Global markets

-

Why this market is starting to look like a ponzi scheme

Roger Montgomery

October 7, 2020

When Tesla split its stock five-for-one and then rallied 12 per cent on the day the split shares started trading, I thought the market had reached a new and unsustainable level of nutty. But I was wrong. continue…

by Roger Montgomery Posted in Global markets.

- 2 Comments

- save this article

- POSTED IN Global markets

-

Why you shouldn’t be spooked by the rise of zombie companies

Roger Montgomery

September 30, 2020

Are you concerned about the increasing number of zombie companies and a looming tech bubble? Well, perhaps the situation is not as worrying as it seems. With governments and central banks continuing to pump money into the economy, share prices could be held aloft for some time yet. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

The growth v value conundrum

David Buckland

September 28, 2020

Since the market bottom of the Global Financial Crisis in March 2009, the Russell 1000 Growth Index (R1G) has outperformed the Russell 1000 Value Index (R1V) by over 300 per cent cumulatively. Many investors seem fearful that this current era of growth style dominance will end with the same thud as its predecessor, when the Nasdaq Composite stock market index, after appreciating by 400 per cent from 1995, proceeded to decline by 78 per cent from its peak in March 2000 to October 2002. continue…

by David Buckland Posted in Global markets, Market commentary.

-

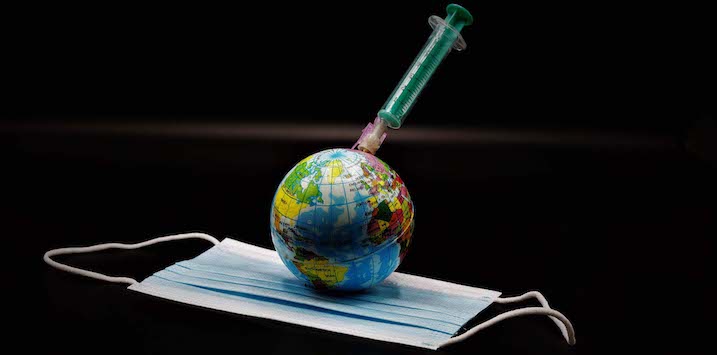

Lockdown, reopen, lockdown, reopen, repeat

Roger Montgomery

September 24, 2020

Globally, investors have hitherto been blissfully optimistic about the end of hard lockdowns, the development of a potential vaccine and broad economic re-openings. But all that may be about to change. continue…

by Roger Montgomery Posted in Global markets.

- save this article

- POSTED IN Global markets

-

What if we get a vaccine but people refuse to be jabbed?

Roger Montgomery

August 19, 2020

Global share markets are being held aloft partly by the hope of a coronavirus vaccine coming sometime soon. But new research shows many people – including around 50 per cent of Americans – could refuse to get a jab. If that happens, then is it possible that what we are now living through will be the new normal? continue…

by Roger Montgomery Posted in Global markets, Market commentary.

-

Farewell fiscal 2020, hello fiscal 2021

David Buckland

July 1, 2020

Twelve months back, who could have predicted the world would be in the state it’s currently in? And yet, despite the pandemic-induced turmoil, some world markets are not that far from where they were a year ago. Here’s a quick look at the year that was. continue…

by David Buckland Posted in Global markets, Market commentary.

-

Could US lockdowns slam the breaks on this market rally?

Stuart Jackson

June 29, 2020

The COVID-19 data coming out of the US is grim and getting grimmer. My concern is that many investors have been pricing in an increasingly positive economic recovery, which may not eventuate if governments in the US need to re-introduce lockdowns. And that spells danger for share prices in the US – and other markets as well. continue…

by Stuart Jackson Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

Why I’m not a fan of the Fed buying corporate bonds

Roger Montgomery

June 23, 2020

In March, the U.S. Federal Reserve moved to prevent a coronavirus-induced downturn by promising to set up an entity to buy corporate bonds and ETFs, including junk bonds and junk bond ETFs. My concern is that the Fed has simply created another time bomb that future generations will have to defuse. continue…

by Roger Montgomery Posted in Global markets, Market commentary.

-

Is the economy on the ropes, or getting back on its feet?

Roger Montgomery

June 13, 2020

Recent economic surveys paint a grim picture of business conditions, job ads and home lending. The question is: can the economy bounce back from the pummeling it took at the hands of the COVID-19 lockdown? continue…

by Roger Montgomery Posted in Global markets, Market commentary.

- save this article

- POSTED IN Global markets, Market commentary

-

Why this market bounce has got me so perplexed

Roger Montgomery

June 11, 2020

The 11-year bull market in global equities, which COVID-19 finally brought to an end, came to be derided as the most unloved bull market in history. So, what to make of the strong, and similarly disparaged, bounce since March? Many investors look to be pricing in better times ahead, but media headlines are telling a different story. continue…

by Roger Montgomery Posted in Editor's Pick, Global markets, Market commentary.