Returning to normal

When the Labor Government proposed changes to the Fringe Benefits Tax in July, it sent shock waves through the novated leasing industry. While the Coalition rejected the proposed changes when it was subsequently elected, companies like McMillan Shakespeare (ASX: MMS) experienced a sharp decline in business activity during this period. It now seems however that conditions are returning to normal.

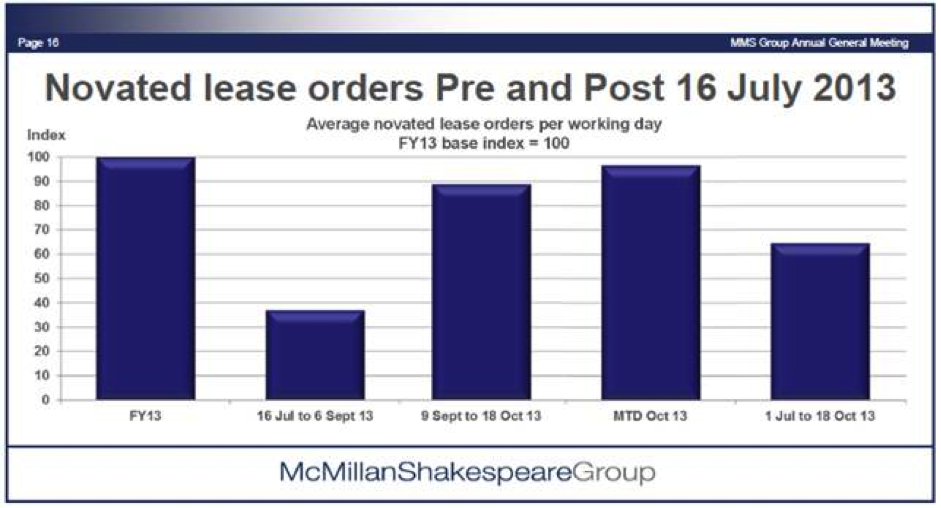

MMS is holding its Annual General Meeting today, and the presentation paints a very clear picture about the recovery in the industry. The graph below depicts the number of orders for novated leases for various periods prior to, and since, Labor’s proposed changes.

When the announcement was initially made, management at MMS was optimistic that the changes would not pass and retained all of its staff. Many of its competitors decided to reduce numbers as enquires for novated leasing fell considerably during the period. With the benefit of hindsight, this has placed McMillan in a good position to win business as the sector recovers.

Management stated today that while earnings in the first half of 2014 will be depressed, conditions are expected to return to normal in the second half. This confidence is reflected in the declaration of a dividend for the 2013 financial year, which management previously withheld due to the material uncertainty created by the announcement.

MMS is the leading remuneration services provider in Australia, and is a company that has held a prominent position in the Montgomery Funds since it relisted after Kevin Rudd’s conniption. The recent period has been an interesting one, and we have written a number of articles setting out our thoughts on managing the investment, including:

F.B.T. – Fairly Badly Trampled

McMillan Shakespeare – Risky Business?

McMillan Shakespeare – Concluding Our Thoughts

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

cameron happ

:

I’m sure I heard it correct. Wish I could find a replay as the firm he works for would be a good one to avoid.

cameron happ

:

Was interesting to hear an “expert ” on Sky Business channel today say that MMS put people off after labour came out with their intentions, and he thinks other companies might be able to take market share. He did say long term they might get back to $16 but it was interesting that he said the exact opposite to your information.

Roger Montgomery

:

Sounds like that expert was 100% incorrect?

Greg McLennan

:

Are you sure you heard that right? MMS specifically came out and said the exact opposite – as did Roger and Tim, and at least one astute contributor….

Simon

:

Thanks Roger,

Have had a read previously and picked some up – not quite at $7 though! Well done on your fund’s investment, it will be interesting to see what it does in the next few months.

Roger Montgomery

:

Interesting some bloggers said exactly the same thing after we paid $7.25!!! It most certainly will be interesting to see how quickly conditions return to normal.

Simon

:

Hi Ben,

Pleasing results and comments from the AGM.

Any view on fair value?

Cheers

Simon

Roger Montgomery

:

Hi Simon,

Please have a read of the previous posts and you will have a still relevant approximation