Your Exclusive Guide to Understanding Biotechs.

Praveen has really put in some effort to bring this to you. Enjoy!

ANATOMY OF A BIOTECH by Praveen Jayarajan 1st May 2012

Investing in biotechnology companies is an inherently risky endeavour for many reasons, with many pundits of the view that the entire sector is highly speculative. But as with any such investment, the potential returns can be huge. However, the average investor, who may not be familiar with the terminology used in company reports, presentations, analyst coverage, and the media, may not have a great deal of understanding about the industry and what these companies actually do. In this article I am going to try and decode and de-jargon the industry and hopefully give you a better understanding of how to assess these companies.

Big Pharma vs Biotech

To begin with, we need to appreciate the traditional differences between a pharmaceutical and a biotechnology company. Traditionally, pharmaceutical companies, also now commonly referred to as “Big Pharma”, have been involved in small molecule therapies. What this means is that the drugs they produce are made from molecules that are relatively simple and small in size. These molecules are all chemically manufactured or synthesized by combining different compounds in a laboratory. They are also available in the form of an oral tablet or capsule, and can be easily absorbed into the bloodstream through the intestine. Once in the bloodstream they are able to penetrate different cells in the body due to their small size. An example is Lipitor, used to treat high cholesterol, made by Pfizer.

In contrast, biotechnology companies, also referred to as “Biotech”, have been involved in large molecule therapies called biologics that are based on molecules that are more complex and large in size. These molecules are manufactured using genetically modified living cells of microorganisms such as viruses and bacteria, as well as from human and animal sources. Biologics are usually administered via an injection or infusion, as they are too big to be absorbed when given orally. Once in the bloodstream they act in different ways to traditional drugs, including binding to receptors on the surface of cells rather than penetrating the cells. An example is Fluvax, which is the influenza vaccine, made by CSL.

The line between these two definitions has become increasingly blurred. In fact, these traditional definitions for Big Pharma and Biotech do not have as much relevance today. Biotech’s are now seen as smaller research and development companies, with Big Pharma taking the role of the larger company with the expertise and funding to progress a drug or biologic (in this article I will may also use the word “product” or “medication” interchangeably when referring to drugs and biologics) through the regulatory process and then take it into production and marketing. Examples of Big Pharma include Pfizer, Roche, GlaxoSmithKline, Novartis, Sanofi, and AstraZeneca. Note that there are also companies that can be loosely considered “Small Pharma” and “Big Biotech”.

The Patent Cliff

What is a patent? A government license that gives the holder exclusive rights to a process, design or new invention for a designated period of time. Applications for patents are usually handled by a government agency (taken from Investopedia).

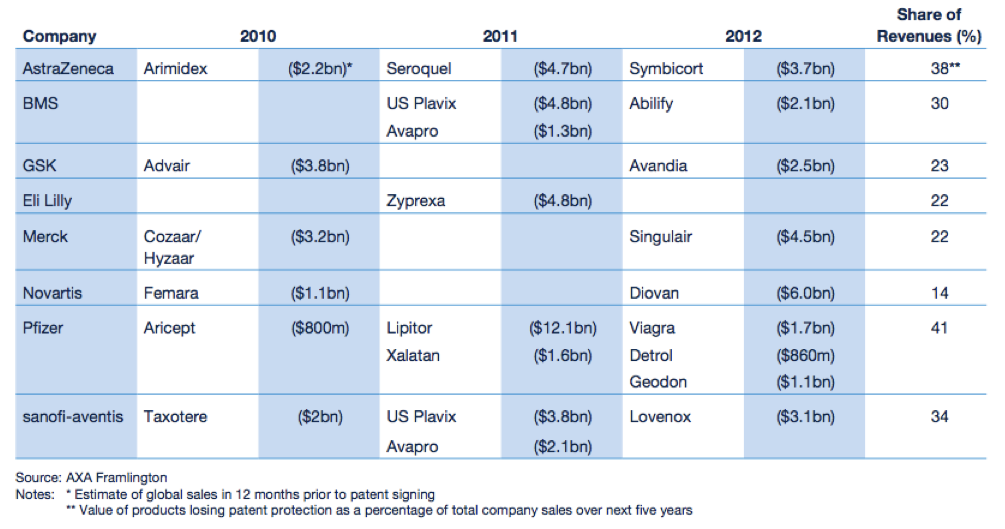

The “patent cliff” refers to what happens to revenues when an original product’s patent expires. As this happens, in the case of Big Pharma, they face competition from similar drugs made by other companies at a fraction of the price. These drugs are called generics. Generic drug manufacturers need to prove that their version of the drug is bioequivalent to the original. That is, it must have the same active ingredient and have the same properties as the original, but it does not have to go through extensive clinical trials like the original. According to the IMAP Pharma and Biotech Industry Global Report (2011), original drugs can face a price erosion of 70% within months of going off patent. Furthermore, revenues of drugs going off patent between 2010 and 2014 will be ~ US$89.5 billion. A number of “blockbuster” drugs (drugs that have revenues greater than US$1 billion) are due to go off patent in the coming years. The world’s biggest selling drug Lipitor, went off patent towards the end of 2011.

With regards to biologics, the patent cliff issue still applies, off patent biologics are called biosimilars or follow-on biologics. The difference is that because biologics are complex molecules, it is much harder and more expensive to make a bioequivalent version, and the regulatory requirements are far more rigorous. The worldwide biosimilars market is still in its infancy, with only a handful on the market. Note that there are also “me-too” products, these have similar active ingredients and mechanism of action to the original product, and almost identical clinical outcome, but unlike generics/biosimilars, may have other benefits. This could be increased efficacy, a different profile of adverse affects, or lower costs.

Figure 1: Expected fall in revenues for Big Pharma

Source: Pharma 2020 Report PWC

The R&D Pipeline

The research and development (R&D) pipeline refers to the group of drugs or biologics that a particular company is aiming to take into production and market. Generally, the more products it is developing and the later they are in the development phase, the more likely it is that one of their products will eventually be produced and marketed. In the 1990s, the discovery of a raft of blockbuster drugs resulted in huge revenues for the companies now recognised as Big Pharma. However, in recent times the efficiency or rate of return on their R&D efforts have been declining, with less products in late-stage development, higher average costs to develop and bring a drug to market, and a dearth of blockbusters to replace the ones going off patent. As a result of this Big Pharma are looking for innovation in the form of new biologics from their brothers in Biotech.

Big Pharma and Biotech collaboration

There is now increasing partnership and merger & acquisition (M&A) activity between Big Pharma and Biotech. Both sides have something to gain in this collaboration. Big Pharma are able to grow their pipeline, and with Biotech able to get the necessary funding to continue their R&D. With partnerships or “in-licensing”, Big Pharma will usually enter into an agreement with a Biotech whereby the Biotech will receive an upfront payment, and then further “milestone” payments as they advance the development of the product. Once the product is on sale, the Biotech will also receive royalty payments. When Big Pharma partner with a Biotech that has a product in the very early stages of development, the Biotech is likely to receive a lower share of royalties, whereas if the partnership occurs at an advanced stage, the Biotech is more likely to receive a larger share of royalties. With M&A activity, Biotech’s are being bought out at significant premiums, with the best companies fielding several bids from cashed up and hungry Big Pharma’s.

Regulatory affairs

Across the world, in order for a Big Pharma or Biotech company to be able to market or sell it’s product, the product needs to have been approved by the relevant government regulatory agency in each region that it plans to sell the product. In the US, this is the Food and Drug Administration (FDA), and in Europe, Japan, and Australia, this is the European Medicines Agency (EMA), the Ministry of Health Labour & Welfare Japan, and the Therapeutic Goods Administration (TGA) respectively. The International Conference on Harmonisation (ICH) was a project that brought together the regulatory agencies in the US, Europe, and Japan with the view to harmonising the regulatory requirements across these regions and the world. The ICH developed guidelines for regulation that have been adopted by certain countries, or are very similar to existing guidelines in others. As such, once a product has been approved in one country, meeting regulatory requirements for approval in others can be relatively straightforward.

The US FDA approval process

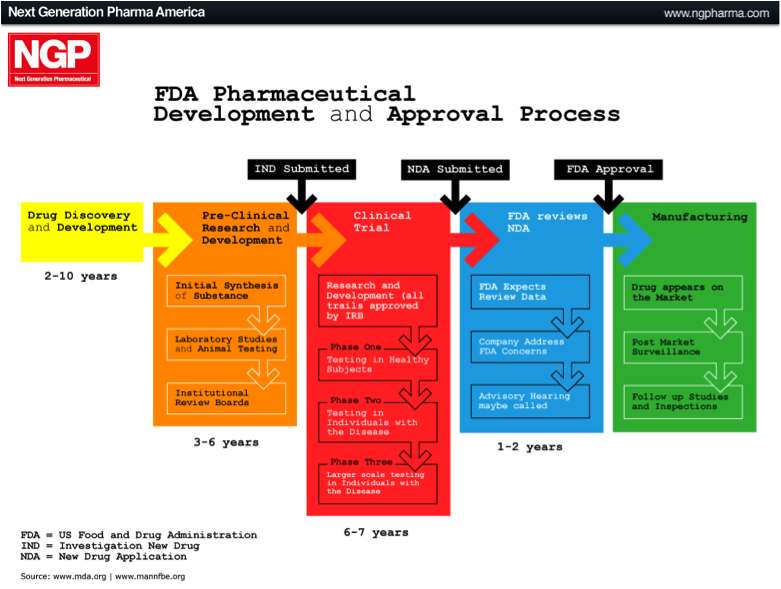

The largest market in the world for drugs and biologics is the US. It is the Holy Grail if you like, which is why many international companies tailor their product development towards meeting the FDA requirements and getting FDA approval. The approval process can be broken down into different phases, as outlined below.

Pre-Clinical Phase: This phase begins after the discovery of new molecules, and is where new molecules are investigated and tested in the laboratory (in-vitro), on animals (in-vivo), or via computer simulation (in-silico). Once this phase is completed the company files an Investigational New Drug Application (IND).

Phase 1: Once the FDA has approved the IND, Phase 1 human testing begins. In this phase the product is tested on a small group of healthy individuals to assess it’s safety. This means testing to make sure it is not toxic or carcinogenic, and to determine appropriate doses. It is also assessed to see how it is broken down or metabolised by the body.

Phase 2: Here the product has been established as safe in humans and is now tested on a small group of individuals that are affected by the disease being targeted. This is done to see if the therapy actually works, as well as any short-term effects.

Phase 3: In this phase, often referred to as the late-stage in development, the product is tested on a much larger population. The trial is generally multicentre, double-blinded, randomised and placebo-controlled (i.e. a randomised controlled trial, RCT). This means that testing is conducted at different centres and neither the subject nor the physician know whether the actual product or a placebo is being given, and the allocation is completely randomised.

At the completion of Phase 3, if the product has been proven to be safe and effective, the company will apply for a New Drug Application (NDA) or Biological License Application (BLA). If this is accepted, the final product can be marketed.

Complete Response Letter (CRL): The FDA issues a CRL in response to an NDA/BLA. In essence it is a “please explain”, that requires the applicant to clarify issues that may relate to the product, including safety, efficacy, or manufacturing related issues. In some cases the issues are minor, in other cases they could results in rejection of the application.

Figure 2: US FDA approval process

Source: Next Generation Pharmaceutical

Special Protocol Assessment (SPA): This is granted to products in uncompleted Phase 3 trials that have design, clinical endpoints/outcomes, and statistical analyses that are acceptable for approval by the FDA. The SPA is an indication that if the trial goes to plan, the final product will be approved.

Prescription Drug User Fee Act Date (PDUFA Date): PDUFA is a law that allows the FDA to collect fees from product manufacturers in order to fund the approval process. The PDUFA Date refers to the deadline by which the FDA must either approve or reject an NDA/BLA. The FDA has 10 months to review new applications.

Fast Track / Accelerated Approval / Priority Review: The FDA grants a quicker approval for important products. Fast Track is for those that treat serious diseases (e.g. AIDS, Cancer) AND fill an unmet medical need (i.e. provide a treatment where nothing else exists, or that is superior to existing treatments). Fast Track designation enables eligibility for Accelerated Approval. Accelerated Approval involves using a surrogate endpoint, e.g. a laboratory measurement or physical sign used in a clinical trial as an indirect measure of clinical outcome (survival or symptom improvement). Priority Review is used when products offer again treatment where nothing else exists, or more superior treatment, but it can be for serious or non-serious diseases, and approval can be obtained within 6 months.

Orphan Product Status: Orphan product status or designation is granted to products that treat rare diseases or conditions. The orphan designation offers a number of advantages, including product tax credits, marketing incentives, and a period of exclusivity.

Phase 4: In this phase the product is already on the market and ongoing monitoring is undertaken to observe for any new short-term or long-term effects. In some cases new data has resulted in products being taken off the market, most notably in the case of the drug Vioxx marketed by Merck & Co. Vioxx was a widely used anti-inflammatory drug used to treat acute and chronic pain related to arthritis. It was found to increase the risk of heart disease and stroke. Prior to withdrawal it had revenues of ~US$2.5 billion and was used in over 80 million people.

Summary: Drug and biologic development is a lengthy process, certainly an 8 to 10 year period from beginning the search for a potential product to final FDA approval is quite common. This requires significant funding. In assessing a Biotech one needs to be acutely aware of the amount of cash they have in reserve as well as the cash burn rate (how much cash they are spending each year). According to the latest AUSBiotech Biotechnology Industry position survey (April 2012), 34% of those surveyed have less than 12 months cash on hand at current burn rates, and 46% intend to raise capital in the coming year. However, raising funds from equity/debt capital markets or even venture capital funds may be difficult for Biotech companies in the current economic climate. Companies that may fare better are those that are already partnered with Big Pharma, or at the least are able to attract a premium valuation for acquisition.

THE PROVIDER-PAYER RELATIONSHIP, PRICING, & REIMBURSEMENT

Once a company (the provider) gets it product approved by the relevant government regulatory agency, it needs to also get it listed on a formulary. A formulary is a list of medications. Private health insurers (the payer) have a formulary. This is a list of the medications that they will pay for, usually with a part contribution or “co-payment” from the person who has been prescribed the medication. More importantly, the provider needs to get its product on a government formulary (another payer). In the US this is the Medicare Part D and Medicaid formulary. Here in Australia it is the Pharmaceutical Benefits Scheme (PBS). Private health insurers generally only cover medications already listed on a government formulary. Payers (private and public) can take up to 9 to 12 months to add new products to their formulary. In Australia, once a product has TGA approval the Pharmaceutical Benefits Advisory Committee (PBAC), an independent expert government body, makes a recommendation (to the Health Minister) as to whether it should be listed on the PBS. Once that recommendation has been accepted the Pharmaceutical Benefits Pricing Authority (PBPA) determines what price the government should pay for the medication. This is then negotiated with the provider. As an example of how the reimbursement process then works, we can look at how medications are dispensed from a pharmacy. A wholesaler first purchases the product or medication from the provider and then sells it to the pharmacy. The pharmacy receives the patient’s co-payment once the medication is dispensed, and then they receive reimbursement for the remainder of their costs from the government. This reimbursement includes the provider’s price for the medication + wholesaler’s mark-up + pharmacy mark-up + dispensing/other pharmacy fees.

THE IMPACT OF HEALTH POLICY

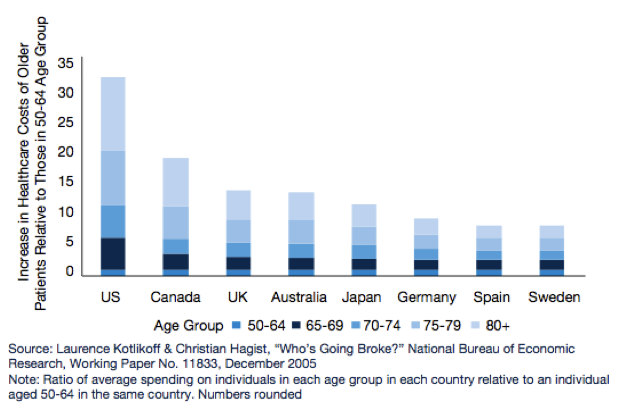

Based on a number of surveys done across the world, what we know about the developed world’s population is that it is ageing. What this means for government’s around the world is that healthcare and pharmaceutical related expenditures are going to rise significantly over the coming years. This will impact government health policy and in turn it will impact pharmaceutical and biotechnology companies.

Figure 3: Increased healthcare costs for older people

Source: Pharma 2020 Report PWC

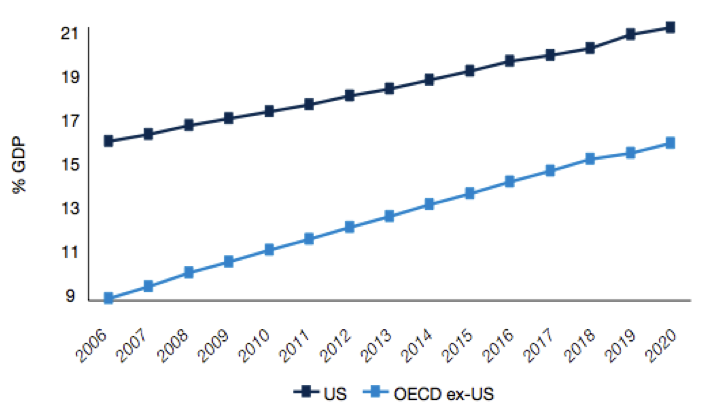

Figure 4: Rising health expenditure as a % of GDP

Source: Pharma 2020 Report PWC

What we could therefore see is tighter regulation of products, shorter periods of exclusivity for original product manufacturers, lower drug prices or reimbursement, and more emphasis on lower cost generics or biosimilars. According to the IMS Institute for Health Informatics (2011), the key drivers for growth in the future will be increased spending from emerging markets (led by China), with a focus on generics or biosimilars, and specialty medicines (biologics).

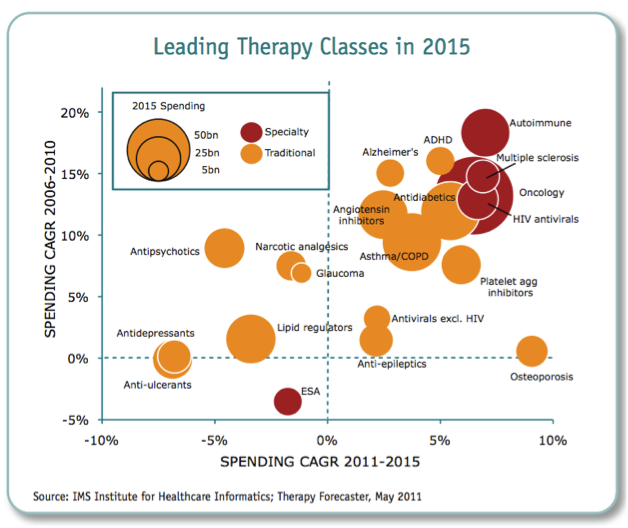

Figure 5: Leading therapeutic classes in 2015

Source: IMS Institute of Health Informatics 2011

GRADE Classification of BioTechs

In reviewing Biotech companies I like to classify them according to 4 Grade’s, albeit arbitrarily. This is a way of trying to differentiate companies according to the strength of their product pipeline. There’s no science behind it, and it is just a guide or a starting point for further investigation, which you may or may not find useful.

Grade 1: At least 3 products on the market.

Grade 2: 1 or 2 products on the market, with at least 1 other in Phase 2 or 3 trials.

Grade 3: 1 product on the market, or no products on the market but at least 1 in Phase 3.

Grade 4: No products on the market, multiple in Pre-Clinical Phase, Phase 1, or Phase 2.

Across the Grade’s, Grade 1 companies could be considered relatively low risk as they already generating revenues and cash flow. On the other hand, these companies may have already experienced high levels of capital growth off the back of their existing products and may not have as much room to climb further, depending a lot of course on their expected future cash flows and pipeline. They may also be faced with the issue of expiring patents and increased competition from new products. I’d expect the most gains to be achieved from investing in a successful Grade 4 company that is held for the long-term. However, with the exceptionally long time it takes for product development, at the Grade 4 stage it is very hard to assess the likelihood for long-term success. Furthermore, success in Phase 1 or 2 trials is not necessarily a reliable indicator of Phase 3 success or likelihood for regulatory approval. The sweet spot for me is going to be Grade 2 and 3. In order to maximise the potential returns on a Biotech investment, I want to capture those that are closer to their “inflection point”, which may be in these mid or lower ranked Grade’s.

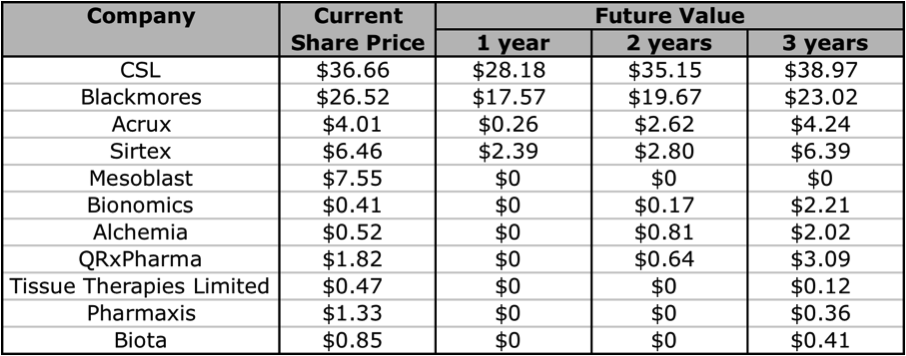

The problem here is that many of these companies are yet to generate any revenues, so a reliable valuation is difficult to make. However, using Skaffold (http:///www.skaffold.com), we can at the very least start by filtering out the ASX-listed Biotech companies, and then find those that are forecast to have a rise in their future intrinsic value. In the table below I have extracted and listed all Healthcare sector companies that that are also part of the Biotechnology/Major Drugs industry groups. The companies listed below all have analyst coverage. I have excluded 2 companies that did not really fit into the defined Grade classification, Mayne Pharma (diversified pharmaceutical services), and Sigma Pharma (wholesale and retail pharmaceutical distribution/sales).

Figure 6: Skaffold biotechnology company current Quality Scores

Source: Skaffold 26 April 2012

Based on the Skaffold Scores, there are 5 companies that could be considered investment grade. They are the A1, A2, and A3 companies: CSL, Blackmores, Acrux, Sirtex, and Mesoblast. Although Mesoblast does not have any intrinsic value, as it does not have any current product revenues. Mesoblast is an interesting one, although it has a lot of cash, this is largely the result of a partnership with Cephalon (now Teva). There are a handful of other companies that have analyst forecasts for near-term product revenue and thus have a future intrinsic value: Biota, Tissue Therapies Limited, Bionomics, Alchemia, Pharmaxis, and QRxPharma. In the following sections I will give a brief overview of 2 companies that currently have products on the market, Acrux and Sirtex, note that the former makes products that enable drug-delivery, and the other is technically a medical device company.

ACRUX (ASX:ACR)

Acrux has a number of products in its pipeline, all of which are based on transdermal delivery. That is, the medications are absorbed into the bloodstream through the skin via sprays, gels, or solutions. The medications themselves have all already been used safely when administered in other ways, for example, via tablets or injections.

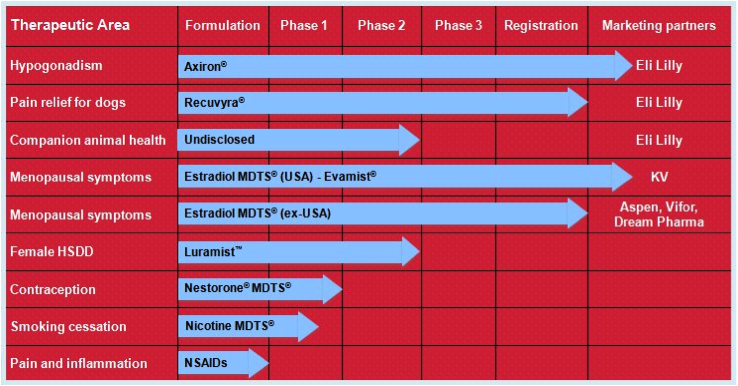

Figure 7: Acrux R&D pipeline

Source: Acrux website

Their lead product is Axiron. Axiron is a testosterone hormone solution used to treat low testosterone hormone levels in men (hypogonadism). It is applied in the armpits using an applicator, much like a roll-on deodorant. It was given FDA approval in 2010 and is on the market in the USA. Acrux signed a global licensing deal with Big Pharma Eli Lily in 2010 for the marketing of Axiron. As part of this deal, Acrux is entitled to up to $US335 million in milestone payments as well as worldwide royalties. The partnership with Eli Lily appears like an ideal fit, with Eli Lily already involved in the men’s health market with their erectile dysfunction product Cialis (a competitor to Pfizer’s Viagra). Axiron is actually the second product that Acrux has progressed to FDA approval, the previous being Evamist in 2007, an oestrogen hormone spray used in menopausal women that is also on the market in the USA. Acrux has also ventured into animal health products with Recuvrya, a pain relief solution for dogs that was only recently approved by the EMA (in 2011).

But let’s get back to Axiron. Low testosterone can result in symptoms such as erectile dysfunction, as well as decreased libido, energy, and mood. It is found in people who have a genetic or acquired disorder of the testes (where testosterone is produced) or of the pituitary gland in the brain (where testosterone levels in the bloodstream are regulated or controlled). Low testosterone levels can also be associated with many chronic illnesses, such as obesity, heart disease, and even depression. These illnesses may cause symptoms similar to that of testosterone deficiency, but this does not necessarily mean that testosterone replacement is required. Often focussing on treatment of the underlying illness is what is required instead. Testosterone levels also naturally decline with age, however this is gradual and usually does not get to the point where treatment is required either.

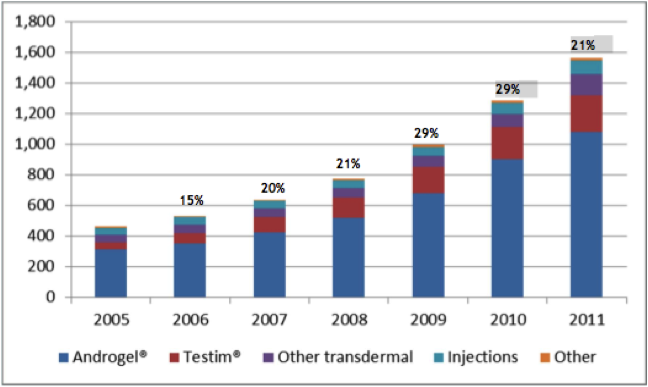

Now there are various testosterone products on the market, with many using different delivery methods, however the recent trend is favouring the newer transdermal routes. When testosterone is given in oral form, it is very difficult to achieve effective and stable concentrations in the bloodstream, this is because after it is absorbed through the intestine it is broken down or metabolised by the liver rapidly. In injectable form (a deep intramuscular injection, e.g. in the buttock) it has to be given every 1 to 3 weeks, this can be associated with severe fluctuations in testosterone concentrations in the bloodstream. This can lead to fluctuations in symptoms such as libido, energy, and mood. In the transdermal market, testosterone patches (think along the lines of nicotine patches) have had anectodally large incidences of severe skin rashes that often result in treatment cessation. This is where the gel/solution based products such as Axiron, Androgel, Testim, and Fortesta are increasingly popular. The overall male testosterone market, in particular for transdermal therapy, has been steadily increasing over the last 6 years as illustrated in the graph below.

Figure 8: Male testosterone market, US 2005-2011 (millions)

Source: Acrux February 2012 Presentation / IMS Data

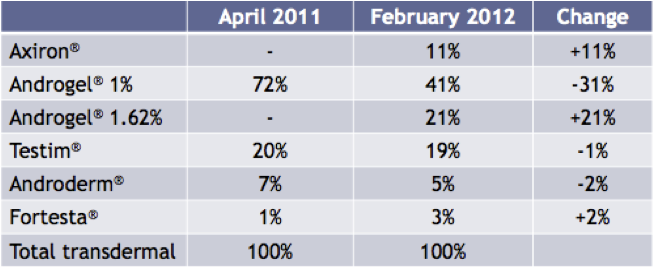

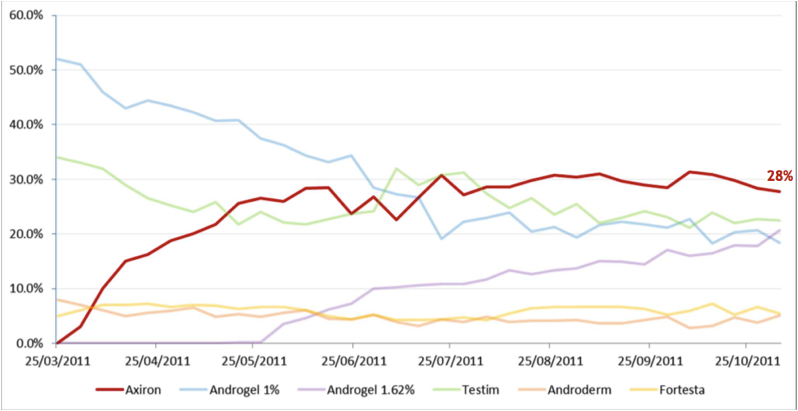

More importantly though is how Axiron has fared since coming onto the market in April 2011. As of February 2012, Axiron has achieved an 11% share of the transdermal market. Axiron’s main rival product in this market is another Big Pharma product Androgel, from Abbott Laboratories. In this same period, Androgel’s total share of the transdermal market has fallen by 10%, as illustrated in the chart below.

Figure 9: Share of Total Prescriptions of transdermal products in the USA

Source: Acrux February 2012 Presentation / IMS Data

The following graph shows the different transdermal products in terms of their share of total new prescriptions for patients being initiated on treatment for the first time by specialists, or being switched from other products. The most obvious thing to note is how in a short space of time Axiron has become the most widely prescribed product, and that the percentage share of total new prescriptions for Androgel has been declining significantly.

Figure 10: Share of transdermal New to Brand Prescriptions by Specialists

Source: Acrux Novembery 2011 Presentation / IMS Data

It appears that the uptake of Axiron has been excellent, and has the potential to eat away an even larger chunk of the total transdermal market. A key advantage of Axiron over Androgel is that is applied to an area that is less likely to come into contact with other people. Androgel on the other hand is applied over the upper arms and shoulders, so has a much greater chance of being indirectly transferred to other people. Another advantage of Axiron is that you do not need to physically touch the solution with your hands, whereas with Androgel you do have to rub the gel directly onto the skin with your hands.

On the Skaffold line graph below I have roughly marked out the Phase 1, 2, and 3 announcement dates as well as the date of FDA approval for Axiron. Acrux is currently trading at a significant premium to intrinsic value, however the intrinsic value is expected to rise significantly in the next few years.

Figure 11: Acrux Skaffold Estimated Intrinsic Valuation line

Source: Skaffold 27 April 2012

SIRTEX (ASX:SRX)

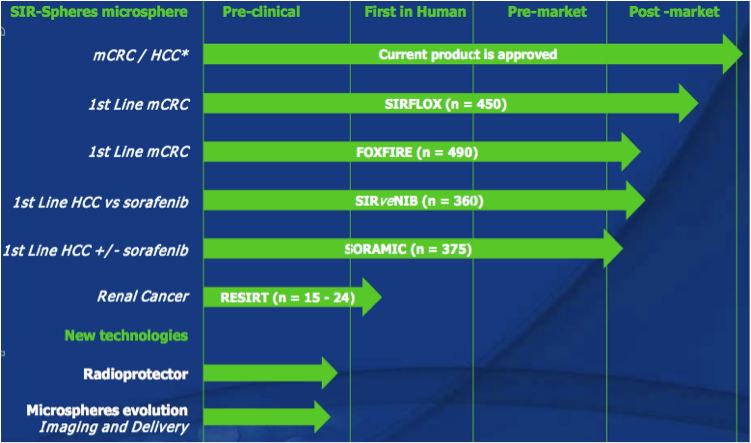

Sirtex has one product on the market, SIR-Spheres microspheres (let’s called it SIR-Spheres from now), which is a treatment option available for advanced hepatocellular carcinoma (“HCC”, liver cancer/tumour(s) that cannot be surgically removed), as well as for metastatic colorectal carcinoma (“mCRC”, bowel cancer that has spread to the liver, where the liver cancer/tumour(s) cannot be surgically removed). Sirtex also has a number of products or technologies in pre-clinical phase, although not a lot of information is available about them as they are at such an early phase.

Figure 12: Sirtex R&D pipeline

Source: Sirtex Company Presentation October 2011

SIR-Spheres is a radioactive treatment. Sirtex have developed micro-particles or beads (made from a substance called Resin) that act as transport vehicles for an isotope called Yttrium-90. An isotope is a radioactive chemical element. SIR-Spheres can be injected into the hepatic artery (the blood vessel that supplies the liver), once here the micro-particles get lodged into the walls of the small blood vessels that surround the tumour. This is a treatment that enables radiation to be given to a very localised area, without affecting normal liver tissue or other bodily organs. It is often referred to as selective internal radiation therapy (SIRT), or radioembolisation. It is a highly innovative product, although there is another company called Nordion that has something similar called TheraSphere. TheraSphere has micro-particles made from glass, but it also uses the Yttrium-90 isotope.

Radioembolisation is currently not used as first-line therapy. Let’s looks at HCC and mCRC separately to see exactly where it fits. For HCC, the first-line treatment for advanced inoperable cases, apart from liver transplantation, is a procedure called Radiofrequency Ablation (RFA). This is basically when a needle-like probe is passed into the tumour and an electrical current heats the probe resulting in the tumour tissue being heated up and destroyed. Where this is not possible, Transarterial Chemoembolisation (TACE) can be used. TACE is where chemotherapy is administered directly into the hepatic artery. SIR-Spheres radioembolisation could be used as an alternative to TACE. Having said that, with regards to SIR-Spheres, there is not yet enough clinical evidence or consensus with regards to when and whether to use SIR-Spheres over TACE. Systemic or traditional chemotherapy is used in more severe cases of HCC where there are multiple tumours or the other options are contraindicated in the patient. Systemic chemotherapy can also be associated with a lot of side effects. With mCRC involving the liver, where surgery is not an option, RFA is also used. Hepatic Intra-arterial (HIA) chemotherapy (similar to TACE) can be used as an alternate to systemic chemotherapy, although the benefits of this over newer systemic chemotherapy regimes have not yet been clearly demonstrated. Similarly, the benefits of SIR-Spheres over newer systemic chemotherapy regimes have not yet been clearly established either.

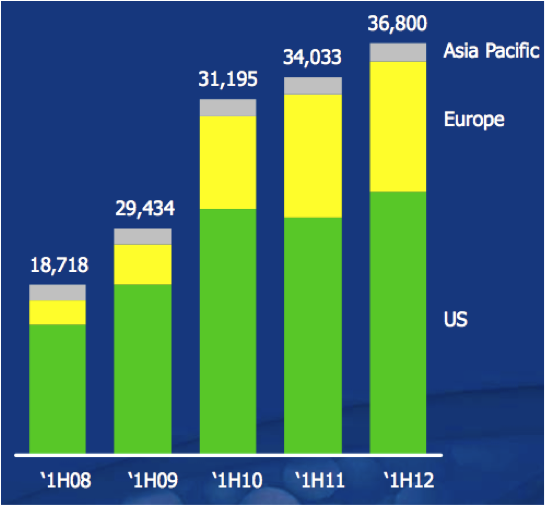

When SIR-Spheres was approved by the FDA, the control group in the Phase 3 trials was being given a systemic chemotherapy regime that has now been superseded by a more effective regime. The key downside to this product is therefore the lack of consensus as to when to use it and the lack of enough clinical evidence over existing treatments. SIR-Spheres has been approved for sale in Australia, Europe, and the USA. FDA approval was obtained in 2002, and this was the time of first commercial sale. So what has happened in the last 10 years? Well, they still have the same product, and the fact that it is still their only product is another downside risk, although they are working on number of clinical trials, with 4 major ones in clinical recruitment. These clinical trials are aimed at increasing the indications for use of the product, to see if they can find evidence to support it’s use in the earlier stages of cancer treatment, as first-line therapy or as an add-on to the newer systemic chemotherapy treatments. All that being said, Sirtex has steadily increased its revenues over the last 5 years.

Figure 13: Sales revenues (thousands)

Source: Sirtex February 2012 presentation

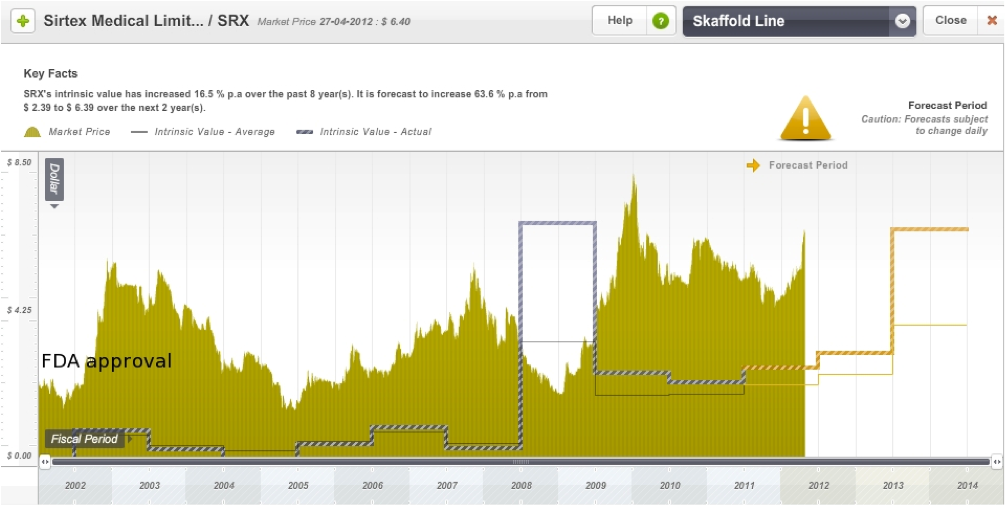

On the Skaffold line below I have roughly marked the date of FDA approval for SIR-Spheres. The share price of the company has been quite volatile over the years, but this is not uncommon in this industry. Like Acrux, it is also trading at a significant premium to its current intrinsic value, however its intrinsic value is also expected to rise in the next few years.

Figure 14: Sirtex Skaffold Estimated Intrinsic Valuation line

Source: Skaffold 26 April 2012

CONCLUSION

A decision as to whether to invest in either of these companies will require a deeper analysis of their management team, cash flows, debt levels, levels of return on equity, the strength and diversity of their pipeline’s, and industry competition. Unfortunately that is beyond the scope of this article. But if you are looking for an A1 company in this industry, you can’t go past CSL or Blackmores. Both are excellent companies that have had steadily rising intrinsic values for over 10 years. If you want to invest in a company at a much earlier stage, there are a few companies that are worth keeping an eye on. Aside from the 2 I have reviewed in this article, I think Bionomics, Alchemia, and QRxPharma are ones to add to your share portfolio watchlist. Below I have extracted some of the Skaffold data and listed the forecasted future intrinsic values of the companies whose intrinsic values are expected to rise in the next 1 to 3 years. Note: Biota has recently announced that it will be delisting from the ASX, and I have slotted in Mesoblast as an extra.

Figure 15: Currently Estimated Future Values

Source: Skaffold 1 May 2012

Posted for Praveen by Roger Montgomery, Value.able author, Skaffold Chairman and Fund Manager, 31 May 2012.

Do you ‘LIKE’ us?

Adam

:

Great article

Could you add some detail on how your model sees Tissue Therapies value at 12c in 3 years when management and other analysts forecast gross earnings for VitroGro growing to 300m pa by end 2015?

Thanks kindly.

Matt

Chris W

:

Thanks for that Praveen. There is still a lot of research for me to do before I touch these sorts of companies but this was a very good and detailed intro.

David

:

Roger and Praveen,

This is a supplement to my previous question Re: AHZ

RBS Morgans (as of 04/05/12) has AHZ down as a buy with a target of 6 cents (currently 1.9cents and was then 2.7cents).

http://www.alliedhealthcaregroup.com.au/files/files/543_AHZ120504_Cash_injection_what_the_doctor_ordered.pdf

Wondering if you agree that 6cents is a good target? Noting that this target was set before the Announcement (05/06/12) stating that the EU CE marking application had been submitted.

My average purchase price is 3.2 cents

Cheers

Praveen

:

I can’t really comment on a price target… I would be interested to know what the outcome of the CE mark application was though.

Praveen

David

:

Great article.

One biotech I am really keen on is allied healthcare group (AHZ), the one that has Fortescue’s Andrew Forrest as a major shareholder and highly acclaimed Professor Ian Frazer on its development team.

Wondering what your thoughts on the company are? They announced this week that one of their products has begun the EU CE marking application process. The share price has dropped dramatically of late although there has been no bad news, my thoughts were that the european debt situation is causing an exodus out of speculative stocks.

To me this company seems like a really solid bet. Would love to hear your thoughts though.

Thanks for this really informative article.

Praveen

:

Hi David

I’m not overly familiar with this company, but from what i can tell it is a company that has grown from acquisitions. The Coridon business is the most interesting one for me. It appears that AHZ have a non-controlling interest in this private company, and Prof Frazer is a director of Coridon. Prof. Frazer is famous for being involved in creating the human papilloma virus vaccine (for cervical cancer), Gardasil. Coridon is targeting the herpes simplex virus (for genital herpes) and epstein-barr virus (for glandular fever). It looks like the herpes simplex virus product is nearing Phase 1 clinical trials and this is what i would be monitoring. This is a potential blockbuster product. When people get genital herpes, they have it for life, and even when they do not have genital lesions, they can still pass it on to other people (through sexual contact). It is not a life threatening problem, but it is very common and extremely uncomfortable. The company is somewhat diversified, and is generating revenues with medical device and equipment sales, but i still feel that it is a high risk play. I would also look closer at their management, i don’t see as much direct experience in biotechnology or science as i normally prefer in these sorts of companies.

Praveen.

David

:

Hi Praveen,

Thanks for your response, very helpful. I will look further into the management team to assess their credentials.

In terms of Coridon. AHZ has rights to a majority shareholding which they are taking up periodically, not sure what the upper limit is. After the last take up this year they are currently up to 44%.

I emailed the Chief Operating Officer who told me that they expect the CE Mark Application for Cardiocel will go through in 6 to 9 months and that they are confident that it is a question of when, not if, it will go through. This will be a great revenue raiser to be used on their other projects, as the revenue they raise at the moment is no where near enough to cover expenses (although they performed a successful rights issue recently and so are cashed up).

I ordered Valuable the other day and am very much looking forward to reading it. I am assuming the question will be answered by the book but just in case which program do you use to generate the intrinsic valuation line graphs?

David

Praveen

:

Excellent! The IV graphs are from Skaffold.

garry

:

Great post Praveen, very helpful..As a long term follower and sometimes commenter of this blog, I would aslo like to thankyou Roger for your recent posts titled, Is the rally over, The crowded Trade, How close for Europe, and there are many more. Thought provoking for the mums and dads investors.. You have a uncanny timing for writing posts at just the right time, that for readers of this blog, is invaluable. Yes the rally was over, it was a crowded trade, and yes resourses are now falling.

Also Roger on the 1st June MTU rallied over 5%, which I would assume was partly because of their inclusion into the asx 200..Can you tell me how long index funds have to add new entries to their fund? Is it the first day of the month the company is added, or do they have a longer period??

many thanks again

Ann

:

The one med stock I have has dropped to almost zero!!

Macca McLennan

:

What a great post

Thank you Praveen for your time & effort

Thank you Roger for allowing it to be posted

Any interested in Acrux would be well advised to read the

2010 Annual Report it really is all about the companies journey.

The integrity, unfailing effort, & dedication of the company shows through..They tell a compelling story without any exaggeration

or “puffery.

Fortunately i bought shares early December 2011 at $3.50.Since then i have received a special dividend of 60c Price is now $4.34

Any one thinking of investing should be aware that Acrux is a Pooled Development Fund. This generally means that their unfranked dividends are exempted from Australian Tax.

Non-resident shareholders are not subject to withholding tax.

Thanks Praveen

Regards Macca

John C

:

Great Post Praveen. Very well researched and written. Macca, I too was a beneficiary of the 60 cents SD which Acrux made under their PDF status last year. At the same time, they gave guidance that they expected all future dividends to be fully franked ordinary dividends if my memory serves me correctly. I note that that they will not pay any dividend this FY due to the timing of their milestone payments from Lily, but the dividends should resume next year. I don’t hold Acrux currently, but I do hold Sirtex. I like both companies and I have enjoyed finding out a lot more about them through this post. Thanks again Praveen!

greg hills

:

Great article, really did your homework there.

Blackmores is a fantastic company , I only hope one day i can buy it cheap. CSL is also another star. I like both of these because they have a great track record and have proven products that don`t rely so much on the R&D. Blackmores sells vitamins & a big part of CSL`s revenue comes from blood plasma sold all over the world.

thanks for the insight

Greg

Brian Nolan

:

Superb analysis, extremely detailed.

Alas, the biotech sector in Australia is largely an object lesson in value investing as carried out in the US. US Pharmaceutical companies wait until the share price on the ASX languishes to ludicrous lows despite promising prospects, and then they take out the company for an insulting premium. Biota being a case in point.

(On a related matter, I would appreciate Roger’s insights into the new rules being mooted by the ASX, which would allow small caps to issue new capital up to 25% every year with the approval of a mere 51% of shareholders. Yet another minefield for the small investor to negotiate when choosing companies.)

Cheers,

Brian.

Roger Montgomery

:

Hi Brian,

I have been asked by a prominent shareholder activist and a shareholder proxy advisor to present on this subject…I am considering the options.

Rob S

:

Brian, I agree in principle that Biotech is greatly under-looked in Australia, and we end up sending a lot of our best ideas overseas.

However, I do not think Biota is a case in point.

The deal with Nabi is in fact a reverse-merger that will see Biota shares listed on Nasdaq. The main reason is that management believe the company is overlooked in the Australian market and is undervalued. The key reason is that they have a contract with the US government which is going to fully fund the development of their latest antiviral drug through to registration with the FSA. The drug is already approved for use in Japan, so I think the chances of getting through FSA approval are significant. This is being done as a matter of national bio-security, and requires Biota to establish everything from manufacturing to distribution and sales within the US (that’s a complete vertically integrated infrastructure, payed for by US taxpayers!). The revenue due to Biota through this contract is on the order of $240M (US), much larger than their current share price, and guarantees a captive market for the life of the product. Moreover, they retain the IP, without having to rely on licensing arrangements and royalty payments as in the past which means greater margins.

The crazy thing to me is that the moment they announced the move to list on Nasdaq (citing undervaluation as a primary reason), their shares plunged ~15% as investors don’t want to have to fill in a little bit of paperwork in order to trade the shares overseas!

Part of the reason is that traditional value investors don’t touch biotech, and many science types don’t give a jot about finance. There is practically no education on commercialisation or product development in your typical Molecular-Biology based-science degree in Australia.

Also, thanks for the post Praveen, it’s a good starting point!

Andrew

:

Well done Praveen, this is a great example of what makes this community so great a resource for those interested in investing. We have such a broad base of knowledge here and people like yourself generous enough to share it. I am sure i will not be the only one thanking you and i also think Roger you should give yourself quite a pat on the back for creating the venue for all of this to take place. I have not seen any other investing related forum, blog or website that covers what gets covered and talked about here and with such respect and generosity.

I do not have much to add except that i pay particular attention to blackmores however i think it is also expensive at the moment.