Which sectors could suffer if we cut our reliance on China?

China is Australia’s largest trading partner, taking almost one-third of our exports. But, after repeated economic actions – such as the imposition of high tariffs and import restrictions on some of our goods – it’s clear we need to reduce our dependence on China. In the short to medium term, that could be painful for some sectors of our economy.

One of the very few things that I agreed with Donald Trump on was that the western world needed to take a different and harder approach to China and the Chinese Communist Party (CCP). The exact tactics that the previous US administration took to confront the rising threat that the CCP represents to western democracies can be debated, but to me it is clear that it has started a chain reaction that will continue for a long time to come and that is in my mind a clear positive.

The atrocious things that are currently happening in Hong Kong, a city that I lived in for three years and where I still have quite a few friends living, is indeed frightening for anyone who believes that democracy in one way or another is the preferred way for people to organize their society. It also sets an extremely bad precedent for the people of Taiwan who now firsthand can see the way that the CCP would handle a reunification and I am sure that there is hardly anyone in Taiwan who would be in favor of this setting up the scenario for armed conflict in the future.

From what I can see, it seems like President Biden has continued the hawkish path on China and given that he is very much more accepted and welcomed by other western democracies than his predecessor, it is now easier for Western European leaders to take a similar approach as they no longer have to worry about upsetting their own voters by being seen to emulate Donald Trump.

Less than three months ago, China and EU agreed on a “Comprehensive Agreement on Investment” (CAI) that was designed to lower trade barriers and give EU companies greater access to the Chinese market. The CAI has not yet been ratified by the EU parliament and now it looks like this is not going to happen anytime soon after China blacklisted five members of the European Parliament and its sub committee on human rights after the EU imposed sanction on certain Chinese officials over the deplorable treatment of Uighurs in the Xinjiang province.

The rising tensions between Australia and China are probably well known to readers but it is to me encouraging to see the EU also stepping up their criticism of the CCP and I cannot see an easy way that tensions will subside as long as Xi Jinping is in charge in China, which after him having removed any term limits in 2018, could be a long time.

This was one of the predictions I wrote about back in September last year and I have to say that this scenario looks even more likely now and this will have a large number of long-term implications. I will not try to list all the implications but some of the most obvious to me are:

- Entire supply chains will have to be reconfigured as the reliance on China has become way too large for many industries. This means increases in capex to rebuild manufacturing capacity in new places and potential increase in costs leading to either overall margin compression or inflation in many sectors.

- Continued trade tension between China and the rest of the world which means continued periodic tariffs and import restrictions on certain goods. This will be painful for certain sectors in Australia given our high reliance on China as an export market; but as most of Australia’s exports are commodities, there are, by definition, alternative markets to sell to as if China does not buy from us, they will buy from someone else and we can sell our exports to the people who previously bought from that “someone else”. It might mean higher logistics costs and potentially lower prices but that is a price worth paying to reduce the dependence on one (unfriendly) buyer of our goods.

- More concerning for Australia is that China will likely try to transform their economy from infrastructure construction driven to service and knowledge driven. This will in particular lead to lower consumption of iron ore which could indeed hurt Australia’s export income as other countries are unlikely to step up infrastructure investments to the same extent that China is likely to reduce.

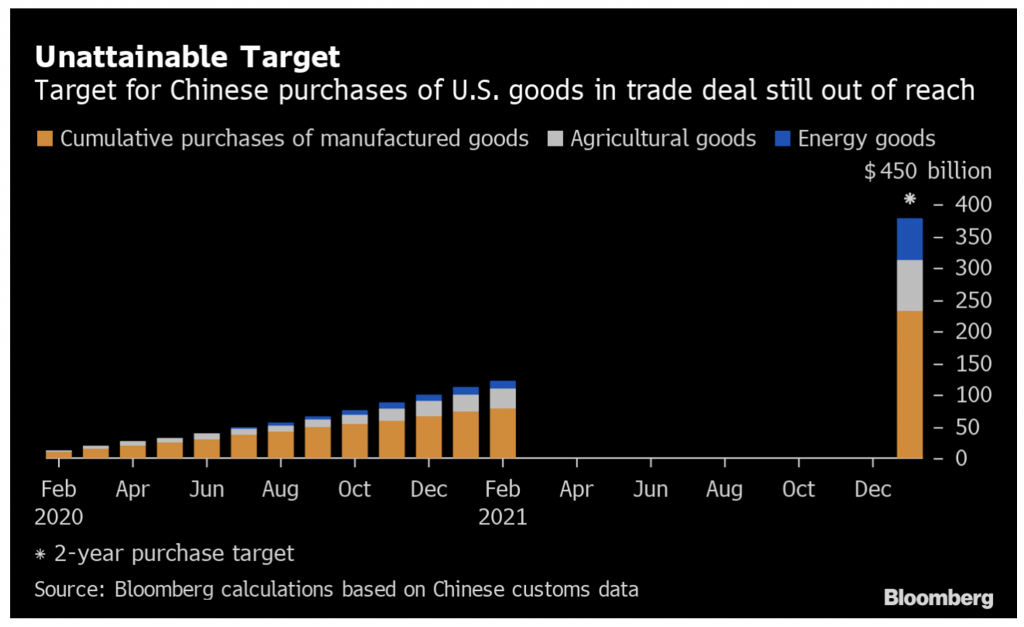

- Even if there are trade deals done with China, we should not expect China to stick to their part of them as we can see from the results of the US trade deal from a couple of years ago where China has so far purchased only about one third of the targeted amount as Bloomberg’s calculations show in the chart below (I acknowledge that this is partly impacted by COVID but it is still a long way behind):

- Sectors in Australia that rely on Chinese tourists and Chinese students will likely be impacted as China either encourages their students to holiday and study at home or in a country that they have better relations with.

It is clear that a transition away from China dependence will be painful for certain sectors but I see it as inevitable and in the long term good for Australia. It is though something that has be taken into account in investment decisions.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY