IS G8 Education worth more than $5 per share?

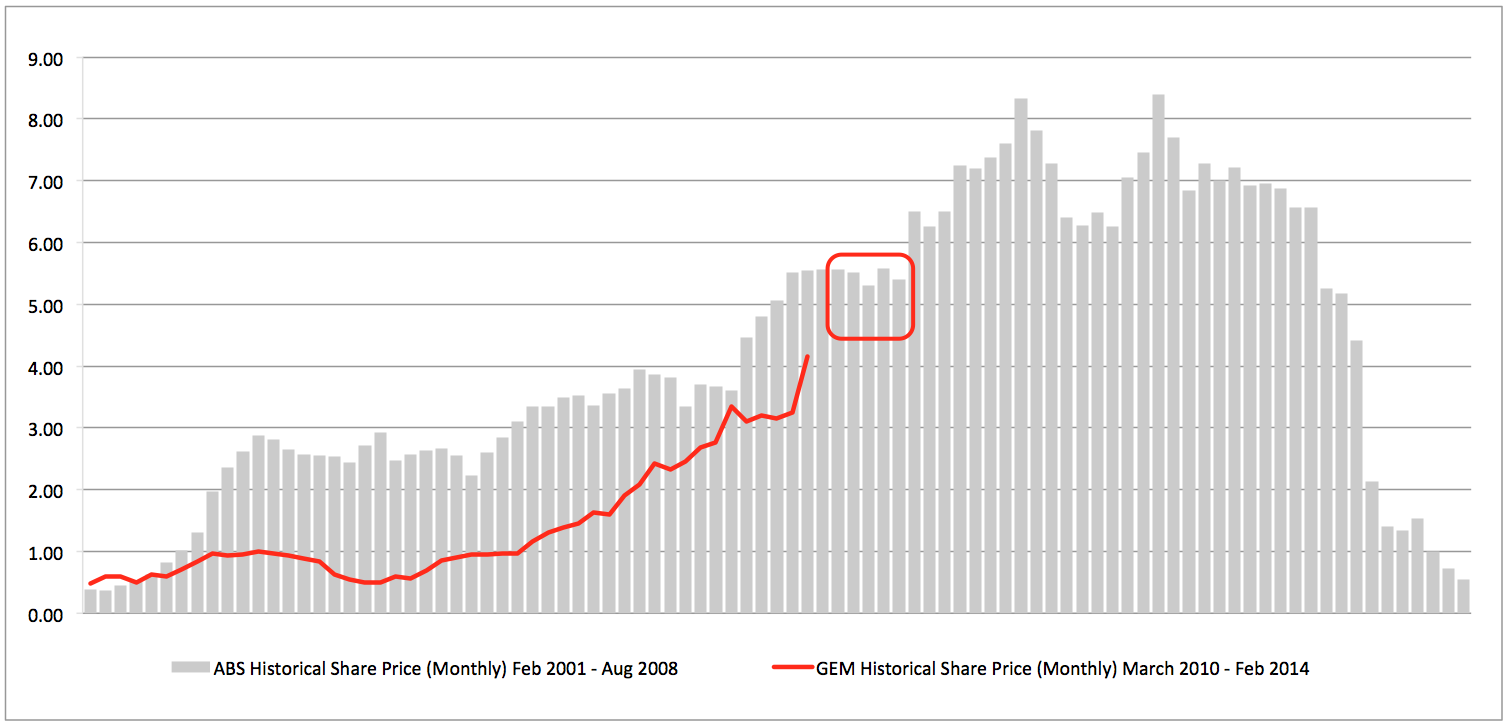

In September last year, when G8 Education shares were trading for three dollars, we asked: “Is $4.00 unreasonable for G8?”. Seven months later, and with a share price circa 45 per cent higher, we again ask a similar question but this time – is G8 worth more than five dollars?

Historical Share Prices of ABS and GEM

So what has changed to drive such optimistic thinking?

Whilst it’s not the only characteristic we look for in an investment, a key fundamental we try to identify in any business is their ability to deploy larger amounts of incremental capital at high and stable – or rising – rates of return. Few businesses have the ability or the requisite competitive advantages to sustain high rates of return on incremental capital over the longer-term and when found, you want to hold them for as long as their prospects for doing so remain bright.

The competitive nature of business means that others will, over time, be attracted to the high rates of return and try to imitate the model – competing on price and driving down the returns for everyone. Either that, or they invest too quickly, fail to generate the returns, or borrow too much and blow up – as was the case with ABC Learning Centres.

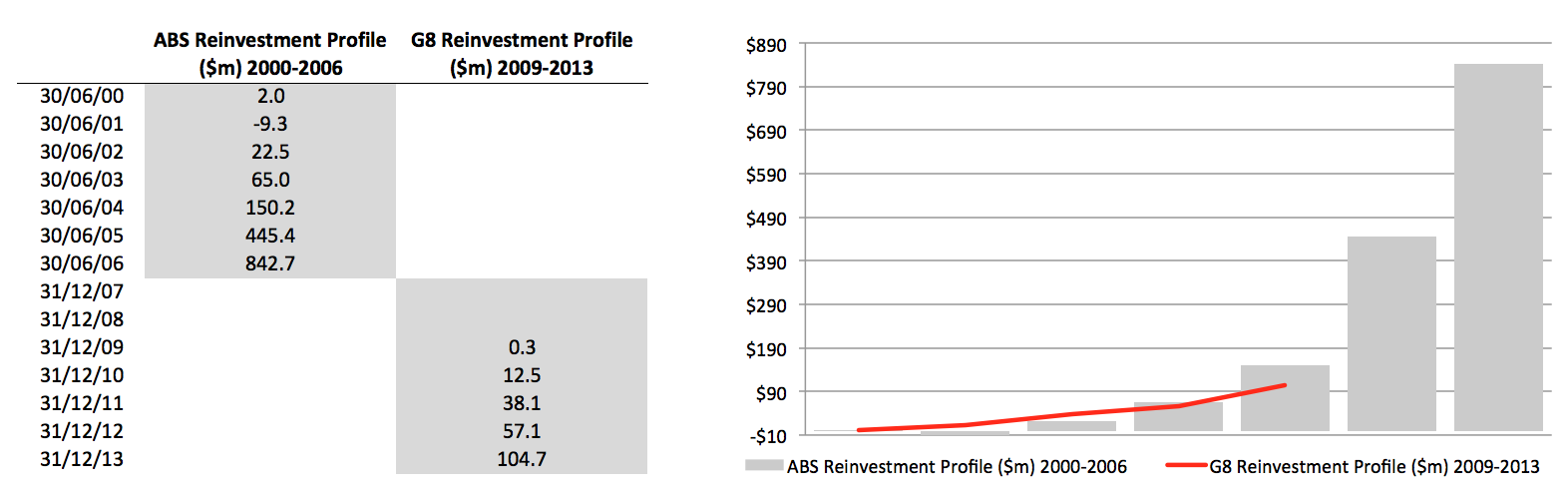

Which brings us to our comparison. In an attempt to see what the future may bring for G8, we graphed the reinvestment profiles (net investing cash flows) of ABC Learning from 2000-2006, and G8 Education from 2009 to 2013. As demonstrated in the graph, G8 Education’s reinvestment trend is following a not too dissimilar path to that of ABC Learning’s in its highly profitable early years.

What we also find interesting is that given there are over 4,000 long-term daycare centres (LDCs) in GEM’s addressable market, and with GEM holding a mere five per cent estimated market share, there remains ample opportunity for the business to continue increasing its incremental investment for the foreseeable future. Of course, to avoid the fate of ABC, it will be important the company resists the temptation to pay more than four times EBIT for centres or over-gear in the pursuit of growth. Having met with management, we are satisfied the company is on the right track and are succeeding in developing systems and processes that are generating real synergies from scale.

We currently estimate G8 Education could snare 15 per cent market share and the business’ growing free cashflow snowball will allow room for further reinvestment. With that in mind, when we asked management last year what they could sensibly and responsibly deploy, they stated their level of incremental investment was between $65m and $100m annually.

More recently, in February, we again asked management the same question. We previously assumed the company’s investment growth would align with a somewhat linear earnings growth profile. We were pleased to hear however that last year’s ‘ceiling’ of circa $100m is now expected to represent a floor, and the upper range has expanded to approximately $150m in incremental capital.

Given the acquisition of 63 centers for $104.7m already this financial year, G8’s management is certainly backing their targets with action, and we can extrapolate their earnings based on a few new assumptions.

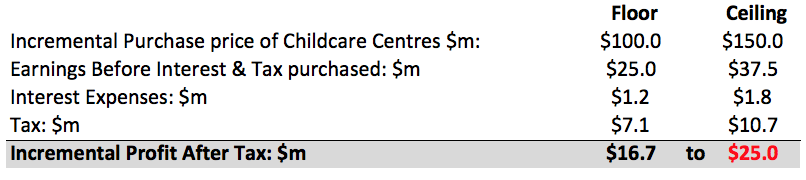

Applying the same four EBIT metrics (see here) to $100m and $150m of incremental investment, one can estimate incremental NPAT of $16.7m to $25m each year in the period from 2014 to 2016.

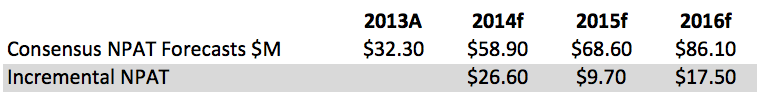

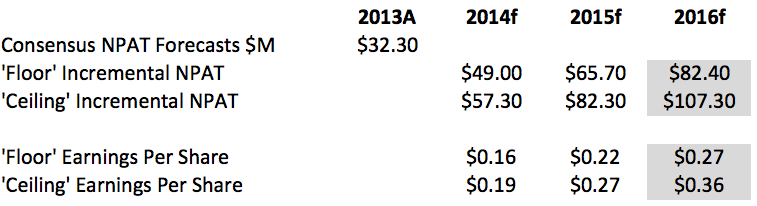

Bear in mind that consensus forecasts currently look like this:

If $100m incremental investment is now the ‘floor’, at least $16.7m in additional ‘acquired’ NPAT in 2014, 2015 and 2016 is possible. As our base case therefore, we get $82.4m NPAT in 2016, which is in-line with consensus thinking.

Considering the bull case however, and assuming circa $150m of purchases are made, then a NPAT forecast of $107.3m emerges in 2016, which is well above current market expectations.

Using these numbers rather than consensus, and on current shares outstanding, earnings per share could emerge between 27 and 36 cents per share. With the average industrial company trading on 16 times forward earnings, a share price range of $4.32 to $5.76, might not completely unrealistic.

A key risk for G8 is of course a change to current legislation, particularly in regard to child care rebates and an irrational competitor entering the market and paying more than 4 times EBIT for centres. The latter would render the economics less compelling, but the failed IPO of Sterling Education late last week – amid an apparent “lack of investor demand” for large-scale start-ups – is a positive, as it removes a competitor. And this arguably gives GEM a clear run at success.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi considering the financials and the PE ratio comparing to sector PE is the stock under valued?

Hi Sathya, Grab a copy of Value.able to understand the trap in that line of thought.

Hi Roger – nice analysis above and this is quite intuitive to say the least. I am just wondering also what your thoughts are about Navitas/Intueri?

the main risk with GEM like any ‘roll up’ company is integration risk and also low hanging fruit may be taken driving up valuations for potential centres.

they are behaving like ABC learning but buying at a lower multiple. They buy far too many centres – impossible to integrate all of these.

Also another main risk to valuation is no organic growth. The p/e of 16 times that you pointed out above is for an industrial company with organic growth. GEM has none, otherwise why would it embark on so many acquisitions. Its growth is all “one offs” technically (previous corresponding period not comparable due to purchasing additional centres) and not demanding its pe ratio of 16 times.

Where is the comment I sent you regarding lease terms on these businesses?

Indeed! Please resubmit.

Compliments to all at Montgomery for being in the hottest stocks this reporting season!

This is a highly strategic buy, and the price tells you they weren’t the only ones bidding. GEM will leverage off the new centres in a way that Sterling, Affinity and Guardian could not. For example, it’s an entry to the WA market.

Further, GEM is utilising the rapid share price appreciation to raise $100M according to latest news, so the debt component isn’t excessive.

For what it’s worth, Merrill-Lynch just raised their valuation from $5 to $5.80 based on the takeover.

One of the things I love about Montgomery Investment Management is your ability to watch companies very closely and consistently. GEM have had a very rigorous 4 times EBIT purchase price rule, and suddenly pay 5.8 times the 2015 EBIT with cash and DEBT. I am surprised and disturbed by this radical departure from such a disciplined approach and wonder that the masterminds at MIM think.

All the best

Scott T

Be on the lookout for a blog piece a little later.

Rest easy. It’s a one-off strategic move, which is also strongly EPS accretive. It’s back to 4x EBIT after this. There’s also $150m of equity to be raised, putting concerns over debt levels to rest.

Russell & Roger,

Any thoughts on today’s (24/3) announcement that GEM is to purchase Sterling Early Education for $228m?

Thanks

Angela

Not writing about it just now but be on the lookout for a blog piece a little later.

They seem to be spending $M240 at 6 times earnings instead of 4 times earnings. Does this mean mean they will loose $80M? .

Hi David,

We’re looking at the details ourselves. We aren’t writing about it at the moment but be on the lookout for a blog piece a little later.

Given that G8 are predominately acquiring small ‘mom and dad’ centres one by one, is there a ceiling to how many transactions that management can adequately perform due diligence upon each 6 months? I’m concerned that snowballing reinvestment could stretch management leading to lower quality acquisitions that overlook the basic metrics such as occupancy levels within the centres. Isn’t this what happened to ABC learning when reinvestment took off in 05/06?

Thats something we are keeping a close eye on Ben. SO far we are comfortable they are digesting what they can eat.

Enjoy this research. What are your thoughs on Affinity (AFJ)? It seems an identical business. While risks exists given it is still so new and have yet to really prove the strategy, given their much lower valuation is this a better bet than GEM?

Someway behind in terms of footprint and extraction of any scale benefits. still trying to bed down the centres they have had since day 1 is our understanding.

I’ve never understood buying something simply because it is cheaper or because it is cheap.

As with all our investment decisions, we prefer to own the number one incumbent, and the one that has the proven business model. Versus speculating on the possibility that the ‘value gap’ may close as the little guys do their best to try and catch up or prove themselves.

By that time, even if one makes a return on the multiple arbitrage, we think GEM will continue to grow, and all things being equal, become a much bigger business than it is today. Noting of course that we have no ability to predict what the share prices of either business will do between now and then.

Russell

Great article Russell and great stock pick. You could argue that having already spent $105m on acquisitions this year, the full $150 of investment might be expected for FY14, (I think there’s $50m in cash from the corporate note issue) which then raises the ‘floor NPAT’ to $90.7m. Potentially management can continue to increase margins over time as well with pricing and rostering changes. It strikes me that G8 may need to issue more equity at some point to make investments of this scale early on, which would impact on EPS? -hopefully not by a great deal. Thanks also for pointing out the risks.