Why this market downturn is a great time to invest

After two years of largely uninterrupted asset price gains, January provided a rude awakening for many investors, as equity markets around the world took a tumble. And it wasn’t just profitless tech stocks that took a beating. Caught up in the carnage were some high quality businesses that saw their share prices crimped – and which now present compelling value.

A combination of persistent elevated inflation (headline CPI posted the largest year-over-year increase in December since 1982) combined with intimations of softening economic growth, and a hawkish reading of the US Federal Reserve’s minutes, were enough to see many high-flying tech stocks de-rate considerably, pulling the rest of the market lower.

The December Federal Open Market Committee Meeting (FOMC) minutes were released in early January and revealed committee members believed economic, labour and inflation conditions warranted raising interest rates sooner and faster than the market had previously anticipated. Of course, the irony is the market had anticipated rate rises at some point, so presumably the sell-off would have occurred eventually anyway. Clearly many investors were on the dancefloor, oblivious to the fact the band was packing up.

Importantly, the FOMC minutes also revealed a faster intended pace of Quantitative Tapering (aka balance sheet runoff).

With interest rate rises set to commence as early as March, and central banks’ cash spigots turning off, investors concluded the party must be over and rushed for the relatively narrow doors.

The consequences include a near-record number of Nasdaq stocks hitting 52-week lows, more than 40 per cent of Nasdaq constituents down more than 50 per cent, a record number of put options being traded in the US on a daily basis and the lowest amount of money allocated to technology stocks since the depths of the GFC, 14 years ago.

It’s good news for investors.

As I have often noted, a 10-15 per cent correction is ever-present and when indices fall by that much, you can be sure some individual sectors and stocks will fall much more. Those falls present investors with the opportunity to pay lower prices for excellent businesses that may have been recently out-of-reach.

Many decades ago the late Ben Graham suggested investors buy stocks like they buy groceries: buy more of your favourite item when on sale. By way of (recent) example, I have always fancied the Australian-made Rhino storage and toolboxes available at Bunnings but I could never stomach $129 for a plastic moulded box. In January, Bunnings held a sale for those same boxes and they were just $30 each. I bought all three on the shelf. Investors should buy stocks the same way, holding out for attractive prices.

Businesses v Stocks

The January sell-off provides a timely reminder the stock market is where we buy businesses. The economic performance of those businesses tends to be much less volatile than their stocks. That volatility provides opportunity. Businesses create value by generating profits, retaining those profits and growing the equity on which they generate further earnings growth. The higher the rate of return on equity, the higher the profits for each dollar invested and the faster the equity can grow when profits are reinvested. And business with a competitive advantage can sustain high rates of return on equity for a long time and the earnings can continue to compound. Of course, in the short term – especially when short term fears replace long-term investing plans – share prices can disengage from the underlying fundamentals, economics and potential of a business. It is during these periods, investors should be sharpening their pencils because, eventually, the share price will reflect the value the business is creating through the process of generating and retaining profits.

Of course, it remains a fact that interest rates act like gravity on the present value of future cash flows. Therefore, each dollar of future earnings is worth less today when interest rates are expected to be higher.

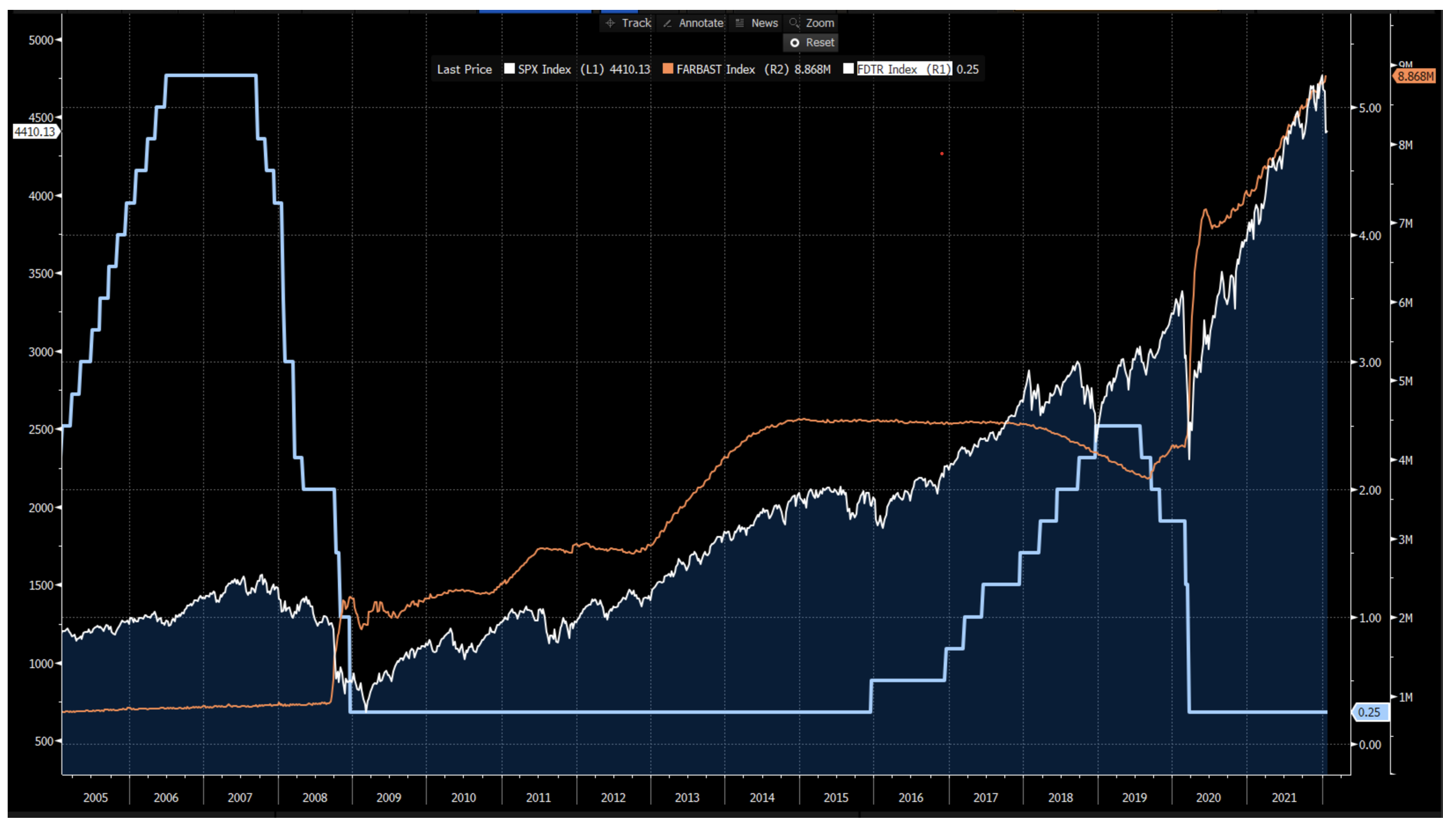

Figure 1. Fed policy impact on market. A little less conversation a little more action please.

For what it is worth, I remain unconvinced that high rates of inflation will persist. Companies have invested record amounts in automation and union representation around the world is lower than at any time in modern history. The upshot is that wages will eventually be under pressure again and given the very high levels of household debt, a few short and sharp rate hikes may be all that is necessary to put the inflation genie back in its bottle.

Moreover, take a look at the performance of the S&P500 between 2015 and 2018 (Figure 1.). Short term rates were lifted nine times and yet the market rallied. Provided (and this is the key) you own companies that are high quality, growing and increasing their intrinsic value, then even rising rates won’t be enough to keep the share price from eventually reflecting its worth.

As I write, the market is already rallying hard and I for one am not surprised. Keep in mind the assets that have been falling are not held on the balance sheets of systemically important financial institutions. By that I mean to point out that any equity market rout is unlikely to lead to a financial crisis. A good old market correction – contained to equity markets – should therefore be seen as an opportunity to add or begin investing.

Above all, remember one thing: the lower the price you pay, the higher your return.

You may also want to read: Why it’s time to capitalize on the carnage in tech stocks

No one really knows with absolute certainty. However, when we look back in 12 to 18 months time, we will.

Buffet’s been a net seller for the past four quarters. Jeremy Grantham says we’re living through the biggest bubble history has ever experienced and Terry McCrann thinks the Dow at fair value is 20,000. My stops are taking me into cash and I don’t think stocks like TNE (great company) which has fallen 24% from its high but is still on a trailing PE of 45 is any great bargain. Unlike you, I am struggling to find value even after the recent correction. I read your excellent article about Black Swan events, Roger, but not all crashes are preceded by them. One of history’s nastiest crashes was 74/75 when the market ground relentlessly down day after day all but destroying hope … there may have been a Black Swan event but if there was I don’t recall it. That said, I don’t disagree that the huge almost instant crashes overnight are the result of Black Swan events but that doesn’t mean the ‘slow grinders’ should be discounted. Some are predicting five interest rate increases in the U.S. this year … if that occurs, batten down the hatches.

Good thoughts Peter, thanks for sharing.

Fantastic article!