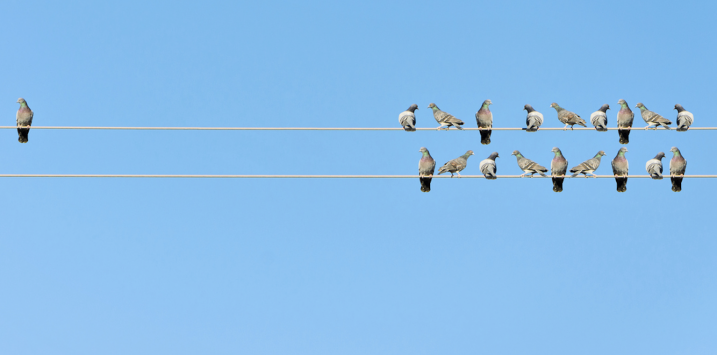

Why investing in index funds and blue chips is for the birds

Investors are being increasingly lobbied to buy funds that track one or more share indices. These index funds are being marketed as a safe, idiot-proof place to diversify your investment. People who are attracted to index funds are also commonly drawn to the so-called ‘blue chips’. But recent research shows this type of ‘investing’ is anything but safe.

EXCLUSIVE CONTENT

subscribe for free

or sign in to access the article

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger,

I agree with your views on the risks in passive investing and index funds for this period in history.

I have also been educating myself for quite sometime about the many facets of the investing universe from many sources with different view points. After all that, I find myself restless in following the general investment advice to stick your money into a low cost index fund of the equity market and just stick it out for the long term with your fingers in your ears. I’ve just started to read ‘The Intelligent Investor’ and the way Benjamin Graham explains the downside of this (and periods of history where it would have taken over a decade to recover after a proper correction) was a revelation. He was also very balanced not to say it’s wrong or right, but that all decisions have upsides with downsides and that it was a matter of the investor’s individual choice and preference with what they could tolerate.

As such, I am planning to allocate funds to active funds in the value investing area. Valuing investing since as a businessman myself, I actually understand what you are doing!

However, I would like to hear more about your views on drawdown risks of active value investing funds such as The Montgomery Fund vs a passive index fund. All of the whitepapers i’ve read compare active funds to the index. But not the different types of active funds to the index. i.e. active value investing funds vs the index.

Also, what are your views on drawdown risks and performance of active value investing funds vs a risk parity all weather fund such as the one from Bridgewater?

For this moment in time, I think there is too much focus on the downside risk of underperformance vs the index and not enough focus on the downside risk of drawdowns. This is especially important if you are unlikely enough to be entering into the market at the top. The question should not be if active outperforms passive in a rising market, but if active can minimise drawdown in a falling / sideways market while capture performance where possible.

Is it possibly a little misleading to select a few “star performers” as representative of the whole class?

How has the index fund performed vs your stock picks (Healthscope, REA, Vita group, Isentia) in the past 12 months? There’s a reason why people have diversified portfolios- ETFs are low cost and avoid stock picking issues. Given most fund managers can’t beat the index, why wouldn’t you back an ETF?

Bazza, yes you are spot on. It is hopwever unreasonable to expect the shares of even the very highest quality companies to rise every day, every week, every month or every quarter or year. We don’t propose to be able to predict share prices. Identifying quality and a margin of safety is not the same as predicting the share price. Over the last ten years BHP has seen its profits decline despite shareholders doubling the amount of equity they contributed to the business and despite debt rising by 250%. You would not be enjoying the experience of owning that business outright. On the other hand REA has seen its profits rise 16-fold over the last ten years. You would definitely have enjoyed owning it outright over the last decade. Perhaps suprisingly however, the share price of REA has been flat over the last twelve months and the share price of BHP has risen more than 70% over the same period. But should you take your cue from the one year move in prices? Porbably not. You see, over a decade REA’s share price is up 1800% while BHP’s share price is up just 9%. Go ahead and reinvest the divvies and you’ll find the difference even more dramatic. You might find watching this video useful: https://montinvest.wistia.com/medias/fbjk73epp1

Hi Roger, with all due respect, a key issue with investors investing with an outstanding fund manager (usually a boutique and independent such as yours) is the key person risk. If the star fund manager gets hit by a bus (touch wood), then the funds are redeemed at the net asset value which might be a time of a market correction. At least with an index fund, the investor is not faced with key manager risk?

Key man risk is a big issue for investors, which is why we have 18 people, three portfolio managers and all exceptional talents so its not an issue at Montgomery.

Unfortunately there are lots of fund managers that underperform the indices. That being the case, some people are attracted to the much lower fees of ETFs. Personally I feel there is a place for both good active fund managers and ETFs in my portfolio.

What I find fascinating is that the dominating feature of the graph above is the period from 1970-1990 which isn’t one of the great “crashes” that appear so dramatically on a graph of the All ords not corrected for inflation. It is also interesting to compare this graph against one that accumulates dividends such as this one: https://cuffelinks.com.au/hold-champagne-thats-recovery-yet/

The fifties were pretty poor as well, as was the period from 1914 onwards, both periods of high inflation. I don’t think this is a co-incidence. It is almost as if the stock market just ignores inflation – probably because the whole machine is focused on the index value – something to remember when we eventually return to a period of higher inflation.

HI Roger, don’t these graphs ignore reinvestment of dividends? If you kept reinvesting dividends back into these indexes then the return over the same period is far higher.

Hi Kobe, Yes and we would also then add reinvested dividends to the ‘Montgomery’ blue chips and the comparison is even more dramatic. $100,000 invested in TLS in 2005 has seen dividends grow from $5800 to $6500 in ten years. Over the same priod of time M2 saw annual dividends grow from $3900 to $98,000.