Health Care

-

MEDIA

Seeking Healthy Results for All

Roger Montgomery

October 13, 2012

Roger discusses his best picks in the healthcare sector in his Australian article published on 13 October 2012. Read here.

by Roger Montgomery Posted in Health Care, In the Press, Insightful Insights.

- save this article

- POSTED IN Health Care, In the Press, Insightful Insights

-

Your Exclusive Guide to Understanding Biotechs.

Roger Montgomery

May 31, 2012

Praveen has really put in some effort to bring this to you. Enjoy!

ANATOMY OF A BIOTECH by Praveen Jayarajan 1st May 2012

Investing in biotechnology companies is an inherently risky endeavour for many reasons, with many pundits of the view that the entire sector is highly speculative. But as with any such investment, the potential returns can be huge. However, the average investor, who may not be familiar with the terminology used in company reports, presentations, analyst coverage, and the media, may not have a great deal of understanding about the industry and what these companies actually do. In this article I am going to try and decode and de-jargon the industry and hopefully give you a better understanding of how to assess these companies.

Big Pharma vs Biotech

To begin with, we need to appreciate the traditional differences between a pharmaceutical and a biotechnology company. Traditionally, pharmaceutical companies, also now commonly referred to as “Big Pharma”, have been involved in small molecule therapies. What this means is that the drugs they produce are made from molecules that are relatively simple and small in size. These molecules are all chemically manufactured or synthesized by combining different compounds in a laboratory. They are also available in the form of an oral tablet or capsule, and can be easily absorbed into the bloodstream through the intestine. Once in the bloodstream they are able to penetrate different cells in the body due to their small size. An example is Lipitor, used to treat high cholesterol, made by Pfizer.

In contrast, biotechnology companies, also referred to as “Biotech”, have been involved in large molecule therapies called biologics that are based on molecules that are more complex and large in size. These molecules are manufactured using genetically modified living cells of microorganisms such as viruses and bacteria, as well as from human and animal sources. Biologics are usually administered via an injection or infusion, as they are too big to be absorbed when given orally. Once in the bloodstream they act in different ways to traditional drugs, including binding to receptors on the surface of cells rather than penetrating the cells. An example is Fluvax, which is the influenza vaccine, made by CSL.

The line between these two definitions has become increasingly blurred. In fact, these traditional definitions for Big Pharma and Biotech do not have as much relevance today. Biotech’s are now seen as smaller research and development companies, with Big Pharma taking the role of the larger company with the expertise and funding to progress a drug or biologic (in this article I will may also use the word “product” or “medication” interchangeably when referring to drugs and biologics) through the regulatory process and then take it into production and marketing. Examples of Big Pharma include Pfizer, Roche, GlaxoSmithKline, Novartis, Sanofi, and AstraZeneca. Note that there are also companies that can be loosely considered “Small Pharma” and “Big Biotech”.

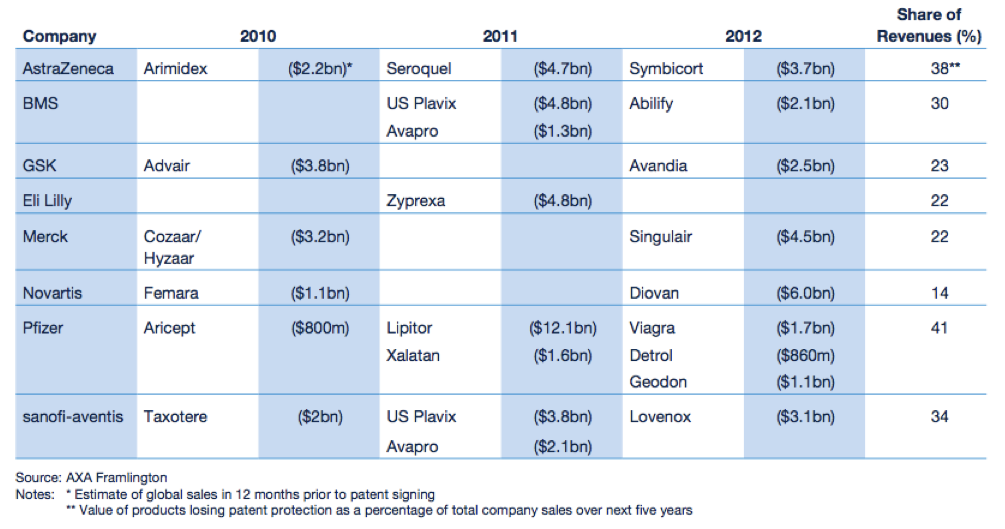

The Patent Cliff

What is a patent? A government license that gives the holder exclusive rights to a process, design or new invention for a designated period of time. Applications for patents are usually handled by a government agency (taken from Investopedia).

The “patent cliff” refers to what happens to revenues when an original product’s patent expires. As this happens, in the case of Big Pharma, they face competition from similar drugs made by other companies at a fraction of the price. These drugs are called generics. Generic drug manufacturers need to prove that their version of the drug is bioequivalent to the original. That is, it must have the same active ingredient and have the same properties as the original, but it does not have to go through extensive clinical trials like the original. According to the IMAP Pharma and Biotech Industry Global Report (2011), original drugs can face a price erosion of 70% within months of going off patent. Furthermore, revenues of drugs going off patent between 2010 and 2014 will be ~ US$89.5 billion. A number of “blockbuster” drugs (drugs that have revenues greater than US$1 billion) are due to go off patent in the coming years. The world’s biggest selling drug Lipitor, went off patent towards the end of 2011.

With regards to biologics, the patent cliff issue still applies, off patent biologics are called biosimilars or follow-on biologics. The difference is that because biologics are complex molecules, it is much harder and more expensive to make a bioequivalent version, and the regulatory requirements are far more rigorous. The worldwide biosimilars market is still in its infancy, with only a handful on the market. Note that there are also “me-too” products, these have similar active ingredients and mechanism of action to the original product, and almost identical clinical outcome, but unlike generics/biosimilars, may have other benefits. This could be increased efficacy, a different profile of adverse affects, or lower costs.

Figure 1: Expected fall in revenues for Big Pharma

Source: Pharma 2020 Report PWC

The R&D Pipeline

The research and development (R&D) pipeline refers to the group of drugs or biologics that a particular company is aiming to take into production and market. Generally, the more products it is developing and the later they are in the development phase, the more likely it is that one of their products will eventually be produced and marketed. In the 1990s, the discovery of a raft of blockbuster drugs resulted in huge revenues for the companies now recognised as Big Pharma. However, in recent times the efficiency or rate of return on their R&D efforts have been declining, with less products in late-stage development, higher average costs to develop and bring a drug to market, and a dearth of blockbusters to replace the ones going off patent. As a result of this Big Pharma are looking for innovation in the form of new biologics from their brothers in Biotech.

Big Pharma and Biotech collaboration

There is now increasing partnership and merger & acquisition (M&A) activity between Big Pharma and Biotech. Both sides have something to gain in this collaboration. Big Pharma are able to grow their pipeline, and with Biotech able to get the necessary funding to continue their R&D. With partnerships or “in-licensing”, Big Pharma will usually enter into an agreement with a Biotech whereby the Biotech will receive an upfront payment, and then further “milestone” payments as they advance the development of the product. Once the product is on sale, the Biotech will also receive royalty payments. When Big Pharma partner with a Biotech that has a product in the very early stages of development, the Biotech is likely to receive a lower share of royalties, whereas if the partnership occurs at an advanced stage, the Biotech is more likely to receive a larger share of royalties. With M&A activity, Biotech’s are being bought out at significant premiums, with the best companies fielding several bids from cashed up and hungry Big Pharma’s.

Regulatory affairs

Across the world, in order for a Big Pharma or Biotech company to be able to market or sell it’s product, the product needs to have been approved by the relevant government regulatory agency in each region that it plans to sell the product. In the US, this is the Food and Drug Administration (FDA), and in Europe, Japan, and Australia, this is the European Medicines Agency (EMA), the Ministry of Health Labour & Welfare Japan, and the Therapeutic Goods Administration (TGA) respectively. The International Conference on Harmonisation (ICH) was a project that brought together the regulatory agencies in the US, Europe, and Japan with the view to harmonising the regulatory requirements across these regions and the world. The ICH developed guidelines for regulation that have been adopted by certain countries, or are very similar to existing guidelines in others. As such, once a product has been approved in one country, meeting regulatory requirements for approval in others can be relatively straightforward.

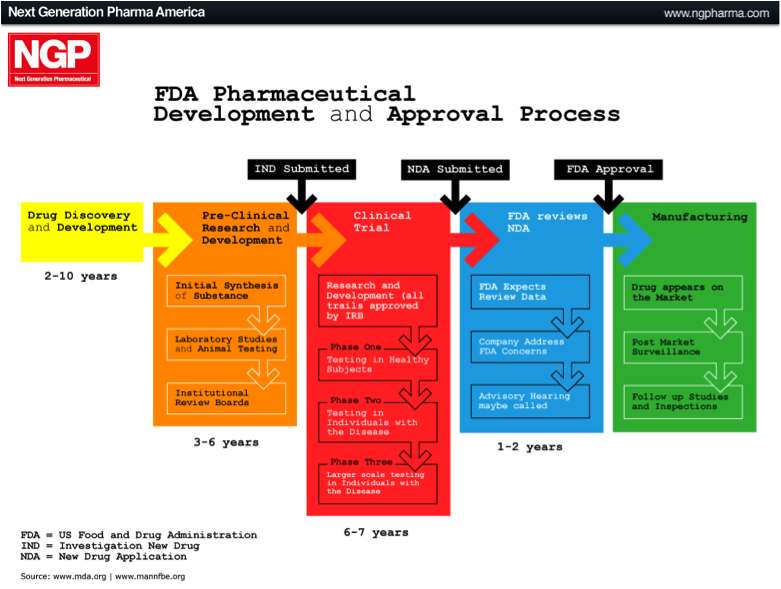

The US FDA approval process

The largest market in the world for drugs and biologics is the US. It is the Holy Grail if you like, which is why many international companies tailor their product development towards meeting the FDA requirements and getting FDA approval. The approval process can be broken down into different phases, as outlined below.

Pre-Clinical Phase: This phase begins after the discovery of new molecules, and is where new molecules are investigated and tested in the laboratory (in-vitro), on animals (in-vivo), or via computer simulation (in-silico). Once this phase is completed the company files an Investigational New Drug Application (IND).

Phase 1: Once the FDA has approved the IND, Phase 1 human testing begins. In this phase the product is tested on a small group of healthy individuals to assess it’s safety. This means testing to make sure it is not toxic or carcinogenic, and to determine appropriate doses. It is also assessed to see how it is broken down or metabolised by the body.

Phase 2: Here the product has been established as safe in humans and is now tested on a small group of individuals that are affected by the disease being targeted. This is done to see if the therapy actually works, as well as any short-term effects.

Phase 3: In this phase, often referred to as the late-stage in development, the product is tested on a much larger population. The trial is generally multicentre, double-blinded, randomised and placebo-controlled (i.e. a randomised controlled trial, RCT). This means that testing is conducted at different centres and neither the subject nor the physician know whether the actual product or a placebo is being given, and the allocation is completely randomised.

At the completion of Phase 3, if the product has been proven to be safe and effective, the company will apply for a New Drug Application (NDA) or Biological License Application (BLA). If this is accepted, the final product can be marketed.

Complete Response Letter (CRL): The FDA issues a CRL in response to an NDA/BLA. In essence it is a “please explain”, that requires the applicant to clarify issues that may relate to the product, including safety, efficacy, or manufacturing related issues. In some cases the issues are minor, in other cases they could results in rejection of the application.

Figure 2: US FDA approval process

Source: Next Generation Pharmaceutical

Special Protocol Assessment (SPA): This is granted to products in uncompleted Phase 3 trials that have design, clinical endpoints/outcomes, and statistical analyses that are acceptable for approval by the FDA. The SPA is an indication that if the trial goes to plan, the final product will be approved.

Prescription Drug User Fee Act Date (PDUFA Date): PDUFA is a law that allows the FDA to collect fees from product manufacturers in order to fund the approval process. The PDUFA Date refers to the deadline by which the FDA must either approve or reject an NDA/BLA. The FDA has 10 months to review new applications.

Fast Track / Accelerated Approval / Priority Review: The FDA grants a quicker approval for important products. Fast Track is for those that treat serious diseases (e.g. AIDS, Cancer) AND fill an unmet medical need (i.e. provide a treatment where nothing else exists, or that is superior to existing treatments). Fast Track designation enables eligibility for Accelerated Approval. Accelerated Approval involves using a surrogate endpoint, e.g. a laboratory measurement or physical sign used in a clinical trial as an indirect measure of clinical outcome (survival or symptom improvement). Priority Review is used when products offer again treatment where nothing else exists, or more superior treatment, but it can be for serious or non-serious diseases, and approval can be obtained within 6 months.

Orphan Product Status: Orphan product status or designation is granted to products that treat rare diseases or conditions. The orphan designation offers a number of advantages, including product tax credits, marketing incentives, and a period of exclusivity.

Phase 4: In this phase the product is already on the market and ongoing monitoring is undertaken to observe for any new short-term or long-term effects. In some cases new data has resulted in products being taken off the market, most notably in the case of the drug Vioxx marketed by Merck & Co. Vioxx was a widely used anti-inflammatory drug used to treat acute and chronic pain related to arthritis. It was found to increase the risk of heart disease and stroke. Prior to withdrawal it had revenues of ~US$2.5 billion and was used in over 80 million people.

Summary: Drug and biologic development is a lengthy process, certainly an 8 to 10 year period from beginning the search for a potential product to final FDA approval is quite common. This requires significant funding. In assessing a Biotech one needs to be acutely aware of the amount of cash they have in reserve as well as the cash burn rate (how much cash they are spending each year). According to the latest AUSBiotech Biotechnology Industry position survey (April 2012), 34% of those surveyed have less than 12 months cash on hand at current burn rates, and 46% intend to raise capital in the coming year. However, raising funds from equity/debt capital markets or even venture capital funds may be difficult for Biotech companies in the current economic climate. Companies that may fare better are those that are already partnered with Big Pharma, or at the least are able to attract a premium valuation for acquisition.

THE PROVIDER-PAYER RELATIONSHIP, PRICING, & REIMBURSEMENT

Once a company (the provider) gets it product approved by the relevant government regulatory agency, it needs to also get it listed on a formulary. A formulary is a list of medications. Private health insurers (the payer) have a formulary. This is a list of the medications that they will pay for, usually with a part contribution or “co-payment” from the person who has been prescribed the medication. More importantly, the provider needs to get its product on a government formulary (another payer). In the US this is the Medicare Part D and Medicaid formulary. Here in Australia it is the Pharmaceutical Benefits Scheme (PBS). Private health insurers generally only cover medications already listed on a government formulary. Payers (private and public) can take up to 9 to 12 months to add new products to their formulary. In Australia, once a product has TGA approval the Pharmaceutical Benefits Advisory Committee (PBAC), an independent expert government body, makes a recommendation (to the Health Minister) as to whether it should be listed on the PBS. Once that recommendation has been accepted the Pharmaceutical Benefits Pricing Authority (PBPA) determines what price the government should pay for the medication. This is then negotiated with the provider. As an example of how the reimbursement process then works, we can look at how medications are dispensed from a pharmacy. A wholesaler first purchases the product or medication from the provider and then sells it to the pharmacy. The pharmacy receives the patient’s co-payment once the medication is dispensed, and then they receive reimbursement for the remainder of their costs from the government. This reimbursement includes the provider’s price for the medication + wholesaler’s mark-up + pharmacy mark-up + dispensing/other pharmacy fees.

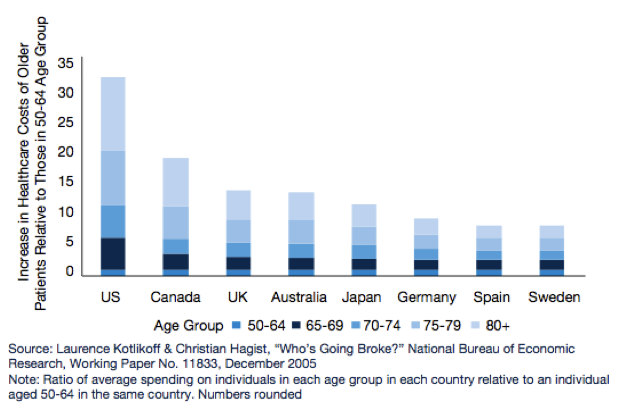

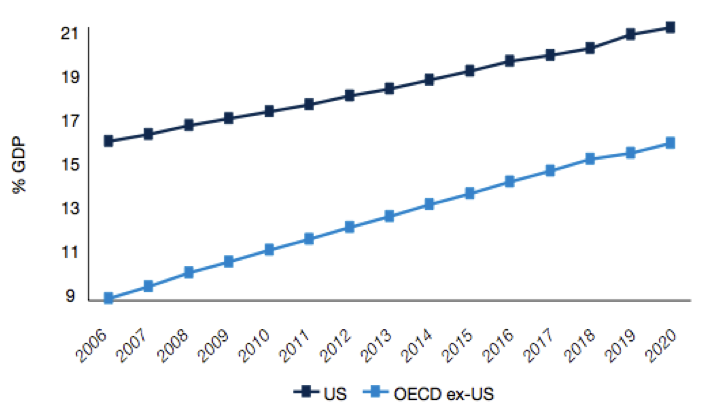

THE IMPACT OF HEALTH POLICY

Based on a number of surveys done across the world, what we know about the developed world’s population is that it is ageing. What this means for government’s around the world is that healthcare and pharmaceutical related expenditures are going to rise significantly over the coming years. This will impact government health policy and in turn it will impact pharmaceutical and biotechnology companies.

Figure 3: Increased healthcare costs for older people

Source: Pharma 2020 Report PWC

Figure 4: Rising health expenditure as a % of GDP

Source: Pharma 2020 Report PWC

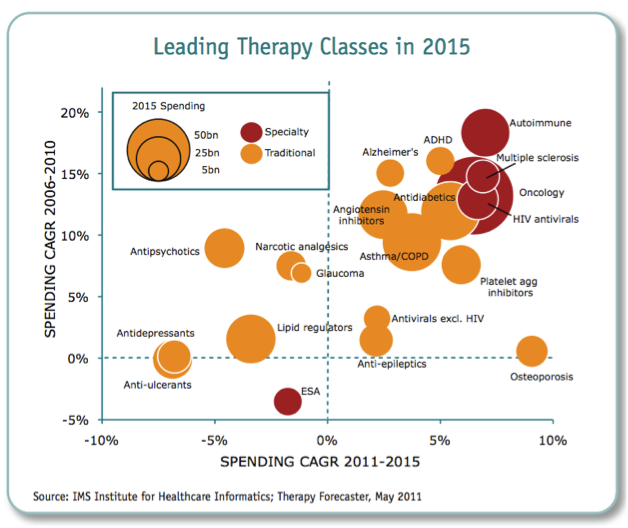

What we could therefore see is tighter regulation of products, shorter periods of exclusivity for original product manufacturers, lower drug prices or reimbursement, and more emphasis on lower cost generics or biosimilars. According to the IMS Institute for Health Informatics (2011), the key drivers for growth in the future will be increased spending from emerging markets (led by China), with a focus on generics or biosimilars, and specialty medicines (biologics).

Figure 5: Leading therapeutic classes in 2015

Source: IMS Institute of Health Informatics 2011

GRADE Classification of BioTechs

In reviewing Biotech companies I like to classify them according to 4 Grade’s, albeit arbitrarily. This is a way of trying to differentiate companies according to the strength of their product pipeline. There’s no science behind it, and it is just a guide or a starting point for further investigation, which you may or may not find useful.

Grade 1: At least 3 products on the market.

Grade 2: 1 or 2 products on the market, with at least 1 other in Phase 2 or 3 trials.

Grade 3: 1 product on the market, or no products on the market but at least 1 in Phase 3.

Grade 4: No products on the market, multiple in Pre-Clinical Phase, Phase 1, or Phase 2.

Across the Grade’s, Grade 1 companies could be considered relatively low risk as they already generating revenues and cash flow. On the other hand, these companies may have already experienced high levels of capital growth off the back of their existing products and may not have as much room to climb further, depending a lot of course on their expected future cash flows and pipeline. They may also be faced with the issue of expiring patents and increased competition from new products. I’d expect the most gains to be achieved from investing in a successful Grade 4 company that is held for the long-term. However, with the exceptionally long time it takes for product development, at the Grade 4 stage it is very hard to assess the likelihood for long-term success. Furthermore, success in Phase 1 or 2 trials is not necessarily a reliable indicator of Phase 3 success or likelihood for regulatory approval. The sweet spot for me is going to be Grade 2 and 3. In order to maximise the potential returns on a Biotech investment, I want to capture those that are closer to their “inflection point”, which may be in these mid or lower ranked Grade’s.

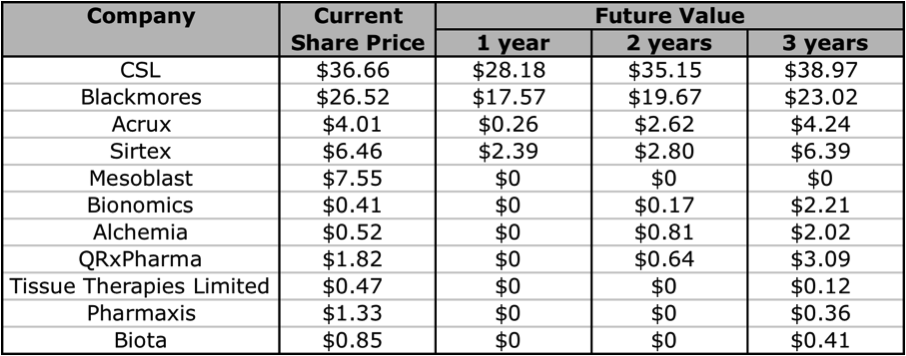

The problem here is that many of these companies are yet to generate any revenues, so a reliable valuation is difficult to make. However, using Skaffold (http:///www.skaffold.com), we can at the very least start by filtering out the ASX-listed Biotech companies, and then find those that are forecast to have a rise in their future intrinsic value. In the table below I have extracted and listed all Healthcare sector companies that that are also part of the Biotechnology/Major Drugs industry groups. The companies listed below all have analyst coverage. I have excluded 2 companies that did not really fit into the defined Grade classification, Mayne Pharma (diversified pharmaceutical services), and Sigma Pharma (wholesale and retail pharmaceutical distribution/sales).

Figure 6: Skaffold biotechnology company current Quality Scores

Source: Skaffold 26 April 2012

Based on the Skaffold Scores, there are 5 companies that could be considered investment grade. They are the A1, A2, and A3 companies: CSL, Blackmores, Acrux, Sirtex, and Mesoblast. Although Mesoblast does not have any intrinsic value, as it does not have any current product revenues. Mesoblast is an interesting one, although it has a lot of cash, this is largely the result of a partnership with Cephalon (now Teva). There are a handful of other companies that have analyst forecasts for near-term product revenue and thus have a future intrinsic value: Biota, Tissue Therapies Limited, Bionomics, Alchemia, Pharmaxis, and QRxPharma. In the following sections I will give a brief overview of 2 companies that currently have products on the market, Acrux and Sirtex, note that the former makes products that enable drug-delivery, and the other is technically a medical device company.

ACRUX (ASX:ACR)

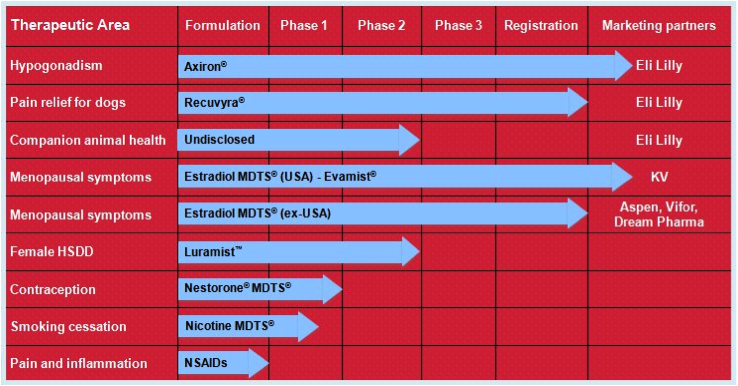

Acrux has a number of products in its pipeline, all of which are based on transdermal delivery. That is, the medications are absorbed into the bloodstream through the skin via sprays, gels, or solutions. The medications themselves have all already been used safely when administered in other ways, for example, via tablets or injections.

Figure 7: Acrux R&D pipeline

Source: Acrux website

Their lead product is Axiron. Axiron is a testosterone hormone solution used to treat low testosterone hormone levels in men (hypogonadism). It is applied in the armpits using an applicator, much like a roll-on deodorant. It was given FDA approval in 2010 and is on the market in the USA. Acrux signed a global licensing deal with Big Pharma Eli Lily in 2010 for the marketing of Axiron. As part of this deal, Acrux is entitled to up to $US335 million in milestone payments as well as worldwide royalties. The partnership with Eli Lily appears like an ideal fit, with Eli Lily already involved in the men’s health market with their erectile dysfunction product Cialis (a competitor to Pfizer’s Viagra). Axiron is actually the second product that Acrux has progressed to FDA approval, the previous being Evamist in 2007, an oestrogen hormone spray used in menopausal women that is also on the market in the USA. Acrux has also ventured into animal health products with Recuvrya, a pain relief solution for dogs that was only recently approved by the EMA (in 2011).

But let’s get back to Axiron. Low testosterone can result in symptoms such as erectile dysfunction, as well as decreased libido, energy, and mood. It is found in people who have a genetic or acquired disorder of the testes (where testosterone is produced) or of the pituitary gland in the brain (where testosterone levels in the bloodstream are regulated or controlled). Low testosterone levels can also be associated with many chronic illnesses, such as obesity, heart disease, and even depression. These illnesses may cause symptoms similar to that of testosterone deficiency, but this does not necessarily mean that testosterone replacement is required. Often focussing on treatment of the underlying illness is what is required instead. Testosterone levels also naturally decline with age, however this is gradual and usually does not get to the point where treatment is required either.

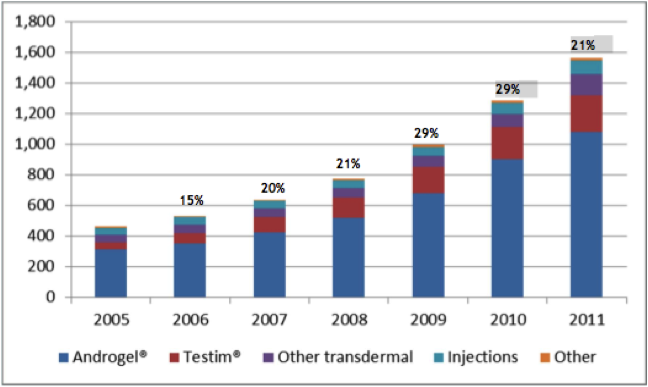

Now there are various testosterone products on the market, with many using different delivery methods, however the recent trend is favouring the newer transdermal routes. When testosterone is given in oral form, it is very difficult to achieve effective and stable concentrations in the bloodstream, this is because after it is absorbed through the intestine it is broken down or metabolised by the liver rapidly. In injectable form (a deep intramuscular injection, e.g. in the buttock) it has to be given every 1 to 3 weeks, this can be associated with severe fluctuations in testosterone concentrations in the bloodstream. This can lead to fluctuations in symptoms such as libido, energy, and mood. In the transdermal market, testosterone patches (think along the lines of nicotine patches) have had anectodally large incidences of severe skin rashes that often result in treatment cessation. This is where the gel/solution based products such as Axiron, Androgel, Testim, and Fortesta are increasingly popular. The overall male testosterone market, in particular for transdermal therapy, has been steadily increasing over the last 6 years as illustrated in the graph below.

Figure 8: Male testosterone market, US 2005-2011 (millions)

Source: Acrux February 2012 Presentation / IMS Data

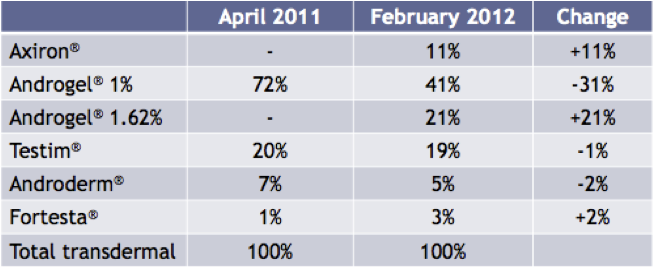

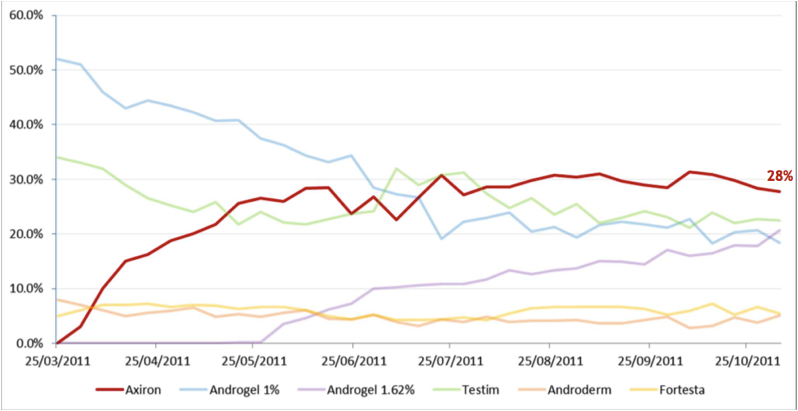

More importantly though is how Axiron has fared since coming onto the market in April 2011. As of February 2012, Axiron has achieved an 11% share of the transdermal market. Axiron’s main rival product in this market is another Big Pharma product Androgel, from Abbott Laboratories. In this same period, Androgel’s total share of the transdermal market has fallen by 10%, as illustrated in the chart below.

Figure 9: Share of Total Prescriptions of transdermal products in the USA

Source: Acrux February 2012 Presentation / IMS Data

The following graph shows the different transdermal products in terms of their share of total new prescriptions for patients being initiated on treatment for the first time by specialists, or being switched from other products. The most obvious thing to note is how in a short space of time Axiron has become the most widely prescribed product, and that the percentage share of total new prescriptions for Androgel has been declining significantly.

Figure 10: Share of transdermal New to Brand Prescriptions by Specialists

Source: Acrux Novembery 2011 Presentation / IMS Data

It appears that the uptake of Axiron has been excellent, and has the potential to eat away an even larger chunk of the total transdermal market. A key advantage of Axiron over Androgel is that is applied to an area that is less likely to come into contact with other people. Androgel on the other hand is applied over the upper arms and shoulders, so has a much greater chance of being indirectly transferred to other people. Another advantage of Axiron is that you do not need to physically touch the solution with your hands, whereas with Androgel you do have to rub the gel directly onto the skin with your hands.

On the Skaffold line graph below I have roughly marked out the Phase 1, 2, and 3 announcement dates as well as the date of FDA approval for Axiron. Acrux is currently trading at a significant premium to intrinsic value, however the intrinsic value is expected to rise significantly in the next few years.

Figure 11: Acrux Skaffold Estimated Intrinsic Valuation line

Source: Skaffold 27 April 2012

SIRTEX (ASX:SRX)

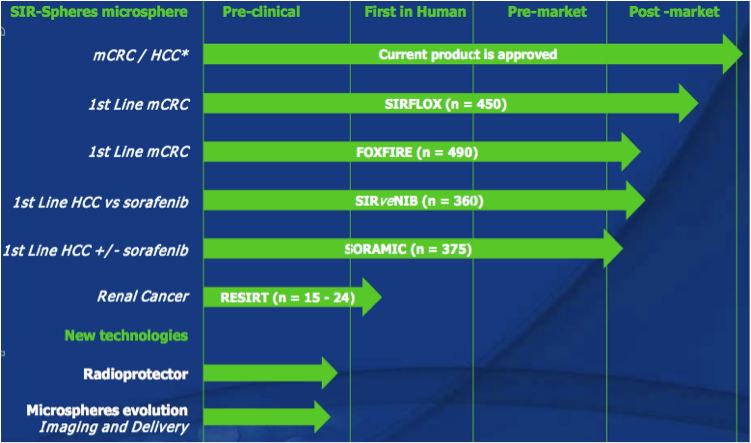

Sirtex has one product on the market, SIR-Spheres microspheres (let’s called it SIR-Spheres from now), which is a treatment option available for advanced hepatocellular carcinoma (“HCC”, liver cancer/tumour(s) that cannot be surgically removed), as well as for metastatic colorectal carcinoma (“mCRC”, bowel cancer that has spread to the liver, where the liver cancer/tumour(s) cannot be surgically removed). Sirtex also has a number of products or technologies in pre-clinical phase, although not a lot of information is available about them as they are at such an early phase.

Figure 12: Sirtex R&D pipeline

Source: Sirtex Company Presentation October 2011

SIR-Spheres is a radioactive treatment. Sirtex have developed micro-particles or beads (made from a substance called Resin) that act as transport vehicles for an isotope called Yttrium-90. An isotope is a radioactive chemical element. SIR-Spheres can be injected into the hepatic artery (the blood vessel that supplies the liver), once here the micro-particles get lodged into the walls of the small blood vessels that surround the tumour. This is a treatment that enables radiation to be given to a very localised area, without affecting normal liver tissue or other bodily organs. It is often referred to as selective internal radiation therapy (SIRT), or radioembolisation. It is a highly innovative product, although there is another company called Nordion that has something similar called TheraSphere. TheraSphere has micro-particles made from glass, but it also uses the Yttrium-90 isotope.

Radioembolisation is currently not used as first-line therapy. Let’s looks at HCC and mCRC separately to see exactly where it fits. For HCC, the first-line treatment for advanced inoperable cases, apart from liver transplantation, is a procedure called Radiofrequency Ablation (RFA). This is basically when a needle-like probe is passed into the tumour and an electrical current heats the probe resulting in the tumour tissue being heated up and destroyed. Where this is not possible, Transarterial Chemoembolisation (TACE) can be used. TACE is where chemotherapy is administered directly into the hepatic artery. SIR-Spheres radioembolisation could be used as an alternative to TACE. Having said that, with regards to SIR-Spheres, there is not yet enough clinical evidence or consensus with regards to when and whether to use SIR-Spheres over TACE. Systemic or traditional chemotherapy is used in more severe cases of HCC where there are multiple tumours or the other options are contraindicated in the patient. Systemic chemotherapy can also be associated with a lot of side effects. With mCRC involving the liver, where surgery is not an option, RFA is also used. Hepatic Intra-arterial (HIA) chemotherapy (similar to TACE) can be used as an alternate to systemic chemotherapy, although the benefits of this over newer systemic chemotherapy regimes have not yet been clearly demonstrated. Similarly, the benefits of SIR-Spheres over newer systemic chemotherapy regimes have not yet been clearly established either.

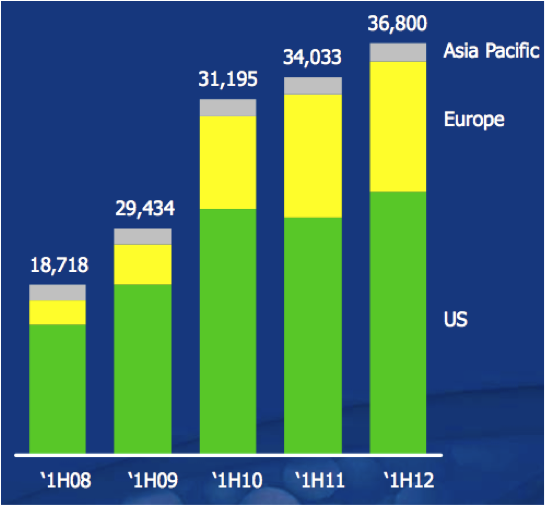

When SIR-Spheres was approved by the FDA, the control group in the Phase 3 trials was being given a systemic chemotherapy regime that has now been superseded by a more effective regime. The key downside to this product is therefore the lack of consensus as to when to use it and the lack of enough clinical evidence over existing treatments. SIR-Spheres has been approved for sale in Australia, Europe, and the USA. FDA approval was obtained in 2002, and this was the time of first commercial sale. So what has happened in the last 10 years? Well, they still have the same product, and the fact that it is still their only product is another downside risk, although they are working on number of clinical trials, with 4 major ones in clinical recruitment. These clinical trials are aimed at increasing the indications for use of the product, to see if they can find evidence to support it’s use in the earlier stages of cancer treatment, as first-line therapy or as an add-on to the newer systemic chemotherapy treatments. All that being said, Sirtex has steadily increased its revenues over the last 5 years.

Figure 13: Sales revenues (thousands)

Source: Sirtex February 2012 presentation

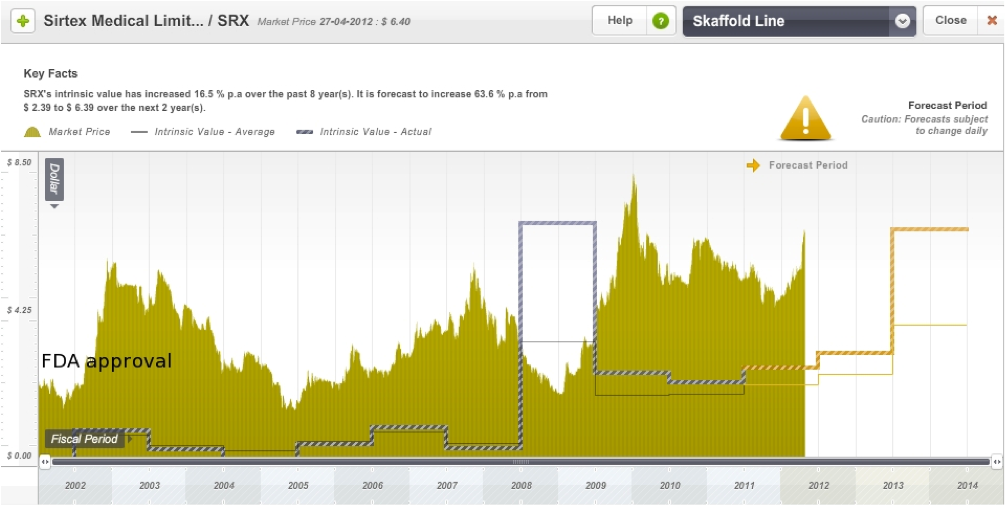

On the Skaffold line below I have roughly marked the date of FDA approval for SIR-Spheres. The share price of the company has been quite volatile over the years, but this is not uncommon in this industry. Like Acrux, it is also trading at a significant premium to its current intrinsic value, however its intrinsic value is also expected to rise in the next few years.

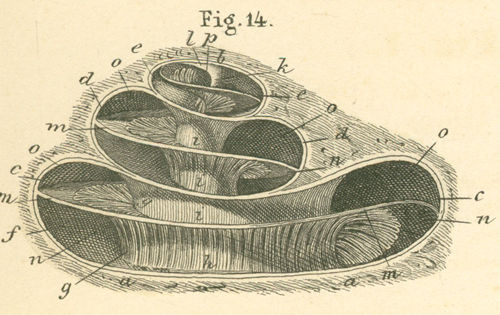

Figure 14: Sirtex Skaffold Estimated Intrinsic Valuation line

Source: Skaffold 26 April 2012

CONCLUSION

A decision as to whether to invest in either of these companies will require a deeper analysis of their management team, cash flows, debt levels, levels of return on equity, the strength and diversity of their pipeline’s, and industry competition. Unfortunately that is beyond the scope of this article. But if you are looking for an A1 company in this industry, you can’t go past CSL or Blackmores. Both are excellent companies that have had steadily rising intrinsic values for over 10 years. If you want to invest in a company at a much earlier stage, there are a few companies that are worth keeping an eye on. Aside from the 2 I have reviewed in this article, I think Bionomics, Alchemia, and QRxPharma are ones to add to your share portfolio watchlist. Below I have extracted some of the Skaffold data and listed the forecasted future intrinsic values of the companies whose intrinsic values are expected to rise in the next 1 to 3 years. Note: Biota has recently announced that it will be delisting from the ASX, and I have slotted in Mesoblast as an extra.

Figure 15: Currently Estimated Future Values

Source: Skaffold 1 May 2012

Posted for Praveen by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 31 May 2012.

Do you ‘LIKE’ us?

by Roger Montgomery Posted in Health Care, Intrinsic Value, Skaffold.

- 17 Comments

- save this article

- POSTED IN Health Care, Intrinsic Value, Skaffold

-

Cochlear update

Roger Montgomery

December 20, 2011

Aside from fears of reputational damage, one of the big concerns surrounding Cochlear’s recall earlier this year, was how long it would take to return to market. As you know we purchased shares after the announcement that it had recalled its Nucleus CI500 cochlear implant much to the chagrin of some investors who follow our musings here at the Insights blog.

In NSW every child receives a hearing test within two days of birth. Those identified as having profound hearing loss are often assisted by Cochlear. And thats just NSW. Cochlear sells its devices in 100 countries. Once implanted changing devices is not easy. Changing brands may be even harder. Audiologists and speech pathologists are involved and the devices are finetuned to ensure the device suits the individual.

As Matthew pointed out here on the blog a few days ago: “A family member [of Matthews’s] is a key member of a large Australian charity that does a lot of work with children that are deaf and many get the implants. All the equipment they use to “map” or finetune the device after implanting is specific to that company. For example the only brand they have is Cochlear. Recently they had a child from the US that they began to support that had a different brand implanted – they had to change many things to be able to help them. When thinking about market share with these devices I think it is important to know that the decision isn’t solely with the surgeon or specialist, because all of the support people have to change too. I don’t think market share will change quickly or by very much because of these barriers.”

Analysts at Macquarie recently surveyed 389 US-based Audiologists. Despite the product recall, Cochlear is still the world leader in CI devices and retains 60% market share selling into 100 countries. The broker also believes the market is growing at 12 per cent per year.

Many of you know we purchased shares in Cochlear after the September recall (see below), confident this was a temporary issue being treated as permanent by a perennially short-term-focused market.

That now appears to be the case as today’s announcement, posted on the ASX platform by the company reveals; 20122011_COH CI500 impant update

The company previously covered the subject in its AGM presentation here: http://www.cochlear.com/files/assets/corporate/pdf/agm_presentation_18102011.pdf

Analysts were subsequently concerned that 1500 units are going to have to be removed through surgery and another 2800 units have been pulled from shelves. They also worry that an inventory shortfall across the entire market will lead to market share losses from insufficient inventory as well as damage to reputation.

Today’s announcement reveals any small market share loss (we estimate five percent and some analysts suggest between five and ten per cent overall) will be now stemmed by the timely identification of the manufacturing issue that resulted in the failure of 1.9% of devices and their subsequent recall.

Cochlear has ramped up production and its early intervention has enhanced its reputation rather than damaged it as evidenced by several surveys with clinicians. In fact, 93% of doctors surveyed by Macquarie felt that Cochlear handled the recall well, while only 8% believe the company’s reputation has been tarnished.

Ultimately the company’s intrinsic value is determined by its profit and we expect there will be an impact on profit of some import. Cochlear has already created a provision of $130-$150 million and an after tax cash cost of $20 to $30 million. Given the news flow that will now transpire, one expects these costs may be treated by analysts as a ‘one-off’ and investors may have to wait for another temporary setback before being able to buy shares cheaply again…

For those of you interested in following our thoughts back in September 14 (COH $51.30), I wrote the following :

“Imagine spending years waiting patiently for the opportunity to buy that rare coin, vintage bottle of wine or celebrated painting, only to be outbid when it finally comes up for auction.

Sometime later the opportunity presents itself again and you are outbid once more, this time by much more. Successive auctions only take the price further out of your reach – if only you acted sooner!

Then one day you stumble across that very thing you desire being offered for sale by someone who appears to have no interest in its long-term value, for a price you regard as a fraction of its real worth.

Would you buy it?

That is the situation I find myself in today as the Cochlear share price plunges another 14% to $51.30, or about 40% since its April 2011 high of $85.

As Cochlear’s technicians work to isolate the problem with the Nucleus 5 range, the company will dust off the Nucleus Freedom range, which it has marketed successfully for many years against products such rivals as Advanced Bionics and Med-El.

Overnight one of those rivals received FDA approval to sell its product (which was itself recalled in November last year) into the US market. This turn of events is not unusual for the industry … but it is unusual for Cochlear and that’s why the news this week came as such a blow. Cochlear is one of the highest-quality companies trading on the ASX today. The company that almost never puts a foot wrong appears to have tripped itself up and investors are spooked.

The financial impacts of these events (and there will be an impact) have yet to be quantified so until they are why don’t we look at how the company has performed in the past and see if we can’t learn something about it in the interim.

Over the past decade, Cochlear has increased profits every year with the exception of 2004. Net profit was just $40 million in 2002 and last week the company reported profits of $180 million for 2011.

Operating cash flow over the same period has risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing is now minus 1.86%.

Those impressive economics have resulted in an intrinsic value that has risen by nearly 18% each year since 2004. If your job as a long-term investor is to find companies with bright prospects for intrinsic value appreciation – believing that in the long run prices follow values – then it quite possible that Cochlear is being served up on a plate.

The recently reported net profit figure of $180.1 million for 2011 was up 16% and in line with consensus analyst estimates, although this occurred despite sales of $809.6 million exceeding analysts’ estimates. It seems the analysts did not expect the EBIT and NPAT margins that were reported. These were flat, which given a very strong Australian dollar, suggests impressive efficiency gains in the operations.

If only that blasted “Australian peso” would go down and stay down!

Back on August 19, 2009, I wrote: “Fully franked dividends have risen every year for the past decade, growing by almost 500% (or 22% pa) since 2000. These are not numbers to be sneezed at; the company has produced an impressive and stable return on equity since 2004 of about 47% with very modest debt. Clearly this is a company worth some significant premium to its equity.”

Nothing changed really for 2011. A final dividend of $1.20 per share was 70% franked and up 14%.

Importantly, it seems Cochlear’s market is growing. Unit sales volumes were up 17% for the year and, given in the first half they were up 20%, it suggests the second half were up 14%. Double digit growth was reported in sales volumes for all major regions and Asia was the most impressive, rising more than 30% to the point where it makes up 16% of total revenues.

This really is impressive stuff. Just two years ago the company reported unit sales growth of only 2%, to 18,553 units, and many analysts were blaming slow China sales. Nobody expected the company to ever repeat its 2007 and 2008 volume growth of 24% and 14% respectively, and certainly not off a higher base.

Growth has always been viewed as is limited by the high cost of the devices and the reliance on insurance and healthcare schemes to subsidise the costs and those of surgery to implant to them.

According to the World Health Organization however, almost 280 million people suffer from moderate to profound hearing loss and an ageing population means this figure will rise. Cochlear is one of a handful of companies that actively contributes to improving the quality of life of its clients.

When great companies stumble, the impact can be exaggerated by the reaction of shareholders who never believed it could happen. Then comes a wave of selling amid doubts that the company will ever regain its mantle.

But strong market share and strong cash flow, high returns on equity and low debt, are rarely offered at bargain prices so I picked up some Cochlear stock yesterday for the Montgomery [Private] Fund. It is likely that I will to add to this position over the coming days and weeks when the full financial impact of the recall is known.

I must confess I didn’t bet the farm on this particular investment because the financial impact of the recall – and there will be one – remains unclear; when that changes it will impact my intrinsic value estimate (UBS has revised its forecast net profit for 2012 by 10.5% to $179.5 million).

Whatever the impact, it will be temporary, even though it won’t necessarily preclude lower prices from this point. During the GFC, Cochlear shares fell from $78 to $44. No company is immune to lower share prices and I don’t know when or in what order they will transpire.

What I do know is that in 2021 we aren’t likely to be thinking about this recall, just as nobody now talks about the Wembley Stadium delays that dogged Multiplex back in 2006. Mercifully, investors’ memories tend to be short.

Recalls, competition, marketing gaffes and wayward salary packages are all part of the cut and thrust of business and if lower prices ensue for Cochlear shares, it will be important to determine whether the recall will inflict permanent scars. My guess is that it will not.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 20 December 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education, Value.able.

-

If value nags, are you listening?

Roger Montgomery

October 19, 2011

Value.able investors can be forgiven for giving up. You wait so long for value to be presented and then when it appears it just hangs around, remaining ‘good value’ for what seems an age. Value can sometimes nag and nag and by the time action becomes urgent, the newest and least patient value investors are no longer listening. I can see it in the statistics of my friend’s financial services businesses and no doubt it’ also being felt by tip sheets purveyors and CFD merchants. For all the talk of value investing, few really have the patience to succeed.

Value.able investors can be forgiven for giving up. You wait so long for value to be presented and then when it appears it just hangs around, remaining ‘good value’ for what seems an age. Value can sometimes nag and nag and by the time action becomes urgent, the newest and least patient value investors are no longer listening. I can see it in the statistics of my friend’s financial services businesses and no doubt it’ also being felt by tip sheets purveyors and CFD merchants. For all the talk of value investing, few really have the patience to succeed.Value.able-style investors can be forgiven for giving up. You wait so long for value to appear and then when it does, its just hangs around. STocks that were expensive, become cheap and then, simply, boringly, stay cheap. Value can sometime nag and nag and by the time action becomes urgent, the newest and least patient investors are no longer listening. I have no doubt this is impacting the revenues of the tip sheet purveyors and the CFD merchants, indeed any business in financial services whose revenue is dependent on investors maintaining the faith.

That is the situation I was recently delighted to observe as the Cochlear share price plunged another 14% to $51.30, or about 40% since its April 2011 high of $85.

Recently I ascribed to Cochlear’s shares, a valuation of $59. Since 2004 the price has been persistently above my intrinsic value estimate, which means the combination of circumstances that have pushed the share price below value most recently are worth exploring.

Cochlear has the largest market share for cochlear hearing implants worldwide and, after announcing a voluntary recall of its flagship Nucleus CI500 implant range recently (the Nucleus accounts for more than 70% of sales), investors voted with their feet and the stock fell more than 20%.

The recall was voluntary and relates only to those devices that have not been implanted. The devices have a fail rate of about 1% and the fault – due to moisture on 1 of 4 diodes from loss of seal – is not believed to be harmful in any way, the device simply shuts down.

With about 25,000 of the units in use globally, that implies around 250 recipients of the implant will be affected and although that is significant, the proactive and patient-focused response of the company should ensure the reputational damage is contained.

As Cochlear’s technicians work to isolate the problem with the Nucleus 5 range, the company will dust off the Nucleus Freedom range, which it has marketed successfully for many years against products such rivals as Advanced Bionics and Med-El.

Med-El is gaining market share in the US generally but patients waiting for implant surgery have switched to the Cochlear Freedom product and apparently with no delays.

At the same time as Cochlear’s recall, Advanced Bionics received FDA approval to sell its product (which was itself recalled in November last year) into the US market. This turn of events is not unusual for the industry … but it is unusual for Cochlear and that’s why the news came as such a blow. Cochlear is one of the highest-quality companies trading on the ASX today. The company that almost never puts a foot wrong appears to have tripped itself up and investors became spooked.

And in that reaction a potential opportunity may be presented.

The financial impacts of these events won’t be fully known until later in the year but is expected currently to be $130 – $150 mln, translating to an after tax impact of about $20 mln.

Over the past decade, Cochlear has increased profits every year with the exception of 2004. Net profit was just $40 million in 2002 and most recently the company reported profits of $180 million for 2011.

Operating cash flow over the same period has risen from less than a $1 million (an exception for 2002) to more than $201 million, allowing debt to decline to just $63 million from nearly $200 million in 2009. Net gearing is now minus 1.86%.

Those impressive economics have resulted in an intrinsic value that has risen by nearly 18% each year since 2004. If your job as a long-term investor is to find companies with bright prospects for intrinsic value appreciation – believing that in the long run prices follow values – then it quite possible that Cochlear is being served up on a plate.

The recently reported net profit figure of $180.1 million for 2011 was up 16% and in line with consensus analyst estimates, although this occurred despite sales of $809.6 million exceeding analysts’ estimates. It seems the analysts did not expect the EBIT and NPAT margins that were reported. These were flat, which given a very strong Australian dollar, suggests impressive efficiency gains in the operations.

If only that blasted “Australian peso” would go down and stay down!

Back on August 19, 2009, I wrote in the Eureka Report: “Fully franked dividends have risen every year for the past decade, growing by almost 500% (or 22% pa) since 2000. These are not numbers to be sneezed at; the company has produced an impressive and stable return on equity since 2004 of about 47% with very modest debt. Clearly this is a company worth some significant premium to its equity.”

Nothing changed really for 2011. A final dividend of $1.20 per share was 70% franked and up 14%.

Importantly, it seems Cochlear’s market is growing. Unit sales volumes were up 17% for the year and, given in the first half they were up 20%, it suggests the second half were up 14%. Double digit growth was reported in sales volumes for all major regions and Asia was the most impressive, rising more than 30% to the point where it makes up 16% of total revenues.

This really is impressive stuff. Just two years ago the company reported unit sales growth of only 2%, to 18,553 units, and many analysts were blaming slow China sales. Nobody expected the company to ever repeat its 2007 and 2008 volume growth of 24% and 14% respectively, and certainly not off a higher base. Growth has always been viewed as being limited by the high cost of the devices and the reliance on insurance and healthcare schemes to subsidise the costs and those of surgery to implant to them.

According to the World Health Organization however, almost 280 million people suffer from moderate to profound hearing loss and an ageing population means this figure will rise. Cochlear is one of a handful of companies that actively contributes to improving the quality of life of its clients.

When great companies stumble, the impact can be exaggerated by the reaction of shareholders who never believed it could happen. Then comes a wave of selling amid doubts that the company will ever regain its mantle.

But strong market share and strong cash flow, high returns on equity and low debt, are rarely offered at bargain prices so I picked up some Cochlear stock for the Montgomery [Private] Fund. It is expected that I will to add to this position over the coming weeks and months (provided value remains) when the full financial impact of the recall is known.

I must confess I didn’t bet the farm on this particular investment because the financial impact of the recall remains uncertain; when that changes it will impact my intrinsic value estimate.

Whatever the impact, it will be temporary, even though it won’t necessarily preclude lower prices from this point. During the GFC, Cochlear shares fell from $78 to $44. No company is immune to lower share prices and I don’t know when or in what order they will transpire.

What I do know is that in 2021 we aren’t likely to be thinking about this recall, just as nobody now talks about the Wembley Stadium delays that dogged Multiplex back in 2006. Mercifully, investors’ memories tend to be short.

Recalls, competition, marketing gaffes and wayward salary packages are all part of the cut and thrust of business and if lower prices ensue for Cochlear shares, it will be important to determine whether the recall will inflict permanent scars. My guess is that it will not. I wonder whether you are listening for value?

Posted by Roger Montgomery, Value.able author and Fund Manager, 19 October 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education.

- save this article

- POSTED IN Companies, Health Care, Investing Education

-

Is CSL a master of share buy backs?

Roger Montgomery

March 1, 2011

When a company buys back its shares, the announcement is often accompanied by reports suggesting either 1) the company has no other growth options towards which it can employ equity capital or, 2) the company has great confidence in its future and other shareholders should be following its lead rather than selling out to the company itself.

Back in 1984, in his Chairman’s Letter to Shareholders (a source of information I have quoted frequently here and in Value.able), Warren Buffett observed:

“When companies with outstanding businesses and comfortable financial positions find their shares selling far below intrinsic value in the marketplace, no alternative action can benefit shareholders as surely as repurchases.”

Note to CFOs and CEOs: “shares selling far below intrinsic value in the marketplace.”

It is just as important for the CEO of a public company to be buying shares only when they are below intrinsic value, as it is for Value.able Graduates building a portfolio.

Buying shares above intrinsic value will destroy value as surely as buying high and selling low – something many Australian companies became all to expert at during the GFC as they issued shares in their millions at prices not only below intrinsic value, but below equity per share.

One question to ask is if companies are engaging in buy backs today, why weren’t they when their shares were much, much lower? The answer of course may be that they may not have had the capital back then. A recovery from the lows of the GFC has not only occurred in the prices of shares trading in the market place, but also in the cash-generating performance of the underlying businesses themselves.

Irrespective of the circumstances, a company now buying back shares that had previously issued them at the depths of the GFC is having a second crack at wealth destruction.

I am pleased to report that not all companies are following the crowd. Some larger companies, including BHP, RIO and Woolworths, have announced buy backs at or slightly below my estimate of their Value.able intrinsic values.

Webjet, Customers, Coventry Group and Charter Hall Retail REIT have all announced buy backs and Bendigo/Adelaide Bank is engaging in one to reverse the impact of shares issued through their DRP.

As I wrote yesterday (Is there any value around?), value is becoming much harder to find. Companies are expensive, even my A1s. Whilst any Value.able valuation is merely an estimate, the absence of a large Margin of Safety, combined with the announcements of buy backs, does not inspire my confidence.

In the US, share buy backs historically peak at market highs. Think back to the first half of 2007 and in 1999 and 2000 – two periods that investors may have wished they’d sold shares back to the companies – are also periods during which buy backs peaked.

Share buy backs are a very public demonstration of management’s capital allocation ability, or lack thereof.

Whilst Warren Buffett is regarded as the master of share buy backs, he has often sited another capital allocator as the real genius – the late Dr. Henry Singleton, the founder and CEO of Teledyne.

When the inflation-devastated stock market of the 1970s had pushed shares to the point that some suggested ‘equities were dead’, Henry Singleton bought back so many shares that by the mid 1980s there were 90% less Teledyne shares on issue. Here’s a para from the web: “In 1976, the company attempted, for the sixth time since 1972, to buy back its stock in order to eliminate the possibility of a takeover attempt by someone eager for the cash reserves the company had accumulated. Altogether, Teledyne spent $450 million buying back its stock, leaving $12 million outstanding, compared to $37.4 million at the close of 1972. With many of the company’s divisions showing stronger results and fewer shares outstanding, Teledyne’s stock increased from a low of $9.50 per share to $45 per share, becoming the largest gainer on the New York Stock Exchange.”

Who is Teledyne’s Australian equivalent?

One iconic Aussie business (it achieves my second highest MQR – A2) immediately springs to mind. In 2009 this business issued shares at a high price to fund a $A3.5 billion acquisition. But things didn’t quite go to plan… the US Federal Trade Commission intervened and the shares slumped. What did management do? They used the cash raised from the share issue to buy them back. Amazing!

Fast-forward twelve months and this business has nearly $1 billion in cash in the bank and no debt. If it keeps using its own cash and that being generated, and buying back shares at the present rate (and assuming the share price doesn’t change of course), it will have bought back all its shares in seven years. A Value.able business… what do you think?

Yes, if not for management’s decision to buy back shares ABOVE intrinsic value.

Unfortunately CSL’s share price may not be as high in seven years as it could have been, had management chosen to buy back its shares below intrinsic value.

If you own shares in a company engaging in a buy back, ask yourself whether value is being added to the company? Value is generated when the shares being purchased are available at prices below your estimate of its Value.able intrinsic value.

If management are overpaying, inappropriate capital allocation practices may be the only addition to the future prospects of the business.

Posted by Roger Montgomery, author and fund manager, 1 March 2011.

by Roger Montgomery Posted in Companies, Health Care, Investing Education.

-

What company valuation did you ask for this Easter?

Roger Montgomery

April 1, 2010

Heading into Easter, I received an enormous pile of valuation requests and while many were little mining explorers burning through $500,000 of cash per month and with just $3 million in the bank, quite a few were solid companies that hadn’t been covered before.

Heading into Easter, I received an enormous pile of valuation requests and while many were little mining explorers burning through $500,000 of cash per month and with just $3 million in the bank, quite a few were solid companies that hadn’t been covered before.And to confess, some of the requests were quite rightly keeping me accountable and making sure I post the company valuations I said I would, when I have appeared on Sky Business with either Nina May, Ricardo Goncalves and Peter Switzer.

What are they, I hear you ask? Forge Group (FGE), Grange Resources (GRR), Arrow Energy (AOE), Cabcharge (CAB), Coca Cola (CCL), Data 3 (DTL), Hutchison (HTA), Incitec Pivot (IPL), Metcash (MTS), Sedgeman (SDM) and UXC (UXC)

I am really impressed by the frequency with which I am now receiving emails containing insights I didn’t know about companies that I have covered.

As a fund manager it was not unusual for me to adopt Phil Fisher’s ‘scuttlebutt’ approach to investing. By way of background, Warren Buffett has previously described his approach to investing as 85 per cent Ben Graham and 15 per cent Phil Fisher. Fisher advocated scuttlebutt – talking to staff, to customers and to competitors. I did the same and would often end my interview of a company’s CEO or CFO with I’d learned from reading Lynch; “if I handed you a gun with one silver bullet, which one of your competitors would you get rid of?” The answers were always revealing. Sometimes I would get; “there’s noone worth wasting a silver bullet on”, but most of the time, I would find out a lot more about the competitive landscape than I had bargained for. Occasionally, I would learn that there was another company I really should be researching.

Back to your insights, they are amazing. Now you know why I enjoy sharing my own insights and valuations with you as much as I enjoy the process of investing.

One thought for you; Many of you are sending your best work via email. I would really like to see everyone benefit from the knowledge and experiences you all have so hit reply and if you have some insights (as opposed to an opinion), just click on ‘REPLY’ at the bottom of this post and leave as much information as you would like.

So here are a few more valuations to ponder over Easter. I hope they add another dimension to your research. And before you go calling me about coal seam gas hopeful Arrow Energy, note that the valuation is a 2009 valuation based on actual results. The forecasts for Arrow for the next two years are for losses, and using my model, a company earning nothing is worth nothing. Of course Royal Dutch Shell and Petro China think its worth more and perhaps to them it is, but as a going concern its worth a lot less for some time to a passive investor.

I hope you are enjoying the Easter break and look forward to reading and replying to your insights.

Posted by Roger Montgomery, 1 April 2010

by Roger Montgomery Posted in Companies, Consumer discretionary, Health Care, Insightful Insights.

-

Which businesses excel in the business of wellbeing?

Roger Montgomery

March 25, 2010

I am guessing from the many emails I received this week about healthcare stocks that the quantity may have something to do with the sector being in the headlines (remember it is an election year)?

Government numbers show that spending on healthcare is expected to nearly double as a proportion of GDP over the next 40 years. With fewer babies being born and people living longer, it is inevitable that the population is ageing. In the next thirty years, the proportion of the population aged over 65 will double to 22% and in the next forty years, the number of Australian’s aged 85 and over is expected to increase from 1.8% of the population to 5.1%.

Government estimates show that this will exact a heavy toll on the cost of providing health and the following chart reveals where those costs for the government and opportunities for healthcare companies lie.

Using government estimates for GDP growth, the above charts suggests the government will spend $38 billion on medicare and $68 billion on the PBS in 2040. Figures such as these have provided the large community of buy-and-hold investors with a sound investment theme to pursue. But in some cases this theme has led to some extremely irrational pricing, as we will discover.

There are more than 20 healthcare stocks listed on the ASX that essentially fall into two categories.

1. The provision of care and related services. This can mean pathology companies such as Sonic Healthcare, private hospitals such as Ramsay Healthcare, and providers of specialist ancillary services, such as software provider iSoft.

2. Research and development. This can mean companies that produce generic pharmaceuticals, such as Sigma, or research into and development of cancer drugs, such as Sirtex.

Like another exploratory industry, the mining sector, the size of these companies can vary from the very small, such as Capitol Health with a market cap of just $15 million, to global blood products and plasma giant CSL, which has a market cap of about $20 billion.

The ideal combination of characteristics for a healthcare company that an investor would seek out is no different to those that should be sought more generally; a very high quality balance sheet, stable performance, a high Return on Equity, little or no debt and a discount to intrinsic value.

So what do I think are the superior businesses? Following is a table of my findings.

Using a combination of 15 financial hurdles, I note that the best quality companies, but not necessarily the cheapest in the sector, are CSL, Cochlear, Sirtex, Biota and Blackmores.

Do you see that Search box to the right, just under my photo? You will need to scroll up. Type CSL, Cochlear or Blackmores into the box and click GO to read my past insights. And if your appetite remains unsatisfied, visit my YouTube channel, youtube.com/rogerjmontgomery, and search there too (there are many videos in which I talk about CSL and Cochlear).

I should point out that each of the remaining three – Sirtex, Biota and Blackmores – are generating high Returns on Equity and has manageable or no debt.

The lowest ranked by quality are Primary Healthcare, Sigma, Australian Pharmaceuticals and Vision Group. I won’t be buying these at any price and their Returns on Equity are less than those available from a risk-free term deposit.

Alchemia, which manufactures a generic treatment for deep vein thrombosis and pulmonary embolism, Phosphagenics, with its patented transdermal insulin delivery system, and Capitol Health are also low in terms of quality and also highly speculative because they are yet to report profits. Analysts, however, are forecasting profits for all three in 2011 and 2012 and Alchemia is forecast to earn more than 30% Returns on Equity after a loss in 2010.

In between this group are companies whose quality is neither compelling nor frightening; these are businesses that if I was forced to by I might only if very large discounts to intrinsic value were presented and in some cases, only if I was happy to speculate – which generally I am not. Sonic, Ramsay (search RHC for more analysis), iSoft, Pro Medicus, Healthscope, Halcygen Pharmaceuticals, ChemGenex, Acrux and SDI fall into this band.

I have ranked all of the healthcare companies by their safety margin: a measure of their discount or premium to the current year’s intrinsic value. This reveals that some companies are trading at discounts to intrinsic value. As an investor you need to be satisfied that the companies you choose also meet your quality criteria, which should mimic your tolerance for risk.

Take a close look at Biota, for example. Its price of $2.38 is significantly lower than the estimated intrinsic value, however you will also see that the return on equity is forecast to fall from 50% to 11%. There will be a commensurate decline in intrinsic value in coming years and the apparent discount will no longer exist, meaning that unless return on equity improves considerably in a few years it will cease to be a good investment.

If my portfolio approach were to include some exposure to healthcare then my first choices would be CSL and Cochlear. These are both well managed, large-cap businesses with stable returns on equity and zero or low levels of gearing.

My next preferred exposure would be pathology and radiology operator Sonic, alternative medicine distributor Blackmores, and liver cancer treatment marketer Sirtex

Finally, if I was comfortable speculating on stocks then the companies I would seek to conduct further research on would be the two pharmaceutical minnows, Halcygen and cancer drug developer Chemgenex. Both companies are forecast to generate attractive rates of return on equity in 2011 and 2012 and have little or no debt. Halcygen is also currently trading at a discount to its estimated intrinsic value.

REMEMBER… Before making any investment decisions, my comments should only be seen as an additional opinion to the essential requirement to conduct your own research and see a qualified financial professional.

Everyone is capable of being terrific investors, you just need to remember that there is serious work to be done by YOU in the business of investing.

Posted by Roger Montgomery, 25 March 2010

by Roger Montgomery Posted in Companies, Health Care.

- 44 Comments

- save this article

- POSTED IN Companies, Health Care

-

Hands up if you asked; What is the intrinsic value of…

Roger Montgomery

March 19, 2010

The requests for valuations and insights have been coming in thick and fast, and I have to confess to being a little surprised. The vast majority of requests have been for great quality businesses, some of them even the ‘A1’ companies that I alluded to on the Sky Business Channel a few weeks ago (the highlights will be on my YouTube channel in the next week or so).

If you have sent me an email requesting my insights and valuation for a particular business, thank you. You have uncovered some really interesting stories.

Lloyd, who was kind enough to drive me to the airport following my ASX Investor Hour presentation in Perth last November, suggested one such company to me, Forge Group Limited (FGE). At the time, FGE was trading at a bit more than a dollar.

If my memory serves me correctly, Lloyd bought the stock around 30 cents. I looked at it, ran it through my models and liked it a lot. For a tiny little company it was a true A1 – very high quality on all counts. It had also doubled its profits a few times.

Today it trades at $2.82 and has received a bid for 50% from Clough Limited. They have a hide! This company is potentially worth a great deal more, but don’t take my word for it – remember that you should see my view as just one more opinion, should always conduct your own valuations and research, and if necessary, seek independent advice from someone familiar with your financial circumstances and needs.

If you asked me to value a particular business, and there have been a few requests, I would have explained that I will do my best to post a valuation up as soon as possible but those companies that received the most requests would be posted first.

So here are my insights, and valuations, for the most popular businesses, as requested by you over recent weeks and even months.

Electrical contractor, Southern Cross Electrical Engineering Ltd (SXE)

Prior to its capital raising and downgrade, SXE was expected to generate Returns on Equity in excess of 37% in 2010 and 30% in 2012. Recent events however are likely to see these numbers fall to 22% and 27% respectively. The value today is 96 cents and lower than the current price, however the value next year, if it can earn the new forecast numbers, will be higher than the current price. You need to satisfy yourself that the revised expectations are indeed achievable.

Pawn shop chain (and commercial microfinance operator), Cash Converters International (CCV)

There has been a lot of interest in Cash Converters. I have seen these stores and while I cannot see them becoming a retailing powerhouse like a JB Hi-Fi or even The Reject Shop, that may not be the company’s intention. More than 2/3rds of reported profits are generated from secured and unsecured small personal loans that are distributed by a network of 509 second hand goods stores. CCV has the metrics of an attractive business indeed its an “A” class stock, but scale is the issue. Just how big can they ever be? If we remember that we want a) Big Equity and b) Big Returns on Equity, then I can see the big returns on equity but Big Equity may be someway off.

The value of CCV today however is 74 cents – about ten cents higher than the current price, and based on current estimates is worth 93 cents in a couple of years. Those valuations compare favourably to the current price and very favourably to the 32 cents the shares traded at in March 2009. Always keep in mind that you want to buy these sorts of stories at very big discounts to intrinsic value.

Figure 1. CCV’s historical and forecast earnings and dividends per share

On the surface here’s a company that has the quality characteristics I like and is at a discount to intrinsic value. The only question mark is about how big they can get. If you intend to trade shares of CCV seek independent financial advice from a qualified professional who is familiar with your needs and circumstances and do not rely on the general nature of comments posted here.

Investors must also be aware of the impact of the intention of the Consumer Credit Code Amendment Bill 2007 and the subsequent Fee, Credit and Transition Bills as they relate to the nationalisation of regulation of operators such as Cash Converters and its perceived competitors, such as City Finance.

(Postscript: ‘Reg’s’ comment below and my response are worth reading and considering and investors should pay attention to the growth of the company’s loan book and the relationship with its new largest shareholder and try to get answers to the questions I pose about continued growth and the ongoing relationship of loan book growth to retail stores)

Online job lister, Seek Limited (SEK)

Seek is a great business. Like all of the world’s most successful internet stories, it’s a plain old list. And it has developed that competitive advantage some companies achieve when scale and popularity leads to ‘essentialness’. People search for jobs at seek.com.au because there are lots of jobs, and there are lots of jobs because lots of people look for jobs there. I haven’t worked out if reaching this point is a function of strategy or dumb luck, but by definition someone has to make it to this point and he who gets there generates a lot of money and a high Return on Equity that is protected from imitation.

Seek is no exception, and its Return on Equity is expected to exceed 30% over the next two and half years. But while ROE is good and its earnings and intrinsic value growth is heading in a smooth north easterly direction, the fact remains that its popularity, as reflected in the current price of $7.90, is well in excess of the value, which is closer to $5.00 and rising to $6.30 in a couple of years. Sorry guys! Of course it was available to buy below $5.00 as recently as August last year, but that is of little use to you now. Patience is required.

Cranes for hire company, Boom Logistics Limited (BOL)

Boom Logistics is a business I remember reviewing when it floated. I was there at the IPO briefing and even then I didn’t like it. And didn’t I look foolish not taking any stock – it shot up from its listing price of 99 cents to almost $4.00 in less than 28 months.

I can sometimes get very frustrated knowing what a business is really worth and since 2005, the value of this business has been declining, along with its Returns on Equity. In 2004 ROE was 30% and today it is expected to approach 4.5%. Because you can do better in a bank account with no risk, you should think very carefully about investing in BOL. It is trading at 33 cents, but its value is less than 10 cents.

Hospital operator, Ramsay Health Care Limited (RHC)

Ramsay Healthcare is a business whose ‘theme’ I like. The population of Australia is ageing – the number of people over 75 will double in the next decade and a half, and while that will bring much sadness, the reality is that hospitals are there to provide the care that an ageing population needs. Despite a great story, hospitals aren’t that easy to run well.

You see, unlike most other businesses, hospitals can’t simply place a price on a service based on its cost and add a mark-up. Instead, they have to deal with insurance pay scales, meaning hospitals will make more money taking care of some patients and not others, and this is often not within their control.

Generally, hospitals make more money when more things happen to patients, such as pathology tests, diagnostic and therapeutic procedures, and operations. Operations are usually reimbursed at a higher rate than a medical patient, and while length of stay counts, its usually the hospital that has more surgical patients is the one that makes more money.

Conversely, a patient who lingers in a hospital is costing them money as their ongoing care may not be justified and they are blocking that bed from receiving another, better paying patient. Ever had a baby in hospital and felt like you were being booted out before your were ready? Anyone?

This is just the tip of the iceberg, but explains why running a hospital is so much more challenging than selling DVD’s to teenagers.

Having said that, Ramsay is doing a good job, as Figure 1 testifies.

Figure 2. RHC’s historical and forecast earnings and dividends per share

Of course, there is a bit of hockey-stick optimism in the forecasts, and you can thank my peers in the analyst community for that. More importantly however, the hospital is generating Returns on Equity of about 14% over the next three years, up from circa 10% in the last few years.

The value of the business is rising, along with the returns. In 2000 Ramsay’s intrinsic value was just 58 cents. In 2012 its forecast intrinsic value is $8.13. – that’s an increase of 25 percent per year! Exceptional, but the price has never allowed investors to buy at a discount to intrinsic value.

In April 2000 RHC shares traded as low as 74 cents, but never below the 2001 valuation of 91 cents. Since then you have had to buy the shares above intrinsic value in order to participate in the growth in intrinsic value. But whereas in 2000 you only needed to wait a year for intrinsic value to catch up, you would be waiting much longer today. With the shares currently priced at $13.50, even a 2 -year wait won’t see the value catch up. It looks a little pricey now.

Keep in mind that I cannot predict share prices. I can tell you what things are really worth and tell you that over time price and value catch up with each other one way or another, but that is all I can tell you. I guess I can also vouch, having managed a couple of hundred million dollars, that if you buy good businesses below intrinsic value, things tend to work out ok.

Mining laboratory operator and cleaning solution seller, Campbell Brothers Limited (CPB)

Second last on the list is Campbell Brothers. Its been generating a decent Return on Equity for a decade, and its intrinsic value has been rising every year in that time. But like Ramsay, CPB’s intrinsic value will still not have reached the current price, even in 2012. I reckon it is worth $20 in 2011, and today its trading at $29.

Finally, one that needs no introduction, ASX Limited (ASX)

I have written about the ASX in my forthcoming book, Value.able. The ASX is worth less than $21 today and intrinsic value should rise to $26 in 2012. But Returns on Equity are not a patch on other companies, averaging 13.5% over the next few years. And despite the monopoly characteristics the company evidently has, it has not been able to charge what it wants for fear of emigration to rivals applying to set up. As a result, there is some correlation to the direction of the stock market, and predicting it is like predicting the price of a commodity – difficult.

Is your hand still up?