Insightful Insights

-

Tailoring the right fit for Pumpkin Patch

Ben MacNevin

January 31, 2013

Pumpkin Patch is a New Zealand company that specializes in higher-end children’s wear. The company began in New Zealand in 1990 and expanded into Australia in 1993, and has managed to reach mature growth in both markets. Many Australasian retailers that reach mature growth will use their positions to support overseas expansions. Pumpkin Patch has managed to launch a profitable wholesale business by signing distribution agreements to hundreds of department stores around the world. However, its store rollout into the UK in 2001 and the US in 2005 has really hurt the company. This retail model was never profitable, and while a high New Zealand dollar and sluggish retail environment did little to help their margins, management were unable to replicate the success of the Australasian stores. The company accumulated NZD13.5 million of retained losses before management made the decision to close their UK and US stores and focus on their online and wholesale divisions.

continue…by Ben MacNevin Posted in Consumer discretionary, Insightful Insights, Manufacturing.

-

Hangover ahead for Miners?

Roger Montgomery

January 30, 2013

Recently a 5.5kg gold nugget was discovered prospecting around an old mine in Ballarat. Sometimes lightning strikes twice but more often trying to repeat past successes is like a dog returning to its vomit.

Spare a brief thought for the hapless long-term investor in businesses with sustainable competitive advantages. Sadly, these are not the businesses the stock market has been enamored with over the past six months.

continue…by Roger Montgomery Posted in Energy / Resources, Insightful Insights.

-

MEDIA

Back to the Good Old Days?

Roger Montgomery

January 29, 2013

In his first television appearance for 2013, Roger provides his insights into the reasons behind the recent rallies on Australian and Global Markets and how and if these trends will continue in discussion with Ticky Fullerton on ABC1’s The Business (Roger appears at 3:30). Watch here.

This edition of The Business was broadcast on Tuesday 29th January 2013.

by Roger Montgomery Posted in Companies, Insightful Insights, Market Valuation, TV Appearances.

-

Brand Manager Battles

Russell Muldoon

January 24, 2013

The half-year reporting season has begun in earnest this week with a slight trickle of financials coming through.

Of little interest to us so far are the reports from a number of listed investment companies (LIC’s) and also Agenix Limited (ASX: AGX), an unprofitable early-stage medical device company. These reports and many others like them are quickly pushed to one side to ensure we focus our time, energy and effort on more productive outcomes. Conversely, we have read GUD Holdings half year with interest.

continue…by Russell Muldoon Posted in Insightful Insights, Market Valuation.

-

Better times ahead for listed insurers?

Tim Kelley

January 23, 2013

After an extended run of disappointing performance from Australia’s largest non-life insurers, there have more recently been some positive signs. Over the past 12 months IAG’s share price has increased to around $5 from around $3 and, more recently, the QBE share price has risen from around $10 to over $12, partly on the back of press reports that cost reduction initiatives are planned. In light of these developments, it may be appropriate to consider whether these businesses face a brighter future.

continue…by Tim Kelley Posted in Insightful Insights, Insurance.

- 1 Comments

- save this article

- POSTED IN Insightful Insights, Insurance

-

McMillan Shakespeare

Russell Muldoon

January 18, 2013

The recent share price fall (now partially recovered) in McMillan Shakespeare over the past week can largely be attributed to this article in The Australian.

by Russell Muldoon Posted in Insightful Insights, Market Valuation.

-

Analyst Forecasts

Tim Kelley

January 17, 2013

In evaluating the future prospects for a business, one useful source of information is analyst earnings estimates. A good broking analyst who covers a particular company will often have a well-informed view of the factors that might influence earnings for that company in the years ahead.

At the same time, there are a number of biases and other issues with analysts’ forecasts. One interesting issue is that the forecasts can have a certain “inertia” to them, which means that changes may occur gradually over time. Because of this, it can be useful to look at the history of the forecasts, as well as the current level.

continue…by Tim Kelley Posted in Insightful Insights, Investing Education.

-

The 5000 mark

Ben MacNevin

January 16, 2013

The S&P/ASX200 Index has increased by 15 per cent since mid-2012 to its current level of 4720, which has focused the attention of market commentators on the “psychologically important” 5000 mark. Since the GFC, the S&P/ASX200 Index has not been able to break through 5000 despite nearing this level in early 2010 and early 2011.

by Ben MacNevin Posted in Insightful Insights, Value.able.

- 1 Comments

- save this article

- POSTED IN Insightful Insights, Value.able

-

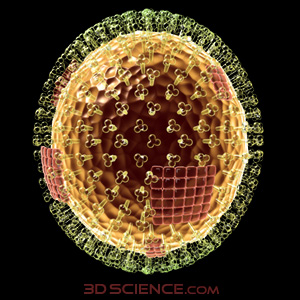

Influenza Outbreak in America

Ben MacNevin

January 14, 2013

It is winter in the United States, and there has been a severe outbreak of influenza. New York State declared a public health emergency on Saturday, with nearly 20,000 cases of flu reported across the state so far this season (compared with 4,400 cases reported in the whole of last season). There has been a widespread public services campaign to encourage people to receive vaccines, and under the emergency order pharmacists in New York will be allowed to administer flu vaccinations to patients between 6 months and 18 years old, temporarily suspending a state law that prohibits pharmacists from administering immunisations to children.

continue…by Ben MacNevin Posted in Health Care, Insightful Insights.

-

Value Investing

Tim Kelley

January 12, 2013

Value investing can be a laborious process. Properly understanding the many aspects that influence the value of a business is time-consuming, and in many cases the end result is to add one more company to the large pile of “No” decisions.

There are much quicker ways to arrive at investment decisions, one of which is to use trend-following systems. A large body of academic research has demonstrated that, historically, it has been possible to earn excess returns in a variety of markets over time by employing systematic trend-following methods (note that systematic trend following is something done by a computer employing back-tested statistical methods, not by an analyst casting their eye over a price chart).

by Tim Kelley Posted in Insightful Insights, Investing Education.