articles by Ben MacNevin

-

Demerging to build value?

Ben MacNevin

October 24, 2013

Brambles, the world’s largest pallet provider, has proposed to demerge its Recall business, which specialises in document management. The company has recently held its Annual General Meeting (AGM), and the board had much to say about the value that would be created for shareholders from the transaction.

Question: is this concept of value creation different to how we consider it at Montgomery Investment Management? Continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 10 Comments

- save this article

- 10

- POSTED IN Companies, Insightful Insights.

-

Returning to normal

Ben MacNevin

October 22, 2013

When the Labor Government proposed changes to the Fringe Benefits Tax in July, it sent shock waves through the novated leasing industry. While the Coalition rejected the proposed changes when it was subsequently elected, companies like McMillan Shakespeare (ASX: MMS) experienced a sharp decline in business activity during this period. It now seems however that conditions are returning to normal. Continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 8 Comments

- save this article

- 8

- POSTED IN Companies, Insightful Insights.

-

Rising intrinsic value

Ben MacNevin

October 18, 2013

Pop quiz everyone: if a company’s market value reflects what is considered to be its “fair value”, will this value change over the long run? Continue…

by Ben MacNevin Posted in Insightful Insights, Intrinsic Value.

- save this article

- POSTED IN Insightful Insights, Intrinsic Value.

-

Deal or no deal, has the damage been done?

Ben MacNevin

October 16, 2013

The financial markets are on edge as the United States once again comes to the brink of defaulting on its debt. Many commentators have claimed that it is impossible to predict the scale of the fallout if Congress fails to reach a deal, and hence are unsure of how to act. But Central Banks may already be adjusting their reserve holdings as the credit quality of the country deteriorates. Continue…

by Ben MacNevin Posted in Economics, Insightful Insights.

- 2 Comments

- save this article

- 2

- POSTED IN Economics, Insightful Insights.

-

-

Boart Longyear – drilling itself out of a hole?

Ben MacNevin

October 3, 2013

Boart Longyear (ASX: BLY) owns the world’s largest fleet of drilling equipment, and in doing so has amassed considerable debt. The downturn in the mining sector brought the company perilously close to breaching its debt covenants, and while management was able to refinance the debt earlier this week, we are unconvinced that this has given the company a lot of breathing space. Continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- 3 Comments

- save this article

- 3

- POSTED IN Companies, Insightful Insights.

-

Acquiring growth

Ben MacNevin

September 27, 2013

Ansell (ASX: ANN) is a company that has grown its earnings by 7 per cent a year for the past 6 years. But rather than doing it organically, it has primarily done this by purchasing other companies. Continue…

by Ben MacNevin Posted in Companies, Insightful Insights.

- save this article

- POSTED IN Companies, Insightful Insights.

-

Knowing the risks (23/09/2013)

Ben MacNevin

September 23, 2013

by Ben MacNevin Posted in Video Insights.

- watch video

- 5 Comments

- save this article

- 5

- POSTED IN Video Insights.

-

Time for ResSleep?

Ben MacNevin

September 20, 2013

Resmed is a company that manufactures machines and masks for sufferers of sleep apnea. At Montgomery, we believe that Resmed is a quality business with strong fundamentals. Despite both funds being shareholders, none of our team has trialled the products first hand. Until now. Continue…

by Ben MacNevin Posted in Companies.

- 6 Comments

- save this article

- 6

- POSTED IN Companies.

-

Seeking Perfection* (*with apologies to George Orwell)

Ben MacNevin

September 13, 2013

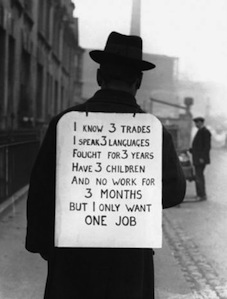

It was a rather gloomy week of economic data releases – total job advertisements in Australia and New Zealand were down by 2 per cent for the month of August, while unemployment rose from 5.7 per cent to 5.8 per cent over the same period. And yet the share price of Seek, Australia’s leading employment classifieds website owner, has risen by 1.7 per cent over the week. That raises the question; why are the rising unemployment headlines not having the same adverse impact on the company’s performance as they once did? Continue…

by Ben MacNevin Posted in Companies, Economics, Insightful Insights, Value.able.

- 6 Comments

- save this article

- 6

- POSTED IN Companies, Economics, Insightful Insights, Value.able.