Value.able

-

Billabong shareholders receive third bid in a year

David Buckland

December 19, 2012

With the wipeout in the Billabong (BBG) share price, from a high of $14.00 in mid-2007, the Company has now received its third takeover bid in a year.

President of the America’s Division since 1998, Paul Naude, together with a consortium of financiers, have “dropped in” a $1.10 per share bid, valuing BBG at $527m. This is a slight premium to the deeply discounted 6/7 rights issue at $1.02 per share, which delivered $225m in mid-2012 for debt reduction purposes.

The Board’s response will be interesting. Recently appointed CEO, Launa Inman, has well developed plans in getting Billabong back into the competition.

We have been told there are pockets of operational excellence at Billabong, but these need to be scaled-up across the organisation. The severe under-spend on IT is also being addressed.

by David Buckland Posted in Value.able.

- save this article

- POSTED IN Value.able

-

Heads in the Sand on LNG Economics?

Tim Kelley

December 12, 2012

One of the issues attracting media and analyst commentary recently is the potential impact of American shale gas exports to the economics of Australia’s large LNG projects.

The theme of many of the comments is that there is no cause for alarm, at least for the time being. Some of the reasons advanced include: the reluctance of US policymakers to permit exports; the time taken to ramp up supply if the US does export; and the fact that LNG contracts tend to be linked to oil, rather than gas prices.

by Tim Kelley Posted in Energy / Resources, Insightful Insights, Value.able.

-

Montgomery Funds’ Performance to 30 November 2012

Roger Montgomery

December 11, 2012

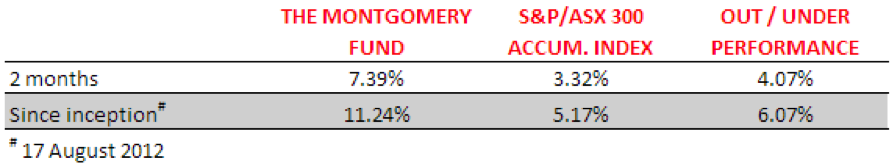

We are again delighted to provide an update on the results for The Montgomery Fund.

Whilst it is still early days and you must understand that past results are not a reliable guide to future returns, we continue to be encouraged by the combined performance of The Montgomery Fund’s 33 constituents.

by Roger Montgomery Posted in Insightful Insights, Value.able.

- 1 Comments

- save this article

- POSTED IN Insightful Insights, Value.able

-

Rising US housing starts – the multiplier effect to add 1.5% to US GDP growth?

David Buckland

December 3, 2012

On 27 July 2012 I wrote “over the past fifty years, US housing starts have averaged 1.5m per annum. Currently starts are less than half the long-term average. Deutsche Bank is looking for US housing starts to jump to 1.0m by 2014 and to 1.4m by 2016 as follows”.

by David Buckland Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

Has Japan just gone over its own cliff?

Roger Montgomery

November 28, 2012

Some believe Japan has just entered a full scale crisis and its not priced into markets. Their Balance of Trade is running at minus ten trillion Yen (US$100bln) and the resurgence of Chinese nationalism over the Senkaku islands could see trade deteriorate further and another 1 1/2 or 2% of GDP added to the deficit. GDP, by the way, is running at minus 3 1/2% to minus 4% in Japan (that forecast post-Tsunami-recovery in economic activity never eventuated dear economic experts!). Averting a full crisis may now be impossible and full current account negativity (deficit) is likely (It has already fallen from a US$210bln surplus in 2007 to US$120bln in 2011 and Credit Suisse were forecasting a seasonally adjusted surplus of just Y206bln in October.

by Roger Montgomery Posted in Value.able.

- 2 Comments

- save this article

- POSTED IN Value.able

-

Unconventional oil and gas – Transforming the US Energy Outlook

David Buckland

November 15, 2012

Earlier this week The International Energy Agency released its World Energy Outlook. While total US oil and gas production is expected to increase 35 per cent from 17 million barrels of oil equivalent per day (mboe/d) in 2010 to 23 mboe/d in 2020, the transformation is explained by the expected 6 mboe/d surge in unconventional oil and gas production over this decade. Together with the widening of the Panama Canal by 2014, which will allow LNG Supertankers to travel to Asia from the Gulf of Mexico, the US could potentially turn into a cheap exporter of gas, in competition with Australia.

continue…by David Buckland Posted in Energy / Resources, Insightful Insights, Value.able.

-

Taking advantage of the rising Asian tide

David Buckland

October 31, 2012

In releasing the Government’s white paper, Prime Minister Gillard told the Lowy Institute the 21st Century would see Asia’s return to leadership. Asia’s rise was “not only unstoppable, it is gathering pace.” Treasurer Swan said Australia “must continue building on our strengths to take advantage of the opportunities that are unfolding in the Asian region”. Large productivity gains is a major focus of the white paper.

Of the twelve separate categories that make up the rankings in the “Global Competitiveness Report” from the World Economic Forum, “Labour Market Efficiency” remains Australia’s nemesis. If our political leaders are serious about productivity gains and workplace reform, then our poor record in areas like burden of government regulation, wastefulness of government spending, flexibility of wage determination and infrastructure bottlenecks need to be urgently addressed.

by David Buckland Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able

-

The Montgomery Fund

Roger Montgomery

October 22, 2012

Last week the retail fund, The Montgomery Fund, celebrated its two-month birthday and thanks to some canny timing of the launch (rather than any skill, which cannot be attributed to a fund that is 8 weeks old) it has recorded a return of approximately 10.2% against its benchmark’s return of 5.75%. While we all have to crawl before we walk, I am pleased with the fund’s first steps.

Investors in the fund can look forward to receiving their first bi-monthly update in early November detailing the performance, major holdings, and the composition of the portfolio.

Over recent weeks we have received a number of questions about The Montgomery Fund and I thought it would be a good idea to try and answer some of those questions here.

If you have any more, feel free to post them and we will endeavor to answer them.

The first thing to point out is that Montgomery Investment Management is now the investment manager for two products. They are, The Montgomery [Private] Fund, and The Montgomery Fund.

The Montgomery [Private] Fund, a fund for wholesale investors with a minimum initial investment of $1,000,000, had its inception on 23 December 2010. In the 21-month period to 30 September 2012 it has pleasingly out-performed its benchmark, the ASX200 Industrials Accumulation Index, by 17.47%.

by Roger Montgomery Posted in Value.able.

- 11 Comments

- save this article

- POSTED IN Value.able

-

Qantas needs all the debt it can get.

Roger Montgomery

October 8, 2012

News of a new debt facility of $400 million for Qantas should send investors zipping up their wallets. Qantas Group is Australia’s largest domestic and international airline.

Back in 2000 the balance sheet of Qantas comprised:

› $2.8 billion of shareholders equity

› $3.1 billion of bank debt

For financial year 2000, Qantas reported earnings of $517 million giving an ROE of 17.45%.

But more recently, Qantas recorded a normalised loss of $16.3 million. The 2012 loss follows the $317 million profit of 2011, the $175.2 million profit of 2010 and the $164.6 million profit of 2009. All of these were lower than what the business reported its earnings to be in 2000 – eleven years ago.

The company however has seen its debt balloon in that time to $6.5 billion and shareholders equity is at $5.9 billion. Meanwhile any simple bank account, with an additional $12.4 billion of capital injected, would be earning more than it did a dozen years ago.

Owners have put in another $3 billion of equity on top of the $2.8 billion injected by 2000. But despite the life support, the company still lost $16 million in 2012.

Even with the very best management running the show and the most generous bankers, there’s no escaping these economics.

by Roger Montgomery Posted in Airlines, Value.able.

- 4 Comments

- save this article

- POSTED IN Airlines, Value.able

-

Materials prices to collapse further

Roger Montgomery

September 30, 2012

If you think the declines so far in iron ore are significant, you ain’t seen nothing yet.

I think the declines we have seen in commodity prices still have a long way to go.

We’ve long argued that a classic supply response would follow the massive investment in exploration and production that itself followed a surge in demand from China that caused prices to reach historic highs.

But China’s demand – itself was based on unsustainable growth in fixed investment spending – is now fading. China represents less than 11% of the global economy, but it commanded 30% to 40% of total global demand for copper and 60% of total global demand for cement and iron ore thanks to the massive social modification projects that required bridges, roads, ports, cities, subways and skyscrapers.

This is not sustainable and so demand for the raw ingredients will decline. Additionally, the nature of future growth will change and more consumer driven growth will again demand less materials.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Value.able.