Bitcoin: down but not out

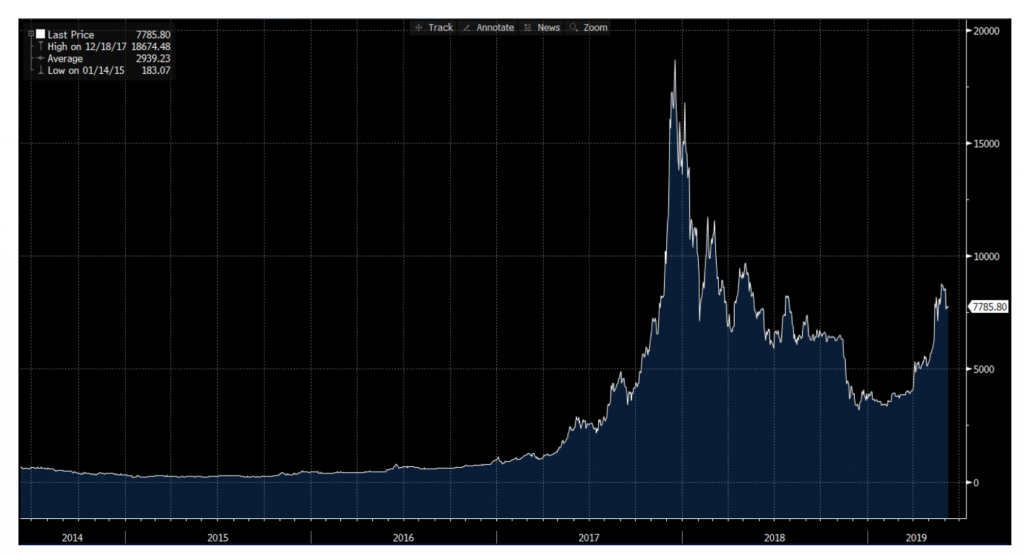

Towards the end of 2017, the price of Bitcoin (along with that of many other crypto currencies) surged to extraordinary highs. At that time, we turned our mind to whether this price growth could make sense, and several of the Montgomery team members wrote opinions (search ‘bitcoin’ on the rogermontgomery.com website) which varied between “maybe” and “certainly not.”

Bitcoin spent the next 12 months losing most of the value it had gained during 2017 – which was a big deal given the gains in 2017 represented pretty much the entirety of its market value – to finish 2018 below US$4,000.

During 2019, however, something interesting has happened. Bitcoin’s fortunes have improved significantly, and the price had roughly doubled since the start of the year. Looking at the price chart, it is possible to think that the 2018 selloff may now be behind us and a new phase beginning.

Source: Bloomberg

To my mind the analysis hasn’t really changed much since the last time I wrote on the topic. If you believe that Bitcoin has a meaningful chance of becoming an alternative store of value to gold, then you can arrive at some very lofty valuations based on the aggregate value ascribed to the world’s gold (which, like Bitcoin, generates no income, but is valuable just because it is). However, in the event that it fails to achieve this status, the right valuation may not be unadjacent to zero.

One thing that would steer me more towards the zero camp would be to see Bitcoin lose its primacy as the leading crypto currency. This feels a bit like a winner-take-all game, where one crypto currency needs to be widely regarded as “the one” in order to sit alongside gold. So far, Bitcoin seems to be holding this position, performing reasonably well in relative terms, and with no other crypto yet making a convincing claim to the throne.

While a return to the heady days of 2017 seems unlikely in the short term, it will be interesting to see where we finish 2019.

Read my previous article: Is Bitcoin a rational investment?

In 2019 Bitcoin’s fortunes have improved significantly, and the price had roughly doubled since the start of the year. Is it possible to think that the 2018 selloff may now be behind us? Share on X

Rob

:

It’s worth zilch but it’s worth trading why the derivitaves market is exploding and market professionals that have been trading options and futures on traditional markets will trade it retail pay us every single time

John

:

Yep its worth zero.