Credit Corp Maintains Momentum

For those who have been reading our quarterly updates for the past few years on Credit Corp Group Limited (CCP), we must be beginning to sound like a broken record. We certainly feel like one.

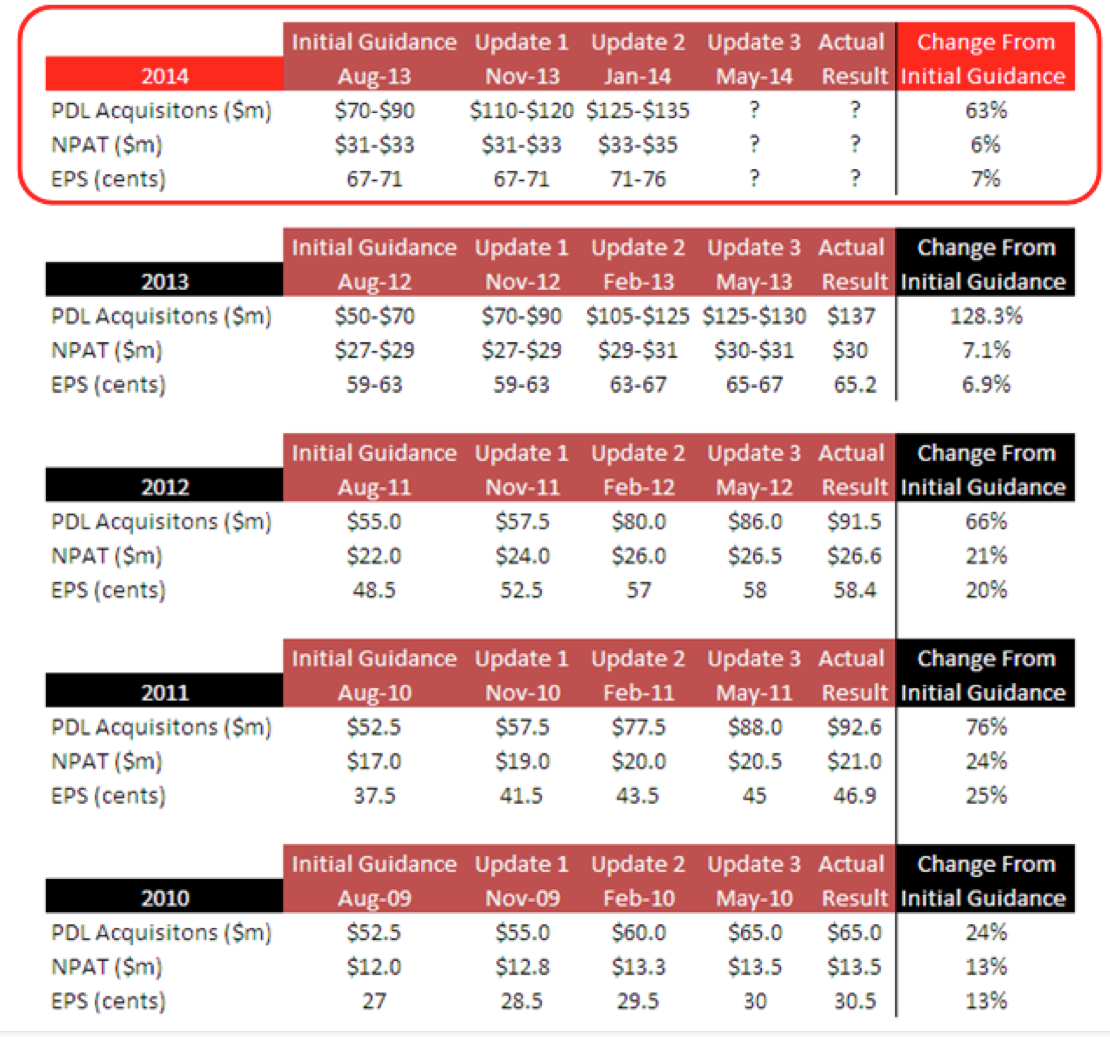

CCP effectively kicked off reporting season for us, as we hold CCP shares in both The Montgomery [Private] and Montgomery Funds. We have again updated the below tables for you:

Pleasingly, this year – as they have done since 2010 – CCP management’s historical track record of consistently breaking their conservative initial guidance at the start of each financial year remains intact.

Digesting their latest half-yearly result and using the midpoint of their guidance ranges, we can see that the increased forecasts were healthy in magnitude across the board in terms of purchased debt ledger (PDL) acquisitions, net profit after tax (NPAT) and earnings per share (EPS).

Management appears to be confident and we would agree with them. Our analysis has identified three main trends driving the business’ strong momentum, and hence guidance into the full-year results:

- Record levels of purchased debt ledgers over the past 18 months, a key variable to watch in this business, gives the collection team a larger asset to work on and deliver growing cash flows over the next 12 months.

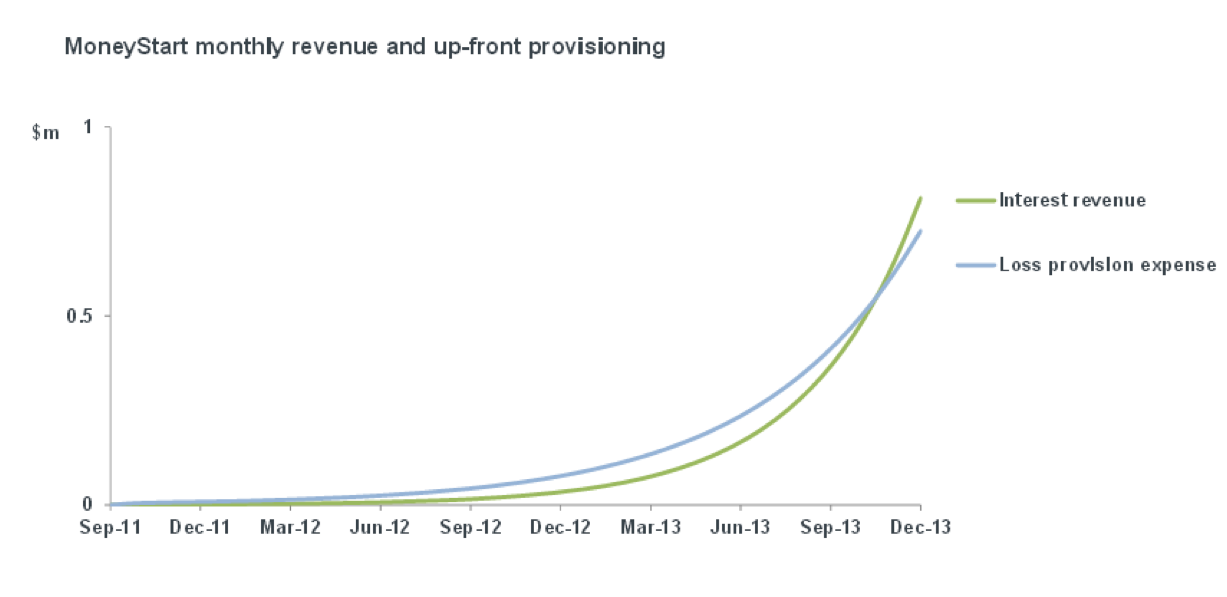

- Money Start, the group’s main new loan product has grown exceedingly quickly and the book now stands at $35 million. When it was first conceived, small loans had a targeted market opportunity of $30 million. That opportunity has now grown in excess of $100 million within the next three years.

These small loans are structured to deliver similar returns to the core PDL collection business – an after-tax return on equity (ROE) of 17-18 per cent. The business should therefore be able to reach its now stated market opportunity. This product may add an additional $17-$18 million in after-tax profits to the bottom line, providing solid growth as PDL purchases mature.

Monthly revenue from the loan book is approaching $1 million, and could grow in excess of $8 million with time, as the below graph shows.

- The big unknown and potentially largest upside still revolves around the US operations. CCP has expanded its workforce in recent times in an attempt to make inroads into the US debt buying market, which is materially larger than the Australian market. Hence, success here (noting that it’s taking longer than originally planned to break even) will be a key driver for the business in the future.

In short, CCP has excellent momentum from recent record levels of PDL purchases, which will drive growth into fiscal year 2014, and early fiscal year 2015. Post that, we expect the loan book to take over as the core driver of profit growth for the next 18-24 months. At that point, it becomes evident that management is positioning the US operations to drive the next leg for many years afterward.

With a valuation range now of $10.50-$11.00 per share heading towards the June 2014 yearly result, we anticipate a higher share price than the current $9.40. It is with this assessment we continue to hold our position in CCP.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Ron

:

Hi Roger, just wondering if you have an update on your thoughts re CCP and the share price given today’s (5/11/15) results announcement?

Roger Montgomery

:

Hi Ron, If it pops up on our screens we will take another look at it. Until then Ron, there’s not a lot to add.

mike

:

Any thoughts on the recent price drop as it relate to fundamentals?

I presume this is just the big US holders selling out and negative sentiment around the new pay-day loan definition that is making them exit that market next year.

PE is attractive but the price looks like a falling knife at the moment.

Roger Montgomery

:

Hi Mike; YOu might like to read: http://www.smh.com.au/business/banking-and-finance/encore-enters-australianz-debt-market-through-baycorp-deal-20150928-gjwwba.html#ixzz3q1RSakuH

david klumpp

:

Hello Russell and Roger: I too would be very pleased to hear your latest views on the recent performance of CCP, and on it’s future prospects. I note the analysts’ data, which are used in Skaffold, imply only moderate growth expectations between now and 2017.

Daniel Rosenthal

:

Hey Roger,

Just wonderring your thoughts on Credi Corp’s most recent results? It’s been some time since you last covered them.

Is the fund still long term holders of CCP?

Regards,

Daniel

Roger Montgomery

:

Hello,

Thanks for your comment.

* unsure what val model you’re using. we are using 18% ROE.

* debt is for MoneyStart loan book investment. Maturity profile isn’t a concern given the business is able to generate significant free cash if it stops investing (which you dont want)

* customers come from their own database (zero acquisition costs) or externally from marketing ~$50-$100 acquisition cost

* they over-provision their book in my opinion in order to keep a lid on profitability. its loosing from an accrual accounting perspective but is making cash

Roger

BJ

:

A few thoughts:

– to get to 10.50+ per share, u need to assume roe of 22%+. If new loans are 17-18%, then over time as this business expands surely it will trend towards that and therefore lower IV? I realise this is incremental to current performance, but if 17-18% is in line with p&l economics them isn’t 22%+ too high?

– the large increase in debt is a query, especially given the short term nature and limited commentary. Need to look at at the webcast, but last I checked was due in mid-14. Have they commented on expectations re rolling it? Gearing remains low, so shouldn’t be a problem, but given investment in growth and impact on available cash, the short term nature of the facility is a consideration.

– still doing dd, but where do the customers for the loan book come from? I assume these just aren’t pdls that have gone bad that they are just recutting with a customer as loans to avoid the write off? Tracking the loan loss provision is key here but they don’t seem to provide it at half year unless I’ve missed it. The fact they only disclose the gross book is odd.

– given the growth in the loan book, they should now be splitting this out as a separate segment in the accounts going forward as it is now material to assets and will be important to track how this actually performs.

Apologies for the typos, hate typing on ipad.

Joe Viscosi

:

Hello Roger

Many people that I know are talking about the Veda Group, that it’s taking on to much, and that it could be a threat because other competitors may get closer. I know of a lot people who have sold out on there Veda shares, but I’m going to ride the wave, regardless of other competitors and how the market will go this year.

I bought my shares just under $1.50 and I’m looking at long term.

Unless a miracle happens like what happened with XRO,

I’m very confident with Veda and that share holders will do well.

What are your thoughts on Veda.

Thanks

Joe

lloyd taylor

:

Thnaks – very useful answers and clarifications.

In particular it highlights the need to understand the discount rate (Required Return) being applied in the SKAFFOLD valuations. Unfortunately, this is not transparent in SKAFFOLD. Perhaps this could be considered in the next round of SKAFFOLD enhancements?

Roger Montgomery

:

Great idea!

Roger Montgomery

:

ee the comments here already made BUT MOST IMPORTANTLY BE SURE TO SEEK AND TAKE PERSONAL PROFESSIONAL ADVICE BEFORE CONDUCTING ANY SECURITIES TRANSACTION!!!! DO NOT BASE YOUR INVESTING DECISIONS FROM READING THESE POSTS. PLEASE READ THE WARNING AND DISCLAIMERS.

lloyd taylor

:

Three and half days later and the comments have not been posted on the website, still “awaiting moderation”, although I note the reference to the pending June 2014 result has been corrected.

Why the reluctance to post the comments and answer a few obvious questions that the discussion post gives rise to?

Roger Montgomery

:

Hi Lloyd,

APologies for the delay. A busy time here.

david klumpp

:

Russel, your excellent post on CCP raises some questions for me of a general kind with regard to the application of Skaffold (a great and powerful tool) Here lies the common conundrum for the ordinary investor: the confidence one can have in EPS/ IV forcasts. The ordinary investor who holds CCP (as I have for a couple of years), and when looking at its data in Skaffold may now begin to wonder if this once great performer may be approaching the time to sell, due to declining performance (A2 down to A3) of cash flow ratio and funding gap, and earnings momentum? Add then a forecast IV average of $8.49 for 2014, and this view then seems reinforced. Its important to note there is a tight range in the analysts’ forecasts (earnings), and thus Skaffold intrinsic value forecasts of from $7.95 to $8.94. Thus your our estimated value ($10.50-11.00) for 2014 is way above even the most bullish analyst. I’ve noted similar situations where analysts reported in Skaffold seem to diverge a lot from what the Montgomery Team have estimated (recent report on Sirtex was a similar situation). My question is, should one place little if any confidence in the Absolute value of these analysts’ forecasts within Skaffold, and only focus on the Trends in these? I note with interest your other observations on CCP’s growing potential with other aspects of it’s business, and as usual I greatly appreciate reading these insights.

Roger Montgomery

:

The declining performance is something to watch closely. The funding gap and cash flows can be explained as the company expands offshore and as a result of record levels of PDL purchases and the new loan product business. The question is whether they have bitten off more than they can chew.

Ron Brown

:

Thankyou for this article I use scaffold and invest in the Montgomery Fund

I use Skaffold and your valuation is significantly different from this for CCP and indeed for an increasing number of your fund stocks Skaffold does not concur

Why is this are you using a different tool?

Roger Montgomery

:

We use Skaffold and a range of other in-house tools. SOmetimes the differences are that we are more bullish or bearish than consensus analyst estimates. Sometimes we are adopting a higher or lower discount rate and often we have spoken to the company and formed our own opinion about the prospects for the company.

lloyd taylor

:

In addition to the valuation dichotomy, the breaking news on the SKAFFOLD blog makes a somewhat less rosy assessment of the CCP interim result https://www.skaffold.com/blog/Credit%20Corp-Google-Amazon-50-Skaffold-Score-updates#.Uu9Bc_ZF5y0

Quote:

Following four years of achieving Skaffold’s second highest score for balance sheet quality and business performance, debt purchase and collection business Credit Corp (CCP) has declined to A3.

An A3 Skaffold Score indicates compelling balance sheet quality, but average business performance. For the first time in the last ten years CCP’s Cash Flow Ratio has moved into negative territory. Skaffold’s Cash Flow Ratio measures the quality of a company’s earnings by comparing earnings to cash flow. Companies with a higher proportion of cash earnings produce a higher Cash Flow Ratio. Skaffold prefers companies whose Cash Flow Ratio is greater than 0.8.

In the results announcement CCP’s management confirmed that its consumer lending business is yet to transition to positive earnings, which subsequently pulled down underlying NPAT growth from 25% to 17%. CCP’s lending business is on track for profitability in 2015, management stated. CCP’s share price recently bounced from $8.85 to just under $9.50 following the release of its interim results. Given CCP’s impressive recent track record and managements statement about the company’s future, CCP’s A3 Skaffold Score may prove to be temporary. Only time will tell.

Unquote

https://www.skaffold.com/join/PRMNAV “Try Skaffold for free and discover why fund manager Roger Montgomery uses Skaffold online share research daily to find the best value investments.” Certainly, the interpretation of the sgnificance of SKAFFOLD updates is subject to different views, but what of the valuation itself, if but one platform is being used?

Roger Montgomery

:

The company’s margins are thinner, partly as a result of the investment in the US, and in particular, expanding staff. We currently reckon it will work but as anyone in business knows, it takes time to get a return. In the meantime there will be inevitable changes in the quality and performance scores. A3 remains investment grade.

lloyd taylor

:

It seems that you are forecasting a much higher percentage increase in earnings between Update 2 and the Actual full-year result than anything seen in the past. Is this correct?

lloyd taylor

:

Quoting from the closing of your post: “With a valuation range now of $10.50-$11.00 per share heading towards the June 2014 half-yearly result, we anticipate a higher share price than the current $9.40. It is with this assessment we continue to hold our position in CCP.”

I think that should be June 2014 full-year result. But that aside, I wonder how we are to reconcile the valuation quoted above to that carried by SKAFFOLD, which for 2014 is $7.52 on the basis of a consensus EPS of $0.74 which is bang on the money of the latest update/guidance from the company. I note that the SKAFFOLD valuation rises to $8.49 associated with a rising consensus EPS to $0.87 in 2016, still well outside of your valuation range for the current year.

Can you clarify for us the reason for the divergence in your 2014 valuation of CCP from that of SKAFFOLD which your site promotes? Are we to understand that the SKAFFOLD promoted by on the Montgomery website is different to that used by Montgomery Fund?

Roger Montgomery

:

G’day Lloyd,

The simple answer is that we are indeed more bullish (see our previous posts on the pattern of upgrades) and as a growing funds management institution we are using a range of models (including Skaffold) as well as a lower discount rate. Keep in mind Chalrie Munger’s comments that he and Buffett, even when looking at the same set of facts will inevitably reach different valuations.