Which Aussie stock will benefit from European QE?

Our good friends at UBS recently released a report with an interesting insight into the general market impact of the European Central Bank’s Quantitative Easing (QE) program.

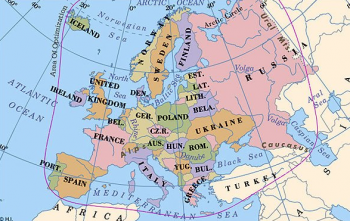

It’s easy, if not lazy, for Australian investors to simply think Europe, the European Central Bank (ECB) and Angela Merkel are all “over there”, and therefore not relevant to Australian investors, but that is not the case.

UBS notes, “The level of QE announced by the ECB amounts to about 7.5 per cent of Euro Area Gross Domestic Product (GDP). The public deficit this year in the Euro Area is expected to be around 2.2 per cent of GDP.”

In other words, not only is the ECB buying all the net new supply of Euro Area sovereign bonds, but it is also purchasing part of the existing supply.

“For the first time since WWII, the stock of public debt available for investors is declining.”

More bonds will be bought than will be issued and the total supply of bonds will also decline.

UBS adds, “By definition, investors will be crowded out of the fixed income market by the ECB action…the credit market is not large enough to absorb investments which means that the credit market could be heavily impacted and continue to rally. Also, part of the funds have to migrate to the stock market. We see that as unavoidable and as a very strong steady support for the European equity market.”

We currently tend to agree and had already uncovered, and invested in, an Australian listed company that met our criteria and was positioned to benefit from the lower-rates-for-longer scenario in Europe.

Henderson (ASX: HGG) is a global asset manager. For Australian investors, it’s easy to fall into the trap of thinking of Henderson as possibly just another small cap company. But with £81.2 billion of Funds Under Management (FUM) ($AUD159 billion), Henderson is similar in size to the CBA’s Colonial First State wealth management business here in Australia, and bigger than Westpac’s BT Investment management business with $70 billion of FUM.

Approximately three quarters of both Henderson’s headcount and FUM are based in the UK. The company also has a presence in Europe, North America and Australia and at December 31, 2014, Henderson had £81.2 billion FUM (60 per cent retail/40 per cent institutional): 63 per cent equities, 26 per cent fixed income, 10 per cent property and 1 per cent private equity.

Interestingly, around half the equities exposure is in European equities, which could benefit from the ECB’s version of QE as outlined above.

Based on our preliminary work, we currently believe Henderson is an attractive long opportunity for three reasons:

- The current share price implies approximate market rates of FUM growth – essentially implying no new net flows. This is surely conservative and would very much buck the recent trend of strong flows.

- The strong exposure to European equities is well positioned for the ECB’s version of its own QE program. And,

- As the majority of Henderson’s earnings are denominated in British pounds, the stock remains largely protected against a weakening Australian dollar.

Furthermore, higher flows have stemmed from the retail channel in 2014 and these have a higher revenue margin (circa 74bps) versus institutional (circa 31bps). The first half of 2014’s average management fee was 58bps, up from 56bps one-year prior. In the second half of 2014 profit before tax was up 26 per cent year over year and growth in net fee income was up 15 per cent year over year.

If we were to assume an increase of FUM to circa £126billion by financial year 2018 (as per the company’s strategic plan), then we estimate the stock is worth A$6.40. There is some reinvestment occurring as part of the strategic plan, which means we may not see the benefits of the operating leverage for a year or two. Debt repayment may also mean high levels of capital returns to shareholders.

In an otherwise expensive market, it is difficult to locate higher quality businesses, with a rising tide underneath them and still offering some value.

Be sure to seek and take personal professional advice and be aware that The Montgomery Fund and The Montgomery [Private] Fund are both holders of Henderson.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

BRONTE DUFFY

:

Hi Roger,

Enjoyed your article on HGG, but was disappointed when I went to my Scaffold site and found there was no research on HGG.Following your guidelines I am not prepared to invest without a Skaffold score and an intrinsic value.Can you please help!

Regards,

Bronte

Roger Montgomery

:

You should find it listed under the London Stock Exchange, which is available on Skaffold. It might have something to do with the fact that the Australian listed securities are not Ordinary Shares. Please send an email to the team at Skaffold if you have any further questions.

Kelvin Ng

:

Hi Roger, thanks for the article.

Your logic is impeccable if the eurozone holds together, but not if it doesn’t. If it doesn’t, there will not even be an ECB. So that is the black swan event that nobody thinks will happen.

Kelvin

Kelvin Ng

:

Hi Roger, I might add that this isn’t all going to unravel imminently – but if you’re in HGG for more than a short term trade, be careful from 6-12 months from now.

Kelvin