Are negative interest rates having unintended consequences?

When it comes to interest rates, these are strange days indeed. For starters, think about this: if you were to lend 100,000 Swiss Franc to the Swiss Government for 50 years, you’d yield a return of 98,500 Swiss Franc in 2066, given the interest rate of minus 0.03 per cent.

You’d get a similar return lending money for 10 years to the German, Dutch and Japanese governments.

Low interest rates were supposed to help dig us out of an economic hole. But I believe evidence is mounting that the historically low/ negative bond yields may in fact be influencing the anaemic prospects for economic growth, as central banks have largely forgotten the affect their interest rate policies are having on the increasing portion of the population who are retired, considering retirement or who are (self) classified as fiscally conservative.

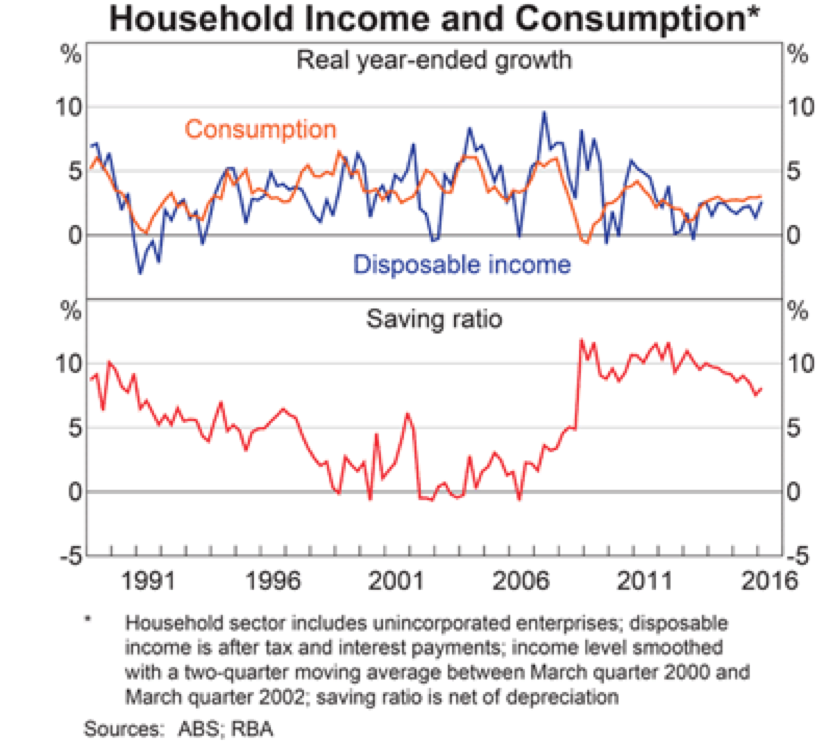

This portion of the population has never felt poorer from a cash flow standpoint as the (relatively) risk-free return on their cash and cash equivalents dwindle to near nothing. And hence they (we) are spending even less and saving more, despite the popular Keynesian concept preaching that the record low interest rates should be encouraging us to do the opposite.

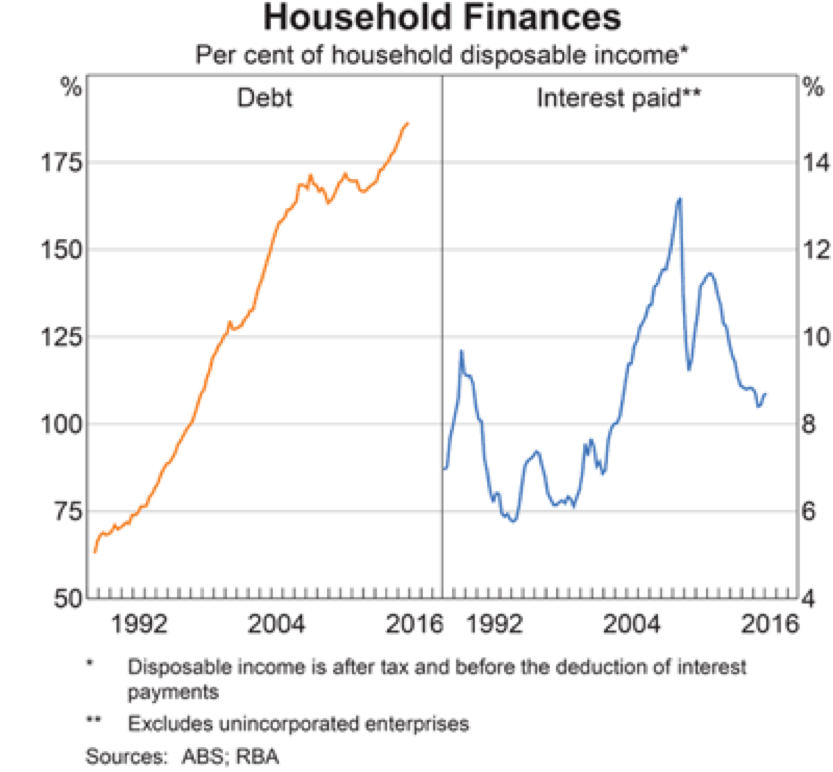

Meanwhile, Australia’s household finances are in poor shape. When measuring the percentage of household debt to disposable income, this ratio has tripled from around 60 per cent to 180 per cent in the past 25 years. If interest rates ever normalise, or unemployment ever seriously rises, or housing values ever come down, then look out! Balance sheet repair mode will become the order of the day, and consumption will come under increasing pressure, while savings ratios will increase and corporates will go through another round of cost cutting.

And as the US share-market hits another all-time high, I would like to remind readers of two remarkable features of US stock returns.

One, while the US stock-market has delivered an annual return of between negative 22 per cent and positive 30 per cent 90 per cent of the time, the average real return of 6.5 per cent annually has been surprisingly stable. (This is also known as Siegel’s Constant after Professor Jeremy Siegel, of Wharton); and

Two, although returns from the US stock-market have been highly variable and risky over the short term (negative 22 per cent per annum to positive 30 per cent per annum, 90 per cent of the time) they have not actually been risky over long term time horizons as might have been expected.

Put simply, high quality stocks with good prospects at a reasonable price will continue to serve investors well over the longer term.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Jason

:

Much of the previous growth phase was unsustainable. When it is riding the back of falling interest rates and increasing debt it can not continue indefinitely.

My opinion is things will muddle along for the foreseeable future as they have been. Interest rates low, in aggregate very little earnings growth and heavily indebted balance sheets at the personal and government level.

The only way to repair balance sheets and raise interest rates is the major world governments agreeing to giving inflation a major kick along in a systematic or coordinated fashion. Lowering interest rates won’t do it so maybe something like boosting public sector wages, encouraging corporations to do the same, cash top ups to existing savers in coordinated steps.

Is it really that bad to muddle along as we are for the next 20 years? Presumably many retirees have been forced to switch out of cash and into shares for the dividends. Raising interest rates and the likely drop in share prices may hurt them just as much or more than low interest rates.

I do think a system that rewards borrowers and punishes savers is seriosly flawed.

David Buckland

:

I agree Jason.

Thanks for your comment.

Tristan Harrison

:

Do lower interest rates help, hinder or not really affect Challenger?

David Buckland

:

Falling interest rates impact Challenger’s earnings in 2 ways. 1) Increases the value of the existing fixed interest assets it holds as asset backing and investment income for the annuity products it has sold. Offsetting this benefit is the increase in the present value of the annuity liability in its balance sheet as a result of a reduction in the discount rate used in determining the present value of the liability. Challenger looks to match the duration of its assets and liabilities.

2) The other factor that needs to be considered is the lower rate of return Challenger is likely to earn on assets in future. As a result, the price of its annuities needs to change to reflect the lower future returns, impacting the annual income a purchaser of its annuities will receive for a given investment. This could make its annuities less attractive to new investors, resulting in lower sales growth for Challenger. However, lower interest rates are likely to impact the rate of return of other substitute products, such as term deposits. The impact of lower interest rates on the attractiveness of annuities and in turn on Challenger’s sales growth needs to be framed relative to other income generating products.

Hope this helps

Tristan Harrison

:

Hi David,

Thanks for taking the time to answer my question, it does help, thanks for explaining.

I appreciate you (and the team) writing these very informative articles.

Tristan