Economics

-

A crash is coming!

Roger Montgomery

September 26, 2024

That’s a headline designed to capture your attention. If it has done so, it is highly probable that a crash is one of your fears. And for some people with that fear, the concern is great enough that it has impacted their investing outcomes and returns. For example, they may have held off buying shares in a company that subsequently rocketed higher, simply because you feared the market was due for a correction or crash. You may have also sold a stock too early, even though nothing about the company in which you owned the shares had changed. You simply thought some exogenous event would trigger a broad market correction. And, in a more extreme example, you were right in your prediction about the market falling, but the shares you owned continued to climb. continue…

by Roger Montgomery Posted in Economics, Editor's Pick.

- save this article

- POSTED IN Economics, Editor's Pick

-

New supermarket CEO’s making very old mistakes

Roger Montgomery

September 25, 2024

With two supermarket CEO’s facing off against the Australian Competition and Consumer Commission (ACCC) in the battle for supermarket reputations, I wonder whether we will see vastly different behaviours from the new heads of Coles (ASX:COL) and Woolworths (ASX:WOW) than what we might typically have expected from their predecessors. continue…

by Roger Montgomery Posted in Consumer discretionary, Economics.

-

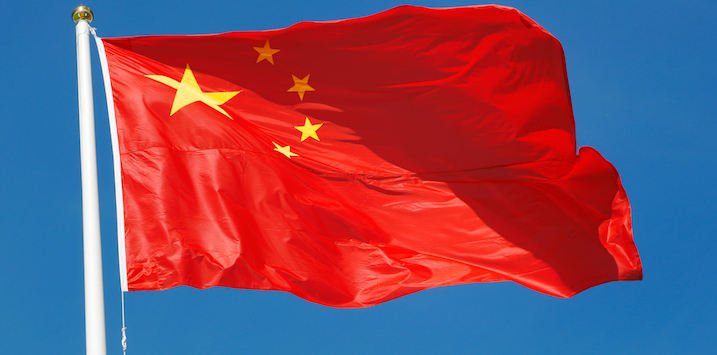

What of China’s imploding economy?

Roger Montgomery

September 24, 2024

According to several reports, China’s property price index is tumbling. China’s new home prices in 70 cities fell 5.3 per cent year-over-year in August 2024, accelerating from July’s 4.9 per cent drop. This marks the 14th consecutive month of decline and the sharpest since May 2015, despite Beijing’s efforts to stabilise the property market through lower mortgage rates and reduced homebuying costs. The downturn deepened across most major cities, with Beijing (-3.6 per cent vs -3.3 per cent in July), Guangzhou (-10.1 per cent vs -9.9 per cent), Shenzhen (-8.2 per cent vs -8.0 per cent), Tianjin (-1.4 per cent vs -1.2 per cent), and Chongqing (-5.4 per cent vs -4.9 per cent) all seeing further price contractions.

by Roger Montgomery Posted in Economics, Property.

- save this article

- POSTED IN Economics, Property

-

Australia’s population is booming

Roger Montgomery

September 16, 2024

Australia is experiencing a population and demographic transformation, with nearly 50 per cent of our population able to claim at least one parent born overseas. George Tharenou of UBS analysed the implications in his recent report entitled “How will a ‘Big Australia’ impact the economy and the ‘intergenerational contract’?” The report dives deep into the effects of Australia’s population boom on the economy, asset prices, productivity, housing, and superannuation. continue…

by Roger Montgomery Posted in Consumer discretionary, Economics, Editor's Pick.

-

What does rising volatility mean?

Roger Montgomery

September 10, 2024

Working in derivatives trading back in the early nineties, one of the aphorisms that became a gospel-given truth was, ‘volatility is heightened at turning points’. It has been my experience that volatility clusters around turning points, but perhaps I only remember that because I want to. If big moves also occur in the middle of bull and bear markets, my aphorism becomes the product of selective memory. continue…

by Roger Montgomery Posted in Economics.

- save this article

- POSTED IN Economics

-

Navigating GDP decline and investment solutions

David Buckland

September 6, 2024

In this week’s video insight, I discuss Australia’s sluggish economic growth, marked by six consecutive quarters of gross domestic product (GDP) decline per capita – the worst result since the early 1980s, outside of the COVID-19 pandemic. I explore how rising interest rates and increased government spending have fueled inflation and exacerbated the ongoing cost-of-living crisis. I also share my personal investment approach, focusing on the Aura Private Credit Income Fund and the Aura Core Income Fund, which have provided strong returns despite these economic challenges. continue…

by David Buckland Posted in Economics.

- save this article

- POSTED IN Economics

-

Recession? What recession? A calm returns to Jackson Hole

Roger Montgomery

September 4, 2024

The mood at this year’s Jackson Hole Economic Symposium, the annual gathering of the world’s top central bankers, hosted by the Federal Reserve Bank of Kansas City, was noticeably more relaxed. The message resonating through the picturesque landscape? The worst appears to be behind us. continue…

by Roger Montgomery Posted in Economics.

- save this article

- POSTED IN Economics

-

Have global carmakers sown the seeds of their own destruction in China?

Roger Montgomery

August 26, 2024

Reggae legend Bob Marley might have been channelling the Bible when he wrote the lyrics for Zion Train and famously observed, “Don’t gain the world and lose your soul; wisdom is better than silver or gold”.

Warren Buffett once famously noted, “We’ve never succeeded in making a good deal with a bad person.” continue…

by Roger Montgomery Posted in Economics.

- 3 Comments

- save this article

- POSTED IN Economics

-

The need to differentiate between the severity of recessions

David Buckland

August 23, 2024

The Sahm Recession Indicator has signalled nine of the previous U.S. recessions over the past 65 years, and the move to 0.53 per cent in July 2024 is now pointing to the tenth. The indicator signals the start of a recession when the three-month moving average of the U.S. national unemployment rate (U-3) rises by 0.50 per cent or more relative to the minimum of the three-month average from the preceding 12 months. continue…

by David Buckland Posted in Economics.

- save this article

- POSTED IN Economics

-

Could Gen X please stand up?

Roger Montgomery

August 14, 2024

As a Gen Xer myself, it seems the press has left us behind, sandwiched as it were, between the Baby Boomers and Millennials. So, when an article purporting to describe me occasionally appears, I sit up and take notice. What do the media and financial experts think of my generation? Did they get it right? Or are they necessarily broad generalisations that don’t apply to me or my friends? continue…

by Roger Montgomery Posted in Economics, Editor's Pick.

- 4 Comments

- save this article

- POSTED IN Economics, Editor's Pick