Are we seeing a dissonance between credit markets & broader equity indices?

UK Macroeconomic Strategist Michael Wilson has penned an interesting piece entitled “Involution” which came across my desk. It was interesting enough that I thought it worth sharing in its entirety.

Involution

Involution is what happens to your muscles when you spend too much time in space. Without the discipline of pushing against gravity, they wither away and become incapable of doing productive work. What happens to human beings at zero G also happens to the global capital stock at zero rates. It withers away. When there is no discipline to make a return above zero, returns fall to zero.

The problem is that deteriorating returns tighten liquidity conditions, even with low rates. That’s because deteriorating returns change corporate behaviour.

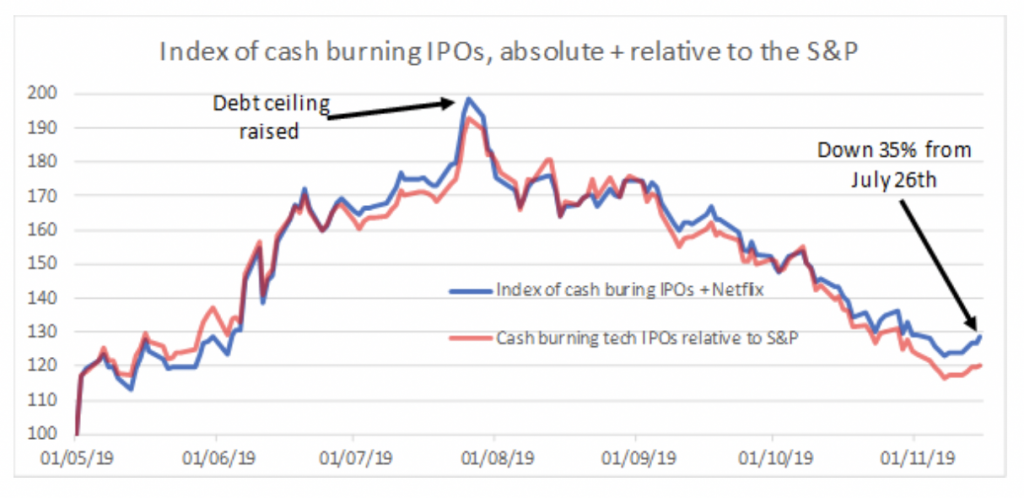

It was the dissonance both between credit markets & broader equity indices and within equity markets that gave away the 2001 & 2008 market downturns ahead of time. That dissonance is returning today. We are seeing it in leveraged loans, in high yield energy spreads & spreads for highly levered companies. We are seeing it in the performance of the recent IPOs of cash burning tech stocks. And we are seeing it in VC funding and the fortunes of WeWork & Softbank.

The ensuing funding squeeze will force these companies to run for cash. With financialised demand now at 9-11 per cent of US GDP on my estimates, it is easy to see how this might trigger an investment recession and an end to the cycle. Fears of a Warren presidency may accelerate the process.

If US corporates switch from growing borrowing by 5 per cent to shrinking it by 5 per cent, it will take US$2 trillion of liquidity out of the system, 10x more than the Fed can inject by cutting to zero by the end of 2020. Whether corporates collectively run for cash or carry on as usual will determine whether the cycle ends in six months, two or four years. My view is that that the cycle ends sooner rather than later.

For more from Macrostrategy Partnership visit: http://www.macrostrategy.co.uk

Maybe someone with a background in finance can correctly interpret the above piece.

To my untrained economic brain it sounds awfully like the world economic system is terminal?

And as he puts it getting there ‘sooner rather than later.’