Why I think share markets will boom in 2021

As 2020 draws to a close, the finance world is awash with market commentators making bold predictions for the year ahead. For what it’s worth, here’s mine: I think 2021 could see a surge in asset prices driven by the rollout of a COVID-19 vaccine, loose money supply and pent-up consumer demand.

Imagine a world with a vaccine that allows everyone to return to living a normal life, releasing a burst of economic activity, and unlocking pent-up demand. Now imagine a world with as much as 20 per cent more money supply!

Broad money supply is up 8 per cent year-on-year in Germany, 10 per cent in China, 12 per cent in Australia, 18 per cent in Canada, 15 per cent in the UK and 25 per cent in the US.

In Australia, we are entering our summer holidays with little or no community transmission and a vaccine on the way. Interest rates remain low, bank credit is being loosened and fiscal policy is accommodative. All the ducks have lined up to give Australian investors a foretaste of what the northern hemisphere will experience in a few quarter’s time.

What worried investors need to remember is that the Northern Hemisphere is in winter and in COVID-19 lockdown. The UK and Europe are experiencing a second or third wave of infections. They have the optimism of a vaccine, but they are still experiencing the fear of infection. Hospitals in the US are at capacity. More people are dying each day in the US than were killed in the Twin Towers tragedy.

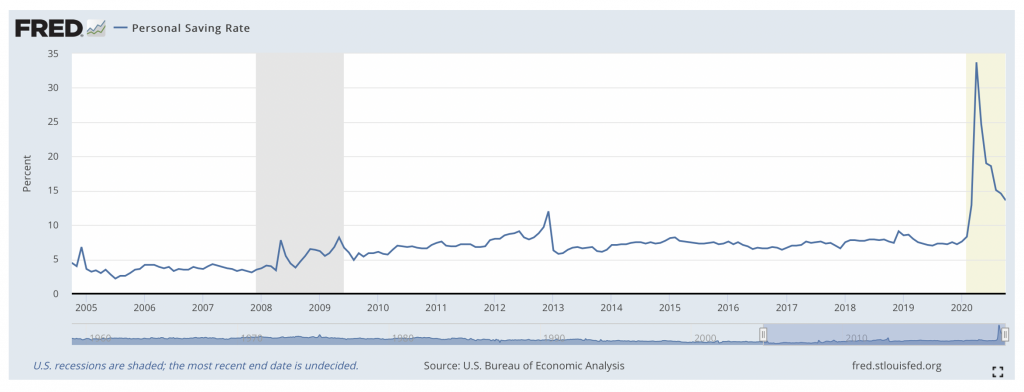

Consumption of services and entertainment are therefore still subdued. But they will rebound. The savings rate has surged (Figure 1.) indicating pent-up demand.

Figure 1. US Personal Savings Rate

Source: St Louis Federal Reserve

What we are experiencing in Australia will be experienced by our northern hemisphere friends, perhaps during their summer, and that optimism could result in a surge in the stock prices of many companies exposed directly and indirectly to the sectors of the economy that are beneficiaries of an overfunded return to normal.

The 2021 recovery

We also tend to agree with analysis that suggests the 2021 recovery will be very different to the dawdling economic revival that followed the GFC. In 2010 the global economy was dogged by a desperately impaired banking system, persistent deleveraging, and a collapse in fixed asset investment in the Middle Kingdom. The consequence was sub-par growth, fears of deflation and a commodities correction shortly afterwards. In contrast, today, the world economy has recovered quickly but fiscal and monetary policy still reflects fears of a ‘double-dip’ recession. The combination has, in the past, driven material increases in asset prices.

Low interest rates, massive money supply escalations and accommodative fiscal policy should ensure much of the existing gap between capacity and production closes.

Normal life is expected to return ensuring the most recent crisis is as transitory as the one that preceded it. Booms in travel, parties, weddings, honeymoons, cruises and all forms of entertainment from concerts to casinos is a distinct possibility. And remember, there is a significantly larger supply of money and more accommodative fiscal policy to fuel it all.

The die appears to be already cast – retail sales in the U.S. and Europe have not only fully recovered but are reaching new heights. Meanwhile liquidity from central banks and governments is in overdrive. If there were ever conditions to promote a boom in property and stocks, we appear to have them in place now. Current sell-side consensus estimates could significantly underestimate the recovery for some companies. How it ends remains to be seen but for now, it appears carefully selected investments that are exposed to M&A, a switch in spending from goods to services and demand for income could prove prescient. Investors might start by examining enterprise values (EVs) today against the EVs just prior to the COVID-19 correction. Where upside to growth and recovery remain, but share prices have yet to recover there may also be value.

Sorry Roger. This virus is going to continue to provide frequent shocks and shutdowns.

The vaccines are not going to create rapidly expanding tourism or markets.

The effects of business shutdowns has not fully flowed through. The effect of MMT with governments printing money and destroying our futures (Zimbabwe, Argentina) is not being accepted or acknowledged.

There’s little value in an overpriced , hyper expectant market.

Signed,

Dinosaur

I have plenty of sympathy for that view David, and I am prepared to change my view at any time. There is no doubt in my mind that there will be a reckoning, but I think not yet…