Companies

-

Corporate Travel Management’s financial update for FY23

Roger Montgomery

July 27, 2023

With reporting season about to begin and confession season well-underway, analysts are keen to understand the extent to which any pullback in consumer activity has, for example, impacted business. continue…

by Roger Montgomery Posted in Companies, Stocks We Like.

- save this article

- POSTED IN Companies, Stocks We Like

-

Why Polen Capital own retailer Five Below

David Buckland

July 24, 2023

Our global investment partner, Polen Capital, seeks to invest in high-quality companies that have strong growth potential and competitive advantages. In this article, I explore a U.S.-based retail businesses owned by the Polen Capital Small and Mid Cap Fund – Five Below. continue…

by David Buckland Posted in Companies, Polen Capital.

- save this article

- POSTED IN Companies, Polen Capital

-

How Yeti Holdings and Floor & Décor Holdings are growing in the hard-surface industry

David Buckland

July 19, 2023

Our global investment partner, Polen Capital, seeks to invest in high-quality companies that have strong growth potential and competitive advantages. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Dechra Pharmaceuticals and Musti Group ride the pet boom

David Buckland

July 18, 2023

The COVID-19 pandemic emphasised the fact pets, at whatever price, have become family members. Two company enjoying this transformation are Dechra Pharmaceuticals and Musti Group. continue…

by David Buckland Posted in Companies, Polen Capital, Stocks We Like.

- save this article

- POSTED IN Companies, Polen Capital, Stocks We Like

-

Legacy point of sale providers are the walking dead

Roger Montgomery

July 14, 2023

I think investors in businesses that generate meaningful revenue from point-of-sale hardware terminals (EFTPOS terminals) are sleepwalking towards their own financial cliff. And my reading of some of the broker research notes, covering the relevant companies, tells me the market doesn’t understand the implications. There is therefore much more downside ahead for these businesses. continue…

by Roger Montgomery Posted in Companies, Consumer discretionary, Editor's Pick, Financial Services.

-

Exploring the growth prospects of Endava and Globant: pioneering companies in digital transformation and software development

David Buckland

July 13, 2023

In this week’s video insight David Buckland introduces two companies in the Polen Capital Small and Mid Cap Fund: Endava and Globant. Endava is a British software development and consulting firm experiencing steady revenue growth and global expansion. Globant is a global IT company focusing on AI and software development. Both companies have faced recent share price declines but hold strong potential for long-term growth and digital transformation in various industries. continue…

by David Buckland Posted in Companies, Polen Capital, Video Insights.

- watch video

- save this article

- POSTED IN Companies, Polen Capital, Video Insights

-

Telix Pharmaceuticals – strong momentum ahead

David Buckland

July 12, 2023

Telix Pharmaceuticals Limited (ASX:TLX) is a Melbourne-headquartered $3.9 billion company which recently entered the Montgomery and Australian Eagle portfolios and seems to have very exciting prospects. continue…

by David Buckland Posted in Companies, Health Care, Stocks We Like.

- save this article

- POSTED IN Companies, Health Care, Stocks We Like

-

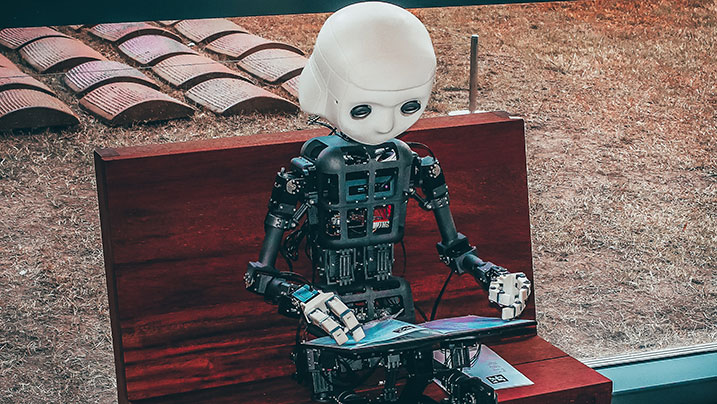

For the bubble to be a boom, AI will have to be monetised

Roger Montgomery

July 7, 2023

While Google, Meta, Microsoft and Amazon battle it out in the artificial intelligence (AI) race, we all know Nvidia is raking in billions, selling them the GPUs they require while simultaneously sending its market cap into the US Trillion-dollar club alongside its major customers. continue…

by Roger Montgomery Posted in Companies, Technology & Telecommunications.

-

Collins foods: Navigating challenges and seeking growth opportunities in the fast-food market

Roger Montgomery

July 6, 2023

Brisbane-based Collins Foods Limited (ASX:CKF) operates, manages, and administratively supports fast-food restaurants and food service outlets. The company’s portfolio of owned and franchised KFC outlets makes it one of the largest KFC franchisees in the world. continue…

by Roger Montgomery Posted in Companies, Consumer discretionary, Editor's Pick.

-

Home-grown Australian biomedical companies shine on the global stage

David Buckland

July 5, 2023

In this week’s video insight David Buckland discusses two Australian biomedical companies, Pro-Medicus (ASX:PME) and Telix Pharmaceuticals (ASX:TLX) which are gaining global recognition. Pro-Medicus specialises in imaging software and has experienced significant growth, while Telix focuses on cancer management technologies with promising market potential. Both companies are poised for further success and expansion. continue…

by David Buckland Posted in Companies, Editor's Pick, Stocks We Like, Video Insights.