Portfolio Puzzle

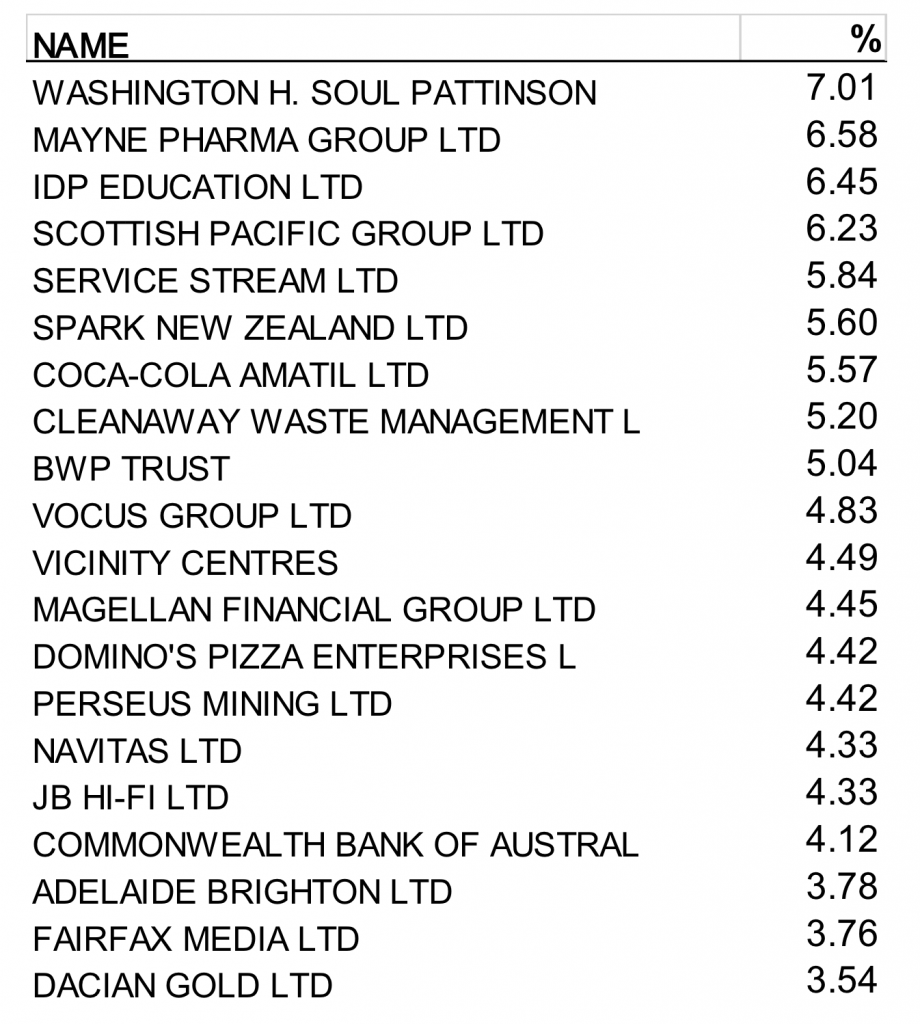

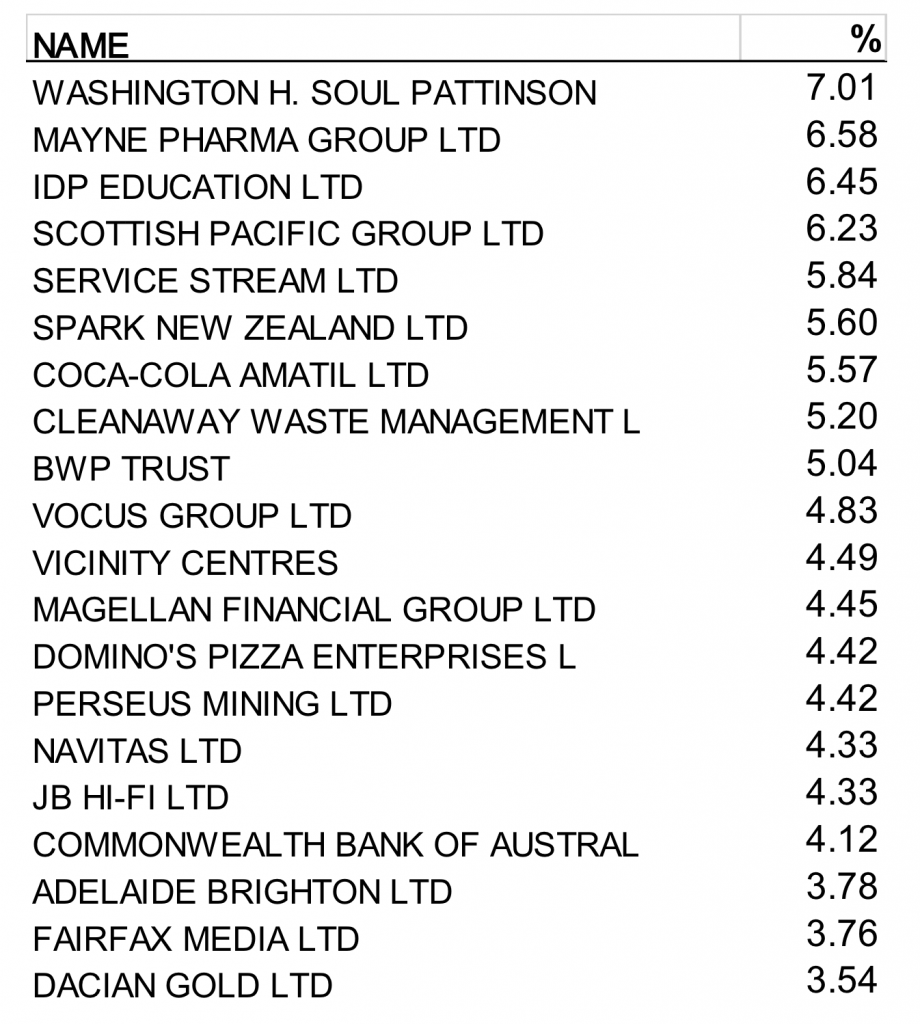

Here’s a quick test to get your week started. It’s not the sort of test that necessarily has a right or wrong answer, so don’t spend too much time trying to nut it out, but take a look at the stock portfolio set out below:

The question is this: From the individual stocks and weights in the portfolio, can you read anything concrete about the investment manager or process behind it? Are there any particular observations you can take away in terms of preferences, style, risk level, investment skill or other attributes? Can we say anything about what they got right and wrong, and if so, are there any areas for improvement?

What I will tell you is that this portfolio has produced outstanding performance for the year to date, returning a little over 13 per cent while the ASX/300 Accumulation Index has delivered a negative return of 2-3 per cent, so clearly a lot more has gone right than wrong this year.

Beyond that, I’ll fill in the missing detail and explain why I think it’s interesting in a follow-up post.

Click here to view the answer.

MORE BY TimINVEST WITH MONTGOMERY

Tim joined Montgomery in July 2012 and is a senior member of the investment team. Prior to this, Tim was an Executive Director in the corporate advisory division of Gresham Partners, where he worked for 17 years. Tim focuses on quant investing and market-neutral strategies.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.