REA Group continues to deliver for long-term investors

Since listing in 1999, the share price of REA Group (ASX:REA) – Australia’s leading online property portal – has risen from around 50 cents to around $140. So you’d have been far, far better investing in REA than in the property market that it serves. REA continues to be one of the highest quality businesses on the ASX, and a slightly underwhelming third-quarter trading update has not changed my opinion of the company’s prospects.

We first described REA Group as an “A1” quality company here at the blog 13 years ago, on 24 June 2010, at $10.24, and here again on July 6, 2010, when it was trading at about $10.50. And we have been writing favourably about the company ever since. In that time, the share price has risen to as high as $180.00 and most recently trades at just under $140.00 or nearly 14 times the price at which we first advocated for the quality of the business.

That share price performance, as was highlighted back in 2010, is a function of the company’s quality, which we define as the ability to generate outsized returns on capital, AND the ability to retain and generate high returns on relatively large proportions of those profits.

Most recently, REA Group provided its trading update for the third quarter of FY23. REA Group noted a “challenging macroeconomic environment in Australia”, which was partly offset by continued strong revenue growth in India. It was also the case that the quarter was cycling a very strong prior corresponding period (pcp).

Core Australian revenue was down six per cent year-on-year. Nationally, listings are down a full 12 per cent. In the company’s major Sydney and Melbourne markets, listings are down 20 per cent and 18 per cent, respectively.

Listings are a primary driver of revenues for REA Group, whose website, it should be noted, attracts 125 million visits per month in Australia, over three times more than its nearest competitor. This means in tougher times, particularly when home vendors decide to list their house with just one platform, they are likely to choose Realestate.com.au.

Contrasting the softer domestic picture, REA India achieved revenue growth of 63 per cent year-on-year, thanks to 21 per cent growth in its audience there. The company’s adjacency products are also growing, partially offsetting the downward cycle in Australian national listings.

Third quarter total revenue came in at A$269 million, which was down three per cent on the pcp. Operating earnings before interest, taxes, depreciation, and amortization (EBITDA) (excluding associates) was $136 million, which was 13 per cent lower than the pcp.

For the first nine months of the 2023 financial year, group revenue of A$887 million remains two per cent higher than the pcp.

Importantly, consensus estimates for full-year revenue are circa $1.2 billion. To achieve this, fourth-quarter revenue needs to grow 16 per cent above the third quarter, however 4Q23 will be cycling very strong pcp listings volumes, suggesting analysts may downgrade their revenue forecasts for the full year and for 2024.

And adding pressure to the decline in revenues, group operating expenses of $133 million were up nine per cent on the pcp. But this is largely due to REA India investment and technology costs that were largely planned. Operating costs in the core Australian business grew three per cent in the third quarter.

Over the short term, the company is exposed to declining listings. And when prices are depressed, vendors tend not to sell unless they absolutely have to. For many the prospect of being forced to sell is dependent on jobs and the jobs market remains tight with unemployment extremely low.

For the time being listings will be under pressure. Indeed, for the month of April, new listings were down 24 per cent on pcp, and the major markets of Sydney and Melbourne were down 25 per cent and 22 per cent respectively.

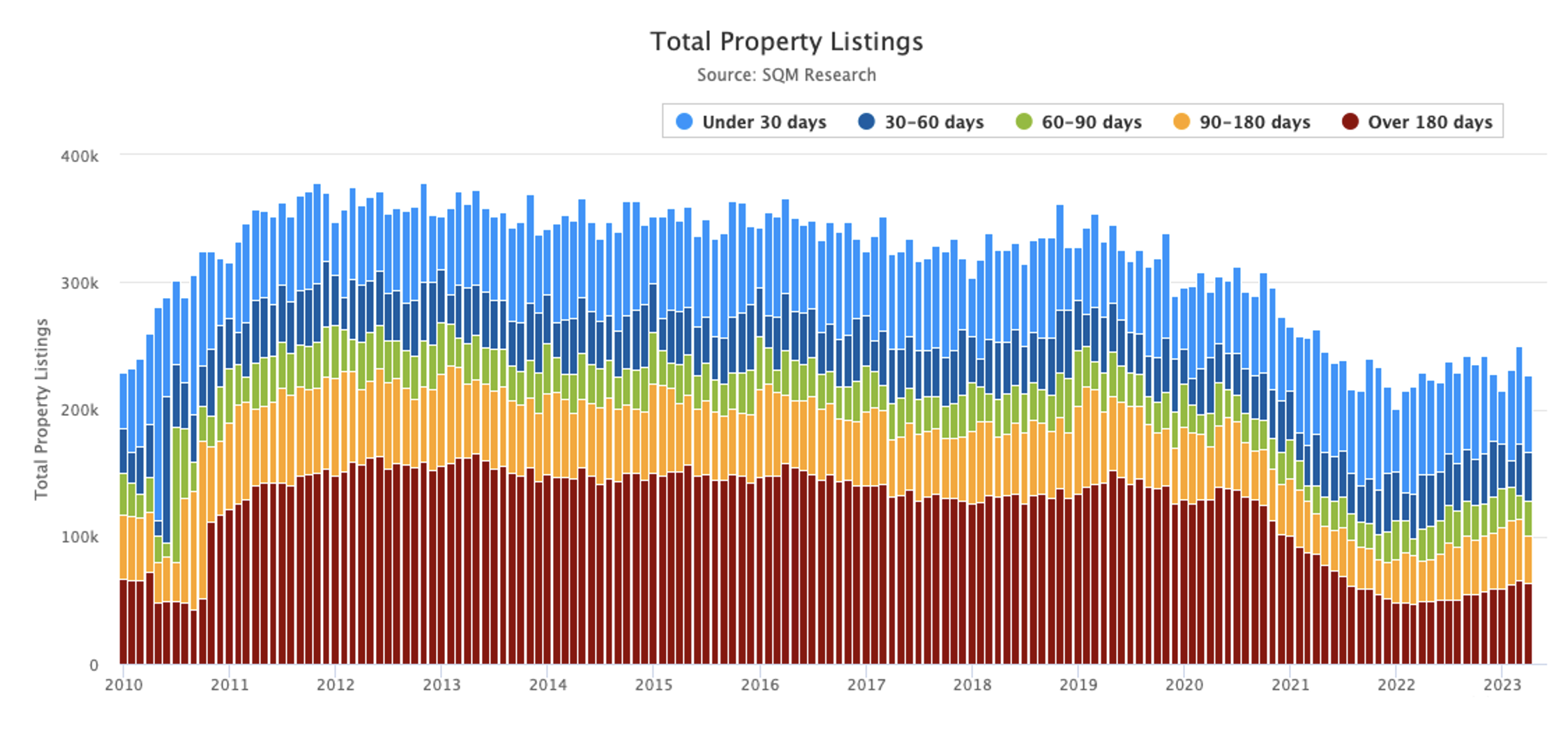

While a weak listings market is likely to destabilise analysts, investors should keep in mind it’s nothing new for REA Group. As Figure 1 reveals, declining listings have been occurring since at least 2010. And in that time, revenue has grown from $194 million to $1.1 billion in 2022.

Figure 1. Total Australian monthly property listings

Source: SQM research

The growth in revenue since 2010, is in no small part due to the company’s ability to raise prices (arguably the most valuable competitive advantage), which stems from its status as the most popular platform for selling property in its core Australian market. And that ability to raise prices remains undiminished.

Analysts currently expect the price REA Group charges for its core service to rise by about six per cent. Meanwhile, premiumisation (think Premiere+) will do likewise. Consensus analysts for FY24 estimate an average 12 per cent price rise in Premiere+ (which enjoys the highest penetration of REA’s product set).

Eventually, Australia’s property market will emerge from its current ‘funk’, interest rates will top out and confidence will return. When that happens, REA’s price rises will combine will a jump in volumes and analysts will be jumping over each other to upgrade their forecasts.

We have seen this cycle before and currently have no reason to believe it won’t be repeated.