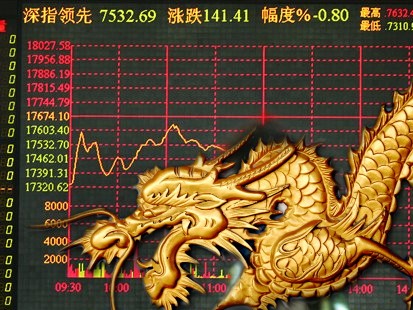

Chinese share market up 10% in 8 business days

The Chinese share market, as measures by the Shanghai Composite Index, spent forty months between late-July 2009 and early- December 2012 declining 44% from 3,478 points to 1,949 points.

In the past eight business days the Index has rallied 200 points or 10% to 2,150.

The preliminary HSBC China Manufacturing Purchasing Managers Index, released Friday, rose to a 14 month high in December, at 50.9 This is the second consecutive month the Index is in expansion territory (i.e. above 50).

Some headwinds remain with pressure on new export orders. China’s export growth decelerated from an annual rate of 11.6 per cent in October to 2.9 per cent in November due to reduced demand from their major customers.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Scott W

:

Unfortunately the nature of the Chinese Investor is quite immature at this stage. The tendency to gamble on an instant return has resulted in excellent returns in Macau but the Shanghai index had also been seen as a Casino by millions of Chinese who have too much time on their hands as well as a massive access to capital. Chinese have a massive savings rate, plenty of extra cash available to invest as well as a willingness to embrace risk taking.

As so many had their fingers burnt trying to get rich in a hurry as they see happening to others all around them the exit from the market has kept up a steady pace for years while the government has walked the line between wanting people to invest away from the Real Estate Bubble while not wanting to have another bubble pop up in the Shanghai Stock Market.

Chinese companies are often massively profitable, but they are also hopelessly corrupt and the real profits very often make their way into the pockets of the chosen few as well as government staffers who are more than willing to abuse their position for profit. This money often exits the country and a lot of it has found a home in the Australian Real Estate Market. Anyone who has wondered why the Chinese foreign investor is willing to pay such high prices for local property needs to understand that the penalty for getting caught with ‘black money’ in China can be execution. So overpaying for a prime property in Melbourne or Sydney is little concern.

Chinese are huge trend followers, take a look at their appetite for luxury goods, wine, or anything else that takes off. Perhaps the Shanghai market is back in fashion at long last. Don’t expect anything except irrational exuberance if the general populace decide to re-enter the market. A look further south at the gambling habits of the Hong Kong market shows what happens when the Mum & Dad Chinese get in for the ride in another equally corrupt market. The index goes up and down like a pulse and the Hong Kong real estate market can be the same.

There is a downside to all this though. Take some time to read about the true state of the Hong Kong market through the research of former HKEX director David Webb and you can see many many company directors their have been to prison. More scary is the hushed up reality that dozens of people jump to their death from the skyscrapers of Hong Kong when the market crashes as they have gambled everything on a win in the market.

It is less likely that Chinese Directors have served Prison time due to the ability of the corrupt to buy their own destiny, but equally how could you trust their annual report or statements to the market?

I have direct investments in Hong Kong managed funds in China and yes I do question my own sanity…