Financial Services

-

MEDIA

What are Roger’s thoughts on limited bank competition placing pressure on interest rates?

Roger Montgomery

February 7, 2012

Is limited competition placing pressure on interest rates and stifling the RBA’s monetary policy options? Roger Montgomery discusses his views with Ticky Fullerton on the ABC1’s Lateline Business on 7 February 2012. Watch here.

by Roger Montgomery Posted in Financial Services, TV Appearances.

- save this article

- POSTED IN Financial Services, TV Appearances

-

2012 Prediction No#1. Will our banks raise capital?

Roger Montgomery

January 11, 2012

The banks are in the firing line again. A few months ago it was their record profits; today its talks of job cuts that dominate. In November I noted that an industry insider had informed me that tens of thousands of jobs would be cut from financial services in 2012. News today of job losses at one credit union suggests the process is underway.

But is something even bigger brewing? Something that’s getting little or no headline attention? We believe so. Collectively our banks made $24.26b in profits in 2011 (CBA $6.4b,NAB $5.5b, WBC $7b, ANZ $5.36b), but remember, banking is one of if not the most highly leveraged businesses on the Australian stock market. And being highly leveraged into any downturn means the economy can bite and bite hard.

While everyone’s focus is on cost cutting and net interest margins – so that the banks can maintain their profits – what are the numerous issues facing them:

• Elevated funding costs squeezing bank margins – Australian Financial Institutions source $310.5b in offshore borrowings.

• Declines in the share market impacting on wealth management profits.

• A higher frequency of natural disasters impacting insurance profits.

• The implementation of Basel III and higher capital requirements.

• Mortgage margins contracting given heavy competition for new loan business in a low growth environment.

• Low levels of system credit growth.

• Low levels of bad debt provisioning. Levels around pre-GFC 2008 levels and ratings agency Moody’s having serious misgivings about Australia’s housing market amid fears the property bubble will burst if Europe’s debt crisis is not contained.

• Analysts expecting house prices to drop further in 2012.

• Below 40% auction clearance rates across Australia.

• High historical levels of private and corporate debt levels.

• Falling property prices in China – the country’s Homelink property website reported that new home prices in Beijing fell a stunning 35 per cent in November from the month before.

• A broader economic slowdown in China and Japan as a result of Europe and US economies.

• Falling commodity prices for many of Australia’s key exports.My view is that our highly leveraged banking system faces many pressures – from higher funding costs to increased unemployment (not just in the banking sector, some 100,000 jobs will be lost in retail alone) and the uptake of Basel III and that these pressures will see them needing to increase their capital. The canary in the coal mine is always of course bad debts.

Like my early prediction last year of a possible Qantas takeover, I may be wide of the mark, but I cannot rule out the possibility of the banks needing to raise capital in 2012.

If you work in the banking sector or are an avid follower of the Australian Banking system or know someone who is, I have a question to ask – despite the possible layoffs, what are you seeing? Clearly growth for banks is anemic and there are many headwinds to current consensus analysts’ earnings forecasts and their growth profiles. Are they achievable for our major banks in the coming years?

It is these forecasts that feed into valuation models which determine whether or not a margin of safety exists at current prices, so I’m throwing a call out to you. Do you agree with the current consensus view that jobs cuts are being made to preserve profits, or do you also see more to the story?

Posted by Roger Montgomery, Value.able author and Fund Manager, 11 January 2012.

by Roger Montgomery Posted in Financial Services.

- 77 Comments

- save this article

- POSTED IN Financial Services

-

Returning to regular programming shortly…we hope!

Roger Montgomery

December 16, 2011

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.

Continuing on our hypothecation theme, David Stockman, former Director of the White House Office of Management and Budget during the Reagan Administration penned the following to Mrs Lee Adler of the Wall Street Examiner. Stockman is currently writing a book on the financial crisis and some of the thoughts he expresses in his exchanges with Adler relate to the ideas he is developing in the book.Those you hoping for a quick end to the ructions in Europe and a return to normal levels of volatility may wish to ponder Mr Stockman’s thoughts on why European Banks are on the verge of collapse:

“The real story of the present is the shadow banking system, the unstable and massive repo market, and the apparent daisy chain of hyper-rehypothecated collateral. It looks like the sound bite version amounts to the fact that the European banking system is on the leading edge of collapse for the whole system. These institutions are by all evidence now badly deficient of the three hallmarks of real banks—deposits, capital and collateral.

BNP-Paribas is the classic example: $2.5 trillion of asset footings vs. $80 billion of tangible common equity (TCE) or 31x leverage; it has only $730 billion of deposits or just 29% of its asset footings compared to about 50% at big U.S. banks like JPMorgan; is teetering on $500 billion of mostly unsecured long-term debt that will have to be rolled at higher and higher rates; and all the rest of its funding is from the wholesale money market , which is fast drying up, and from repo where it is obviously running out of collateral.

Looked at another way, the three big French banks have combined footings of about $6 trillion compared to France’s GDP of $2.2 trillion. So the Big Three [F]rench banks are 3x their dirigisme-ridden GDP. Good luck with that! No wonder Sarkozy is retreating on France’s AAA and was trying so hard to get Euro bonds. He already knows he is going to be the French Nixon, and be forced to nationalize the French banks in order to save his re-election.

By contrast, the top three U.S. banks which are no paragon of financial virtue—JPM, Bank of America, and Citigroup—have combined footings of $6 trillion or 40% of GDP. The French equivalent of that number would be $45 trillion. Can you say train wreck!

It is only a matter of time before these French and other European banks, which are stuffed with sovereign debt backed by no capital due to the zero risk weighting of the Basel lunacy, topple into the abyss of the shadow banking system where they have funded their elephantine balance sheets. And that includes Germany, too. The German banks are as bad or worse than the French. Did you know that Deutsche Bank is levered 60:1 on a TCE/assets basis, and that its Basel “risk-weighted” assets are only $450 billion, but actual balance sheet assets are $3 trillion? In other words, due to the Basel standards, which count sovereign and other AAA assets as risk free, DB has $2.5 trillion of assets with zero capital backing!

This is all a product of the deformation of central banking and monetary policy over the last four decades and the destruction of honest capital markets by the monetary central planners who run the printing presses. Furthermore, this has fostered monumental fiscal profligacy among politicians who have been told for years now that the carry cost of public debt is negligible and that there would always be a central bank bid for government paper. Perhaps we are now hearing the sound of some chickens coming home to roost.”

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 December 2011.

by Roger Montgomery Posted in Financial Services, Market Valuation.

-

Hyper what?

Roger Montgomery

December 12, 2011

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.

How many of you have heard the financial term ‘Hypothecation’? Microsoft word hasn’t – the bug-prone program constantly tells me to check the spelling. If it’s also new to you, take note because you may be hearing a lot more about it and it could impact your portfolio.Prior to the collapse of MF Global, it’s unlikely that many in the investment world would have ever heard of the terms; ‘hypothecation’ or ‘re-hypothecation. If you hold any dollars in an international brokerage / trading account, especially one where your funds are dispatched to somewhere in the UK, hypothecation may be the canary in the mine.

MF Global was allegedly using client-segregated monies for its own trading activities – a practice that is for obvious reasons, not practiced in most countries. The trading brought a 230-year old firm to its knees in a matter of weeks and resulted in the freezing of client funds. Funds thought to be ‘segregated’ and separate from the working capital of the firm, weren’t. But is MF Global an isolated case or is a practice that levers clients funds widely practiced and one that could undermine the financial system?

What the MF Global collapse has uncovered is that laws designed to prevent to access to ‘segregated’ accounts are being circumvented. Some firms may have also shifted accounts to countries where it is legal to access client’s funds for the firms trading activities. When you thought the only risk was that of your trade or investment selection going wrong, think again.

Hypothecation is, in simple terms, the practice of a borrower putting up collateral to secure a debt. An example of this is the typical purchase of a house. The buyer puts down a 20% deposit and borrows the remaining 80%. In this case the borrower has put up some cash and the house (at an agreed value) as collateral to cover the debt until the mortgage is paid off. Until such the borrower retains ownership of the collateral. Thus the collateral (both the deposit and the house) remains “hypothetically” controlled by the creditor, usually a bank. If the borrower can’t afford to meet agreed repayments (default), the creditor can take possession of the collateral and sell it to recover its assets. That’s Hypothecation – hypothetically the borrower owns the house, but in fact, they don’t until all loans are paid off. The same goes for securities purchased on margin.

With the basics out of the way we return to MF Global. Surprisingly hypothecation occurs when an investor puts their capital into a trading account to buy and sell securities such as CFD’s, Futures, Options, Commodities, etc.

And that should be that. Your money sits in your segregated trading account as collateral covering your positions – margined or not – until such as a time that you suffer an inability to pay back your debt to your broker (creditor) – if you ever do. And that is as we know it in Australia. MF Global here in Australia appears to have followed that procedure. But has it done so in the UK and the US? And how do others behave?

The practice and rules regulating hypothecation vary depending on the jurisdiction in which the trading account exists. In the US for example, the legal right for the creditor to ONLY take FULL ownership of the collateral if the debtor defaults is classified as a lien – a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation.

In the UK however, these rules are more than a little different. In the US there are some breaks, re-hypothecation is capped at 140% of a client’s debit balance. In the UK however, there is no limit on the amount of a clients funds that can be re-hypothecated, except if the client has negotiated an agreement with their broker that includes a limit or prohibition. UK brokers can ‘REUSE’ collateral put up by clients to secure their own trading activities and borrowings through a little unknown process called Re-hypothecation! While you may think that your ‘segregated’ capital is being used only as collateral for your own trading activities and borrowings / margin, a firm such as MF Global who operates out of the UK, can re-use their clients collateral to back their own trades and borrowings! Are you thinking credit card on credit card, gearing on gearing, leverage on leverage? And how do excessively leveraged position usually work out? Not well generally.

In the industry it’s referred to as “fractional reserve” synthetic liquidity creation by Prime Brokers. The IMF in their 2010 paper The (sizable) Role of Rehypothecation in the Shadow Banking System” Manmohan Singh and James Aitken state: “Mathematically, the cumulative ‘collateral creation’ can be infinite in the United Kingdom”. They add that courtesy of no re-hypothecation haircuts one can achieve infinite “shadow” leverage and the creation of a large shadow banking system.

Gary Gorton in his 2009 paper “Haircuts” about systemic risk in the repo market (something I used to teach for the Securities Institiute of Australia) suggests that banks’ reliance on the repo market constitutes a systemic fragility which renders the entire banking system prone to runs: “Gorton predicts the crisis was not a one-off event and it could happen again”.

He also addresses the relationship between confidence and liquidity suggesting when “confidence” is lost, “liquidity dries up” and concludes the financial crisis was a manifestation of an age-old problem with private money creation, banking panics. ‘Haircuts’ are the functional equivalent of information arbitrage: “When all investors act in the run and the haircuts become high enough, the securitized banking system cannot finance itself and is forced to sell assets, driving down asset prices. The assets become information-sensitive; liquidity dries up. As with the panics of the nineteenth and early twentieth centuries, the system is insolvent.” “Liquidity requires symmetric information, which is easiest to achieve when everyone is ignorant. This determines the design of many securities, including the design of debt and securitization.”

What Gorton says is that the increasing complexity of banks and the securities they issue is motivated by the need to obfuscate the masses and distract them from what is really occurring.

Let’s say a hedge fund (who is managing your money) puts up $100,000 collateral to support a leveraged position of $1,000,000. If the broker then re-hypothecates that $100,000 and uses this to support the same level of leverage, the firm is in a position where just $100,000 in collateral (not theirs) is supporting $2,000,000 in leveraged market positions.

A move of just 5% on $2,000,000 equates to $100,000 in profit and both you and your broker make $50,000 each. A move however of 5% against a $2,000,000 position can however wipe most of the collateral – and such moves are not uncommon today. While a single trade will unlikely bring down a broker’s diversified trading book, if all trades move in unison (remember US house prices were never expected to all decline at once), as was the case when MF Global traded European bonds, you can see how quickly everything can unravel.

And remember, while the broking firm enjoys all of the trading profits and fees, the clients bear the risk. If the broker loses, they file for bankruptcy, leaving clients holding an empty can. This appears to be what transpired at MF Global. It’s the ultimate privatization of profits and socialization of losses. And according to an increasingly vocal group of experts it could all happen again if a sovereign defaults.

And now you also have the reason why Central Banks around the world are applying a policy of ‘price stability’ or ‘price support’ in asset markets like the stock market – everyone is leveraged to the hilt.

It has been estimated that in 2007, re-hypothecation accounted 50% of the worlds Shadow banking system and the IMF estimated that US banks received $4 trillion of funding from the UK from re-hypothecation using just $1 trillion in clients funds, funds being levered several times over. In this light, don’t think for a moment that MF Global is alone in using client’s funds to trade and borrow for their own trading activities.

It appears in the current market environment that the first question you should ask is not whether or not your investment idea will work out correctly, it’s more a question of whether the money you put into your broker sponsored account will ever come back.And now that re-hypothecation is exposed, I wonder how many assets have been double, tripled and quadruple-counted. An expose on this subject by Reuters about this subject following the collapse of MF Global, revealed that “Engaging in hyper-hypothecation have been Goldman Sachs ($28.17 billion re-hypothecated in 2011), Canadian Imperial Bank of Commerce (re-pledged $72 billion in client assets), Royal Bank of Canada (re-pledged $53.8 billion of $126.7 billion available for re-pledging), Oppenheimer Holdings ($15.3 million), Credit Suisse (CHF 332 billion), Knight Capital Group ($1.17 billion), Interactive Brokers ($14.5 billion), Wells Fargo ($19.6 billion), JP Morgan($546.2 billion) and Morgan Stanley ($410 billion).”

And if you are wondering what the implications are, it may not be what you think. Initially there will be the denials and then, if Prime Brokers have to recall all the stock they lent out, imagine the global short covering rally?

And meanwhile the Euro crisis related elimination of deficit spending could force banks into administration or liquidation, which in turn causes assets to be marked down to market and pressure on equities. We invest in interesting times…but don’t forget highest quality stocks at substantial discounts to intrinsic value.

Posted by Roger Montgomery, Value.able author and Fund Manager, 12 December 2011.

by Roger Montgomery Posted in Financial Services.

- 33 Comments

- save this article

- POSTED IN Financial Services

-

What on earth is a covered bond?

Roger Montgomery

November 18, 2011

When Sean Connery played James Bond in the 1967 hit, You Only Live Twice one doubts he had this week’s billion dollar covered bond issue of ANZ in mind. Asking the question “what is a covered bond?” reveals an extra life has been given to borrowers at the expense of prudent savers. Its Australia’s own little moral hazard.

moral hazard n.- a situation in which a party insulated from risk behaves differently from how it would behave if it were fully exposed to the risk.

According to the Treasurer, Wayne Swan, legislation the government passed last month will strengthen the local financial system, increase the supply of credit, and provide cheaper, more stable and longer-term funding.

ANZ this week issued $US1.25 billion of five-year covered bonds. CBA is looking to Europe for its issue while Westpac and NAB are said to be eyeing the US debt markets for theirs ahead of increases in wholesale funding costs on their upcoming refinancing.

When banks issue covered bond they pay a lower rate on their funding than if they issued senior unsecured debt. And if as some commentators suggest the banks in aggregate issue $100 billion of this stuff in coming years the savings can amount to more than half a billion in interest expenses.

The lower rate that banks enjoy on covered bonds is partly due to the AAA rating they receive. This AAA rating (which is higher than the AA rating the banks themselves enjoy) is derived from the fact that banks can use their assets (loans presumably) as collateral for issuing the bonds. If the bank goes bust, the bond holder as recourse to those assets.

Interestingly (and here’s why they just might be Triple A), if the assets are worthless the bondholder has recourse to the bank itself. In other words those bond holders get access to your deposit money and those bond holders rank BEFORE you in terms of their right to your money.

Unsurprisingly, the size of the covered bond market is therefore capped. Banks can only issue covered bonds backed by up to 8 per cent of their assets. Based on the majors’ full year results, the ANZ, CBA, WBC and NAB have a collective $2.686 trillion in assets. Eight percent of those assets amounts to $214.9 billion.

Many believe that the issues in Europe are contained to Europe. Someone wriley observed recently however that debt crises are only contained to planet earth. Investors like central banks who are limited to investing in AAA rated securities will no doubt be interested in the paper because our banks are perceived as safe. But what is that assumption based on? We’ll leave that discussion for your comments below.

What I am most interested in is the unilateral decision to allow that which has previously not been permitted; To rank a bond holder ahead of you in terms of rights to your deposits.

On the flip side, the banks argue that the cheaper funding means you can borrow from them more cheaply – assuming they pass it on of course. But like the ladies in James Bond’s bath, its all part of the policy drive in this country to make things cheap. Cheaper cars at the expense of local manufacturing, cheaper flights at the expense of local jobs, cheaper food at the expense of local farmers and cheaper bonds at the expense of your entitlement to your deposit.

Keep prices down and there won’t be an uprising. Have a good weekend.

Posted by Roger Montgomery, Value.able author and Fund Manager, 18 November 2011.

by Roger Montgomery Posted in Financial Services, Insightful Insights.

-

Are the banks robbing sensible investment returns?

Roger Montgomery

November 15, 2011

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).

Amid all the talk of GFC II and the Eurozone unravelling, Warren Buffett’s Berkshire Hathaway Inc. (BRK/A) has been increasing its stake in US bank, Wells Fargo & Co (WFC – 420 Montgomery Street San Francisco).Buffett (or was it Todd Combs?) topped up Berkshire’s holdings in the world’s 24th biggest bank by 9.7 million shares in the three months to June 2011 (we don’t have more recent information because Berkshire requested and was granted permission to withhold stock specific information). Between 1 March and 30 June – the three months during which the stake was increased – Wells Fargo traded as high as $33 and as low as $27.

WFC currently trades at $25.65 and its book value is $26.10 per share. Paying a small discount to book value for a bank that earns a return of 11.86 per cent on that book value doesn’t seem like a fantastic bargain and paying a premium to book value is perhaps less so. But the fact remains one of the best investors of our generation, reckons it is ok to be selectively buying US banks. Is Buffett going to make off with a bank fortune the way Butch Cassidy did or will he be caught red handed this time? Should you be doing the same as Buffett with Australian Banks?

Wells Fargo is the biggest U.S. home lender (think Commonwealth Bank) and Berkshire is its biggest shareholder. Given Berkshire’s interest in Wells Fargo and Bank of America should be taking a look at our own Banks?

I know there are conflicting and well-articulated opinions here at the blog about the banks, so feel free to add your own thoughts.

Here are mine.

Broadly, the local banking system is in a relatively strong position compared to peers globally. The funding, capital and liquidity position of the major banks has been strengthened and those who fear a housing collapse in Australia should be mindful that such an event would impact consumer confidence and credit growth more than the immediate profits of the banks, who have insured their exposure.

From a funding perspective, bank deposit growth has outstripped lending growth and while further increases in wholesale funding costs could reasonably be expected, the banks are ahead of schedule in raising term wholesale funding that is said to provide 6 months grace. Of course if deposits continue to grow faster than loans, the gap that is funded from overseas wholesale markets diminishes.

As I have previously noted, high levels of leverage at the consumer, company and country level simply take time to pay off. You just don’t go off spending aggressively again until you feel your debt is under control. As a result, it is reasonable to expect bank balance sheet expansion will be muted over the next year or two at least. Some of you may think even longer or permanently…

Globally, the banking picture is at the very least, interesting to watch. The five biggest US banks excluding bank of America posted 8 per cent profit growth, while in the UK the five majors posted H1’11 profits that were half of those reported the year before. Predictably this has resulted in announcements of an intended five billion Sterling cost cutting drive by 2014. In Europe, the largest ten banks saw profits fall less than 8 per cent. Curiously some observers suggest that the present problems befalling sovereigns will have less of an impact on banks than the GFC because sovereign debt is less complex than credit default swaps on collateralized debt obligations and stress testing has been completed and widely reported. With little exposure to European debt and strong growth domestically, Asian banks (with the exception of Japan) are the one bright spot.

Globally, banks are targeting cost to income ratios of less than 40 per cent despite the higher costs associated with reengineering systems and procedures to meet a heightened regulatory environment.

Locally, our major banks have posted more than acceptable profits considering global financial conditions and local consumer and business sentiment, which has remained muted

Growth has been achieved at least partly by the reduction in the provision for bad and doubtful debts. Additionally, the reduction in the aggregate loan impairment charge was 37%; from $8.4 billion to $5.3 billion.

While significant reductions in loan impairment charges can be seen as a positive, future growth in profits – in the absence of a recovery in consumer and business confidence – will have to come from cost cutting.

Collectively, cost cutting is being reflected in some results – cost to income ratios improved for the CBA and NAB and less so for the ANZ and Westpac. Further improvements should be expected and I have been reliably informed to expect significant retrenchments – in the thousands – in the financial services sector, even though full time employees increased at the ANZ and CBA last year. The changes in cost to income ratios should also be seen in the light of the dramatic reductions achieved since the early nineties when cost to income ratios were; ANZ 74%, WBC 68%, CBA 67% and NAB 57%.

Net interest margins – the net margin earned or the difference between interest paid on deposits and interest earned on loans – were broadly unchanged and while the CBA recorded an improvement, this has not been widely reported elsewhere as being materially due to an accounting reclassification of net swap costs. Competition for retail deposits and higher-cost, post-GFC funding as well as regulatory changes forcing an increase in liquid assets put pressure on margins. A broad maintenance of margins is therefore laudable.

The banking industry’s preferred measure of profit is Cash Profit (after tax), which removes the impact of discontinued operations, adjustments for acquisitions, Treasury shares and fair value adjustments.

On this measure, all the banks posted healthy increases.

The ANZ increased profits from $5.1 to $5.6, the CBA $6.1 to $6.8, NAB $4.6 to $5.5 and Westpac from $5.9 to $6.3.

Non-interest income, which includes trading, fees & commissions and Wealth management & insurance (which includes life insurance, superannuation and investment management products), declined in aggregate. Fees & commissions across the major banks were largely steady at just under $12 billion due to a drop in lending offset by an increase in corporate M&A. Wealth management profits fell for all the banks bar Westpac (BT). Profits here are largely a function of equity market performance given the big brand’s focus on index hugging and fund inflows/outflows. Funds under management and administration grew only for the CBA.

The outlook for Australian banks will remain mired by the general ‘funk’ Australian consumers and business are in. Our one-cylinder economy is not going to spur rapid balance sheet expansion (read credit growth) for the banks in the near term. With property prices and volumes in some areas also depressed the number of mortgages and the size of a loan on any individual property is necessarily lower. Banks love mortgages the most because their perceived lower risk means the banks have to provision less for each one they write. You are welcome to discuss your views about the direction of property in Australia in the comments below and I would welcome your thoughts. I think that we shouldn’t expect any immediate recovery in property activity to spur bank balance sheet expansion.

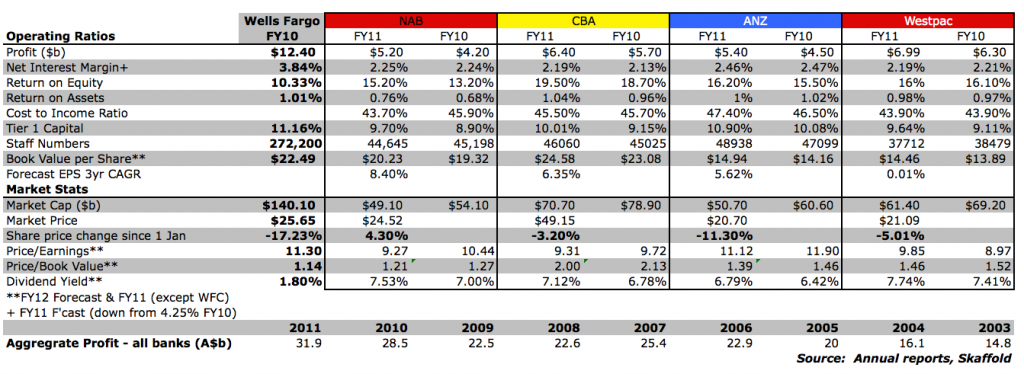

With the details broadly out of the way what are the current estimated valuations and prospects for intrinsic value growth for each of the banks? Keep in mind the intrinsic value expectations for the next three years are based on earnings growth and equity figures as stated in the table included with this column.

Skaffold’s (www.Skaffold.com) current estimated intrinsic values for the banks are: WBC $22.12, ANZ $24.49, CBA $51.54 and NAB $27.69. Of course these will change over the next weeks and months as estimates are updated and the banks make announcements about prospects, acquisitions or capital raisings etc. and I may not update those details here at the Insights Blog.

The bank displaying the greatest estimated margin of safety currently is ANZ, which at the current price, is displaying an estimated safety margin of 16%. Of the others NAB appears to be next, with an estimated margin of safety of 11%, WBC 5% and CBA 3%.

Despite being second on this list, the NAB has produced the lowest returns on equity and assets but also the lowest cost to income ratio, second highest Net interest margin and the highest forecast earnings per share growth for the next three years.

In aggregate the opportunity to buy at either very large discounts or smaller discounts but with solid growth potential does not appear to be available. An investor requiring meaningful margins of safety, would demand lower prices before being seriously interested. I will leave that decision to you after taking personal professional advice of course – from Buffett or your advisor. Growth doesn’t have to be sensational to make attractive returns but in such cases, one should require a large margin of safety to be more certain of a reasonable return.

What are you thoughts about the banks? Have I missed an angle that you would like to add? For example do you think the economic growth prospects are bright for the US compared to Australia? What are your estimates for earnings growth and what are your expectations for the residential, agricultural or commercial property market? I would be delighted to facilitate a discussion on these subjects.

Posted by Roger Montgomery, Value.able author and Fund Manager, 16 November 2011.

by Roger Montgomery Posted in Financial Services.

- 48 Comments

- save this article

- POSTED IN Financial Services

-

Which bank?

Roger Montgomery

November 11, 2010

Everyone from the media, to politicians and litigation funders have been busy bashing our banks over the head. Led by a possibly tipped-off/advised Joe Hockey, this particular attack seems to have legs. Have you been distracted by the noise?

Not me, I have been busy looking at the latest set of financial results from ANZ, NAB and WBC and comparing them to my CBA benchmark.

I have spent many hours and analysed many industries and their KPI’s and for the banks I will simply say that CBA and WBC are currently my two highest quality banks (based on the Montgomery Quality Rating). WBC gets an A1 MQR (up from an A5!), CBA is an A2 (up from an A4). They’re also the biggest.

My salient facts for the big four are shown below.

While ANZ appears to be the cheapest and the most tempting, I continue focusing on the goal of filling the portfolio with only the best businesses. So it may prove a better option to exercise patience and wait for wider safety margins. With the latest round of bank bashing and China announcing further tightening measures, I may not have to wait long.

Between now and then you will read many views about the size of each bank’s reported profits, why they have too much power, why they should cut this fee or stop doing this and that. But keep in perspective that no matter what is written or said, they provide many services and functions that are vital to capitalism.

Another important couple of things to remember is that they collectively have 92% market share and don’t provide all (or any!) of their services for free. ATM Fees… Debit Card Transaction Fees… Annual account-maintenance fees… Monthly Account keeping Fees… Minimum Balance Fees… Wire Transfer Fees… Overdraft Protection Fees… Overdrawn fees… Dishonour Fees… Clearance Fees… Statement Fees… Voucher Fees… Periodical Payments or transfer fees… Stop payment fees… Recent Transaction List Fee… Overseas transaction fees… Electronic banking fees… Interest fees… Establishment Fees… Deferred establishment fees… Over the limit fees… Currency conversion fees… Annual Fees… Deposit Fees… Withdrawal Fees… Online-banking fees… Teller fees… the list goes on, there’s even “late” payments fees for paying your credit card too early.

As you might know there are four basic sources of competitive advantage – something Buffett is primarily focused on – they are: economies of scale, the network effect, intellectual property rights and high switching costs. The four biggest banks enjoy both economies of scale and the benefits of high switching costs. It is personally more taxing for a client to change banks than the benefits that inhere from switching. And so very few people switch. As I have often said, if you live on an island with a long swim to anywhere else, then owning a bank is not a bad idea. They can charge you to put your money in, charge you to take your money out and even charge you to find out how much money you have.

For me, being active in the share market can bring on-line brokerage fees, telephone order fees, custody fees, software fees, transfer fees, late settlement fees, margin lending fees etc…

No matter where you turn, the banks are entrenched in my daily life.

And where do all of these fees, along with net interest income and trading profits go? Into wafer thin 1% margins. Yes, our banks rely on massive volumes. WBC has $620b of assets. A 1% return on those assets equates to a profit of $6.2b – roughly what they reported in their full year result.

They are also some of Australia’s highest leveraged businesses shouldering enormous risks (albeit controlled) to generate that return. If you have ever heard that ‘X’ bank has a tier 1 risk weighted capital ratio of 8%, generally this means that the bank is holding only $8 for every $100 that a customer has borrowed. Being highly geared, it is therefore in the bank’s interest to ensure that everything in our economy ticks along.

By far the biggest variable expenses for banks are bad debts. During the GFC when bad debts increased dramatically, do you remember what happened when things turned ugly? Those wafer thin profit margins disappeared like the last Mars Polar Lander. The impact on NAB’s profits, for example, was dramatic with profit in 2009, $2 billion lower than the year before.

With these risks in mind it seems a tad irrational to quibble over the enormous profits being earned, particularly when they are largely returned to Australians. Shareholders receive 70%-80% of profits in fully franked dividends and the Australian public receive 30% of pre-tax profits via tax payments to the government.

On the other side of the coin is the very real fact that these are mature businesses. As Value.able Graduate Richard Quadrio mentioned in his comment here on the blog yesterday, banks can only increase their profit by either lending us more or charging us more. The former depends on our appetite, which may be slowing. That leaves the latter.

In my mind, they have the power to keep increasing prices but the legislators now need to be convinced that they should be allowed to in return for wanting to continue lending and perpetuating the GDP growth dream. Paralysed by these competing forces, I go back to what I know – investing, and ask; which bank is the best? For me that’s the only question – which bank?

Posted by Roger Montgomery, 11 November 2011.

by Roger Montgomery Posted in Financial Services.

- 114 Comments

- save this article

- POSTED IN Financial Services

-

Where are my valuations Roger?

Roger Montgomery

July 22, 2010

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.Pimco’s Bill Gross says we have entered the era of the “new normal’ – expect low aggregate returns. Jeremy Grantham at GMO says that attributing the chance of recovery at 25% is “generous” and the US will be lucky to achieve 2% economic growth over the next seven years. And David Rosenberg at Gluskin Sheff says deflation is more likely than inflation, describing the stock market as meat grinder – “No return for a decade and yet plenty of sleepless nights on this roller-coaster ride.” Keep in mind David is a perennial bear. I remember during my days as trader being told; listen to the bears but don’t sell until they turn bullish!

Over at the bullish camp PuruSaxena says “the ongoing range trading should conclude with a bullish resolution” and cites Intel’s best quarter ever and JP Morgan’s analyst estimates-beating performance as justification.

At Montgomery Inc. ‘we’ don’t claim to know how the world’s debt issues will be resolved. What we do know is that you cannot solve them with more borrowing.

In Australia many ‘analysts’ are pointing to the fact that the recent rally has not been accompanied by much volume. Indeed, one of my friends who is a broker said they can “hear pins drop” in their office. But before you rush out and sell in anticipation of some imminent correction (I am not forecasting anything), have a look at the volume that accompanied the beginning of the bounce from the March 2009 lows. They were relatively light too. Perhaps that means the whole thing will indeed end in a massive correction that will see even lower lows! (I am not forecasting anything).

Stock market investing however need not be so mysterious and confusing. Instead of focusing on stocks, focus on businesses. Instead of focusing on prices, focus on values. When bargains are available it is obvious. When the banks were at their lows, there was no justification and large discounts to intrinsic value were evident for three of the big four. Their prices were following the pattern of their global peers that were each losing billions and being bailed out or nationalised. While their prices were on their knees, their values were being driven by the fact they were reporting multibillion-dollar profits. Focus on the business – don’t take your cues from share prices.

More importantly, when bargains are available you are writing to me with requests to value high quality companies. “What is the value of CBA Roger?” “What do you think of CSL and Cochlear at these prices?” “They’re pricing QBE like it is going out of business, that’s just crazy.”

Today, value is not so obvious and once again that is reflected in the general quality of the companies that you are asking me to value for you. While you have requested a few decent businesses, there have been a few raised eyebrows at Montgomery Global.

With those thoughts in mind, I offer another Value.able update from Montgomery Inc, along with the relevant MQRs – “Montgomery Quality Ratings”. At some point I will publish, somehow, the entire universe with the A1, A2, A3, to C3 C4 and C5 MQRs.

Don’t forget that the valuations you are seeing here are based on inputs that include analyst estimates. As some of you have indicated, analysts are notoriously bullish and particularly at the beginning of a reporting period tend to have estimates for earnings that need subsequent downward revision. I will discuss this and my observations and insights in a future post.

For now, know that the studies conducted by McKinsey, for example, into the persistent excess bullishness among analysts, aggregate and average the data which can produce a result that does not reflect any particular year. Stick your head in an oven and your feet in the freezer and your ‘average’ temperature will be about right, but of course you won’t be feeling so good!

The point I should make however is that my valuations for CBA, WBC, NAB, ANZ, QTM, CAB, HZL, FLT, SOL, MMS, CPU, AXA, BLD, CFU, DYE, DMX, ISF, VLA, QHL and CLQ (especially the 2011 estimates) will be revised over time. They will change. And having just been calculated they may also have changed from any previously published valuation and supersede them.

WARNING: Not recommendations or advice. Didactic exercise only. Seek personal professional advice before doing anything!

* Quality Score shown for last full year results. May change dramatically. May have been one good year – a flash in the pan. There is more to know. If for example, a company makes a debt-funded acquisition, its quality score could change.

++ 2009 Valuation. No forecast information available

+++ No forecast information available

^ US Company listed in the USYour copy of Value.able will be delivered soon. I’m looking forward to comparing you’re valuations here on my blog.

Posted by Roger Montgomery, 22 July 2010.

by Roger Montgomery Posted in Companies, Financial Services, Insightful Insights, Investing Education.

-

Which Bank do you own?

rogermontgomeryinsights

December 24, 2009

Half of all shareholders in Australia own at least one major bank in their share portfolios. The economics for banks in the last two years have changed dramatically and on several fronts.

First, they are believed to have largely dodged the impact of the GFC. This was predictable, as was the second change – the substantial gain in market share the banks enjoyed as their mortgage origination peers fell like dominoes relying, as they were, on short term wholesale funding and with no deposit base.

For both reasons I mentioned at the end of 2008 and the beginning of 2009 on CNBC that bank prices represented a rare opportunity to own the best businesses you can on an island – a legislated oligopoly that charges people to get their own money in and out. You can see the video from December 16 here.

There was also another major change that kept analysts on our toes. Dilutionary capital raisings wreaked havoc on the returns on equity and the equity per share for all four majors. Then Westpac, previously the bank with the best business performance, bought St George, and CBA bought ING. NAB has since bid for Axa (at arguably a price that is double the intrinsic value of the Axa) and ANZ…well who knows (read more here)

The effect of all this activity has not changed the fundamental attraction of owning a big four bank on an island of 22 million people who don’t care what you charge them because they cannot be bothered moving to another bank; “they’re all the same”. What has changed however is the future returns on equity for each of the banks and therefore, their intrinsic values.

Here’s my take on each banks’ forecast return on equity range for the next few years and valuation. I have ordered them by profitability in ascending order (ROE range, Intrinsic value):

NAB (11%-15%, $22.08)

ANZ (12.6%-16%, $18.10)

WBC (14.5%-18%, $19.19)

CBA (17.5% – 20.7%, $53.53)

In every case, current prices are well ahead of the current valuation however, I should add that the valuations are based on 2010 estimates and for all four banks, the valuations rise significantly in future years as ROE heads towards the top of each of the ranges given. Given the time frames that I can see, you will be waiting for values to catch up to current prices. NAB and ANZ are the cheapest, but you are buying the new 2nd tier banks. WBC is a better performing bank than ANZ and NAB but its price reflects it and you will be waiting twice as long as the others to catch up.

Many of you have told me you want to keep this blog a little bit of a secret, but let me tell you we will all benefit if we receive contributions and insights from those closer to the coal face of various industries. So let me encourage you to post your own thoughts and insights and invite anyone else you know (that owns bank shares for example or works in a company that is a competitor to any of those I mention) to do likewise. Do you think you know anyone that owns bank shares and would benefit from this insight? Spread the link.

http://rogermontgomeryinsights.wordpress.com/

Posted by Roger Montgomery, 23 December 2009

by rogermontgomeryinsights Posted in Companies, Financial Services, Insightful Insights.

-

Is AMP getting good value for Axa and could ANZ really pay that much for AMP?

rogermontgomeryinsights

November 23, 2009

Corporate Australia has a rich history of overpaying for the right to be big, bigger, the biggest. While size may help fatten the wallet of the steward steering the ship, it is often the case that investors, particularly those late to the party, see their wallets lose weight.

When ABC Learning bought all those centres and Wesfarmers bought Coles, it was obvious that the prices being paid were much higher than a rational and patient value investor would pay. Justified with promised synergies however, many acquisitions can be made to look good, disguising the real he’s-got-one-so-I-want-one-too motivation.

Turning to the AMP/Axa deal I should first point out that I am not suggesting either company is in the same boat as ABC Learning. What I will say though is that ultimately a business is worth some multiple of its equity and that multiple must be related to its profitability. Talk surrounds the possibility that Axa could be the recipient of another bid – although none has been forthcoming and with wealth management being a key growth strategy for the banks, there is also talk that ANZ might bid for AMP. The hunter becomes the hunted. Ignoring the cliches, the rumours and share price gyrations, we can value Axa and decide whether we like AMP management’s capital allocation strategy. We can also value AMP and decide, if ANZ make a bid, what we think of them.

Turning first to Axa; AMP has, with cash and shares, bid about $5.40 per share. Unsurprisingly Axa shareholders want a higher bid. Well of course they do. I would rather receive a few million more for my house too. But Axa’s performance doesn’t justify a higher bid and AMP needs to be prudent. According to analyst estimates of EPS, Axa will generate a return on equity of about 13 percent over the next two years. With the exception of the 2008 loss, the return on equity for the last ten years has ranged between 6.8% in 1999 and 27% in 2003. Based on the forecast ROE and a payout ratio of between 61% and 67%, Axa’s 2010 equity of $2.58 per share is worth a little more than $3.00 per share. The market believes AMP will bid more and so the shares are trading at $5.84.

With AMP at $6.35 – up from its lows earlier this year of $3.52 – the price does not reflect the actual value of the business which is between $4.53 and $5.24. Should ANZ bid even more than the already optimistic price, it would reflect a genuine me-too strategy over at ANZ.

Nothing gets the blood racing more than a takeover and when blood leaves the head for other regions, common sense usually follows.

By Roger Montgomery, 23 November 2009

by rogermontgomeryinsights Posted in Financial Services, Insurance.

- 4 Comments

- save this article

- POSTED IN Financial Services, Insurance