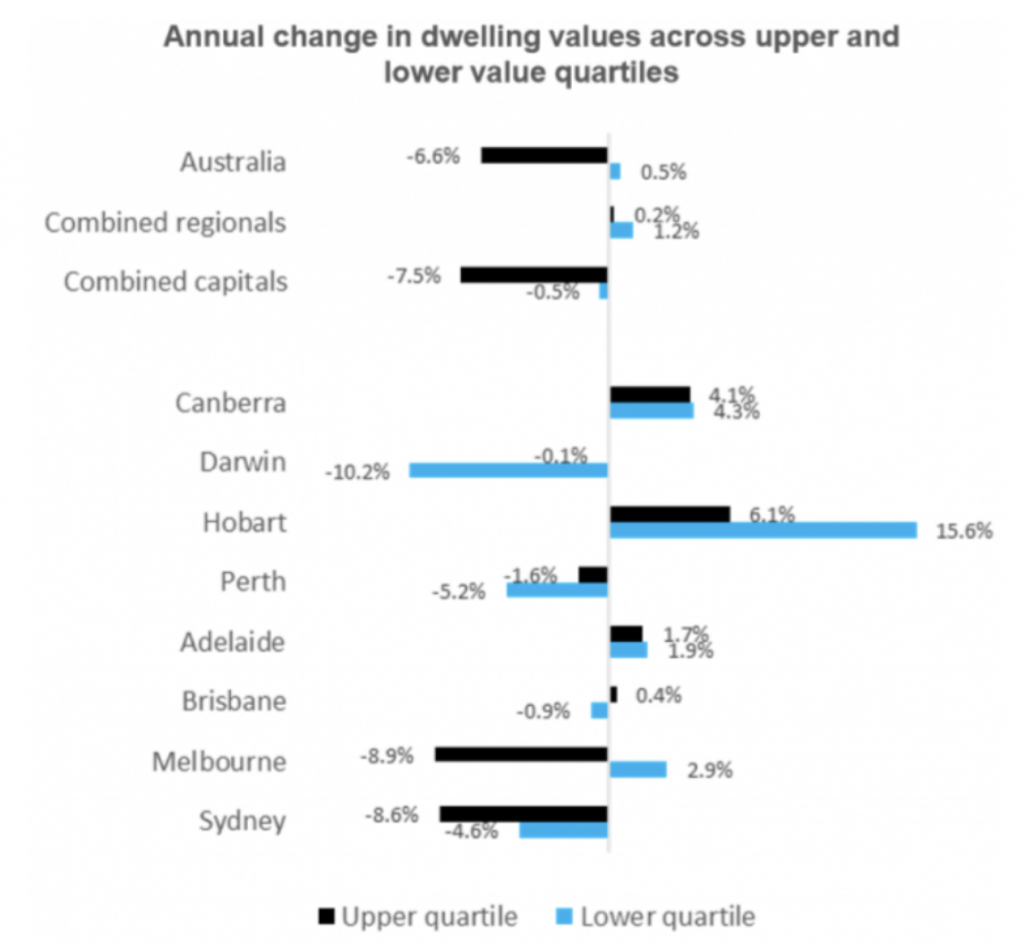

Adding to falling values, is the upper end of the market is falling the most and as stamp duty is a progressive tax, as it is only collected above a threshold, this means that stamp duty overall is falling more than the average house price falls should indicate:

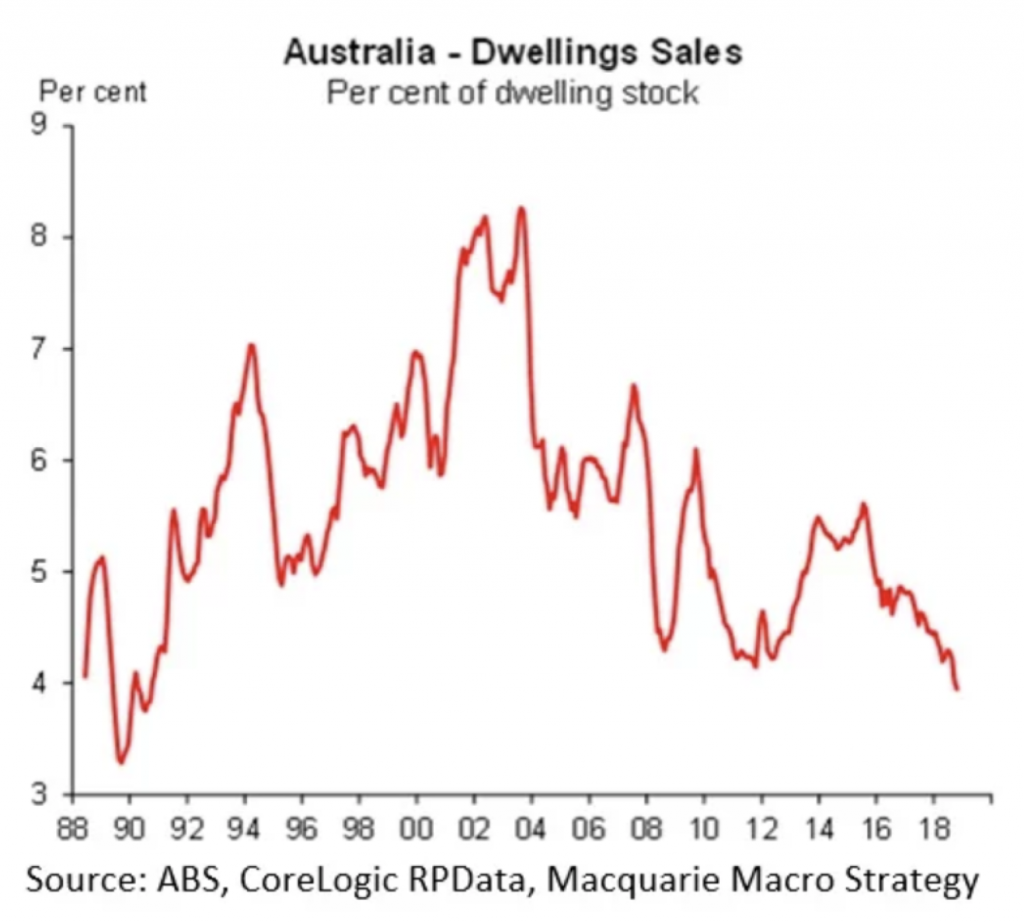

What is probably less known is that the transaction volume has also collapsed as can be seen in the chart below from Macquarie which shows that current transaction volumes are the lowest since the early 90s and down around 30 per cent since the most recent peak in 2016.

The combination of falling house prices, negative mix effect from the most expensive homes falling the most and the steep drop in transaction volume must surely mean that the treasurers in our two most populous states should take a very good look at the assumptions for their budgets for the coming years.

A quick look at the most recent budgets suggests that there is a significant risk for budget shortfalls if the property market does not recover quickly both in terms of value and volume as the current estimates are for a quick recovery for NSW following a fall in FY2018 and steady growth in Victoria…

For NSW:

Source: NSW Government

And for Victoria:

The next step is then to ask what the implications are if the budgeted strong recovery does not happen?

The governments have a few choices:

- To cut back on spending and primarily on infrastructure investments. This has the unfortunate implication that it will impact the other large revenue source for state governments which is payroll taxes.

- To accept the lower revenues and fill the gap by increased borrowing. Both NSW and Victoria have a AAA credit rating and could fill the gap in this way but it might be politically hard to do.

- To raise revenues by selling state assets. This has historically been a prominent feature of both states but at least my reading of the political climate suggests that it is becoming less attractive for political reasons.

- The last alternative is to raise other taxes and in particular payroll taxes but this is also politically challenging.

What we can be certain of is that the state treasurers are watching the property market with great interest and are hoping for a quick recovery!

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY