Has the bull run its course?

It’s been a record run for stocks. The past two years delivered historic returns for global and U.S. stocks. Indeed, the 24- months ending 31 December 2024 ranks as one of the top 10 two-year periods since the middle of last century.

And notably the gains came hot on the heels of the post-COVID19 2020 and 2021 gains which also ranked among the top 10 in the 24-month periods.

Figure 1. Top 10 performance (S&P500 and MSCI ACWI)

Source: Polen Capital

Unlike previous rallies, the recent gains have been very concentrated. This time the bulk of the stellar returns have been generated by just seven so-called ‘Magnificent’ stocks (Magnificent 7; Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla). Consequently, by 31 December 2024, those seven stocks represented 34 per cent of the S&P 500 and 17 per cent of the global MSCI ACWI indices.

As Figure 2. reveals, the absence of gains in these seven stocks, would have led to a very different outcome for the returns of the major indices that include them.

Figure 2. Narrow market breadth

Source: Polen Capital

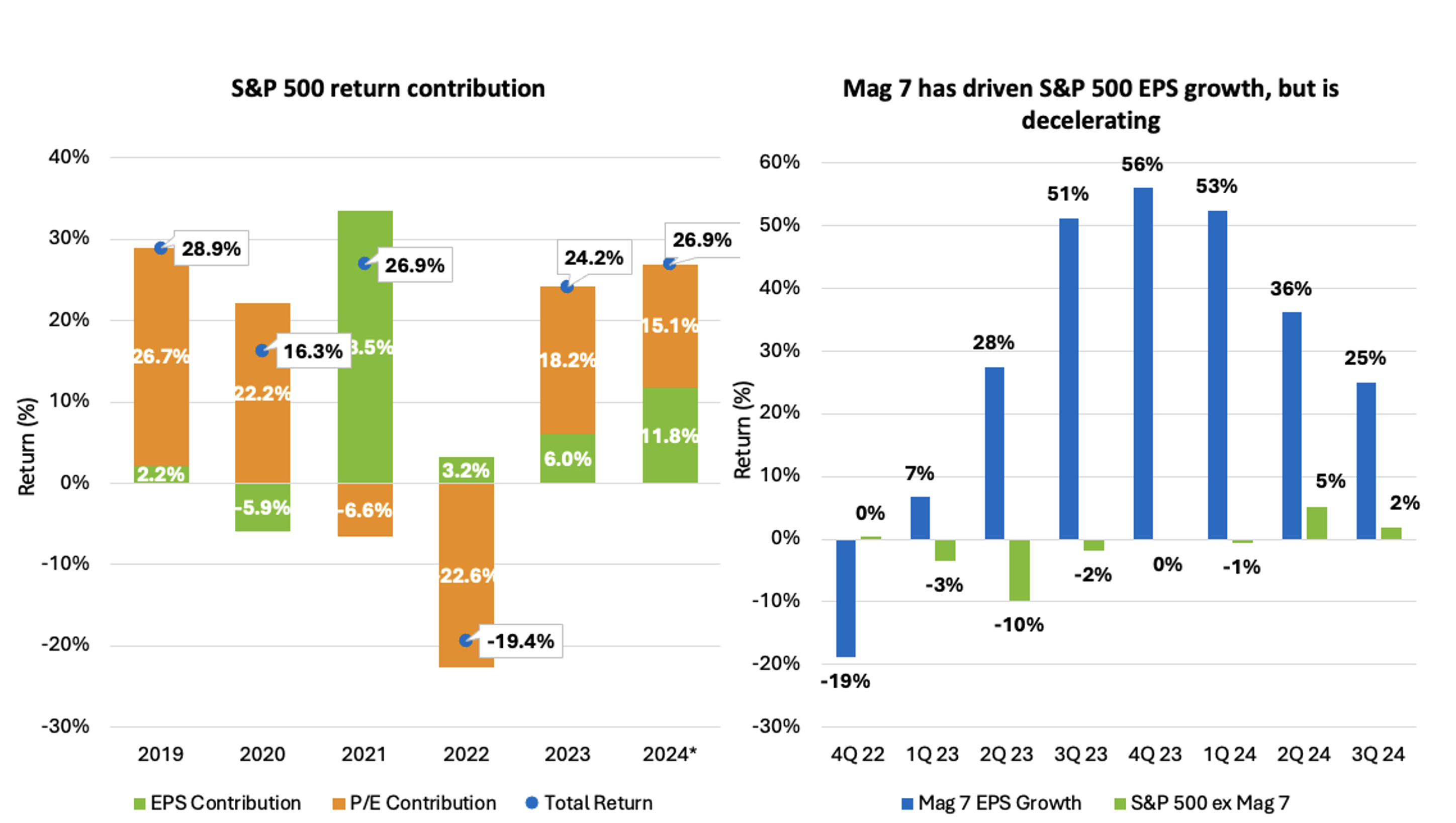

Another observation is that the returns have primarily been driven by multiple expansion (increase in price to earnings (P/E) ratio), while earnings growth has remained narrow.

This is something I wrote about extensively in my blog entry ‘Would you like P/Es with that? in 2022. I noted that investors will generate better returns than earnings per share (EPS) growth rates of the companies they buy if P/E ratios expanded from the subdued levels that existed after massive P/E compression in response to interest rate increases (Figure 3.).

Figure 3. P/Es and earnings growth picture

Source: Polen Capital

As Figure 3. reveals, P/E multiple expansion explains roughly half of the recent S&P 500 returns, while the contribution from earnings growth was entirely derived from the ‘Magnificent 7’ – which is currently decelerating.

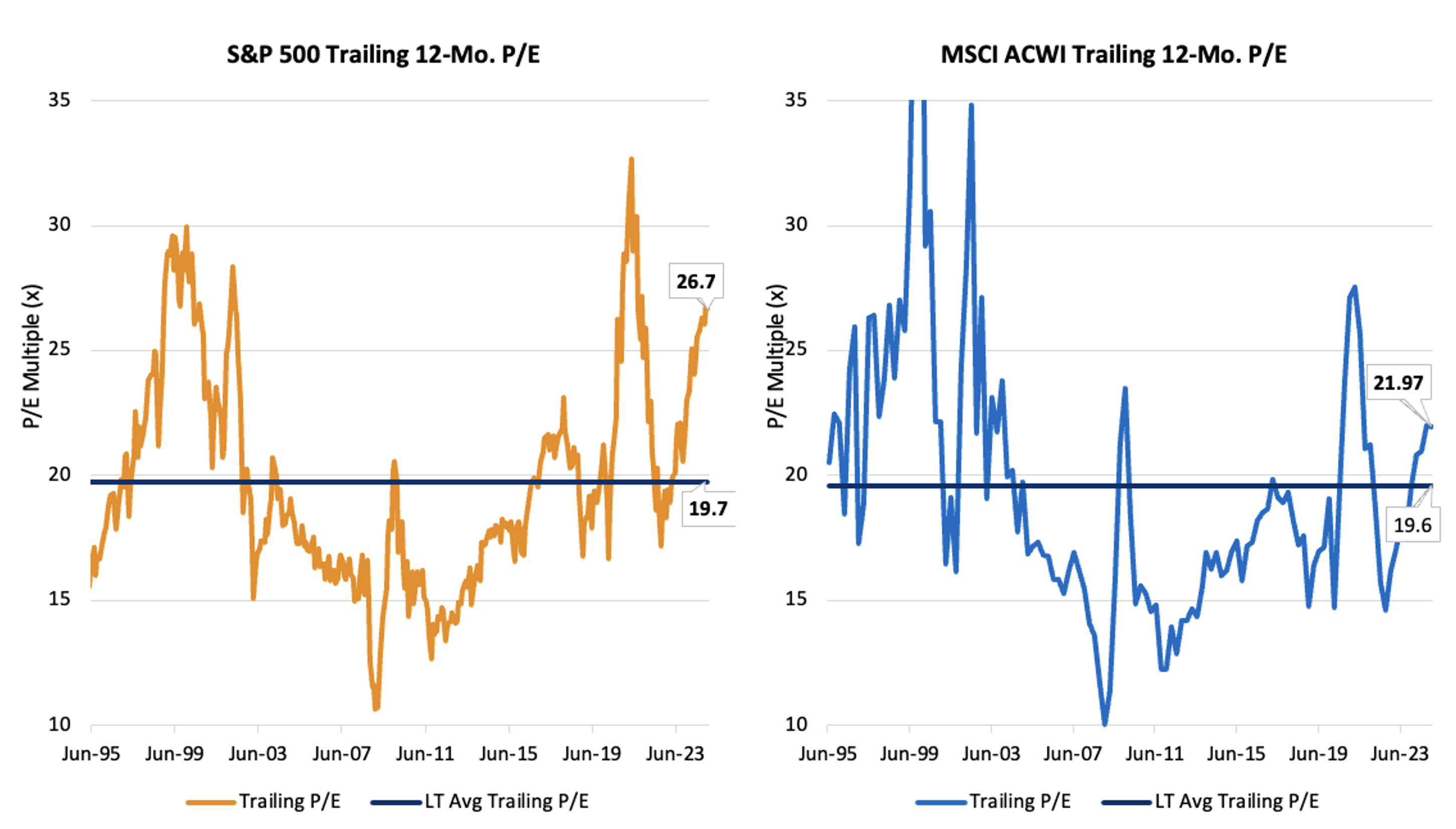

As a consequence of those expanded P/Es, and mindful of decelerating EPS growth, Figure 4. reveals trailing S&P 500 P/Es are relatively elevated compared to history, while the same P/E measure for the MSCI ACWI is marginally above its long-term average. For the S&P 500, 12-month trailing P/Es are at levels seen only during the late 1990s Dot.com bubble and the COVID-19 pandemic period.

Between December 2022 and May 2024, the U.S PHLX Semiconductor Sector Index (SOX) delivered extraordinary gains, far above those produced by IT services, software, hardware, and tech stocks in general. For the past nine months the U.S. SOX Index of semiconductor companies has treaded water, suggesting the GenAI hype is fading from markets.

Figure 4. Valuations above long-term averages

Source: Polen Capital

What does it mean?

First, it’s worth remembering that a correction doesn’t immediately follow elevated P/Es. Falling prices always start from higher levels, but higher levels alone aren’t a correction trigger. That depends on liquidity more than anything else.

Simply speaking, all this means is that the days of blindly buying the index and doing well (thanks to surging Magnificent 7 share prices) may now be a thing of the past, and experienced stock-picking will now make the difference in returns.

And the fact that the hype has come out of Magnificent 7 stocks, and particularly semiconductor stocks, should also be good for those portfolios seeking to generate returns from less-hyped sectors.

Whatever your expectations of 2025 returns, now is the time to conduct some attribution analysis of your returns over the last two years. We believe 2025 won’t generate the easy market-driven returns of the past year or two. This suggests finely-honed stock picking and fundamental analysis skills (and perhaps AI-driven idea generation) will come to the fore this year.

The Polen Capital Global Growth Fund own shares in Amazon and Microsoft. This article was prepared 17 March 2025 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Amazon or Microsoft, you should seek financial advice.