articles by Ben MacNevin

-

The Big Four’s Best…

Ben MacNevin

May 5, 2014

The Big Four banks feature prominently in many investors’ portfolios, typically because financials account for over 40 per cent of the Australian share market, coupled with their attractive dividends. At Montgomery, we focus on a company’s growth prospects rather than yield, which is the reason we hold ANZ in the Funds. Continue…

by Ben MacNevin Posted in Companies, Financial Services, Insightful Insights.

-

A Question of Value

Ben MacNevin

April 28, 2014

Here’s a question for you. If a company receives a takeover offer at a material premium to its current share price, has the company’s management been successful at realising value for its shareholders? Continue…

by Ben MacNevin Posted in Insightful Insights, Investing Education, Value.able.

-

No Pickups with Trucking

Ben MacNevin

April 24, 2014

For companies that deal in capital-intensive vehicles, construction generally provides better growth opportunities than production. With large miners progressively shifting spending from capital expenditure to operating expenditure, the consequences are being felt by vendors. Continue…

by Ben MacNevin Posted in Energy / Resources, Property, Value.able.

- 1 Comments

- save this article

- 1

- POSTED IN Energy / Resources, Property, Value.able.

-

-

What can cause a 10 per cent sell-off…

Ben MacNevin

April 12, 2014

Unless you attended management or business school, there may not seem to be much of a distinction between a plan and a strategic review. The two terms, however, mean completely different things, and each has significant implications for a company’s long-term value prospects when employed. Continue…

by Ben MacNevin Posted in Insightful Insights.

- save this article

- POSTED IN Insightful Insights.

-

The patience pay-off

Ben MacNevin

April 10, 2014

When one is invested in a high quality company and the share price is below the estimate of intrinsic value, the best thing to do is exercise patience. Of course, this can be easier said than done when Mr Market acts irrationally. Continue…

by Ben MacNevin Posted in Insightful Insights.

- 7 Comments

- save this article

- 7

- POSTED IN Insightful Insights.

-

Talking about: operational leverage

Ben MacNevin

April 7, 2014

Operational leverage can have a powerful effect on a company’s earnings, in both a positive and a negative sense. When considering an investment in companies with high operating leverage, you must be comfortable with the company’s ability to manage downside risk. Continue…

by Ben MacNevin Posted in Insightful Insights, Value.able.

- save this article

- POSTED IN Insightful Insights, Value.able.

-

Making the change: agent to retailer

Ben MacNevin

March 29, 2014

Flight Centre (ASX: FLT) is transitioning from a travel agent to a travel retailer. You may be wondering: what is the difference between the two, and what effect will it have on the company’s long-term prospects? Continue…

by Ben MacNevin Posted in Consumer discretionary, Insightful Insights, Tourism.

-

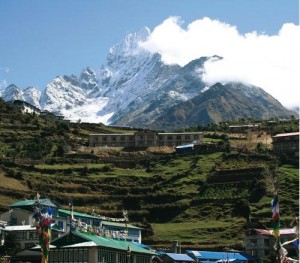

Kathmandu still climbing

Ben MacNevin

March 27, 2014

Kathmandu (ASX: KMD) has reported pleasing financial results for the January 2014 half-year. While Kathmandu’s store rollout is well on track, it’s the company’s long term potential that has us excited. Continue…

by Ben MacNevin Posted in Consumer discretionary, Insightful Insights.

-

Talking about: De-commoditisation

Ben MacNevin

March 21, 2014

A commodity is a basic good or service produced to satisfy wants or needs. It is difficult to generate value when businesses deal in commodities, as there is limited ability to exert pricing pressure. Continue…

by Ben MacNevin Posted in Insightful Insights.

- 1 Comments

- save this article

- 1

- POSTED IN Insightful Insights.