Companies

-

Has BHP and WOW survived the reporting season snow storm?

Roger Montgomery

August 31, 2010

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.

The final reporting season avalanche has coincided with a serious amount of snow in the high plains. No matter where one turns, there’s no escaping heavy falls. More than 300 companies have reported in five days and I am completely snowed under. If you haven’t yet received my reply to your email, now you understand why.To put my week into perspective, up until last Monday morning, around 200 companies had reported (see my Part I and Part II reporting season posts). This week’s 300-company avalanche brought the total to 500. I’m sorry to report that without a snowplough, I have fallen behind somewhat. Around 200 are left in my in-tray to dig through. I will get to them!

Thankfully, there are only a few days left in the window provided by ASX listing Rule 4.3B in which companies with a June 30 balance date must report, and by this afternoon, I will be able to appreciate the backlog I have to work through. So not long to go now…

Nonetheless, today I would like to talk about two companies which I am sure many of you are interested in: BHP and Woolworths. Both received the ‘Montgomery’ B1 quality score this year.

For the full year, BHP reported a net profit of around A$14b and a 27% ROE – a big jump on last years $7b result, which was impacted by material write-offs. Backing out the write-offs, last years A$16b profit and ROE of 36% was a better result than this years. The fall in the business’s profitability has likewise seen my 2010 valuation fall from $34-$38 to around $26-$30 per share, or a total value of $145b to $167b (5.57 billion shares on issue).

With the shares trading in a range of $35.58 to $44.93 ($198b to $250b) for the entire 52 weeks, it appears that the market and analysts expected much better things. While they didn’t come this year, are they just around the corner? I will let you be the judge.

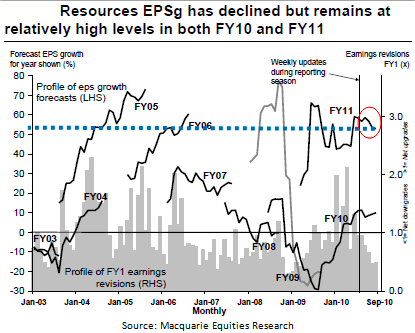

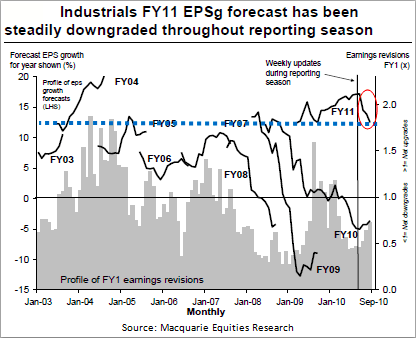

The “market” (don’t ask who THAT is!) estimates resource company per share earnings growth of 50 per cent for 2011. I have drawn a thick blue line to show this on the left hand side of the following graph so you can see where my line intersects.

BHP has a large weighting in the resources sector, so the forecast increase in net earnings by 57 per cent to A$22b is having a material impact on the sector average. Importantly, the forecast growth rate is similar to those seen in 2005 and 2006 when the global economy was partying like there was no GFC. Call me conservative, but I reckon those estimates are a little optimistic in todays environment.

As you know I leave the forecasting of the economy and arguably puerile understandings of cause-and-effect relationships to those whose ability is far exceeded by their hubris. Its worth instead thinking about what BHP has itself stated; “BHP Billiton remains cautious on the short-term outlook for the global economy”.

Given my conservative nature when it comes to resource companies and the numerous unknowns you have to factor in, I would be inclined to be more conservative with my assumptions when undertaking valuations for resource companies. If you take on blind faith a A$22b profit, BHP’s shares are worth AUD $45-$50 each.

But before you take this number as a given, note the red circle in the above chart. Earnings per share growth rates are already in the process of being revised down. I would expect further revisions to come. And if my ‘friends-in-high-places’ are right, it’s not out of the realm of possibilities to see iron ore prices fall 50 per cent in short order. You be the judge as to how conservative you make your assumptions.

A far simpler business to analyse is Woolworths and for a detailed analysis see my ValueLine column in tonight’s Eureka Report. WOW reported another great result with a return on shareholders’ funds of 28% (NPAT of just over $2.0b) only slightly down from 29% ($1.8b) last year. This was achieved on an additional $760m in shareholders’ funds or a return on incremental capital of 26% – and that’s just the first years use of those funds. This is an amazing business given its size.

My intrinsic value rose six per cent from $23.71 in 2009 to $25.07 in 2010. Add the dividend per share of $1.15 and shareholders experienced a respectable total return.

Without the benefit of the $700 million buyback earnings are forecast by the company to rise 8-11 per cent. However, the buyback will increase earnings per share and return on equity, but decrease equity. The net effect is a solid rise in intrinsic value. Instead of circa $26 for 2011, the intrinsic value rises to more than $28.

But it’s not the price of the buyback that I will focus on as that will have no effect on the return on equity and a smaller-than-you-think effect on intrinsic value (thanks to the fact that only around 26 million shares will be repurchased and cancelled). What I am interested in is how the buyback will be funded. You see WOW now need to find an additional $700m to undertake this capital management initiative. So where will the proceeds come from? That sort of money isn’t just lying around. The cash flow statement is our friend here.

In 2010 Operating Cash Flow was $2,759.9 of which $1,817.7m was spent on/invested in capital expenditure, resulting in around $900m or 45% of reported profits being free cash flow – a similar level to last year. A pretty impressive number in size, but a number that also highlights how capital intensive owning and running a supermarket chain can be.

From this $900m in surplus cash, management are free to go out and reinvest into other activities including acquisitions, paying dividends, buybacks and the like. So if dividends are maintained at $1.1-$1.2b (net after taking into account the DRP), that means the business does not have enough internally generated funds to undertake the buyback. They are already about $200-$300m short with their current activities. In 2010 WOW had to borrow $500m to make acquisitions, pay dividends and fund the current buyback.

Source: WOW 2010 Annual Report

Clearly the buyback cannot be funded internally, so external sources of capital will be required. In the case of the recently announced buyback it appears the entire $700m buyback will need to be financed via long-term debt issued into both domestic and international debt capital markets, which management have stated will occur in the coming months. They also have a bank balance of $713m, but this has not been earmarked for this purpose.

Currently WOW has a net debt-equity ratio of 37.4 per cent so assuming the buyback is fully funded with external debt, the 2011 full year might see total net gearing rise to $4.250b on equity of $8,170b = 52 per cent.

A debt-funded buyback will be even more positive for intrinsic value than I have already stated, but of course the risk is increased.

While 52 per cent is not an exuberant level of financial leverage given the quality of the business’s cash flows, I do wonder why Mr Luscombe and Co don’t suspend the dividend to fund the buyback rather than leverage up the company with more debt? This is particularly true if they believe the market is underpricing their shares.

Yes, it’s a radical departure from standard form.

I will leave you with that question and I will be back later in the week with a new list of A1 and A2 businesses. Look out for Part Three.

Posted by Roger Montgomery, 31 August 2010.

by Roger Montgomery Posted in Companies, Consumer discretionary, Energy / Resources.

-

What do I think of McMillan Shakespeare Now?

Roger Montgomery

August 27, 2010

It is not unusual for me to seem contrarian in my thoughts about stocks. And it is often the case that I am fond of companies out of favour at least temporarily. As prices rise I become less enthused rather than more so. Quite simply, the higher the price, the lower the return.

The last time I commented about McMillan Shakespeare was 27 May this year (MMS: $2.64). It was then that I stated that if that nothing came out of the Ken Henry Tax Review that permanently impacted MMS’ profitability, the shares were worth $6.01 – you can find me making those comments here.

With the benefit of hindsight, we now know that the legislative concerns surrounding the business failed to eventuate (well not yet – they await the next Government), and the shares have traded as high as $6.45 since.

But since MMS has released its annual results, you may be wondering if and how my thoughts have changed since May. Please keep in mind, as I have said many times before, I am under no obligation to continue analysing a business or updating my comments.

If you watch the interview above, clearly I was happy with the quality of MMS and its valuation being materially above its price. Indeed it was one of my A1’s at the time – so let me fill in the gaps.

As you would be well aware from Value.able, you should not focus on the share price but on the business itself. It’s a simple truth that if the underlying business does well then the share price tends to look after itself. While I am impressed about the price currently trading close to my valuation, am I still happy with MMS as an investment candidate? In short, no.

Things can change pretty quickly in business. One minute you are staring down the barrel of a major financial review with the threat of having half of your business taken away over night, and the next you are on the front foot and announcing a major acquisition. It’s the latter than concerns me.

Three days after my TV interview, MMS management announced the acquisition of Interleasing (Australia) Limited (ILA) in a 34 page information memorandum and 9 days later completed the purchase.

In that IM was a detailed breakdown of the purchase. I had suspected for a long time that management where keenly looking for an acquisition given it was producing so much free cash flow.

Up until this point, MMS had been an A1 every year since 2006. Given my stringent A1 rules, to achieve this rating four years in a row is an excellent achievement by founder Anthony Podesta. But with new management come new ideas, and this time the idea was to take a debt free business and fund the ILA acquisition with $25m of existing cash, $41.3m from the sale of ILA’s novated lease receivables and debt totalling $141.7m. A total purchase price (not value) of $208m.

The impact can be seen on the business’s balance sheet;

Source: MMS 2010 Annual Report

Source: MMS 2010 Annual ReportIf you tally the circles labelled “1” you will discover that the business now has net debt (total debt less cash and bank balances) of $125.156m. If you then look at the final line of the balance sheet “equity” which stands at $89,417 we can calculate that MMS (which was completely debt free last year) now has a gearing level of 139.97%. This in anyone’s book is a high level of gearing and a material change on the conservative financials in prior years.

If we now look at the circles labelled ‘2”, you will note that the business’s current liabilities (items which generally require repayment within the next 12 months) exceed by more than double the level of current assets (the liquid assets available to meet obligations due within the next 12 months).

In analyst speak; a current ratio of just 0.4972 is generally poor. In contrast the ratio last year was a healthy 1.9694.

While the uplift in earnings per share has been a boon for shareholders, as you can see, there has been a huge price to pay. In summary, the quality of the business has fallen from what I considered to be an A1 business to a B3.

Many will argue that MMS generates huge cashflows and that it still produces excellent (albeit highly geared) returns on equity and it should therefore have no concerns in meeting its interest expenses and maintaining its current capital structure for the foreseeable future. While this is all true, I always prefer to reduce risk in my portfolio by owning extraordinary businesses.

My investment process prevents me from investing in anything but the highest quality companies; one of the characteristics that I look for is little or no debt.

Also, when management start saying “key requirements of this funding” are that our “dividend payout ratio not to exceed 65%”, “interest and debt cover covenants” I have to wonder; are management controlling the business or is the bank?

Posted by Roger Montgomery, 26 August 2010.

by Roger Montgomery Posted in Companies.

- 103 Comments

- save this article

- POSTED IN Companies

-

Part II: What else has the reporting season avalanche uncovered?

Roger Montgomery

August 24, 2010

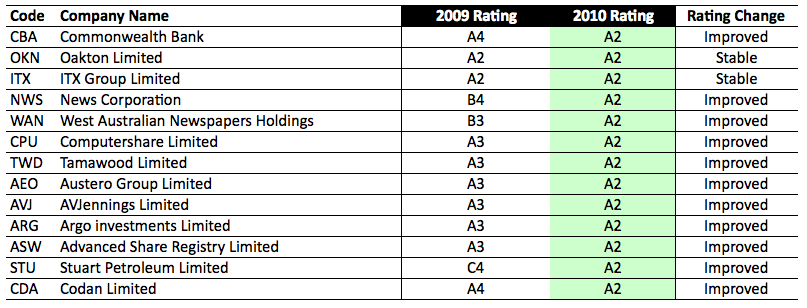

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.

The second full week of reporting season has just been and gone and saw another 80-100 companies report their financial results. More than 200 have reported and yes I am working feverishly to keep up and cover them all. I am happy to report that I’m ready for another week.So far the results have been mixed. Information Technology, Banking and Mining/Oil & Gas Services sectors have stood-out, receiving high Montgomery Quality Ratings. The remainder have been distributed somewhat randomly amongst the other sectors.

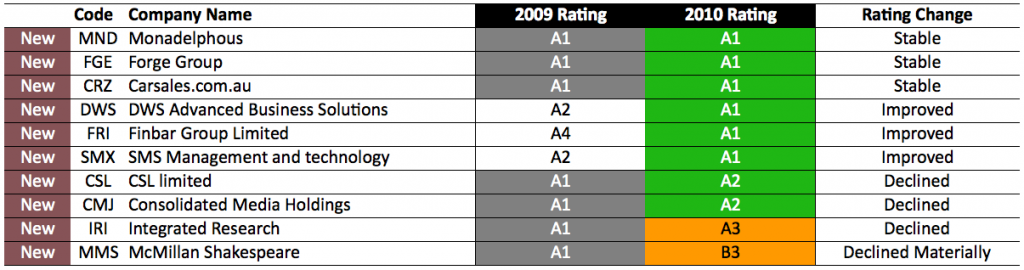

And having analysed all of them so far, I can reveal that only 11 (5.5%) of the 200 have achieved my coveted A1 status (an additional six on top of the five from my previous post). These businesses have all passed my rigorous stress tests and come up trumps.

You may be surprised that after another full week and 80-100 individual results, only six additional companies have made it. But my A1 rating system has been specifically formulated to yield only the best and it is performing its function very well.

Of the six companies, three held onto their A1 status. These are Carsales.com.au (CRZ), Forge Group (FGE) and Monadelphous (MND) which have been joined by 3 new entrants in DWS Advanced Business Solutions (DWS), Finbar Group Limited (FRI) and SMS Management and technology (SMX).

Unfortunately, on a net basis we lost one A1 this year with four other businesses experiencing ratings declines from A1. These businesses include CSL limited (CSL), Consolidated Media Holdings (CMJ), Integrated Research (IRI) and McMillan Shakespeare (MMS). While CSL and CMJ have both declined to A2 status – nothing to be sneezed at, IRI and MMS have had larger rating declines.

Most notably, MMS has declined materially in terms of quality as I predicted it might after its acquisition, and it is now a ‘B3’. The mostly debt-funded acquisition of Interleasing (Australia) is the cause of this fall which I will cover in a separate post.

There are also another 20 A2 businesses that have passed my stress tests and rate in the top 15 per cent of the market in terms of overall quality.

Don’t forget to combine these lists with the A1 and A2 businesses I highlighted last week to continue identifying the best of the rest and stay tuned, I will post my intrinsic valuations for all 11 A1 businesses soon.

Finally, an update on my Telstra valuation. Last week I said that my valuation following the annual result was $2.50. I have updated my numbers and now get $2.30.

I sincerely hope that my Telstra comments have served your research well and that you have not been caught by all of the “it’s high yield and therefore a cheap stock” talk.

While others may have been tempted to buy shares for ‘yield’, you can use Value.able to first discover the intrinsic value. To save you a little time, Telstra’s valuation has declined since it listed. Even in the past year intrinsic value has fallen from $3.00 to $2.30! And the share price has fallen from $3.55 to the current $2.77.

In reality this is a widely reported and closely tracked company and its weighting in the index ensures a level of support from the large, conventional, index-based and tracking-error-focused funds. Indeed this is one of the reasons it has taken so long for Benjamin Graham’s weighing machine to catch up to the valuation – ten years! An improvement in the clarity for Telstra (forgetting whether its profitable for the business) could be enough to result in substantial price rises. Of course as a disciplined value investor focused on only the highest quality business, I cannot let that speculation tempt me.

Posted by Roger Montgomery, 24 August 2010.

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Who is in front of the reporting season avalanche?

Roger Montgomery

August 17, 2010

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.

We are now two weeks into one of the most important times of the year for investors – reporting season. Eighty companies have reported to date, some good, some not so good – I know this because I track every single one. Yes, I am very busy. Are you wondering which companies are my A1’s now and which stocks I am interested in? In the last two weeks you will have heard me on TV saying I have bought a few things. Well, I don’t buy C5s so read on.TLS was a clear disappointment, as it has been since it listed. I have been on the front foot for a long time saying that this is a company to avoid, I hope you took notice. My valuation has fallen now from $3.00 to almost $2.50. If anyone can turn it around however I think Thodey can.

Qantas should have come as no surprise. A $300 million cash loss and I wouldn’t be surprised to see another raising of capital or debt.

Personally though I am not interested at all in TLS or QAN as investment candidates. I am only interested in the highest quality best performing businesses available – it’s here that intrinsic value can be created rather than destroyed and with reporting season just about to kick into top gear from this week, to find them, I put each company through the same rigorous process.

My initial screening process is a vital part of the investment process as it allows me to determine those companies that deserve to retain their place in the short list and it also highlights new opportunities as they arise. But to do this for some 2,000 listed Australian companies can be a very burdensome task unless you have a systematic way of analysing and comparing results in a consistent manner.

For me, it involves pulling out some 50-70 profit and loss, balance sheet and cash flow data fields from each annual report to populate my five models. All of these models employ industry specific metrics to calculate my quality and performance scores. This allows me to rank all companies from A1 – C5 to sort the wheat from the chaff.

For those not familiar with my ranking system, A1s are the simply the best businesses and the safest to own, while C5s are the poorest performers and the least safe.

Out of the 80 companies that have reported, only 5 have achieved my coveted A1 status – around 6.25% (the best of the rest).

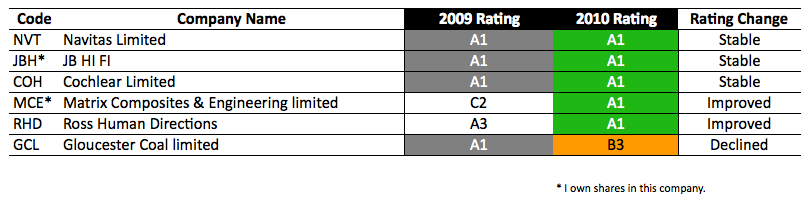

NVT, JBH and COH had my A1 rating last year and retained it this year and there are 2 new entrants in MCE and RHD, with GCL (it was an A1 last year) having a dramatic rating decline. I tend to shy away from resource companies for obvious reasons.

On my blog I have previously spoken about NVT, JBH and COH and also mentioned ITX, so please revisit those thoughts. itX is under takeover and Navitas, it was recently reported, had been approached some time ago by Kaplan – a company I have done some consulting work for and a subsidiary of Warren Buffett’s Washington Post company – so a big tick for the A1 to C5 Rating system!

That only leaves MCE, an engineering business that currently generates most of its returns from the manufacture of riser buoyancy modules for deep-sea oil rigs. Its order book is already underwriting a doubling of revenue for 2011. The 2010 result revealed profits had almost tripled and significantly exceeded prospectus forecasts and it is producing returns on equity of 49% – a rate that is unavailable generally elsewhere. Borrowings amount to about $8 million compared to equity of about $60 million (of which a little over 10% is capitalised development and goodwill intangibles). Best of all, the share price over the last week is a long way below my estimate of its intrinsic value.

If you have seen me on TV or heard me on radio in the last week or so you would have heard me mention that I had bought something, MCE is it. Please be mindful that if you act rashly and go and push the share price up, you will be helping me perhaps more than yourself. Also remember that I am not recommending the stock to you and that I cannot forecast the share price direction (although I am pleased with its performance since my purchase). The share price, I warn you, could halve, for example if there is a recession and or the oil price plunges – delaying expenditure of the construction of oil rigs globally. I simply am not recommending it to you.

Also remember that I am under no obligation to keep you informed of when I buy or sell nor answer any specific questions, which means 1) you have to do your own research and 2) you have to be responsible for your own decisions. Seek and take personal professional advice BEFORE you do anything.

Moving on, another 13 companies have achieved my second highest rating of A2. They are listed below with their prior years rating so you can compare.

Noteworthy in this list is the excellent performance of the Commonwealth Bank (which I continue to hold in my Eureka Report Value Line portfolio, along with JBH and COH) and those companies I generally classify as being in the Information Technology sector including OKN, ITX, CPU and ASW. Both sectors appear to be doing well in aggregate.

While focus should always be placed on the A1’s (the top 5-7% of the market) at any one point in time, A2’s are still very high quality businesses. The use of the two lists in tandem will therefore provide you with an excellent starting point in isolating those who have reported high quality financials and performance levels above the average business. An important first step in the Value.able Montgomery brand of investing.

It is from here that I will select candidates worthy of further analysis (qualitative and quantitative) and possibly meet with company management, if I have not already done so. Once again I have taken you to the river I fish in, you have my fishing rods and tackle box. Now up to you to catch the right priced fish.

Please use these two lists as a starting point to conduct your own research and use Value.able as a guide to estimate your own valuations. If you don’t yet have a copy you can order one at www.rogermontgomery.com so you too can do your own valuations. Remember to always focus on the highest quality and best performing business available.

If you focus on the best when they are cheap and simply forget the rest, you should avoid more (if not all) of the disasters and should be able to build a portfolio that will give you a greater chance of out-performing the market.

Happy reporting season!

To be continued… Read Part II.

Post by Roger Montgomery, 17 August 2010.

by Roger Montgomery Posted in Companies, Insightful Insights, Investing Education.

-

What do you think of the QAN, JBH and ITX results Roger?

Roger Montgomery

August 12, 2010

Here we are in the midst of reporting season and there are some reasonably predictable results. Qantas reported a profit today that was less than a quarter of its profit more than ten years ago. The airline reported a $112 million profit but that was boosted by $1 billion of revenue from its Frequent Flyer program and a $300 reduction in employment costs. For those of you interested in the real numbers, the company actually lost $302 million (see my chapter in Value.able on cash flow) and this can be explained by the very wide gap between the depreciation item in the profit and loss statement and the real expenditure on property plant & equipment. Depreciation looks backwards, but new planes cost more.

Here we are in the midst of reporting season and there are some reasonably predictable results. Qantas reported a profit today that was less than a quarter of its profit more than ten years ago. The airline reported a $112 million profit but that was boosted by $1 billion of revenue from its Frequent Flyer program and a $300 reduction in employment costs. For those of you interested in the real numbers, the company actually lost $302 million (see my chapter in Value.able on cash flow) and this can be explained by the very wide gap between the depreciation item in the profit and loss statement and the real expenditure on property plant & equipment. Depreciation looks backwards, but new planes cost more.Separately, JB Hi-Fi’s result was excellent but my concern is that its $94 million of cash flow (of which $67 million was allocated to dividends and $20 million allocated to paying down debt) is superfluous to its needs. Take a look at the biggest asset on the balance sheet – Inventory of $334 million. Then take a look at the creditors item in the current liabilities section. Almost the same amount!

Think about it this way; the suppliers are funding the inventory so the company doesn’t even need cash to pay have the stuff it sells and that are on its shelves. Actually it really does, the gap is about what is left over once we subtract the debt repayment and dividends from the cash flow. It is small though. Once the debt is gone and the cash keeps growing it may do something that could harm intrinsic value.

Now don’t get me wrong; JB Hi-Fi is an amazing business that retained its A1 status in this result and the risk associated with its plans to roll out more stores is very low. I also think intrinsic value will continue to rise at a satisfactory rate. The concern for me with all this cash (and there is no evidence of it yet) is that the company increases the dividend payout ratio again. This would mean a reduction in the rate of growth of intrinsic value. It could stop being the “compounding machine” it has been to date. Return on equity also appears to be flattening, which could mean within the next few years, the valuation may plateau (but at a higher level than the current price).

On an unrelated issue, I note that back on 4 May 2010, I put together a list of the companies that I though represented the last of value in a blog post entitled Do these three companies represent the last of good value? ITX was one of the companies listed and I note the company has announced “itX confirms that it is in discussions with an interested party regarding a preliminary non-binding indication of interest to acquire 100% of the ordinary shares in itX.”

I’m pleased to strike another one up for the quality rating and valuation approach advocated here at my Insights blog!

Posted by Roger Montgomery, 12 August 2010

by Roger Montgomery Posted in Airlines, Companies, Insightful Insights.

- 29 Comments

- save this article

- POSTED IN Airlines, Companies, Insightful Insights

-

How do your Value.able valuations compare?

Roger Montgomery

August 10, 2010

Thank you for your encouraging comments about Value.able and all of your generous feedback. You have indeed given me enough suggestions for Value.able#2, or at least a workshop/lecture. While I consider these and in the meantime, I have received a number of questions (some of which go beyond the mandate for the book) that I think, if answered, could benefit everyone. Besides, I suspect if there is one person that has written me a question, there will be others who have the same query but didn’t write. In the interest of efficiency and to avoid repetition, here are what I believe represent the most likely questions you could have and the corresponding answers.

Thank you for your encouraging comments about Value.able and all of your generous feedback. You have indeed given me enough suggestions for Value.able#2, or at least a workshop/lecture. While I consider these and in the meantime, I have received a number of questions (some of which go beyond the mandate for the book) that I think, if answered, could benefit everyone. Besides, I suspect if there is one person that has written me a question, there will be others who have the same query but didn’t write. In the interest of efficiency and to avoid repetition, here are what I believe represent the most likely questions you could have and the corresponding answers.Question 1: Historical Information

In terms of valuations, is all the requisite historical information on individual companies freely available? You mentioned you look ahead 2 or 3 years when estimating intrinsic value. How do you go about getting the information for this? Can you recommend a source of financial data.

Answer 1: I have discovered that all the data you need to estimate intrinsic value and apply the steps in Value.able is available on Commsec, Westpac and E*trade (Thanks Ashley for the latter!). Here is the link to a demonstration of where EXACTLY to find the data. Or click on the Source Data button just to the right.

Financial data is also available for free on Google Finance and Yahoo Finance and you can also purchase publications that have up to ten years of historical information (I am currently trying to negotiate a special price for owners of Value.able).

Question 2: Analyst Forecasts

Where can I get analyst forecasts?

Answer 2: Consensus analyst information is available on Commsec and E*trade. Yahoo finance also provides consensus analyst estimates for 6000 companies updated weekly and the 2 year forecast EPS and DPS growth can be found under the Key Statistics tab. Not wanting to be left behind, Google Finance also has consensus estimates for Sales Profit and Dividends. Click here, then click on “More Ratios” under Key Stats and Ratios over on the lower right hand side of the page. Of course, if you use a full service broker you should be able to ask your adviser for access to the firm’s online research repository. Given analyst forecasts come from the analysts, they will have estimates as well.

Question 3: What tools can I use?

Perhaps you may know what I can use to filter the “good businesses” from the “not so good businesses”?

Answer 3: Sure, I do it right here! For my Insights blog (and for me) to remain independent I will not discuss any third party products or services.

Question 4: The retention rate

Calculating the value of an infinite life asset that has a 100% retention rate and a lower ROE than the required return is a mathematical impossibility.

Answer 4: I wouldn’t ever buy such an abomination! The most technically adept of you have suggested that where Retained earnings =100% and ROE<RR, my estimates are not conservative enough. I can see why – in theory – some of you would like to treat it more harshly with the valuation formula. However I prefer to treat it even more harshly than you – simply throw it in the bin! Why would you want to own a business where, through your inputs, you have assumed wealth destruction? The question about whether to invest or not is made in the head instantly. You don’t need a calculator for that.

Considering a margin of safety, I look for companies likely to sustain an ROE that far exceeds my required return and avoid businesses whose management retain profits at unproductive rates.

Question 5: Is value investing becoming too popular?

My concern is if there is a possibility that the rising popularity of value investing, by purchasing at a discount to intrinsic value, could spoil this method of investing?

Answer 5: There are a lot of people who worry that finding gold will immediately mean everyone else will find it at the same time and render it valueless. Don’t worry, there are vastly more investors speculating than there are investing. Even Buffett observed that after 40 years of teaching it, he has seen no migration towards value investing.

Question 6: Forecast Equity per share

How do I calculate forecast equity per share, I cannot find it anywhere?

Answer 6: Forecast equity per share is:

Forecast Year Equity Per Share = Previous Year Equity per share + Forecast Earnings per share – Forecast dividends per share + new share capital(per share) – buybacks(per share)

The last two elements can be deduced from any announcements the company makes about capital raisings or buybacks.

Question 7: Referencing others

You refer a lot to the work of these investing giants but as a successful former fund manager, you should have had more “Roger” in it.

Answer 7: As I say in my introduction, what I have been able to accomplish has been thanks to the writings and teachings of others. In my own investing I have adopted and adapted the frameworks suggested by many investors and academics and combined them in a way that is unique, suits me and works of course! I have for example not found my final approach to valuation anywhere else – it is an amalgam of the work of those mentioned in the book. I have not read about the extension of the margin of safety concept anywhere else either and the list goes on. There is a now a rather fruitful garden but the seeds were borrowed from the great and celebrated mathematicians and investors. Indeed I think even Buffett picked up a few pointers from others, especially Walter. To that end here’s a well known Buffett quote that I should have included in the book: “I don’t think I have any original ideas… I’ve gotten a lot of ideas myself from reading. You can learn a lot from other people. In fact, I think if you learn basically from other people, you don’t have to get too many new ideas on your own. You can just apply the best of what you see.”

It is my hope that now that you have the answers to these questions, you won’t have to wait for me to try and reply to emails with the same requests.

Roger… please check my valuations!

Finally, many of you asked me to check your work! I really am humbled by how many of you are launching straight into the application of value investing. Well done! Instead of going through everyone’s examples, I thought it would be much better to give you some worked examples for you to try yourself. Take these inputs and run them through the process in my book. By the end of next week I will release the answers for you to check your work against along with the substeps. The inputs are in the table. Print it and fill in the blank columns to arrive at your answers (click on the table to enlarge the image).

Ten Value.able valuations

Posted by Roger Montgomery, 10 August 2010

Click here for the answers… no cheating.

by Roger Montgomery Posted in Companies, Investing Education.

-

What are investors saying about Value.able?

Roger Montgomery

August 3, 2010

It has been four days now since the very first copies of Value.able were received.

It has been four days now since the very first copies of Value.able were received.I am very grateful for your feedback and I am impressed. I have received some requests to check valuation workings and many of the valuations I have seen so far are close enough to ‘spot on’. Congratulations everyone. It looks like the penny is dropping all over Australia as well as in Asia, Canada, the UK and the US.

Rather than continuing to check your workings individually, I thought I would post some calculations in the next few days for you to check your own workings against. A ready reckoner if you will.

There will be ten Value.able valuations for widely-held and well-known companies that you may use to cross-check against your own calculations. I will include the inputs used, so that we are comparing like with like. These valuation examples will be available by the end of the week. They are ASX Ltd, Computershare, Caltex, David Jones, Foster’s Group, Leighton, McMillan Shakespeare, Westpac, Woolworths and Wridgways.

Until then, I wanted to take this opportunity to express my sincere thanks for the overwhelmingly kind emails you have sent me and the positively entertaining comments you have written on my Facebook page.

Here are a few I would like to share and say a particular thank you for.

…Not that I’m complaining, I had planned to wash the car, and watch the rugby tomorrow night, but it looks like I will have more Value.able things to do!

BenI’m somewhat of a minimalist and love it when I get a book where it makes me feel like I can throw away all the other books I have on a subject – this is such a book.

GrahamThanks for the book. It is sooooooo good to finally have a tool to find good companies.

Keith… I am up to about Chapter 4 in your book. This is my first read and I will start over when I finish it. There is much to absorb in your book. I think its true that I have made every mistake so far detailed in the book. I have repeated some mistakes many times!!!!!

RussellI am very impressed by your book. I only wish I had had it in my hands ten years ago!

JohnAlthough I have not yet finished reading your book I have been telling myself to stop speculating and to start investing. I just wish it had been in print when i first began “investing” more than twenty years ago.

KevI am just writing to congratulate you on this great book, especially for a newbie investor (or should I say “speculator” having read the first two chapters of the book now!). Yesterday morning when I stepped out of the house (to take my family to the Moscow Circus at Rosehill!) I noticed a package sitting on my car’s windscreen. Little did I know that it was the much-awaited book! I have read the first two chapters so far and couldn’t resist my temptation to jump directly to Chapter 11 – Intrinsic Value! I must say this is one of the foremost reasons why I was so keen on getting this book and I am not disappointed. I am talking all these fundamental/technical terms now and able to make an attempt at calculating the real value of a company…all thanks to you!

VishaYou may already have saved me many times the investment I made in your book.

GeoffInitial impression is that your book has a particularly pleasant ‘feel’ – font, layout, texture, etc – quite incidental to the subject matter I know, but important in something you spend hours with in close association. I am also enjoying your writing style. So congratulations on both.

JimYour book is making my neck really, really, really sore. I’ve just come back from the doctor. He says it is from too much nodding.

TomBook arrived today. Where is the address for that deserted island? I need to go somewhere to read it.

young LesReceived your book and just want to say I am enjoying it very much. In fact I am thinking of purchasing another couple of copies one for my son and one for my Dad. My Dad listens in every Thursday night to your Money Your Call and always hope you are going to be on the panel. As we live in different states we then chat to each other about the show via the phone his comment is always wasn’t it great to hear Roger! Again thanks so much for a wonderful informative book which is so well written. (PS My Dad is 83, which proves we can always learn something!)

LynneI received your book and read it every spare moment I had. Thank you for sharing your knowledge with me.

AndrewI just finished the book and I’m very impressed. From 7pm until now (1.58am), I couldn’t put it down. I’m amazed by how simple your calculation of IV is. I like how logical it is and therefore free from fancy arithmetic. Munger once said this: By keeping it simple & logical you have achieved [this] in spades. The margin of error therefore of a person applying it should be minimised because at least hopefully they will understand what they are doing. Very well done & a testament to you.

MatthewI received the book yesterday and i finished it yesterday! I thoroughly enjoyed it and will recommend it to my enlightened friends! Any plans on an advanced Value.able haha?

AlexValueable arrived yesterday. I read until midnight and checked some valuations in my portfolio this AM. Using IV metod most of portfolio is “overpriced”. Will need to think about this for awhile. The book is well written and the example valuations you take us through are excellent. I have been a Buffet fan for a while and read Snowball etc. but you have made his valuatiuon techniques very simple to understand. Congratulations on a terrific book.

EdI’m almost finished reading my copy of your book which will forever change my outlook and approach to investing in the stock market. I’m so impressed with your work, I’ve just ordered another copy for my son.

PeterI am a chartist and I can see how your book will greatly assist me and complement my charting decisions; especially during these troubled times when seeking good value stocks that are also resilient!

BrendanI bought a book for myself. Now I have bought one for my son. I am up to chapter 6 at the moment, and it is the most value-able book in my investing collection.

GeoffReceived your book. It’s excellent – clarified so many issues that I have struggled with. Many thanks

KeithThe book arrived and we very much appreciate the gesture of your personal message. As a retired plumber my economic skills extend only to requesting pocket money from Mrs Management. I am two chapters in and I think my frontal lobe has dropped off but as I plough on and try to absorb the message it becomes clearer that it is a book that is sorely needed by us amateurs outside the economics / equities industries, the plodders if you will.

Glenn & Mrs ManagementYesterday, I received your new book and even though I have not yet completed reading it in full, I wish to congratulate you (IMMENSELY) for your fabulous publication.

KevinJust finished Value.able and about to have a crack at a few valuations. The book was truly fantastic, I think in many ways it was the way I have always tried to approach buying shares but you have really managed to synthesize and lay down an excellent framework.

BenGreat book. I have recommended it to friends and family. The examples, tables, figures etc were easy to understand. I enjoyed reading the examples using data from real businesses. I will never look at PE’s and dividends in the same way again. Thank you.

PatrickLove the book. I have always thought that value investing made sense, but wasn’t business minded enough to know where to start. Your book fills a large gap in teaching investors how to become investors and speculators. I’ve also realised a few home truths about my own business….. I have bought another copy for my dad David Graham so he can teach his share club a thing or two about what they are doing that he’s finding frustrating!

PaulI recieved your book last week and haven’t been able to put it down. I’ve been a big fan of yours on the business channel since starting out in the sharemarket a couple of years ago, and I very much connect to your investment methods AWESOME :) I have to admit i’ve been driving my wife crazy excitedly repeating everything i’m learning in your book, Haha. Thanks for all your insight and wisdom, it’s great to have a method by which i can value companies myself for our wealth creation.

AdamI just ordered 2 more copies for my daughters… It is the best! Good luck to you and thank you for disseminating such good information in a really nice style. Well done.

MikeI have received Value.able and have been reading it non-stop and have to say its one of the best books on investing I have read!

BenI’m into my second read of your book. It is sooooo gooooodddd.

RussellJust finished Valuable – aptly named since its intrinsic value is much greaer than the price. Well done!

KevinJust started reading your book –clear ,precise, common sense knowledge. Wish I had read it years ago. Have just ordered a copy for my daughter.

JohnYour book is great, even I can understand most of it. I will now be an investor and not a speculator.

RodThat little book… its supreme. Thanks, you’ve changed my world.

TomYour book is so simple in its explanation and your analogies are fantastic. They really drive home how easy it is to judge a company based on the value of their business not what the share price is doing.

AndrewI wish I had read your book ten years ago – I realise with some shame that I have been just a gambler all this time – but that is in the past and I genuinely look forward to practising as a value investor.

BradleyReading through your book I keep finding myself nodding my head in agreement with what you have written, I think it is called positive reinforcement! It is a good read and I think will be a good reference.

GarryI have read about 70 pages of your book so far and already have difficulty in putting the book down….very interesting and it caters for simple minded investors very well! …by combining my technical analysis system with yours, I achieve the synergy for greater confidence.

BrendanCongratulations on publishing your book, I very much enjoyed reading it from cover to cover. I was very impressed that you delivered everything that you have promised, it is very easy to read and more importantly you have explained step by step how to actually apply all your methods in the real world. Now I will have a go at actually calculating some company valuations. Thankyou very much for sharing your knowledge, I have been searching for a practical valuation model for a long time.

JohnI’ve been reading your book, and have really enjoyed it. I think it does a great job of breaking down Buffet’s methods and making them accessible and understandable for Australian investors. I’ve actually already suggested a number of people get a copy, and I’m going to make sure that all of our brokers read it as well.

PeterMy son was excited to see a package with so many stamps he can put into his collection! I was extremely pleased to see that it was signed twice and the message. My sincere gratitude for taking the time to respond to my emails and taking the time to sign my book. It will be chrished for many years to come, particularly for the boys when they are suitably old enough to understand. I am up to chapter 11, was up to 3am this morning and have been reading it in between screaming kids etc. I am hoping for quiet 3hrs from about 10pm when everyone is in bed and the red wine absorbed in the system to take in the rest of the book.

SebValue.able received in good time and I have now finished my first “read through” to get a feel for it. Very much impressed by the ease of reading and now look forward to reading it on a serious basis, starting later this week.

BillCongratulations on the book. I am finding it very valuable in my daily work and can get the valuations down in a few minutes. When you are dealing with other people’s money you want to now what you are paying for and while our analysts do a very good job, having a “valuable” overlay just gives me that peace of mind or otherwise.

FrankI would just like to thank you for your book. I received it in the mail late last week and have been reading it eagerly. I appreciate the depth with which you have gone into your investing approach and hope it will serve me well in my investing career (as I am sure it will many others)… Thank you gain for your amazing book.

JulianYour blog was most helpful and I am madly using your method to value companies that I am interested in. Unless I am wrong I am finding less companies worth buying? In the past I would have bought them and therefore speculated. So thanks again for your great book and look forward to hearing more from you.

GinaThank you very much for your book. It is one of the most helpful books I have ever read. You have also managed to simplify it enough for us laymen to understand (a pity I did not have it prior to investing all of the family’s super into ABC).

StevenOnly have one word to say to you and that is brilliant. Thanx for the effort. Thanx for the knowledge. Thanx for the honesty.

HaydenYour book was a very good read and well presented. Whilst I have looked at ROE to help myself “value” a company in the past, I have been painfully guilty of using dividend yield, p/e ratios, PEG ratios etc to determine if I should buy shares in a company. I’ll never look at prices again when trying to determine value (only when obtaining my valuations first and then checking the market to see if I should buy or not buy). The insights I have gained from chapter 11 in your book are extremely valuable to me and can only thank you so very much.

EdwardI have just finished reading `Value.able`. It is an understatement to say I am thrilled. You have taken Buffet’s concepts and written in an easy to understand, up-dated and Australian version. Having previously read `the intelligent investor` by Ben Braham I just found your book so much clearer and precise. I do need to go back and `re-visit` some parts for a better understanding but I wish to say thank you for all your efforts in writing this book. I know that my portfolio only stands to benefit and we all need reminding that those `zig zags` on the ticker are actually businesses not stocks, thanks again.

PeterThank You Roger. Finished the book. It is one of the best common sense books on investing that I have read.

PeterReceived your book last week and couldn’t put it down. I now look at share investing from a very different perspective

NancyFinally I finished your book, this is the only book I read from begin to end in my life.

HenryI’ve finished reading your book and just about to begin a second read. Fantastic and thoroughly enjoyable. Congratulations, an absolute credit to you. I’m certainly looking forward to Value.Able 2 if it ever eventuates.

MichaelGreat book, wish I had it 5 years ago, would have saved a lot of money.

DavidI just want to say thank you for the book. I’m really enjoying it – you should be proud of the contribution you have made to the investment process.

WayneI ordered your book prior to the launch and, after reading it through once and now going into it in much more detail, I am very certain of one fact. That is – That I have been on the wrong track for a long, long time when choosing my share investments. I always knew that something was ” MISSING” AND YOU HAVE SHOWN ME WHAT IT WAS. Thanks for showing me the light at the end of the tunnel. Great book, it has really got me fired up again!!

KevThankyou ever so much for writing an easy to understand investing book.

MonicaI really enjoyed your book. Must be the best investment book I have read.

AndrewA comprehensive well written piece on investing, written in plain English with valid and humorous analogies. A book valuable (excuse the pun) for both the neophyte & expert or professional on (what is termed) Value Investing, both in general & how it relates in Australia. I have never seen DRP (Dividend Re-investment Plans) covered anywhere else & the relevant references to tax implications/advantages for Australian’s can only be found in an Australian book. The fact that it only took 8 months to write, and is in such detail, truly demonstrates Roger’s thorough understanding of investing. Well done, only wish I had it sooner.

QuentonAnd a few from my Facebook page

I got my book this morning, totally made my day!!!! Can’t wait to get stuck in to it this weekend, read a bit just very quickly at work and had trouble putting it down. There goes my sleep plans for the weekend.

The book arrived, whoopee some solid reading for the weekend. I hope it rains.

Woo Hoo! I got it. I was woken up by my wife singing happy birthday (it’s not my birthday) and giving me a parcel.

Yeah! I got it today. So happy right now, I’m like a kid in a candy store!

My Book arrived, and you can’t wipe the smile off my face! A new road map to my investing success.

Just chiming in great content from what I have read so far… Great book. Recommended to all my friends and family. =)

I got the book, thanks Roger…. I will have to send the wife and kids away for the weekend so I can read it!

Got mine just then! On my way to uni, but I think this will take preference over financial statistics….

Thank you Roger for my edition of Value.able. It arrived in perfect time today to greet me at the door for my birthday. It looks a lot easier and much more fun to read than other books. I’m confident I’ll fully be able to understand and apply the principles.

Hi Roger, your book has safely arrived and the cover looks very stylish. I am sure the guts are even better. Looking forward to start reading it

Got the book today. Great cover and even looks good without the cover. Am busy reading it now. Looks great so far. Can’t wait to finish it to be honest.

I received my book today – my assignments can wait. I’m doing some Value.able bedtime reading.

Just got your book yesterday and have been reading it when ever I get a spare few minutes. So far the only thing that comes to mind is this. If Ben Graham’s Security Analysis is dubbed the “investment Bible” then Roger Montgomery’s Value.able is the “New Testiment” of that Bible. A great job!

And some already on the blog

Got it yesterday. Couldn’t put it down last night even with the footy on the tv. Clarity through knowledge and understanding – that’s what this book is offering me.Thanks so much.

ManiValue.able was delivered last Friday. Took it (and my wife) away for a weekend up the coast. Roger, your book is a brilliant effort and importantly, for the value of the concept you deliver, it is entertaining and easy to read. If Value.Able – Chapter 6 – ROE, had been available before I bought shares in two companies on a tip sheet recommendation, I’d also be a few $$ better off.

IvanCongratulations on the book, have given it a quick skim and will be giving it a more thorough going over in the weeks ahead, but have already recommended it to a few friends based on the quick read. Looks like a pretty thorough and commonsense treatment for investors and an excellent addition to the bookshelf! PS: Saw you running like a maniac down George St at lunch time today – I immediately decided to start carrying your book with me to get that elusive autographed copy!

JakeI got your book today. The bad thing is I now have to work for eight hours before I get to read it!!!!! Thank you so much.

TerryI have had the book for a couple of days now, and my impression is that it is the best book I have so far read on investing. It’s a fantastic distillation and a voice of perfect reason. Your valuation method is very easy to follow.

RobertClick here to read more comments and see the first photographic evidence of Value.able in action.

Thank you for your kind feedback and encouraging words. If you would like to keep adding your thoughts, inights and stories, please Leave a comment here at the blog, or join me on Facebook.

Posted by Roger Montgomery, 3 August 2010

by Roger Montgomery Posted in Companies, Investing Education, Value.able.

-

Which A1’s look expensive at the moment?

Roger Montgomery

July 31, 2010

While share prices move every day, valuations move much more slowly. But move they do. Especially in the next few weeks as companies report their annual results. Many analysts however and a great deal of the commentary will focus on earnings growth, revenue growth and dividend growth but all that matters is whether return on equity is being maintained and the company is increasing in intrinsic value. Once you have established that and found a company that ticks every box, then all that matters is buying at a big discount to intrinsic value.

I have been saying for some time that the vast majority of A1 and A2 companies appear to be expensive.

In response to several requests to be more specific on the subject, I thought I would list a few companies that I believe are currently above their intrinsic values.

The following companies are those that come immediately to mind and that I believe are both very high in quality AND very high in price: Servecorp, ERA, Seek, Navitas, ASG Group, Domino’s Pizza, Fleetwood, Carsales, David Jones, Cochlear and Reckon.

Obviously, I will be interested in the full year results for these companies and indeed every company, which may change the intrinsic values dramatically. Moreover, I am NOT predicting that the shares of these companies will fall in price. As much as I would like to be able to share that information with you, I just do not have it. I am not able forecast share prices and as I have repeatedly noted, estimating the value of a company is not the same as predicting their share price.

For now however, those listed above look sufficiently expensive for me to conduct research on other companies. Be sure to seek and take personal professional advice BEFORE undertaking any activity in shares or derivatives or any securities.

Posted by Roger Montgomery

31 July 2010

by Roger Montgomery Posted in Companies, Investing Education.

- 32 Comments

- save this article

- POSTED IN Companies, Investing Education

-

A C5? But it’s a blue chip!

Roger Montgomery

July 23, 2010

Last week on the Sky Business Channel Peter Switzer asked me for one ‘blue chip’ stock that I rate as ‘A1’.

So I asked… what is a blue chip? Peter described such businesses as having a very good reputation and great brand name, pay a good dividend and have stood the test of time. Such businesses, Peter said, also tend to go up with the market.

Whilst I couldn’t name an A1 blue chip, I can name plenty that fall in my C4 and C5 categories.

Last night I revealed 18 ASX-listed businesses that some investors consider ‘blue chips’, yet don’t make my A1 grade. Westfield, Transurban, Asciano, Lend Lease, Ten Network and Virgin Blue are just a few.

Switzer TV with Peter Switzer was broadcast on 22 July 2010 on the Sky Business Channel. Visit www.rogermontgomery.com to secure your First Edition hard back of Value.able, my step-by-step guide to valuing the best companies and buying them for less than they are worth.

This video is provided by Switzer.com.au, an online portal for retail investors and small business owners. Switzer also provides Financial Planning and Business Coaching services.

Posted by Roger Montgomery, 23 July 2010.

by Roger Montgomery Posted in Companies, Investing Education.

- 34 Comments

- save this article

- POSTED IN Companies, Investing Education

-

Where are my valuations Roger?

Roger Montgomery

July 22, 2010

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.Pimco’s Bill Gross says we have entered the era of the “new normal’ – expect low aggregate returns. Jeremy Grantham at GMO says that attributing the chance of recovery at 25% is “generous” and the US will be lucky to achieve 2% economic growth over the next seven years. And David Rosenberg at Gluskin Sheff says deflation is more likely than inflation, describing the stock market as meat grinder – “No return for a decade and yet plenty of sleepless nights on this roller-coaster ride.” Keep in mind David is a perennial bear. I remember during my days as trader being told; listen to the bears but don’t sell until they turn bullish!

Over at the bullish camp PuruSaxena says “the ongoing range trading should conclude with a bullish resolution” and cites Intel’s best quarter ever and JP Morgan’s analyst estimates-beating performance as justification.

At Montgomery Inc. ‘we’ don’t claim to know how the world’s debt issues will be resolved. What we do know is that you cannot solve them with more borrowing.

In Australia many ‘analysts’ are pointing to the fact that the recent rally has not been accompanied by much volume. Indeed, one of my friends who is a broker said they can “hear pins drop” in their office. But before you rush out and sell in anticipation of some imminent correction (I am not forecasting anything), have a look at the volume that accompanied the beginning of the bounce from the March 2009 lows. They were relatively light too. Perhaps that means the whole thing will indeed end in a massive correction that will see even lower lows! (I am not forecasting anything).

Stock market investing however need not be so mysterious and confusing. Instead of focusing on stocks, focus on businesses. Instead of focusing on prices, focus on values. When bargains are available it is obvious. When the banks were at their lows, there was no justification and large discounts to intrinsic value were evident for three of the big four. Their prices were following the pattern of their global peers that were each losing billions and being bailed out or nationalised. While their prices were on their knees, their values were being driven by the fact they were reporting multibillion-dollar profits. Focus on the business – don’t take your cues from share prices.

More importantly, when bargains are available you are writing to me with requests to value high quality companies. “What is the value of CBA Roger?” “What do you think of CSL and Cochlear at these prices?” “They’re pricing QBE like it is going out of business, that’s just crazy.”

Today, value is not so obvious and once again that is reflected in the general quality of the companies that you are asking me to value for you. While you have requested a few decent businesses, there have been a few raised eyebrows at Montgomery Global.

With those thoughts in mind, I offer another Value.able update from Montgomery Inc, along with the relevant MQRs – “Montgomery Quality Ratings”. At some point I will publish, somehow, the entire universe with the A1, A2, A3, to C3 C4 and C5 MQRs.

Don’t forget that the valuations you are seeing here are based on inputs that include analyst estimates. As some of you have indicated, analysts are notoriously bullish and particularly at the beginning of a reporting period tend to have estimates for earnings that need subsequent downward revision. I will discuss this and my observations and insights in a future post.

For now, know that the studies conducted by McKinsey, for example, into the persistent excess bullishness among analysts, aggregate and average the data which can produce a result that does not reflect any particular year. Stick your head in an oven and your feet in the freezer and your ‘average’ temperature will be about right, but of course you won’t be feeling so good!

The point I should make however is that my valuations for CBA, WBC, NAB, ANZ, QTM, CAB, HZL, FLT, SOL, MMS, CPU, AXA, BLD, CFU, DYE, DMX, ISF, VLA, QHL and CLQ (especially the 2011 estimates) will be revised over time. They will change. And having just been calculated they may also have changed from any previously published valuation and supersede them.

WARNING: Not recommendations or advice. Didactic exercise only. Seek personal professional advice before doing anything!

* Quality Score shown for last full year results. May change dramatically. May have been one good year – a flash in the pan. There is more to know. If for example, a company makes a debt-funded acquisition, its quality score could change.

++ 2009 Valuation. No forecast information available

+++ No forecast information available

^ US Company listed in the USYour copy of Value.able will be delivered soon. I’m looking forward to comparing you’re valuations here on my blog.

Posted by Roger Montgomery, 22 July 2010.

by Roger Montgomery Posted in Companies, Financial Services, Insightful Insights, Investing Education.