Who wins when US yields go higher?

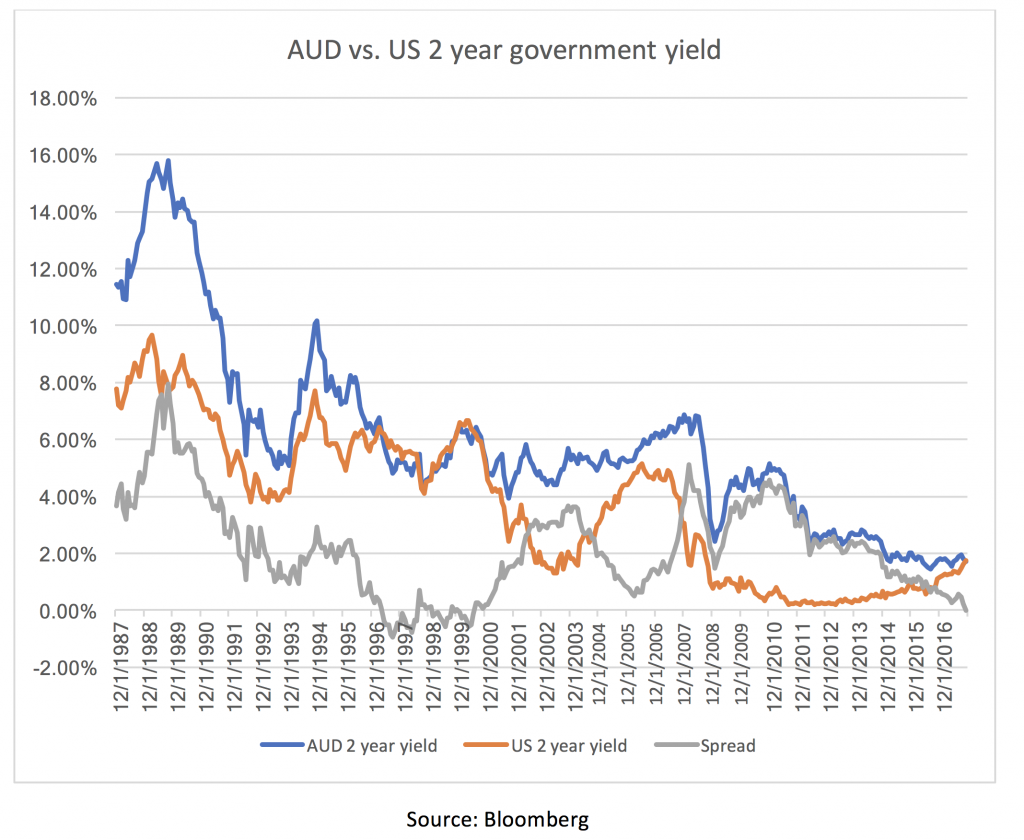

For the first time in 20 years, 2-year US government interest rates have gone above 2-year Australian government interest rates. This is a significant turning point, and could signal the start of a new economic phase. Australian investors will need to be mindful of the consequences.

Australia has generally always had higher interest rates than the US which has helped stimulate foreign investments into Australia by investors seeking yield and also to compensate for the less diversified economy of Australia vs. US.

So, what is happening now that is causing this to reverse and what are the potential outcomes?

Let’s start with what is causing the spread to reverse:

- The main reason is that US Federal Reserve started tightening in December 2015 and has since increased the Federal Funds Rate target 4 times to the current level of a range between 1.00-1.25 per cent while the RBA has in the same time period cut their cash target rate twice and is currently at 1.5 per cent.

- Even though the Fed Funds Rate is still below the RBA Cash Rate, there is also an anticipation that the Fed will continue to tighten as economic conditions in US continues to improve on back of strong asset markets, proposed tax cuts, recovering housing market and good consumer confidence while the consensus is that there is little chance that the RBA will tighten policy anytime soon on back of a peaking housing market, high consumer debt levels, weak consumer confidence and rising energy prices.

While there are many different implications from this trend, some of the more likely things we expect to play out are:

Scenario one. If RBA holds rates steady:

- Investors that are seeking yield (insurance companies, retirees or anyone who is dependent on a steady cashflow stream) will probably look more to US than to Australia if they can get a higher yield in a more diversified economy. This will have implications for companies that run heavily leveraged business models (e.g. banks and other financial companies etc.) that rely on easy access to capital to fund themselves.

- Interest rate parity suggests that this should be negative for the Australian dollar over time. This is good for Australian exporters with Australian dollar costs and foreign currency income as they get a free margin boost and bad for importers and retailers as it will make foreign goods more expensive in Australia so they will either face declining demand or a margin squeeze.

- It is a positive for the domestic property market as it makes Australian assets cheaper for investors in foreign currency which might provide some support but we note that several Australian states have recently imposed penalty taxes on foreign investors potentially negating this effect.

Scenario two. If RBA raise rates to defend the AUD:

- Rising rates would very likely have a very negative impact on the domestic property market as it is already starting to turn down and higher funding rates for the banks would likely be passed on to borrowers.

- This would in turn have a very negative impact on overall consumption as the wealth effect we have seen the last years from rising property prices goes into reverse so again negative for retailers and also negative for construction as property developers are less likely to construct new buildings in such an environment.

As you can see, both scenarios are pretty negative overall. As we have written about before, the Australian economy has been driven by access to cheap credit and increasing leverage and rising interest rates in other market means that access to credit will be reduced in Australia one way or the other.

We believe that scenario one is the more likely at least in the short term as the RBA is unlikely to want to be blamed for any dislocation in the property market. Coincidently we are overweight exporters and generally underweight financial companies.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

If the banks have borrowed in USD in offshore markets and say at 80c and now the AUD drops to 65c, would that not increase the repayments as they have to be made in USD, which in turns to higher mortage rates anyways

Hi Rajneesh,

Your logic is correct but banks most often hedge out the currency risk by entering into a matching forward contract at the time of borrowing so the increase in repayments will be matched in gains on the forward contract.

The only justification for reducing the cash rate to these emergency levels was to reduce the interest rate differential and protect exporters from a high AUD. If the RBA doesn’t increase along with the fed we’re going to be left up the creek without a paddle just at the time when the economy actually needs a rate reduction.

I Like the article and agree with the 2 main points. But if we go down scenario 1, with Foreign property applications down 60% yoy already and an apartment oversupply, I don’t think the cheaper AUD bringing in more foreign ownership outweighs the funding squeeze on banks as funds run overseas. I think either option puts property under duress and the 2nd would be worse.

Hi Laurent,

Fully agree! Scenario 1 is only positive compared to scenario 2. We have been very clear that we see the property market as overvalued and due a correction.

I note that general consensus in the media is that interest ratesin Australia arent moving due to the significant level of debt on Australian households and a lower Australian dollar is a positive for the Australian economy and our exporters but the following factors are not really considered.

1. We export mainly commodities which tend not to benefit as much as commodity prices which are quoted im USD adjust downeards to reflect the strength of the USD and if you exclude the impact of commodity exports this country is a significant net importer hence the “structural” issues in our balance of payments.

2. The first point flows into the second point that should the outlook for the Australian economy continue to deteriorate and the gap widen with the US economy and the RBA has now been pushed into a corner where they cannot raise rates of their own accord and a potential capitulation of the aud looms as a real threat. This will them cause items such as fuel and other basic imports to become significantly more expensive. The effect of which is twofold where households may not be able to handle the burden if increased cost of living and the RBA all of a sudden has an inflation problem on their hands.

So whilst it may appear all is smooth sailing for Australian interest rates I believe that rising interest rates in the US will force the RBAs hand here in some way or another. The housing market does not seem to be pricing in any risk of this occuring.

Hi Matthew,

Thanks for your observations. I agree, it would be better long term if the RBA did start to raise rates in line with the rest of the world as if not, they are just prolonging the inevitable and then it will hurt even more when it eventually happens.