Insightful Insights

-

How much capital intensity does it take to sell seats?

Roger Montgomery

August 30, 2011

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.

Did you know some of Qantas’ planes are more than twenty years old? And our estimate is that they fly, on average, 14 hours per day. The rest of the time they mimic that expensive bit of fashion in your garage, earning no income. That garage/hangar time has expensive ramifications for the economics of airlines, just as your decision to buy an expensive but garaged ‘fashion’ item has expensive ramifications for you.Capital-intensive businesses, such as airlines, erode shareholder wealth. Inflation ensures their maintenance and replacement is a significant proportion of cash flow, which could otherwise be paid out to shareholders. Parts plus labour, which protect the business assets from wear and tear, actually causes wear and tear on shareholders’ funds.

Raising capital and increasing debt, has hitherto been easy for Qantas, but the market is slowly coming to the realisation that it cannot continue. The market capitalisation of Qantas – the ‘value’ the market ascribes – is less than all the equity that the company has raised – much less.

As a result of the market’s slow migration to understanding the economics of airlines, fresh management have had to respond quickly.

The best measure of economic performance is Return on Equity (ROE). This year QAN achieved a ROE of just over four per cent. Meanwhile, Oroton shareholders have been enjoying eighty per cent returns. Did you know there are 267 companies that earn more than 15 per cent returns on equity?

The business of selling seats is an expensive one for Qantas, and while the business of selling the hope-of-getting-a-seat (the Frequent Flyer program) is extremely profitable, owning planes means the cash is always inhibited – it can’t be distributed to shareholder owners.

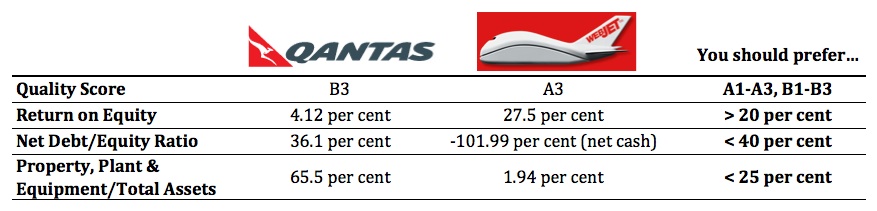

Qantas however isn’t the only seller of seats on planes. Indeed there are businesses that sell seats on planes and they don’t have any planes. Let’s compare two seat-sellers: Qantas and Webjet.

I believe the very best businesses online are lists – lists of jobs, lists of apps, lists of songs, lists of cars, lists of houses, list of flights and lists of seats. What is particularly attractive is that a business with a list of seats doesn’t have any planes. Sure its revenue is going to be lower, but what about its profit?

Let’s compare…

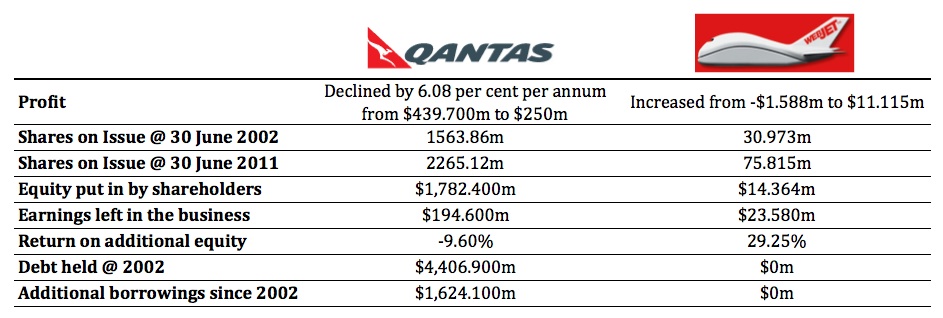

Now, lets take a look the economics of these businesses over the past ten years.

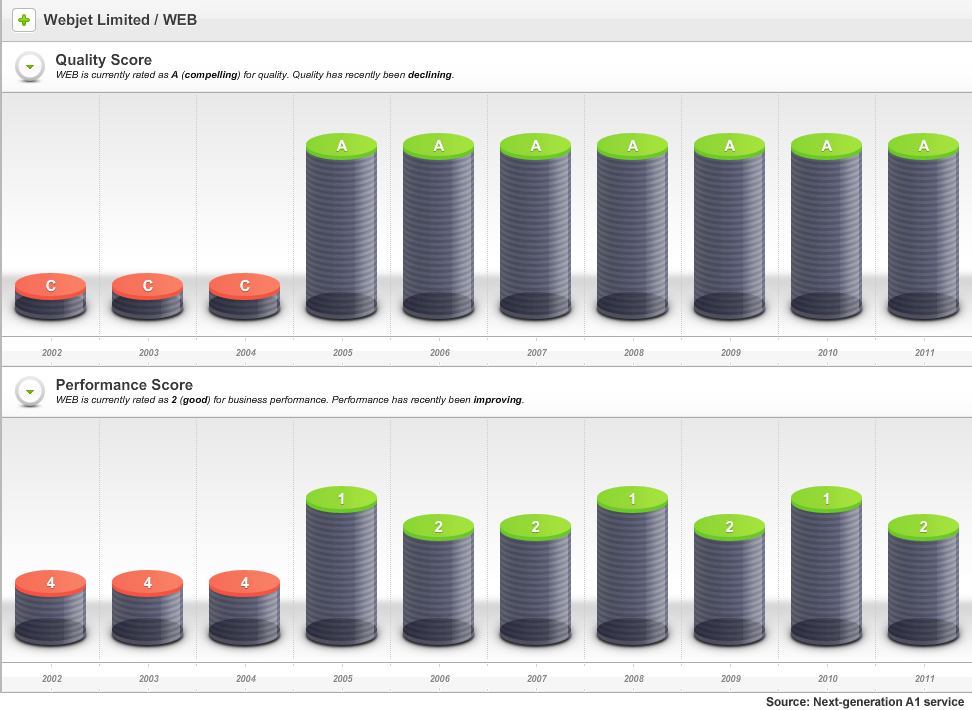

As the following sneek peek charts from our soon-to-be-released next-generation A1 stock market service display, Webjet has scored, on average, an A2 since 2005.

In this example, the Quality Score information tells us that something dramatic happened in the 2004/2005 financial year.

Webjet was once called Roper River Resources Company and in July 1999 the shares, under the ASX code; RRR, were trading at 25 cents. By March 2000 – near the peak of the internet bubble – RRR shares were trading at $1.38.

The reason is now obvious, although at the time it may have been a bit of a mystery.

In January 2000, Roper received a ‘speeding ticket’ from the ASX to which it responded on 14 January with the following statement:

“1. There are no, matters of importance, about to be released to the market.

“2. The Company is not aware of any information to explain the recent trading in the shares.

“3. The Company can offer no other explanation for the price change and increase in volume in the securities of the Company.”

“4. I confirm that the Company is in compliance with the listing rules, in particular, listing rule 3.1.”

On 27 January 2000 however – less than two weeks later – Roper River Resources (ASX:RRR) announced it was issuing 50 million shares to acquire Webjet Pty Ltd.

By June 2004 the shares were still trading at 15 cents, however the company announced the previous October that it was trading in the black for the first time. By November 2004, it was reporting 400 per cent monthly increases in sales. Almost every month to its full year results in June 2005, it continued to report 400 plus percentage increases in monthly sales.

And in that year Webjet’s Quality Score jumped from C4 to A1. As you can see, Webjet has maintained an A1 or A2 quality rating since.

By comparison, Qantas’s Quality Score profile has been more marginal. This should be unsurprising to many, if not most Value.able Graduates, who understand the downside of capital intensity. Lots of property plant and equipment results in more equity for a given profit, and that means lower returns.

So, what do you think?

With reporting season about to end, your mission, if you choose to accept it, is:

Source the latest Annual Report for each business in your portfolio. Go to the Balance Sheet and under ‘Non-Current Assets’ find ‘Property, Plant and Equipment’.

If you have any, how many capital-intensive businesses are hiding in your portfolio?

Making this process simple and easy is something we have been working on for you. We created our next-generation A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. The above graphics are just one

It’s an A1 service that is like nothing you have ever seen before.value

Value.able Graduates – your invitation to pre-register is coming soon.

If you haven’t graduated to guarantee your invitation, click here to order your copy of Value.able immediately. Once you have 1. Read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team, fund managers and creators of the ext-generation A1 stock market service, 30 August 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

-

What has probing the reporting season avalanche revealed?

Roger Montgomery

August 24, 2011

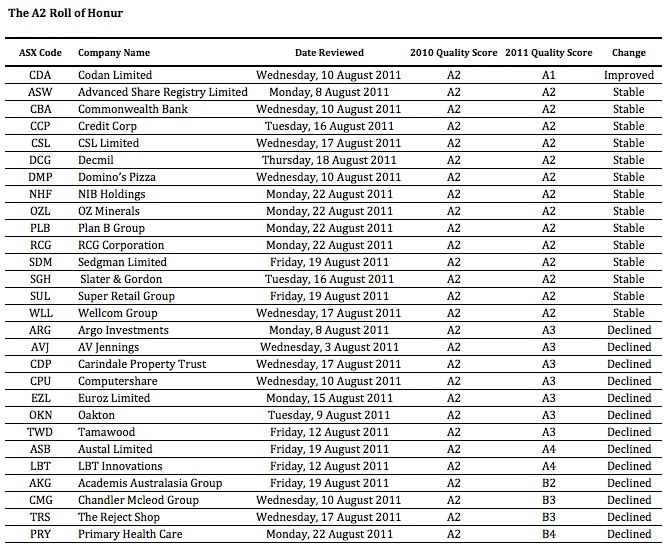

With reporting season in full swing, I would like to share my insights into whose Quality Score has improved, and whose has deteriorated. Remember, none of this represents recommendations. It is intended to be educational only. You must seek and take personal professional advice before acting or transacting in any security.

To date, 232 companies have reported their annual results. I am sure you can understand why we feel snowed under. With almost 2,000 companies listed on the ASX, the avalanche still has a way to roll.

We have updated all of our models for each of the 164 companies that we are interested in. As you know, we rank all listed companies from A1 down to C5. The inputs for those rankings always come from the company themselves. I would hate to think how bipolar they would be if we allowed our emotions and personal preferences to infect those ratings (or be swayed by analyst forecasts)!

Rather than arbitrary and subjective assessments, we download some 50-70 Profit and Loss, Balance Sheet and Cash Flow data fields from each annual report to populate five templates. All of these templates employ industry specific metrics to calculate the Quality Scores. This allows us to rank every ASX-listed business from A1 – C5. Its our objective way to sort the wheat from the chaff.

For Value.able Graduates not familiar with our scoring system, company’s that achieve an A1 Score are those we believe to be the best businesses, and the safest. C5s are the poorest performers and carry the highest risk of a possible catastrophic event.

A1 does not mean nothing bad will ever befall a company. A1 simply means to us that it has the lowest probability of something permanently catastrophic. Further, ‘lowest probability’ doesn’t mean ‘never’. A hundred-to-one horse can still win races, even though the probability is low. Similarly, an A1 business can experience a permanently fatal event. In aggregate however, we expect a portfolio of A1 businesses to outperform, over a long period of time, a portfolio of companies with lesser scores.

With that in mind, we are of course most interested in the A1s and – on a declining scale – A2, B1 and B2 businesses.

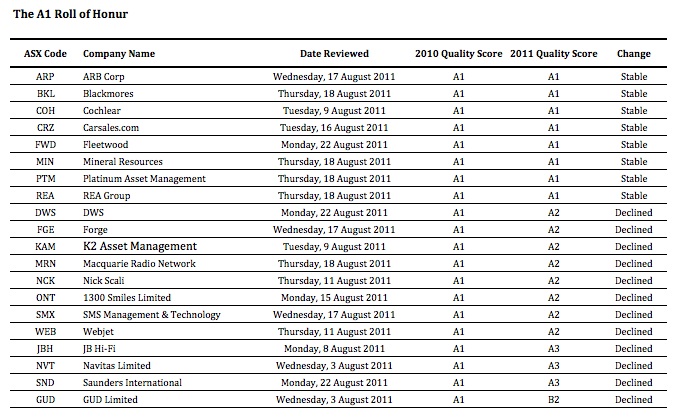

So, who has managed to retain their A1 status this reporting season? And which businesses have achieved the coveted A1 status? If you hold shares in any of the companies whose scores have declined (based of course on their reported results), please read on.

Of the companies that have reported so far, last year 20 of them were A1s, 28 were A2s, one was a B1 and 13 scored B2. That’s an encouraging proportion, although we tend to discover each reporting season that the better quality businesses and the better performing businesses are generally keen to get their results out into the public domain early.

Its towards the end of every reporting season where the quality of the businesses really drops off. This is always something to watch out for – companies trying to hide amongst the many hundreds reporting at the end of the season. It’s always a good idea to turn up to a big fancy dress party late, if you aren’t in fancy dress.

This year we have seen the number of existing A1s fall to nine from 20, A2s from 28 to 24, B1s rise from one to two and B2s fall from 13 to six.

The first table shows all twenty 2009/2010 A1 companies that have reported to date. You’ll see a number of very familiar names in here, including ARB Corp (ARP), Blackmores (BKL), Cochlear (COH), Carsales.com (CRZ), Fleetwood (FWD), Mineral Resources (MIN), Platinum Asset Management (PTM), REA Group (REA), DWS (DWS), Forge (FGE), K2 Asset Management (KAM), Macquarie Radio Network (MRN), Nick Scali (NCK), 1300 Smiles Limited (ONT), SMS Management & Technology (SMX), Webjet (WEB), JB Hi-Fi (JBH), Navitas Limited (NVT), Saunders International (SND) and GUD Limited (GUD). Nine have maintained their A1 rating this year.

Now, before you go jumping up and down, a drop from A1 to A2 is like downgrading from Rolls Royce to Bently. When we talk about A2s, its not a drop from RR Phantom to a Ford Cortina, not that there’s anything wrong with the old Cortina (if you are too young to know what I am talking about Google it!).

The only big rating decline is GUD Holdings, which made a large acquisition (Dexion) during the year. Indeed, a common theme amongst the higher quality and cashed up businesses this reporting season has been the deployment of that cash towards, for example, acquisition or buybacks (think JB Hi-Fi).

Moving onto the 2009/2010 A2 honour roll: Codan Limited (CDN), Advanced Share Registry Limited (ASW), Commonwealth Bank (CBA), Credit Corp (CCP), CSL Limited (CSL), Decmil (DCG), Domino’s Pizza (DMP), NIB Holdings (NHF), OZ Minerals (OZL), Plan B Group (PLB), RCG Corporation (RCG), Sedgman Limited (SDM), Slater & Gordon (SGH), Super Retail Group (SUL), Wellcom Group (WLL), Argo Investments (ARG), AV Jennings (AVJ), Carindale Property Trust (CDP), Computershare (CPU), Euroz Limited (EZL), Oakton (OKN), Tamawood (TWD), Austal Limited (ASB), LBT Innovations (LBT), Academis Australasia Group (AKG), Chandler Mcleod Group (CMG), The Reject Shop (TRS) and Primary Health Care (PRY).

The businesses that make up this list showed slightly more stability. The biggest fall in quality this year was Primary Healthcare (PRY),which is still struggling to digest the large purchases it made a few years ago. The Reject Shop (TRS) also declined, to B3. TRS is still investment grade and we would lean towards believing this is a short-term decline, given the floods in QLD that caused the complete shutdown of their new distribution center and the massive disruptions subsequently caused. As the company said, you can’t sell what you haven’t got!

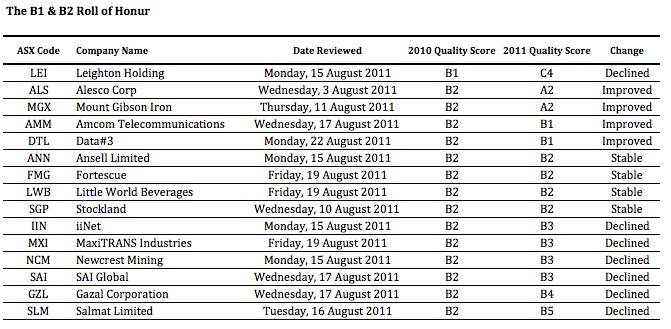

Finally, B1 and B2 companies: Leighton Holdings (LEI), Alesco Corp (ALS), Mount Gibson Iron (MGX), Amcom Telecommunications (AMM), Data#3 (DTL), Ansell Limited (ANN), Fortescue (FMG), Little World Beverages (LWB), Stockland (SGP), iiNet (IIN), MaxiTRANS Industries (MXI), Newcrest Mining (NCM), SAI Global (SAI), Gazal Corporation (GZL) and Salmat (SLM).

About half the companies in the B1/B2 list retained or improved their ratings from last year. Mind you, half also saw their rating decline!

The clear fall from grace is Leighton Holdings, whose problems have been well documented in the media and via company presentations.But once again, like The Reject Shop, this could be a temporary situation. If the forecast $650m profit comes through, I expect LEI’s quality score will improve. What the dip will do, however, is remain a permanent reminder that Leighton is a cyclical business. Getting the quote right on a job is important, even more a massive enterprise like Leightons.

Are you surprised by any of the changes? We certainly were!

Sticking to quality is vitally important. That’s what my team and I do here at Montgomery Inc, and its what our amazing next-generation A1 service is all about. Value.able Graduates – your invitation is pending.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have 1. read Value.able and 2. changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our soon-to-be-released next-generation A1 service).

Remember, you must do your own research and remember to seek and take personal professional advice.

We look forward to reading your insights and will provide another reporting season update soon.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 24 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

Is iiNet worth two Bob?

Roger Montgomery

August 15, 2011

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.

iiNet’s full-year results have been released. I have taken particular interest because communications and data is one sector of the marketplace I believe is relatively less affected, in terms of share-of-wallet, by the ructions in the US Europe.The results released today (15 August 2011) were marginally below the expectations of several analysts we correspond daily with. Underlying EBITDA was up just shy of 30 per cent to $104.8 million (some analysts were expecting $106 million and a little more).

With DSL (Digital Subscriber Line) – the technology that significantly increases the digital capacity of ordinary telephone lines, and excluding HFC (Hybrid Fiber-Coax network – CABLE) – iiNet is now the number two competitor and the leading “challenger “in the Australian residential telecommunications market. As an investor, I am always interested in the number 1 or 2 player in town. However the gap between number 1 (Telstra) and iiNet (#2) is enormous. iiNet have 641,000 paid DSL subscribers (up 19 per cent). Telstra has 2.4 million.

The company reported its underlying Net Profit After Tax was $39.0m, up 12.4 per cent on FY10, while reported NAPT fell 3.7 per cent to $33.4m (FY10 $34.7m). On a quick glance, I reckon underlying profit was $37 million (you have to add back $3.9 million in deal costs, redundancy costs of $1.2 million and legal costs of $1.4 million but tax effect it). Stripping out the impact of the acquisition, I also estimate cash flow was close to $40 million.

The reason for the less than stellar growth in reported net profit was because iiNet’s tax bill was much higher than last year. The increase in tax wiped out all of the increase in the net profit before tax.

Whilst many analysts will look at the growth in operating profit (EBITDA), I’d look at the net profit before tax. If I add the legal costs in 2010 back to that year’s profit-before-tax and then add the one-offs for 2011, I get a jump in net profit before tax from $43.85 to $53.4 million and a reduction in margins from 9.25 per cent to 7.6 per cent. Hopefully the company’s expected ‘synergies’ (an extra $10 million from porting AAPT customers across to the iiNet billing system?) raise this to 8.5 per cent.

Net debt increased to $96.4m from $56.3m as a result of the AAPT Consumer division. This has had an impact on our Quality Score (the A1-C5 system), which was B2 previously. Gearing will be 40 per cent. And the the balance sheet? It now contains $302 million of goodwill compared to $242 million of equity.

Revenue and operating cash flow was up significantly with the full year’s benefit of the Netspace acquisition and a nine month benefit of the AAPT consumer division. What really would be interesting however is an estimate of what like-for-like revenue and operating cash flow is. Sure iiNet has no ‘stores’, but acquisitions and synergy extraction doesn’t have the same whiff of sustainability as a business that can grow organically. I would like to see how the old business (excluding the acquisitions) is travelling. Value.able Graduates – would you?

And when I hear company say that it is “Ideally positioned for the future“, I want answers as to whether they were previously ideally positioned for ‘now’.

The 19 per cent growth in DSL subscribers includes AAPT’s consumer division, so it doesn’t give us much insight into the organic growth of the company. With ARPU (Average Revenue Per User) largely unchanged, yet network and carrier costs up 56 per cent – above the 47 per cent increase in revenue – some insights into organic growth would be helpful. I suspect subscriber growth will reflect slow organic growth in FY12, and any margin/profit improvement will come from ‘synergies’. While these may be significant ($9 – $12 million from migrating AAPT customers onto iinet billing system), they are not a long-term delivery platform for profit growth.

It is clear that management’s confidence is high. They have significantly increased the dividend from $12.1 million last year to $16.7 million this year and have announced separately a share buy-back of up to 7.6 million shares, or about 5 per cent of the issued capital (about $17 million at current prices), despite the fact that debt has risen substantially by a net $52 million. Perhaps when you have $766 million coming through the door you can afford to be a bit fancy-free with your capital allocation? Thoughts anyone?

I hear whispers in the background… Roger, how do you know all this? Yes, I do listen to company presentations and we do read investor briefings. But nothing compares to the clarity that comes from using our A1 service. It is, quite literally, extaordinary. And we can’t wait to share it with you. Value.able Graduates – expect to receive your invitation very soon. Now, back to the program…

If organic growth is slow and acquisitions begin to thin out, one would expect debt repayment followed by an increase in the payout ratio. Or perhaps the other way around, if share price support is contemplated?

The prices paid for acquisitions does not immediately cause concern for me, because the returns on equity being reported aren’t poor. But they aren’t A1 either.

Investors have tipped in $223 million and left in $15 million. On those amounts, iiNet’s Return on Equity is about 16 per cent.That’s not bad, but are there better opportunities out there. Before you suggest Telstra, keep in mind it is 140 per cent geared and profits are boosted by the failure of the company to recognise software development expenses in the year they are incurred.

The old fashioned Value.able investor in me doesn’t like looking at a balance sheet that reveals the debt-funded acquisition of goodwill. I have witnessed far too many examples of this turning out poorly. Sure, some of you may say that MMS did the same thing? But while debt rose significantly there, the corresponding asset was PP&E, not goodwill. You may instead point out that interest cover is still high at 9 times (20 times last year). That, I accept.

Finally, the NBN. What does it mean for iiNet?

First, some background. An ‘Off-net’ customer is provided a DSL service through another network – usually Telstra wholesale. An ‘On-net’ customer is one that is provided a DSL service through the iiNetwork (iiNet’s own broadband network). The NBN is expected to reduce the average monthly cost of broadband + Voice bundling to $33, which compares favourably to the current off-net cost of $57. This is a potentially major saving, but the reason I am not as excited about this as the company is because as the transition is made, there will be some leakage. It will occur over an unexciting period of time and any number of offsetting factors could adversely impact revenues, costs and profits during that time.

I am more excited about other companies at the moment. A growth by acquisition strategy may offer wonderful potential in the short-term, but it can also be used to mask slow organic growth. The buy-back can be a sign that cashflow will be strong, but it can also be used to merely ‘display’ confidence and support the share price. At Montgomery HQ, we reckon the shares are very close to their Value.able intrinsic value, but iiNet’s fall in quality, from A3 to B2, suggests shifting your attention to other opportunities.

You should be practising your own Value.able valuations. So what do you get for iiNet for 2011, 2012 and 2013?

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 15 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Technology & Telecommunications, Value.able.

-

What’s your stock market survival story?

Roger Montgomery

August 10, 2011

Last night, First Edition Value.able Graduate Scotty G shared his stock market story at our blog. Scotty’s story is far too value.able to not receive its own, very special post! Over to you Scotty…

A Tale of Two Crashes

by Scotty G

2008/2009

An ‘investor’, whom we’ll call Scotty G for anonymity purposes, has woken for work at 05:00 to see that the Dow is off 700 points. He nervously heads in to work to check what it means for his portfolio of ‘blue chips’. He’s down badly and it’s only made worse by the fact that he is in a margin loan, which he kept at a ‘conservative’ 50 per cent level of gearing.

His ‘great’ stock picks are not holding up well in this environment and his ‘genius’ ‘value plays’ like buying Babcock and Brown at $7 because ‘its fallen from $28 and surely at a quarter of the price it represents value’ no longer looks like genius at all. He had imagined himself some sort of Buffet-ian hero, stepping into a falling market and making the tough buy call that would surely pay off. No actual analysis is done to back up these calls.

Finally he is 1 per cent off a margin call. He is tense at work, snapping at friends and chewing a red pen so hard it stains his lips and chin. He capitulates, calls his broker and sells out, including his ‘value pick’ Babcock and Brown at 70c. He feels relieved to be out, but is bruised and jaded by his experience. He vows to return to the stock market some day and do better, but doesn’t know how.

2010

Our ‘hero’ comes across a beacon of light in a sea of information. It is the Value.able column in Alan Kohler’s Eureka Report, penned by a knight known as Roger M (name changed to protect the innocent). He follows the link to the Insights blog and is astounded that the information he has been searching for is all here. He eagerly orders the Tome of Wisdom (known as Value.able to some). Upon receiving it, he reads it in one sitting. Wheels click in his head and light shines in the dark. Could it be so simple? Knowing what something is worth and then refusing to pay above it? In fact, demanding a discount? He set off onto his journey for the Grail.

2011

Our hero is now equipped with a spreadsheet devised from the Value.able rule book. He can value companies quickly and decisively. Many don’t make it onto the spreadsheet, as he can now spot a ‘Babcock and Brown’ coming from a mile away. Stock ‘tips’ from colleagues can now be waved away. When they ask why, he tells them. If they say he’s crazy, he smiles and feels at peace. He knows he is still not perfect, but he’s a darn sight better than he was three years back.

The markets turn down. The spreadsheet is rechecked. MCE and FGE are added as they shift below his 20 per cent discount rate. JBH is added soon after. The markets shift lower. But reassured by the facts this time, and not the hype, he buys more of the above.

Markets shift lower still. Figures are checked and rechecked as more great businesses come within range. The panic of a fall is now replaced by a calmness and certainty that an anchor of value provides.

The market finally slides steeply over several days.

Finally! Some of his best targets are in range.

VOC falls, then MTU (a company he has waited ages to acquire), and finally DCG. Sadly, ARP refuses to come within range, but he his patient and does not chase it.

He retires to his castle (lounge/bar), content with the work he has done and happy to await the next chance to hunt and switches on the sport, deftly ignoring the news and business channels hosting ‘experts’ eager to proffer their take on why things were the way they were. He feels at peace and sleeps soundly that night.

“Ok, stripping out all the ‘poetic’ and imaginative stuff, this is pretty much how it went in real life. I suffered a loss due to poor decisions with no research. I found Value.able, I converted (or got innoculated as some of the greats say) and took advantage of the recent situation. And I do sleep soundly at night.

“Thank you Roger for your willingness to share and to all on the blog for the same spirit of camaraderie. I look forward to many years of sleeping soundly at night.

To Value.able and to Value!”

Thanks Scotty.

If you are yet to join the Graduate Class, click here to order your copy of Value.able immediately. Once you have; 1. read Value.able and 2. Like Scotty, changed some part of the way you think about the stock market, my team and I will be delighted to officially welcome you as a Graduate of the Class of 2011 (and invite you to become a founding member of our very-soon-to-be-released next-generation A1 service).

Posted by Roger Montgomery and his A1 team (on behalf of Scotty G), fund managers and creators of the next-generation A1 service for stock market investors, 10 August 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What did Ash and the team talk about?

Roger Montgomery

July 7, 2011

Yesterday we had the pleasure of meeting Ash in person. If you scroll through any of the threads on our blog, you will no doubt find some extraordinary insights from one of Value.able’s founding Graduates.

Indeed, Ash’s generosity and willingness to share his experience and insights with new investors has fostered a spirit of camaraderie that has become integral to the Value.able community.

What did we talk about? It’s been a hot question at the Facebook page!

…Matrix, the recovering Lockyer Valley, cotton, gas explorers, an exciting new float, Lloyd, rugby and the 2GB podcast about a small cap gold stock that resulted in 170 comments and the thought to shut this blog down!

Thanks again Ash. We look forward to catching up with you again when you are next in Sydney.

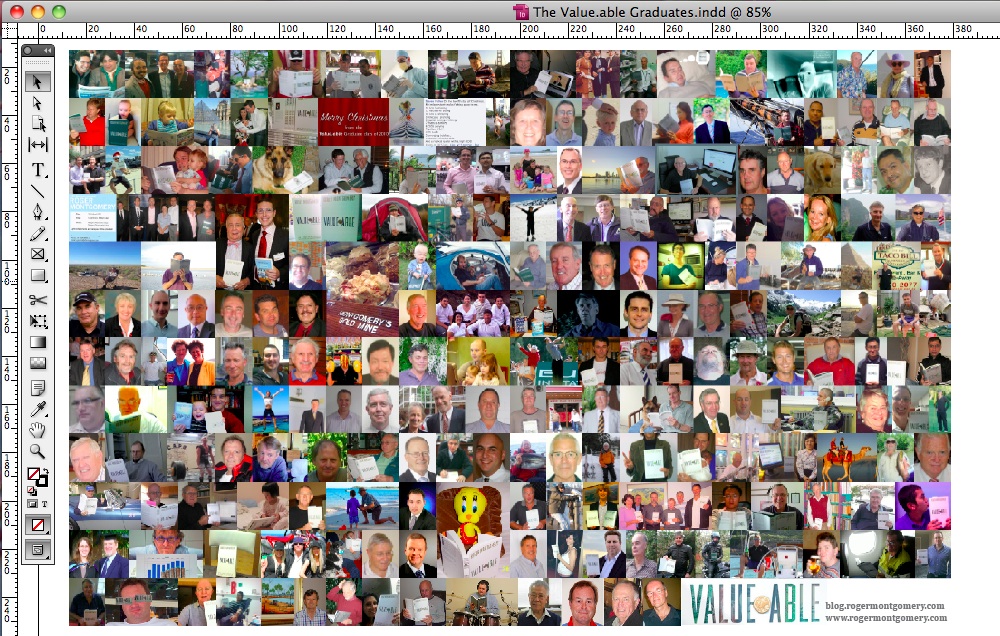

Now to the photo… can you spot some familiar faces?

The first four of six framed artworks are now featured at the entrance of our office.

It was a proud moment indeed. We will publish some more photographs of the artworks in coming days.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 7 July 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Value.able.

-

What are you cooking up Roger and team?

Roger Montgomery

June 23, 2011

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.

I am working tirelessly to generate superior returns for the Montgomery [Private] Fund. That is the number #1 goal. But stay tuned, because I am also writing a post for next week that will list some of the companies you should be seriously watching this reporting season (and there may be a few gems). Stay tuned and keep checking in.Today’s earlier post (What if the sell off is just a Flash?) lists some out-of-favour A1 companies.

If you have a company that you believe investors should be watching this reporting season, please start posting them here. Check in next week to see if they’re on our list too.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What if the sell-off is just a Flash?

Roger Montgomery

June 23, 2011

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?

Did you overhear a prominent investment commentator (not a Value.able Graduate, of course) recently express how upset/annoyed they were that the market for big companies’ shares was deteriorating?In the short run prices move independently of the underlying business, so let’s encourage the market to decline further!

For those truly concerned about Australia’s prosperity, relax. Be comfortable in the knowledge that short-term share price moves are unlikely to impact the employment policies of Australia’s largest listed businesses.

Looking over the financials of fifty-six A1 companies, little has changed. While Telstra and Fosters share prices are beating to the drum of hoped-for franked dividends and a takeover, the fundamentals of many other companies, particularly A1s (and indeed A2 and B1), are resolute. Are these businesses worth 10% to 26% less than they were worth before? No chance. The Value.able intrinsic valuations of companies that were cheap before haven’t changed.

So what has changed?

Only investors’ perceptions. Perceptions about the global economic outlook; perceptions about a US slowdown becoming a recession; perception about a Chinese slowdown causing a global rout the world cannot afford; and hope that Australian house prices will fall to levels people can actually afford.

Think about that for a moment. Baby boomers own $1m + homes that they will be forced to liquidate to fund their retirements and health care. Meanwhile, Generation Y is struggling to afford a property. Something has to give. Economics 101 suggests price declines.

Investors have simply been reducing their appetite for risk.

Armageddonists are spouting scenarios similar to those that followed Britain’s exit from the gold standard in 1931.

But this fear may be unfounded. It’s most certainly not a cause for permanent worry. Even if a recession does transpire, it will not be permanent.

Our job as Value.able Graduates is not to guess the gyrations of the economy – while they are vital in determining the sustainability of a given return on equity, many of the world’s very best investors do not even employ economists (they employ former US Federal Chairmen).

Your mantra is to simply put together a list of ten extraordinary businesses that you believe will be much more valuable in five, ten or twenty years time.

Of course trying to fit all this into your daily life can be a challenge. Completely eliminating the drudgery, and making it simple and fun, is something my team and I have been working on for you. We created our A1 service because we wanted to make finding extraordinary companies offering large safety margins easy. And, of course we love investing. We have worked really hard to create our next-generation service because its what we all want to use. We are its first members! Soon, you will be able to make your investing life simpler too (remember, Value.able Graduates will be invited first – have you secured your copy?). It’s an A1 service that is like nothing you have ever seen before.

You may sense our excitement…

… back to the regular program.

So, here it is. Our list of out-of-favour-but-extraordinary businesses. WARNING: out-of-favour does not always mean ‘bargain’.

Steve Jobs once said; “People think focus means saying yes to the thing you’ve got to focus on. But that’s not what it means at all. It means saying no to the hundred other good ideas that there are. You have to pick carefully.”

With that in mind, here are my thoughts on ten businesses we have discussed over the past few months with a back-of-the-business card reason for interest…

JB Hi-Fi (ASX: JBH, MQR: A1) – Bad news across the board in retail may get worse, but it will turn around and JB Hi-Fi is not Harvey Norman. The buyback has increased intrinsic value at the same time the price slides below.

Cochlear (ASX: COH, MQR: A1) – The shining star amongst A1s (COH is one of this country’s best export successes), yet the worst performer on the share market amongst its peers. Rational, anyone? Australian dollar fluctuations doesn’t change the quality of COH’s business, only the nature or shape of its earnings. Aussie dollar appreciation may last a while, but is not permanent.

CSL Limited (ASX:CSL, MQR: A1) – Another A1 amongst A1s. Like COH, earnings are affected by currency fluctuations.

Woolworths (ASX: WOW, MQR: B1) – Trading at a premium to current Value.able intrinsic value, but a small discount to 2012. Intrinsic value has taken five years to catch up to the price and the price has complied by waiting. In the absence of further downgrades, intrinsic value for future years now rises beyond the price at a good clip.

Reece (ASX: REH, MQR: A2) – Great quality business. Wait for weaker prices or intrinsic value to catch up.

Platinum Asset Management (ASX: PTM, MQR: A1) – Whilst few businesses can compete with Platinum on an ROE and low capital intensity basis, patience is required before acquiring.

Matrix C&E (ASX: MCE, MQR: A1) – Matrix is unique amongst its small capitalisation peers also servicing the resources sector. Watch the full year results closely.

ANZ (ASX: ANZ, MQR: A3) – Short of swimming off the island, we don’t have much choice when it comes to choosing a banking partner. Thanks to fears of an ineffectual Asia roll-out, ANZ is the cheapest of Australia’s big four at the present time.

Vocus Communications (ASX: VOC, MQR: A1) – Run by some of the best in the business, the intrinsic value of Vocus has the potential to be much, much higher in five years time.

Zicom Group (ASX: ZGL, MQR: B2) – Like Matrix, Zicom is exposed to both small-cap and resource sector engineering negativity. And like Vocus, the intrinsic value could rise much higher on the back of further rises in the price of oil and demand for gas.

What’s on your list?

This market, with an increasing number of companies hitting 52-week lows, is demanding your attention!

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 23 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights.

-

…You can’t touch this?

Roger Montgomery

June 13, 2011

“Yet you do not know about what may happen tomorrow. What is the nature of your life? You are but a wisp of vapor that is visible for a little while and then disappears“. James 4:14

“Suddenly a mist fell from my eyes and I knew the way I had to take.” Edvard Grieg

“Fog and smog should not be confused and are easily separated by color.” Chuck Jones

With apologies to 90’s rapper M.C Hammer, today I plan to lift the lid, ever so slightly, on a misconception about the value of tangible assets. I’ll throw in a few Value.able intrinsic valuations for you too.

Were you as fascinated recently, as I was, to read Harvey Norman suggesting that the price premium to book value of JB Hi-Fi compared to that of itself was unjustified? The company pointed out – and allow me to paraphrase – that the market capitalisation of JB Hi-Fi ($1.9 billion) against just $365 million of book value is high, when Harvey Norman’s market capitalisation is $2.7 billion and its book value is expected to be $2.2 billion at the end of this financial year.

The attachment to physical assets held by many is not unusual, nor is the belief that intangible assets are akin to a puff of smoke. Premiums to book value however are justified when that ‘book’ generates above average rates of return. And it is assets of the intangible variety – the economic goodwill (rather than the accounting variety) – that are more valuable anyway. Physical assets can be replaced, imitated and replicated. Any competitor (with deep enough pockets) can purchase almost all of them. Ultimately, any unusual returns these generate will be competed away as competitors secure the same machines, tools, equipment etc. Many in the printing game experience this phenomenon. A new machine gives them a marginal advantage only for as long as it takes their competitor to make the same investment.

Assets of an intangible nature are less easily copied and so high rates of return can be sustained longer, and are therefore worth more.

A company’s book value is the net worth of its assets. Book value is made up of both tangible assets and intangible assets. Tangible assets are physical and financial and include property, plant & equipment, inventory, cash, receivables and investments. Intangible assets aren’t physical or financial and may include trademarks, franchises and patents.

To demonstrate the difference in value between intangible and tangible, have a look at Google; That company’s market capitalisation is US$165.5 billion and yet its book value is just US$48.6 billion. Its price to book value is 3.42 times. JB Hi-Fi’s price to book value is 5.2 times and Harvey Norman’s is 1.22 times. But Google’s ‘book’ generates returns of 19.16%, JB Hi-Fi; 41.5% and Harvey Norman; 11.6%. There is indeed a relationship between the price premium to ‘book’ and the profitability of that ‘book’ (‘ROE’). A business is worth much more than its net tangible assets when it produces profits well in excess of market-wide rates of return.

I wrote about the capital intensity of airlines in Value.able (re-read Pages 60-63, 122, 164, 172-3), so you should know my thoughts about this already (You can also read any of these articles and transcripts for a refresher: Taking-off or crash-landing?, Qantas cuts costs to stay in profit, Qantas cuts staff, flights to counter fuel price hit and Flights reduced, jobs cut at Qantas).

When it comes to physical assets, less is more. For a business to double sales and profits, there is frequently the requirement to increase the level of physical assets. The higher the proportion of physical assets compared to sales that are required, the less cash flow available to the owner. This is the antithesis of the intangible-heavy business that continually produces profits without the need to spend money on maintenance, upgrades or replacements.

Let me demonstrate with an admittedly rudimentary example. Take two companies Rich Pty Limited and Poor Pty Limited. Both companies earn a profit of $100,000. Rich Pty Limited has net assets of $1 million. Intangible assets, such as patents and a brand, represent six hundred thousand dollars while physical assets, including machinery running at full capacity and inventory, represent $400,000. Poor Pty Limited also has a net worth of $1 million, but this time the intangible/intangible mix is reversed and eight hundred thousand dollars represents tangible assets and $200,000 is intangible.

Rich P/L is earning $100,000 from tangible assets of $400,000 and Poor P/L is earning $100,000 from tangible assets of $800,000.

If both companies sought to double earnings, they may also have to double their investment in tangible assets. Rich P/L would have to invest another $400,000 to increase earnings by $100,000. Poor P/L would have to spend another $800,000.

For many investors a large proportion of physical assets – also reflected in a high NTA – is seen as a solid backstop in the event something catastrophic should befall a company. I would suggest that the opposite may just be true. A high level of physical assets may be a drag on your returns.

Physical assets are only worth more if they can generate a higher rate of earnings. Any hope that they are worth more than their book value is based on the ability to sell them for more, and that, in turn, is dependent on either finding a ‘sucker’ to buy them or a buyer who can generate a much higher return and therefore justify the higher price.

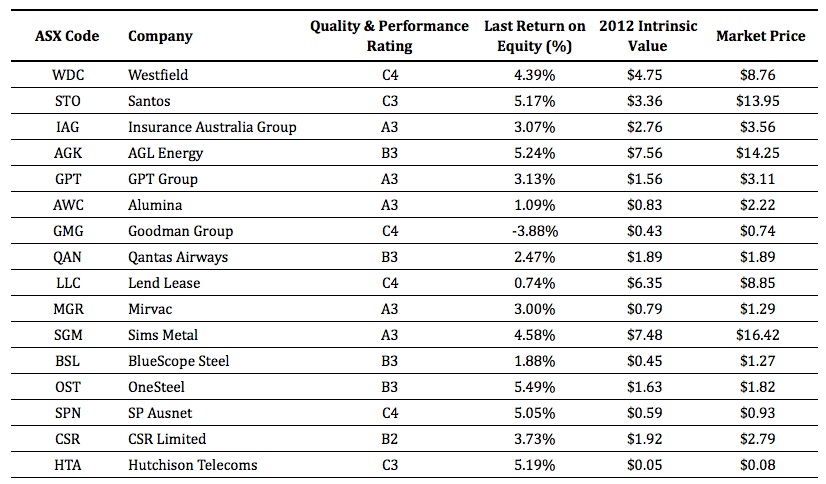

With these ideas in mind, its worth looking at a list of companies that further investigation may show have very high levels of tangible assets compared to their profits. Let’s also throw in those companies that have highly valued intangible assets too. If they are generating low returns on these, the auditors should arguably take a knife to their stated ‘book’ values.

Starting with those companies whose market captitalisation is more than $1 billion (156), I then ranked them by return on equity (return on book value) in ascending order. 49 (31 per cent) companies generate returns less than your bank term deposit. The 16 largest (based on market capitalisation) companies with low ROE, possibly indicating either high levels of tangible assets or possibly overstated intangible assets carried on the balance sheet, are:

I have excluded resource companies. For while there are plenty that qualify, their returns are dependent on commodity prices.

Something to remember about the Quality & Performance Rating…

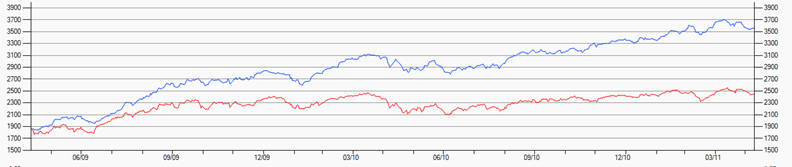

Rated A1 to A5, B1 to B5 and C1 to C5, every listed company is rated based on a series of over 30 discrete metrics, measured at both a point in time and over time. Most importantly, the Quality and Performance Rating is applied without any subjectivity. All companies are judged according to the metrics they generate. A1s have the lowest probability of a liquidation event. “Lowest probability” however doesn’t mean a liquidity event won’t occur. It just means far fewer A1s will have a liquidity event imposed on them compared to C5s. A liquidity event includes a capital raising, debt default or renegotiation, administration, receivership etc. An A1 company could of course raise capital if it needs to fast track construction of a new factory. MCE is an example of a high quality company whose cash flow has needed supplementation for this reason. Sticking to A1s and avoiding C5s should, over time, produce better returns. I demonstrate in the following chart:

The above chart shows the performance of a portfolio of the 20 biggest companies listed on the ASX rated ‘A1’. The red line is the poor old ASX 200.

There is merit with sticking to A1s (just as those who like the taste of Coca-Cola don’t settle for Pepsi). My team and I are fine-tuning something that will make the identification of A1s extraordinarily simple. So ignore those ‘Beat-the-tax-man’ pre-June 30 ‘special’ offers from various investing experts and other ‘helpers’. Avoid the temptation of an extra one, two or three month ‘subscription’, a show bag full of tips, a free magazine, DVD, or even a set of free steak knives.Wait for an A1 opportunity instead. Your patience will be rewarded.

Posted by Roger Montgomery and his A1 team, fund managers and creators of the next-generation A1 service for stock market investors, 13 June 2011.

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights, Value.able.

-

Have you submitted your photograph to the Value.able Graduate Album?

Roger Montgomery

June 9, 2011

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.

Jesse, Michael, Young Les, Justin, Matt, Rad, John, Ron, Young Max, Gary, Dan’s mum, Gary, George, Steven, JohnM, Paul, Steven and Sophie, Michael, Alya, Martin, Bernie, Amit, RBS Morgans Gosford, Jim Rogers, Daniel, Keith, Gavin, Graeme, Nick, Gelato Messina, Chris, Rodger, Phil, Vikki, Mark, Hien, Kenneth, Greg, Peter, Bernie, Paul, John, Bill, Bryan, Di and Lesley, Craig, Scotty, Chris, Main Amigo Stan, Charles, Fred, David, Mark, Collin, Nevada Cody and Winston, Peter, John, Nathan, Mal, John, Tony, Les, William Grant, Greg, Mike, Paul, Roger, Mike, David, Paul, Sinaway, Anders, Frank, Jake, Johan, Mark, Rob, Ian, Joan, Claude, Toni, Richard, Matt Jnr, Indrash, Sara, Garry, Jonathan, Ganesh, James, Kevin, Jim, Peter, Greg, Stuart, Craig, Eric, Robert, Ermin, Mike, Syed, Wilma, John, Alf, Tony, Phillip, Robyn, James, Carolyn, Roy, Peter, Jack, Kevin, Howard, Leo, Jonathan, Carole, Eileen, James, John, Martin, Ordan, Warren, Andrew, Liz, Jim, Anthony, Bob, Douglas, Christine, Frank, Martyn, Michael, John, Dave, Peter, Darrell, Jeffrey, David, Joof, Tom, Leigh, Mervin, Paul M, Paul K, Noel, Bob, George, Leigh, Bob, Steve, Monica, Richard, Frank, Brett, Steven, Colin, Wayne, Joanne, Dan, Garry, Lin, Judi, Allan, Stephen, Garth, John, Joab, Phillip, Kevin, John, Robert, Tweety and Bert, Peter, Mike, Patrick, Eugene, Brian, Harold, Russell, Brad, Rajest, Tim, Gemma, William, Bill, Robert, Geoff, Gary, Emily, Kent, Lucas, Neil, Peter, Rowley, Jason, Simon, Charles, Russell, Grahame, Lester, David, John, Richard, Mitra, John, Dave, Peter, Geoff, Paul, Derek and Rod have already submitted their photographs for inclusion in the Graduate album. My team – Russell, Vanessa, Rachel and Chris, will add theirs shortly.Have you emailed yours?

We plan to frame the album and hang it at the entrance of our office, next to another invaluable piece – Stay Calm and Carry On.

Posted by Roger Montgomery and his A1 team, fund managers and Value.able Graduates, 9 June 2011.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education, Value.able.

-

What did the company really earn in 2011?

Roger Montgomery

June 3, 2011

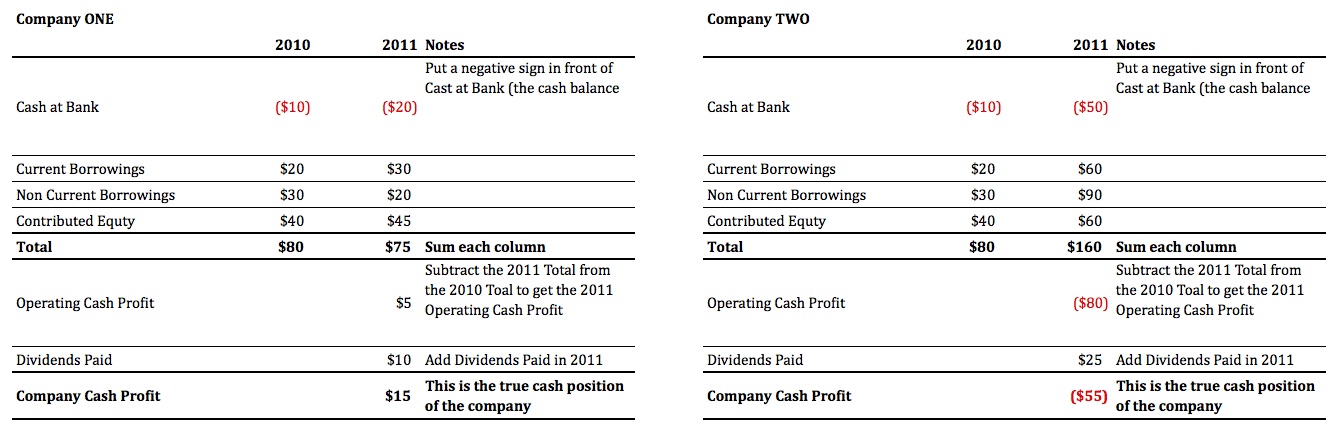

Last night on Sky Business, I discussed a quick back-of-the-envelope way to get to the heart of a company’s true cash flow performance. This will be useful for you during the upcoming reporting season to help you determine whether to investigate further, or to move on.

Last night on Sky Business, I discussed a quick back-of-the-envelope way to get to the heart of a company’s true cash flow performance. This will be useful for you during the upcoming reporting season to help you determine whether to investigate further, or to move on.It’s very simple. The exception being financial services and insurance companies, which can be problematic and require many more ‘edge-case’ explanations that are best kept close to my chest (with apologies).

So here’s what you do.

1. Find the Balance Sheet and Cash Flow Statement of a business you wish to examine (use the current year’s annual report) and lay it out on a table.

2. Pull out the headings you need and arrange them as illustrated below (Cash at Bank, Current Borrowings, Non Current Borrowings, Contributed Equity).

3. Put a negative sign in front of Cash at Bank.

4. Now sum the two columns.

5. Subtract the current year Total from the previous year. You can do this with half-year results too, for example, compare the 1HY11 with the final 2010 results.

6. Finally add back any Dividends actually paid in the 2011 Financial Year (get this from the Cash Flow Statement).

7. Done.

Now you have a number that better reflects the true change in the company’s cash position. The changes in every other item on the balance sheet will explain this number. But this number – Company Cash Profit – is the number.

The company at left earned a positive cash profit. What about the one on the right? It lost cash during the year (or spent it on an acquisition(s)). Click the image to enlarge.

Why don’t you run the steps yourself on a few companies in your portfolio and see what you come up with. Where there is a big difference between your calculation of the company’s cash position and the reported profit, pop it up here at our Insights Blog.

This simple calculation is just one of over a dozen other simple strategies detailed in Value.able to help you improve your investing. They’re all there in one comprehensive guide.

If you haven’t yet ordered your copy, now isn’t the time to procrastinate. The last print run for a long while is walking out the door right now. Order your copy at my website, www.rogermontgomery.com.

Posted by Roger Montgomery, author and fund manager, 3 June 2011.

by Roger Montgomery Posted in Insightful Insights, Investing Education.