Manufacturing

-

China Rongsheng Heavy Industries – the good, the bad and the ugly, part 2

Roger Montgomery

August 2, 2012

We had a wry smile this morning after reading Macquarie Equities daily newsletter.

China Rongsheng Heavy Industries’ net earnings have been downgraded by 37% in 2012, 68% in 2013 and an astonishing 79% in 2014. Forecast 2014 profitability is now one-sixth of the the level recorded in 2011.

A significant factor which had come to light is the fact that Rongsheng has provided highly attractive pre-delivery finance to customers to win market share.

As Rongsheng has had operational (and credibility) issues, it has had to increase its working capital and gearing to meet expenses during during the shipbuilding construction period. With the fast decline in their order book, from US$6.6 billion in 2011 to an estimated US$3.6 billion in 2014, cash flows are under pressure.

The extraordinary rise and fall of Rongsheng and the outlook for the Chinese shipbuilding industry lends support to Montgomery’s caution with respect to the materials industry.

We will become more positive on materials stocks when the outlook from the Chinese steelmaking, cement and shipbuilding industries is less pessimistic.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing, Value.able.

-

China Rongsheng Heavy Industries – the good, the bad and the ugly…

Roger Montgomery

August 1, 2012

Earlier this year we had the opportunity to visit China Rongsheng Heavy Industries, one of China’s leading shipbuilding companies. Rhongsheng was founded in 2005 and floated in November 2010 on the back of winning an enormous order from Vale to build twelve ore carrier vessels each 360 metres long, 65 metres wide and 30.4 metres deep with a deadweight tonnage of 400,000. The ambitious founder, 46% shareholder and Chairman, Zhang Zhi Rong, was desperate to challenge the global leaders, South Korean based, Hyundai Heavy Industries and Daewoo Shipbuilding & Marine.

Back in 2008, Rongsheng represented all that is good and bad in China. With Government support, Chinese corporate support, recently announced offshore diversification and the cost of shipping dry goods such as grain, coal and iron-ore at US$55,000 per day, the outlook was superb.

Let’s fast forward to July 2012 and the price of Rhongsheng’ shares have declined from HK$8 to HK$1. For the six months to June 2012, China’s 1,536 shipyards have announced a combined 50% decline in orders. The cost of shipping dry goods has crashed to sub US$10,000 per day (-82%), and Rhongsheng is experiencing a number of operational and credibility issues.

With the global slump in ship orders caused by a glut of vessels, Rongsheng is trying to diversify from shipbuilding and earlier this year they won a contract to build an offshore support vessel for CNOOC, one of China’s largest government controlled oil production and exploration companies.

Last week CNOOC announced a US$15 billion offer to acquire Nexen, a US listed Canadian based oil company. Nexen rose 52% on the announcement. The US Securities and Exchange Commission (SEC) just announced various traders had stockpiled shares of Nexen in the days leading up to the takeover bid. The SEC has claimed US$13m of illegal profit was realized and the finger is being firmly pointed to a Hong Kong based company controlled by none other than Zhang Zhi Rong.

The development of China has seen some extraordinary national champions in industries like ship building, however we wonder how many of these companies will ultimately become global champions. With several front page newspaper disasters associated with misfeasance, we continue to be wary of China’s corporate governance record.

In the meantime we believe a lot of companies in commoditized industries like shipbuilding, steelmaking and cement production are likely use their upcoming results presentation as an avenue to downgrade their outlook.

by Roger Montgomery Posted in Insightful Insights, Investing Education, Manufacturing.

-

They may never be needed but are there enough?

Roger Montgomery

April 18, 2012

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.

Republished: PORTFOLIO POINT: Leighton’s recent performance issues have been exacerbated by a poor relationship between management and staff.The 15th of April will mark the 100-year anniversary of the tragic sinking of the Titanic on its maiden voyage from Southampton England to New York. Owned by The Oceanic Steam Navigation Company or White Star Line of Boston Packets, the tragedy was not that her advanced safety features, which included watertight compartments and remotely activated watertight doors malfunctioned. The tragedy was the operational failure and that the Titanic lacked enough lifeboats to accommodate any more than a third of her total passenger and crew capacity.

It occurred to me on this anniversary that there are many lumbering, giant business boats listed on the Australian stock exchange today, whose journeys have been equally eventful, if not fatal, and whose management is no less responsible for operational failures and for providing lifeboats only for themselves.

Take the situation over at Leighton (ASX: LEI) – a company I wrote about here some time ago, saying: “There is a significant risk of downward revisions to current forecasts for the 2012 profit.” On March 30, the company wrote a further $254 million off its two biggest projects – Airport Link and the Victorian desalination plant. More broadly, Leighton downgraded its FY12 profit guidance to $400 million-$450 million from $600 million-$650 million, taking the company’s writedown tally to almost $2 billion in the past two years. This will reduce the return on equity from 22% to 15% for 2012, and significantly reduce the 2012 intrinsic value, which now sits below $14.00 (see graph below).

Source: Skaffold.com

Back when I wrote my prediction, I also noted that workers at the desalination plant had cited ‘safety concerns’ causing them to work more cautiously (read slowly) to ensure their physical safety and the safety of their $200,000 per year wage, which of course would not continue beyond the project’s completion.

This week, it was revealed that similar problems have emerged at Brisbane’s Airport Link project. According to one report, “an increasing level of aggressive behaviour” from unionised workers who wanted to “get paid for longer” was an attempt to “leverage this finishing phase” of the project.

Leighton must construct to a deadline, and liquidated damages clauses cost the company about $1.1 million per day for every day that the Airport Link project is delayed. My guess is that as a result of the workforce’s alleged ‘go slow’, Leighton is forced to bring in hundreds of sub-contractors such as sparkies (with “specialist commissioning skills and experience”, according to John Holland) to complete the work. Either way, it costs Leighton more. A 25% blow-out on a multi-billion dollar project can amount to $1 billion.

On top of these problems, Leighton has a $200 million deferred equity commitment to make two years after Airport Link opens. And if my speculation that the operator may be broke before Christmas comes to fruition, Leighton will be forced to write off another $63 million – the amount remaining to be written down.

But before you jump to attack the unions reported to be responsible for Leighton’s woes – something I believe is often justified, not because of what the unions represent, which is honourable, but because of the tactics they sometimes use to seek redress – you should remember that there are many companies whose more humble management works in harmony with its workforces, unionised or otherwise.

Management is an important part of the investment analysis mix and while I firmly believe, as Buffett does, that the business boat you get into is far more important than the man doing the rowing, I do also believe that management will make the bed that ultimately every stakeholder must lie in.

Any company whose management drives flash cars to the office, pays herculean salaries to themselves and/or takes advantage of company relationships for self-gain is always going to be the target of unrest and distrust from its staff. This is driven often by envy, a sense of unfairness or lack of equity, and while I am not saying this is the case at Leighton, clearly there’s something amiss that is the root cause of this much trouble.

Over the last decade, Leighton has generated cash flow from operations of $8.3 billion, but its capital expenditure has now exceeded $7.5 billion. This would leave $800 million for dividends, but the company has paid dividends of over $2 billion (perhaps to appease non-unionised, income-seeking shareholders who support the share price upon which management’s lucrative remuneration is based). Given the cash to fund this dividend largesse was not generated by business operations, $850 million of ownership-diluting equity has been raised and $1.3 billion of debt borrowed. And for this less-than-spectacular performance, the top 10 current executives were paid almost $20 million last year. Eight of those were paid more than $1.2 million in 2011, four were paid more than $2.3 million, and the year before, three of the 10 were paid more than $4.5 million each.

Forecast profits for 2012 will not be any higher than five years ago, and the company workforce has doubled to 51,281 employees at June 30, 2011. But $190 million in salaries for 15 senior executives (excluding van der Laan’s $47,000) between 2007 and 2011 (see table), while overseeing such performance does not sit well with staff (or vocal but ineffectual minority shareholders) and it’s the relationship between management and staff that is more than partly to blame for the company’s ills.

Whether or not the CFMEU’s Dave Noonan’s claim in The Australian Financial Review this week is correct – specifically that “the markets were the last to know [about Airport Link], everybody else in the industry knew that the company were going to drop hundreds of millions of dollars and obviously they chose to tell the stock market very late in the piece” – is less significant than whether a carcinogenic tumour has grown between management and staff. The former can be resolved but the latter is potentially more permanent, and therefore damaging to shareholder returns.

Leighton is a fixture in the portfolios of thousands of superannuants nearing retirement and their disappointment with their investment returns can be at least partly attributed to the poor wealth-creating contribution of this company and its management. In turn, this can be attributed to the motivation and satisfaction of staff.

Shareholders are also the owners and have a right to know how management is performing, but now the majority shareholder’s demands will hold sway and the majority shareholder is Spain’s Grupo ACS, not the many Australian super funds who thought the company’s management was working for them. Oh, and I am guessing there is the risk of further writedowns on projects that haven’t yet hit the headlines.

Like the Titanic, where only the executives at White Star Line were truly safe, minority shareholders may find there aren’t enough lifeboats for them either.

First Published at Eureka Report April 11. Republished and Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 19 April 2012.

by Roger Montgomery Posted in Companies, Energy / Resources, Insightful Insights, Investing Education, Manufacturing, Skaffold.

-

Will China demand Iron…or…?

Roger Montgomery

April 11, 2012

PORTFOLIO POINT: A fall in China’s demand for iron ore, combined with a boost in supply, will lead to lower prices and put the margins of Australia’s big producers under pressure.

PORTFOLIO POINT: A fall in China’s demand for iron ore, combined with a boost in supply, will lead to lower prices and put the margins of Australia’s big producers under pressure.Like a thief in the night, it crept across our news screens a two weeks ago: “The rate of China’s iron ore demand has peaked…”

This report from Dow Jones’ wire service follows recent comments by BHP that Chinese demand will be weaker than previously anticipated.

But Peter Richardson, Morgan Stanley’s global metals chief economist, is putting forward a strong investment case for the “crucial” steelmaking commodity. Remember; Never ask a barber whether you need a haircut.

For what it’s worth (and I know it’s not a widely accepted view right now), I think commodities are cyclical. When prices are low, there’s precious little investment in building productive capacity; the lack of investment and long production lead times result in supply lagging demand. As prices rise, investments are proposed, delayed and then made, and this pattern causes prices to extend their rise. Then just as prices peak, marginal operators come on line, backed by NPV calculations that assume the high prices will be sustained. It’s in their interest to be bullish about the future, because their jobs and reputations – as well as the dollars they have attracted as capital – are all on the line. But eventually, supply increases and prices stop going up; if it can’t go on forever, eventually it must stop.

And a commodity company has no competitive advantage, no compelling reason for people to pay more for their product or service. Their customers arrive at the counter with a price and say: ‘This is the best price we can get from someone else – can you beat it?’ The commodity business, which lacks any competitive advantage, has no option but to say ‘yes’, otherwise it runs the risk of underutilising its production capacity and its machinery sits idle. This is the antithesis of the business with a true competitive advantage.

The most valuable differentiator or competitive advantage is one that allows the business to simply raise the price each year without losing any business at all, even if excess productive capacity exists. Clearly, I am not describing the iron ore business.

In 2010, global mine iron ore production amounted to 2590mt. Of this, China produced 1070mt. By 2011, global mine production had grown to 2800mt, or a growth rate of 8.1%. Australia’s production from 2010 to 2011 grew by 11% to 480mt, and China’s production grew by 12.1%.

In 2010 China imported almost 60% of the world’s total iron ore exports and produced about 60% of the world’s pig iron. China’s significant participation is the main factor upon which sustainable expansion of the global iron ore industry depends. But China’s demand is slowing.

Peter Richardson (the barber for the purposes of this story) reckons even though the growth rate of iron ore demand from the world’s second-biggest economy has likely peaked, the sheer size of China’s requirements means the market will remain imbalanced until 2014 at least. Because of the very large numbers, he says a 3% or 4% year-on-year increase on China’s existing steel production base still requires close to 40 to 50mt more iron ore this year than last year.

The statistics that I have, however, suggest iron ore production globally could grow by 8% again. If China were to import another 60% of the world’s total iron ore exports, that would mean China imports an additional 136mt, but as Peter Richardson speculates, China will require 40-50mt. If China doesn’t buy the extra production, what does the additional production – that which isn’t imported by a slowing China, whose iron ore demand has peaked – do to prices? The pressure is, of course, for prices to come down.

Morgan Stanley and I agree on this. They are, of course, quite precise about just how prices will fall. Their latest forecast is that iron ore will trade at $US151 per metric ton, $US160 and $US140 in 2013 and 2014, respectively, and $US125 in 2015, $US110 in 2016 and $US105 in 2017. And if iron ore prices actually do that, I am the Tooth Fairy. Commodity prices don’t rise and fall so smoothly. They fall in fits of fear.

Either way, declining prices put pressure on margins unless capital expenditure is scaled back. Correction: even if capital expenditure is scaled back. And that’s what I think could be the outlook for some of Australia’s big iron ore producers.

Fig 1. Iron Ore Price chart

This is occurring at exactly the same time as analysts and brokers get very bullish about the large order wins and full pipelines for many mining services businesses. In the Montgomery [Private] Fund, we have owned mining services businesses for a year, but suddenly our once-comfortable train has become very crowded.

Fleetwood is one such business, providing manufactured accommodation to the resource industry, including BHP’s iron ore businesses. The company will also produce manufactured accommodation for caravan parks, as well as transportable homes. It is also the second-largest manufacturer of caravans in Australia.

And if you didin’t already know that I use Skaffold a lot here

Figure 2. Skaffold’s current Fleetwood Intrinsic Value Chart.

Source: www.Skaffold.com – be sure to register for next week’s webinar by clicking here

Fleetwood’s recent results met the market’s expectations at the earnings level. Indeed, the $26.9 million profit for the first half of the 2012 financial year was slightly better than some analysts’ expectations. The balance sheet was also very strong, with net cash of $13 million, and operating cash flows were equally strong, increasing by 210% to $47.6 million. But revenue was down; manufactured accommodation revenue fell by 7%. For recreational vehicles, revenue was down 12% and EBIT for this business fell 61%.

With timid and shy consumer sentiment putting pressure on Fleetwood’s recreational vehicles business, the company’s near-term future results will depend very much on resource companies.

Tellingly, the company’s half-year outlook statement revealed just how dependent on the resource sector many companies like Fleetwood have become: “demand for manufactured accommodation for the West Australian resources sector is expected to continue to strengthen as more projects are approved and moving to the construction stage.”

Analysts talk about current high levels of tender activity from resource projects that are likely to emanate over the coming 12 months. Mastermyne, for example, a company I wrote about here a couple of weeks ago, is seeking 900 people for which it has advertised in Poland to meet demand. But given my earlier comments about a slowing China and the impact that could have on iron ore prices, perhaps many of these companies and the analysts that follow them need to lower their expectations.

Many investors have seen planned projects shelved before and if any further declines in China’s demand for iron ore occur, the impact on the single cylinder of the Australian economy that is still running won’t have a happy impact on all those BHP and Rio shares that have been inherited by a generation of baby boomers nearing retirement.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 11 April 2012.

by Roger Montgomery Posted in Energy / Resources, Manufacturing.

-

Is this company a master of the mine?

Roger Montgomery

March 26, 2012

PORTFOLIO POINT: Coal mining services provider Mastermyne is attractive if you consider its work in hand, revenue and earnings prospects. Cash flow, however, must be watched closely and value has recently taken flight.

Investors can be an irrational lot. When share prices are low, investors are reluctant to buy, preferring first a rise in prices to confirm their beliefs. Yet when those beliefs are confirmed and after share prices rise, the reluctance to buy remains; now the investor waits for lower prices to provide a more attractive entry point.

Mastermyne (ASX:MYE) has enjoyed a recent surge in its share price. Even though the rise has pushed its share price above a rational estimate of intrinsic value, it should not dissuade an investigation of MYE as conventional wisdom suggests favourable industry dynamics bode well for its earnings prospects over FY2012 and beyond. For now, turn the stockmarket off and focus on the business.

Mastermyne, established in 1996, is Queensland’s “leading” provider of specialist underground coal mining services. The company’s operations are primarily in the Bowen Basin, but the company also enjoys a growing presence in NSW’s Illawara. The company counts BHP, Rio, Vale and Anglo Coal among its Tier 1 customers. Demand for the company’s services is tied to coal production volumes and the short and medium-term outlook for coal production is positive, thanks to demand from emerging economies.

Bright prospects do assume the following: a benign environment for union action against coal miners (union action is currently underway for the BHP-Mitsubishi JV); no impact from litigation by the “Stopping the Coal Export Boom” movement that has also carefully planned and funded litigation action to delay development of port and rail infrastructure; and the spread of new production in Queensland’s Galilee Basin and NSW’s Hunter Valley.

Mastermyne’s three business segments are:

Mastermyne Underground (Mining Services) (>90% group revenue) (underground conveyor installation, extension and maintenance; underground roadway development; underground ventilation device installation).

Electrical and Mechanical Services (>1% of group revenue) (above ground electrical and mechanical services, including construction, maintenance and overhaul of draglines, wash plants, materials handling systems and other surface infrastructure).

Engineering and Fabrication (designs and fabricates attachments for underground equipment; general engineering and fabrication; supply of consumables for underground coal mines).

Since listing in May 2010 and under the direction of Tony Caruso (CEO since 2005, MD since 2008 – pictured above at far left during Mackay’s best business 2010 gala awards), MYE is off to a good start as a listed company. Importantly, investors should note that of the $40 million raised in the float, not a dollar went into the business. About $2.3 million went to the deal’s brokers and vendors received $37.7 million. Equally importantly, the company didn’t say in its prospectus that the proceeds had been used as ‘working capital’. I have seen plenty of companies that did, even though not a cent went in.

Supported by a strong order book, MYE exceeded its prospectus forecast revenue and earnings for 2010 by circa 4%, and earnings for 2011 by 10%.

Citing limited ‘through-the-cycle’ performance transparency, many investors get nervous about a company that is either new or newly listed. There is no escaping the argument in this case. Not only that, but the fact remains these types of mining contractors typically have high operating leverage and feast can quickly turn to famine, especially where barriers to entry are low (such as in this case) and competitors are willing to price irrationally when pickings get slim. However, between FY2007 and FY2010, MYE achieved compound annualised growth of 17% in earnings before interest, tax and amortisation. Encouragingly, the company grew operating earnings during the GFC and, in a more recent six-month period to August last year, grew its FY2012 contracted order book by 30% – this on top of the previously mentioned prospectus-exceeding growth for FY2011 and second-half 2011 operating earnings growth of 22%.

During MYE’s annual general meeting (AGM) late last year, a very strong start to the current financial year was also cited. Growth in the two smaller divisions is being targeted (expect strong growth off a low base) and the company is positioning to engage in larger projects that are coming online over the next three to four years. Specifically, Mastermyne said that demand for its services remains strong and is increasing.

While several analysts have cited MYE’s strong employee growth as evidence of its statements about pipeline growth, it also serves as a reminder of the operating leverage that engineering contractors typically display. A leading position is essential in the event that industry-wide revenue ever turns south.

Watch the cash

On a work-in-hand, revenue and earnings basis, this is a company with bright prospects. The one caveat, however, is cash flow. Ultimately, it is by cash flow that a company lives and dies. A company waiting for its customers to pay while growing fast must manage its cash flow very carefully.

As is typical in a capital-intensive business (note: reason to moderate any plans for grand portfolio allocations), growth requires significant capital expenditure, as well as more typical variable expense increases. For 2011, net operating cash flows declined from $15.1 million to $9.4 million (take a look at the $20 million jump in receivables for a partial explanation). However, after subtracting $2.6 million for capex, the company was still able to pay its borrowings down by $6.7 million (the apparent increase in ‘borrowings’ is due to finance leases – another cost associated with expansion). Finally, a dividend of $2.6 million arguably caused the bank balance to decline by $2.2 million in 2011.

Using my method to estimate business cash flow, an $8.7 million business cash outflow can be offset by an $11 million increase in property plant and equipment, but the company really needs some of those 1200 additional staff it has taken on to be working in the receivables management part of the back office.

I suspected the accrual accounting used to record revenue would be based on effort expended, and indeed, the annual report confirms this:

“Revenue from services rendered is recognised in profit or loss in proportion to the stage of completion of the transaction at the reporting date…”

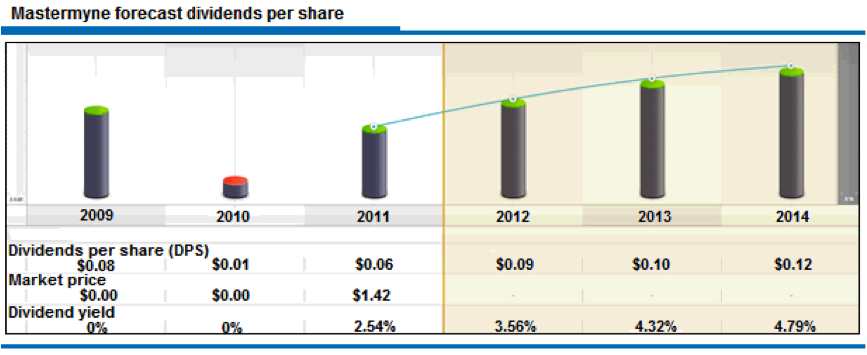

However, clients like BHP, Rio, Anglo Coal and Vale, while making a great looking CV, will also ensure Mastermyne won’t be dictating cash payment terms. The impact of this should not be underestimated, because Mastermyne will require cash to maintain and expand its equipment fleet, as well as maintain dividends (forecasts for per share dividends can be seen in the graph below).

Source: www.Skaffold.com

Only once you are comfortable with an understanding of how the cash flows through the company, its quality and its prospects do you move to analysing its intrinsic value.

Intrinsic value is a function of a company’s equity and the profitability of that equity, as well as a conservative required return.

The make-up of Mastermyne’s equity is therefore important and an examination of the balance sheet reveals that a not-insubstantial portion of the owner’s equity is comprised of intangibles, namely goodwill. The payment to the vendors of around $40 million was well in excess of the book value of net tangible assets, and so the accountants created a common control reserve to ensure the balance sheet balanced. The upshot is this would be a problem if the company were required to borrow meaningful funding. The combination of operating leverage and higher debt (if it were to grow) is itself less than perfect, and debt backed by goodwill leaves shareholders with precious little to support share prices if revenue or operating margins were to turn down.

That appears unlikely in the near term and so we move to the other element of the intrinsic value equation, which is return on equity. For the next two to three years, these returns are expected to remain high and stable at around 31%.

Based on these expectations, and turning the stockmarket back on, Mastermyne is trading at a premium to its current value. A pullback to $1.80, if it were to transpire and all else being equal, should be a trigger to pull the file out and conduct some due diligence on the company’s prospects at that time.

*Mastermyne (ASX:MYE, Score B1) is a small Montgomery [Private] Fund holding.

Posted by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 26 March 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing, Skaffold.

-

Is China exporting inflation now? Did the RBA know? What’s going on at RIO?

Roger Montgomery

February 10, 2012

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.

Following on from our comment yesterday about BHP and comments in the media explaining why we weren’t buyers of BHP or RIO (falling Iron Ore prices and a contracted customer (28% of RIO’s revenue last year) who won’t honor contracts), we are interested in the flow of information through the week.First the RBA held off cutting rates. Did they know that China would soon be exporting inflation (cost pressures there)? Then the next day China reported…guess what….the biggest jump in inflation…so forget about rate cuts there to help out US and Euro exports?

And now we are hearing that over at RIO a freeze has been placed on contractors and recruitment. Read; “massive overspend / cost inflation”.

Today Bloomberg quoted an analyst on China: “Domestic demand was genuinely weak in January, while exports remained on a gradual downward trend,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. And “Tom Albanese, chief executive officer of Rio Tinto Group, said yesterday he remains confident of a so-called soft landing in China… Inflation (CNCPIYOY) accelerated last month for the first time since July as food prices climbed before the holiday that started Jan. 22, a statistics bureau report showed yesterday. An index of export orders in the agency’s survey of manufacturing purchasing managers released last week showed a contraction for the fourth straight month. The IMF said in a Feb. 6 report that China’s economic expansion may be cut almost in half from its 8.2 percent estimate this year if Europe’s debt crisis worsens, a scenario that would warrant “significant” fiscal stimulus from the government.(See my postscript).

17/2/2012 PostScript: An analyst we regard highly wrote this to us today:

“On this recent visit, our wise counselor forecast China’s growth rate will be in therange of 8 to 9% in 2012—assuming no major external shocks. Inflationary pressurewill be lower this year than last, especially in the first half of the year. The inflation ratein China for the entire year will be lower than 4%. Low inflation will allow thegovernment to deregulate prices—water, natural gas, and power.Our trusted counselor believes that export markets cannot be counted on to deliver thegrowth that China needs in 2012. Likewise, domestic consumption, while on the rise as apercentage of GDP, is hard to stimulate quickly. Therefore, the only remaining option to preventChinese economic growth from slowing is for the government to use investment as a stimulus.”“On this recent visit, our wise counselor forecast China’s growth rate will be in therange of 8 to 9% in 2012—assuming no major external shocks. Inflationary pressurewill be lower this year than last, especially in the first half of the year. The inflation ratein China for the entire year will be lower than 4%. Low inflation will allow thegovernment to deregulate prices—water, natural gas, and power.Our trusted counselor believes that export markets cannot be counted on to deliver thegrowth that China needs in 2012. Likewise, domestic consumption, while on the rise as apercentage of GDP, is hard to stimulate quickly. Therefore, the only remaining option to preventChinese economic growth from slowing is for the government to use investment as a stimulus.”

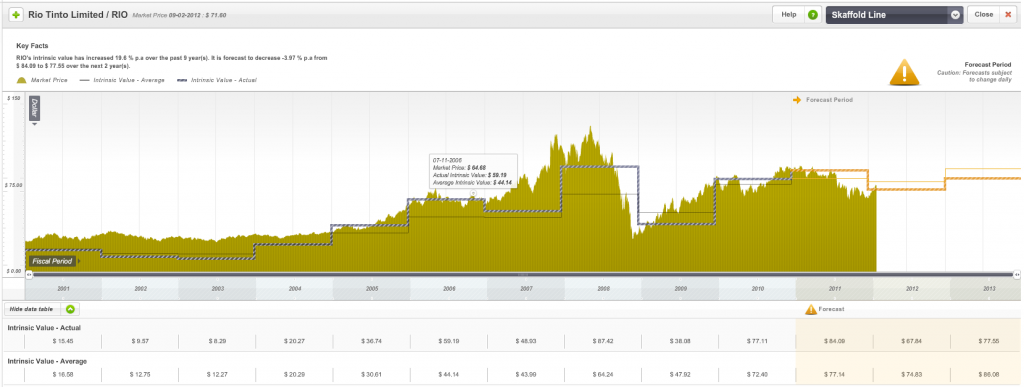

Here’s a quick view from Skaffold of RIO. To become a Skaffold member and enjoy having every stock in the Australian market quality rated and valued and all valuations and data automatically updated for every company every day CLICK HERE

Posted by Roger Montgomery, Value.able and Skaffoldauthor and Fund Manager, 10 February 2012.

by Roger Montgomery Posted in Energy / Resources, Insightful Insights, Manufacturing.

-

Is Australian manufacturing dead, or just in need of a cuddle?

Roger Montgomery

October 13, 2011

With high salaries, higher rents, a strong Aussie dollar and ‘level-playing-field’ policies, are Australian manufacturers being unwillingly and inexorably dragged to doormat status?

We are in a race to the bottom and run the risk of ultimately being chewed up and spat out when our commodities are no longer required with such urgency.

Driven by a belief that economists are right and the way to measure happiness is by the consumption of “stuff”, government policy in Australia is set to keep the masses happy by making that “stuff” as cheap as possible.

Our way of life, and the quality of that life for our kids, is at risk if we continue to be apathetic. Driving around Sydney’s Eastern Suburbs and Lower North Shore, its apparent there isn’t a communal approach to the solution. Instead there is an individual race to accumulate more “stuff” to protect oneself. “Forget about the neighbours”. “Look after number one”. “If I have plenty in the bank, the kids and grandkids will be set up. What do I care if the rest of Australia goes to pot?”

It’s like watching seagulls fighting over a Twistie.

When competing against a country with an ethos that puts ‘the people’ first, what hope does a country whose constituents are clambering over each other for the next short-term dollar have?

Manufacturing in Australia needs help. I am not suggesting protection or a hand out. I am suggesting a leg-up.

Singapore rolls out the red carpet for new businesses with tax-free holidays for the first few hundred thousand in profits. What does the Australian government do for new businesses in Australia? A TAFE course? R&D tax breaks are a start, but helping big business roll out classrooms at $5000 per square metre helped who exactly?

Unemployment in Australia’s wealthiest suburbs is creeping up because we don’t need so many bankers and Merger & Acquisition experts when there aren’t any businesses left to merge and acquire.

Can our current way of life survive without manufacturing? It seems we may just find out. What will we do without manufacturing?

The commodity boom will end one day and we are selling large tracts of arable land to foreign investors. Without manufacturing, will we be running around serving each other lattes? Is that it?

Australia is still the home of ingenuity. Just look at programs like the ABC’s New Inventors. The best and brightest should be receiving generous awards and access to incubator programs that ensure the international success and that the commercial benefits flow back to Australia.

One American recently lamented “10 years ago we had Steve Jobs, Bob Hope and Johnny Cash. Now we have no jobs, no hope and no cash”. If we don’t want to end up in the same place, Australia needs to do more to help incubate, nurture, commercialise and protect our best ideas.

And what are we doing bringing the brightest foreign students into Australia, giving them some of the world’s best education and sharing our IP and then, when they graduate, telling them they cannot work here and sending them home to compete with us?

“Go Australia”? Or “Go, Get Out of Australia”?

We also have some amazing established manufacturing businesses – paint, water heaters, bull bars, truck tippers, caravans, mattresses, wine, beer, pharmaceuticals, chemicals, anoraks, toilets.

The list of those producing attractive products and results is nothing short of A1.

A company that…

1) Has built a brand and or reputation for quality, value or innovation;

2) Is vertically integrated – owning the distribution channel;

3) Is manufacturing a highly specialised or customised product and not competing solely on price;…has a chance to succeed in manufacturing in Australia. And while it’s a shame our government has gradually allowed manufacturing to ‘die’, there are pockets within which Value.able Gradutes can find extraordinary businesses, especially when the market’s manic phase turns to depression.

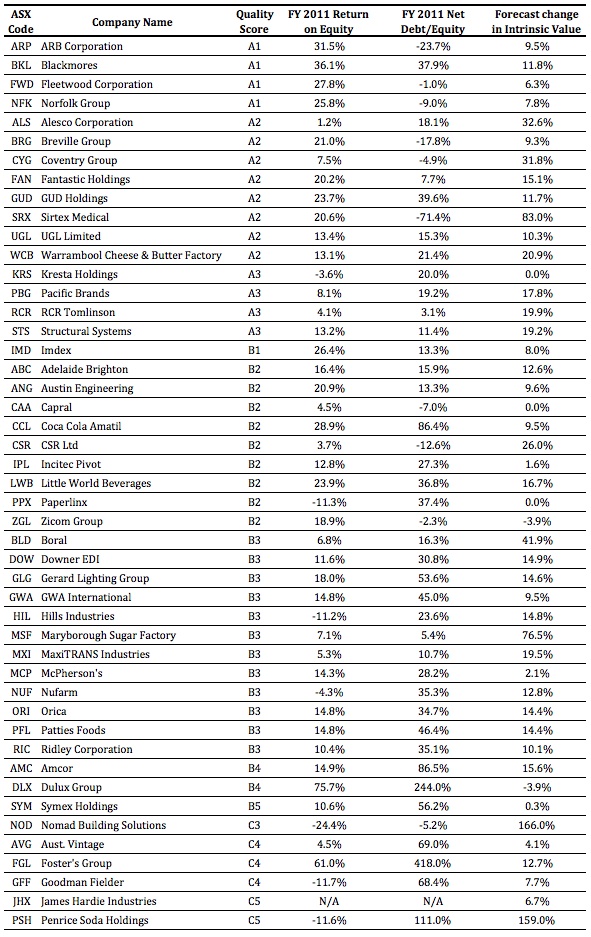

Many of the manufacturers listed in the following table have a long history of operating through a variety of economic conditions. They are ranked from A1 down to C5 – you can immediately see the broad spread of quality. I find looking at the ‘tails’ to be particularly insightful.

While declining in volume, manufacturing in Australia is not dead. Indeed some businesses are positively ‘raking it in’.

Manufacturing is tough and because inflation is always running against a business with a high proportion of fixed assets, smart managerial decisions are constantly required.

Ironically, with so many winds against manufacturers, those that have little or no debt, high rates of return on equity, bright prospects for future growth in intrinsic value and are trading at substantial discounts to current intrinsic value, may just prove to be Value.ablely positioned to leverage a broader economic recovery, locally and globally.

Who’s your top pick for Australia’s best manufacturer? I also want to hear your stories about manufacturing here. Are you a business owner that makes something we should be proud of? How is government policy or a monopoly customer affecting you? What changes need to be made to give Australia a fighting chance?

The universe of great businesses to invest in will inevitably decline unless something is done.

I look forward to your stories. They will be read by the who’s who in banking, management and government, so jot down your thoughts and share your Value.able experiences.

Posted by Roger Montgomery and his A1 team (courtesy of Vocus Communications), fund managers and creators of the next-generation A1 stock market service, 13 October 2011.

by Roger Montgomery Posted in Insightful Insights, Manufacturing, Value.able.

- save this article

- POSTED IN Insightful Insights, Manufacturing, Value.able