Which is a better investment – property or shares?

After a previous post on negative gearing, a reader asked us what an investment property would look like from a company value analysis perspective. Good question. Here’s my attempt to answer it. You may find it useful when considering your next investment decision.

To start off, I would like to point out a fundamental difference between a company and an (existing) investment property:

• A company generating excess operating cashflow above the cost of servicing its debt and the cost of replacing the assets that does not have an infinite life has the choice whether to pay out a dividend now and provide its investors a direct return on their investment or to reinvest the excess cash into the business and eventually pay its shareholders a higher dividend. If the incremental return on such investments is in excess of the cost of equity for the company, shareholders should be supportive of the company doing so as the additional amount of cash they will receive at a later date is high enough for them to forgo the immediate receipt of a smaller amount of cash (i.e. the discounted value of future cash receipts is higher than the current value of the cash).

• Conversely, for an existing investment property, there is not much reinvestment that can significantly increase the value of the property directly (a renovation like a new kitchen or bathroom should in my mind be compared to maintenance capex for a company). The reason for this is that a property is not a productive entity in the sense that it does not take an input, adds value to it and then sells it for a higher price that reflects the value added and is hence not able to deploy incremental capital in the same way as a business, but is a stable asset providing a basic need that does not change over time (shelter).

• What an investment property provides is instead an income stream in terms of the rent it can generate plus any potential change in its value which is driven by investors’ increasing appetite for income and/or their anticipation that someone else will be prepared to buy the asset from them in the future for a higher price than they paid (greater fool theory).

From this follows that an investment property should really be looked more at through the lens of a fixed income security (an inflation fixed income security adjusted as rents can increase over time to reflect the overall price levels in the economy) but with an overlay of the potential for capital gains if either external conditions change that makethe asset more attractive (e.g. interest rate reduction or lack of alternative investments etc.).

For simplicity, lets compare an investment in an investment property to buying an index fund investing in the S&P500 (the available data for S&P500 is much longer than for ASX but the principle is the same).

The scenario

The scenario I have assumed is that you are investing on a 10-year horizon and that you need to access the capital at the end of the period for some reason (i.e. fund your children’s education, buy a nice boat to sail the world etc).

Expected return for a fund investment

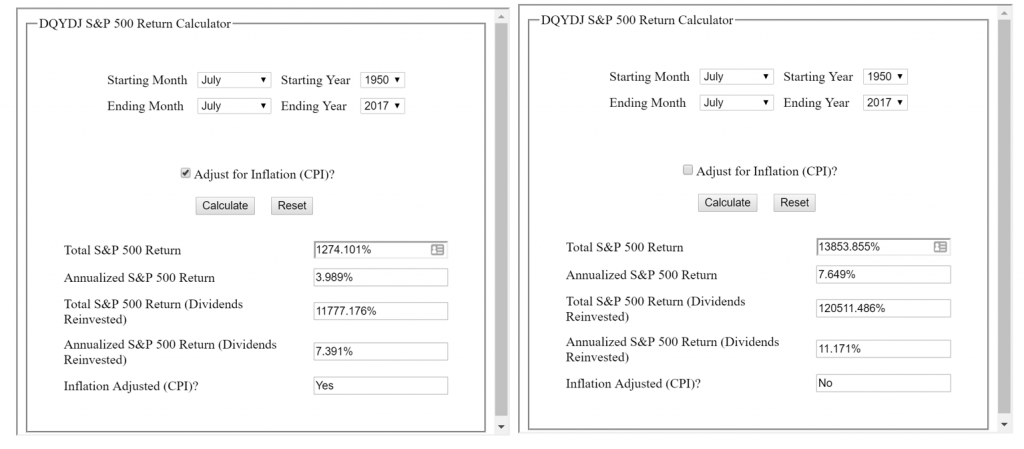

Over a long time (say since 1950 to take away the effects of WW2), the S&P500 accumulation index (which assumes reinvestment of dividends) has returned 7.4% adjusted for inflation and 11.2% if we do not adjust for inflation.

On top of this, we have to adjust for fees as an individual investor most likely cannot replicate the S&P500 by himself due to not having enough money to invest in all the companies included in the index; but for this analysis, let’s assume that you are able to, by picking a fund which slightly outperforms the index to compensate for fees, so the net expected return going forward is equal to the gross returns.

Now, during this period we have had interest rates on average falling significantly making stocks more attractive than bonds and this will not be repeated going forward (as interest rates are already close to zero in many places) so we should most likely not expect that the future will be as strong as history but let’s say that we should probably expect to, over the long term, make a nominal return of about 9% per year (i.e. including inflation) from investing in the stock market.

A special feature of investing in the stock market is that there are virtually no transaction costs apart from capital gains tax when you exit your investment, which, in Australia, depends on your overall income. Assume that you have a 30% marginal tax rate (which we will assume for the rest of this example) and the post-tax return you can expect over time from investing in the stock market is near 6.3% per year.

Expected return for an investment property

The expected return for an investment property is a bit more complicated to calculate but let’s give it a try! Let’s start by dividing the return into two parts:

- Yield – the direct return you get from owning the property

- Capital gain – The potential gain you get if the price of the property increases by the time you sell it.

Let’s start with yield:

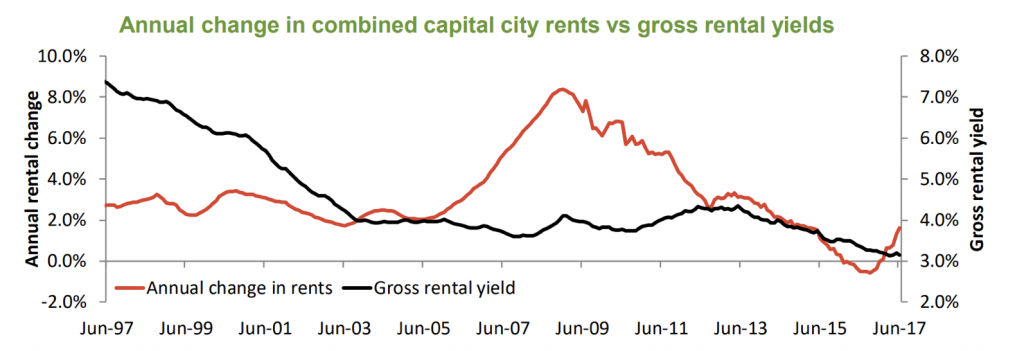

Gross rental yield is currently (according to Corelogics property monitor), on average across the combined capital cities in Australia 3.1% and is current growing by about 1.5% per year but for this example I am going to assume that rent grows in line with overall inflation that I assume will be 2.0% per year.

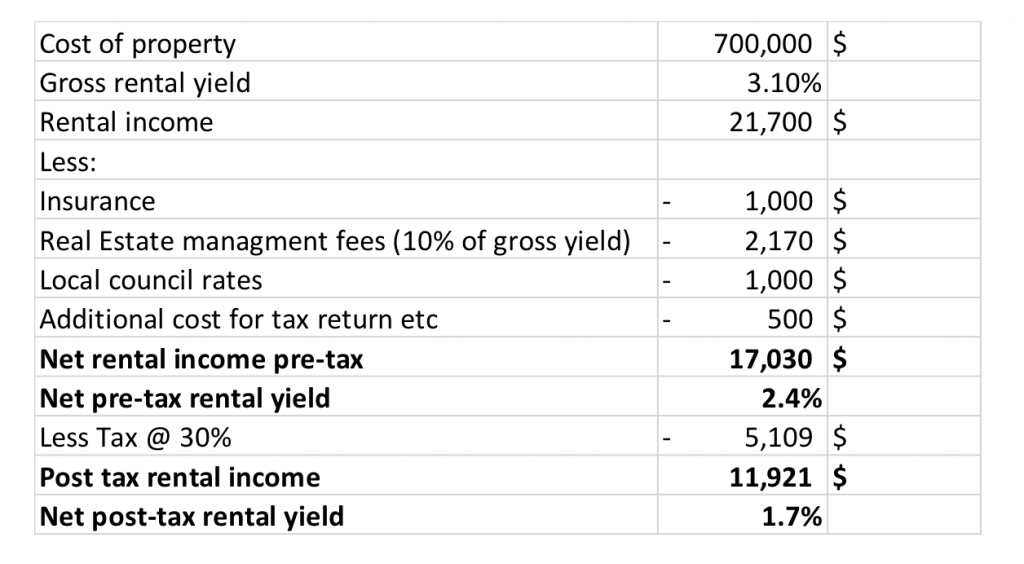

We do need to take away several costs associated with owning the property (assume we buy a property valued at $700,000):

- Insurance – You are not going to let this expensive property be uninsured so let’s assume $1,000 per year.

- Real estate management fees – Generally about 10% of the rental income

- Local council rates – Water and sewerage etc. Assume $1,000 per year

- Additional cost for tax return – Your tax return is suddenly much more complicated and your accountant will likely charge you more to prepare the tax return (or see it as an opportunity cost on your own time). Let’s assume $500 per year.

- Tax – As per above, we assume that your marginal tax rate is 30% and that the rental income is taxed at that rate.

Your net rental yield on a $700,000 property is therefore about 2.4% or ~$17,000 per year which we can grow with inflation (which we have assumed is 2.0%):

Capital gains

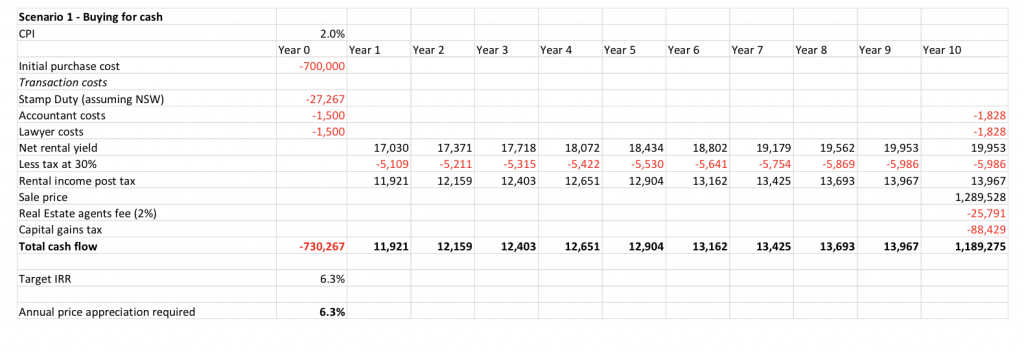

In addition, you’ll have a few one-off transaction costs associated with buying and selling the investment property:

- Stamp duty – Assuming that the investment property is in NSW (it would be much higher in VIC and slightly cheaper in QLD), the stamp duty for a $700,000 property would be about $27,000 and this is payable at the purchase of the property.

- Agent commission – This is ~2% of the transaction and the seller pays this so for our purposes, we apply this at the end of the 10-year period.

- Other transaction costs – You will likely have some accountant and lawyer costs associated with the transaction which I have assumed will be $3,000 in total both on the way in and on the way out (the cost when selling has been adjusted for inflation as it is 10 years into the future).

- Capital gains tax – I have assumed that the current 50% discount on CGT is still in place by the end of the 10-year period despite the current political talks about removing it.

In the tables below, I have for two different scenarios looked at what level of nominal (i.e. including inflation) annual price appreciation would be needed to match the 6.3% post-tax return that we assume a long-term investment in the equity market should give you (technically, we are solving the annual price appreciation that gives us an internal rate of return (IRR) of 6.3% over the 10-year period). The scenarios are:

- You buy the property for cash.

- You invest $250,000 of equity and borrow the rest:

a. We assume a non-amortising loan (interest only) variable interest loan with an interest rate of 5.5%.

b. We also assume that there are $1,000 of set-up fees for the bank loan.

c. We also assume that you have a constant tax marginal rate of 30% during the 10 years for the purposes of negative gearing offset as with a pre-tax net rental yield of 2.4% and borrowing costs of 5.5%, you are clearly going to be experiencing ongoing negative cashflow.

Scenario 1

As can be seen from the table below, we need to assume an annual price appreciation of 6.3% per year to achieve a post-tax IRR of 6.3%.

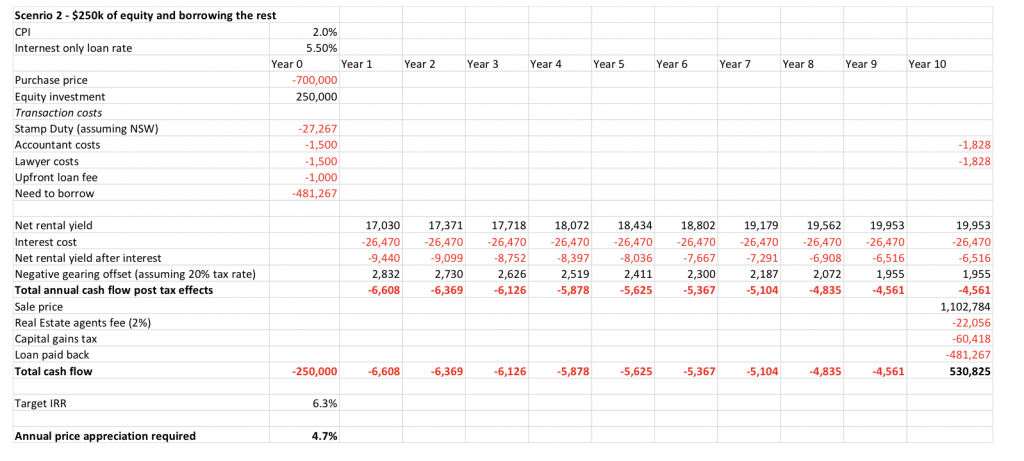

Scenario 2

Thanks to the leverage effect, the required annual price appreciation needed to achieve a 6.3% post tax IRR is a little bit lower than in scenario 1 at 4.7%. We should though remember that due to the leverage we have taken on, our investment hurdle rate should be much higher due to the additional risk we are taking on (remember that you have a subordinated interest in the property, the bank has the first priority and will outrank you in case the value goes down and if you wanted a higher expected return from an investment in equity markets, you could gear your investment there through a margin loan) but for this analysis we are ignoring that.

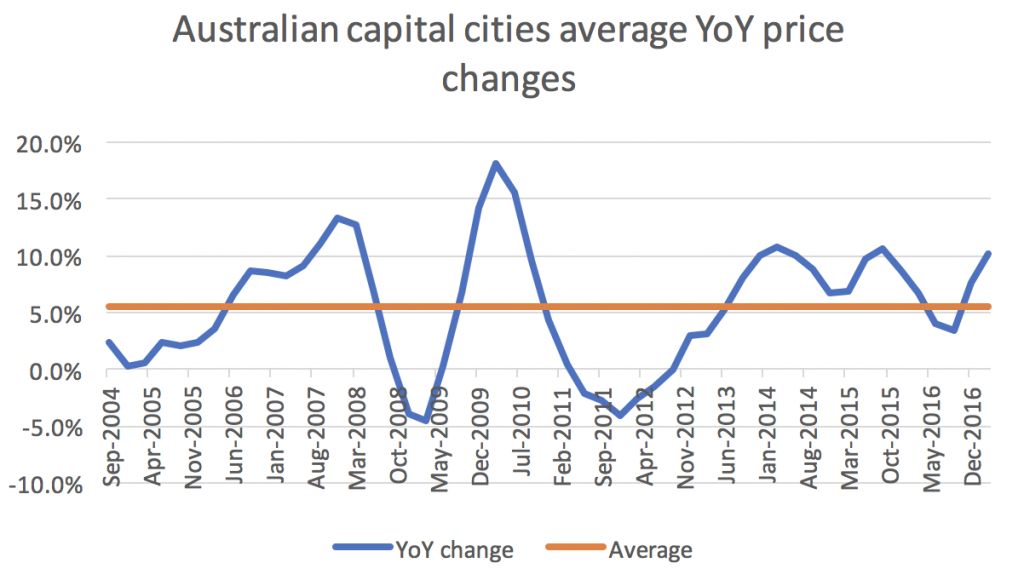

Looking at historical price appreciation of property in Australia for the last 13 years (this is the length of the data ABS supplies) we can see that the average has been 5.5% which means that you would have underperformed the expected returns from investing in the S&P500 if you had bought the property for cash and only slightly outperformed an ungeared stock market investment by taking on a lot of leverage.

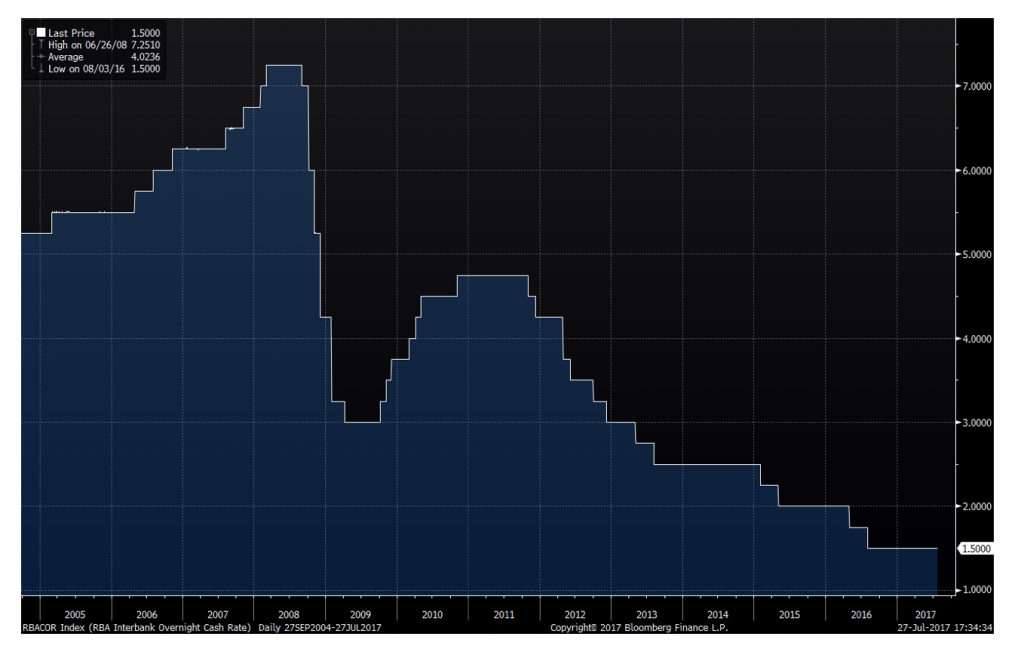

We should though note that during this period, the cash interest rates in Australia declined from 5.2% to 1.5%, increasing the affordability of borrowing…

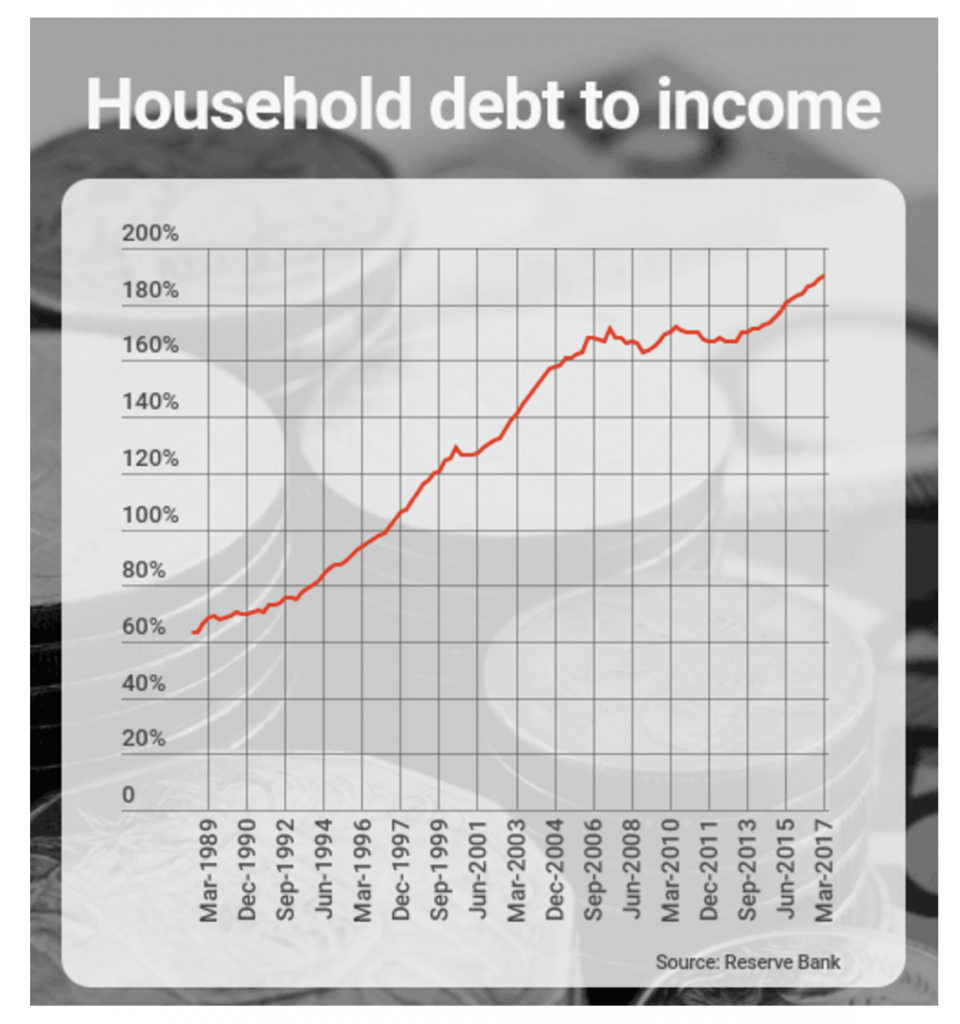

and that households have responded to this and taken on significant amounts of debt, resulting in the average debt to income ratio increasing from roughly 125% in 2004 to 190% currently which is one of the highest levels in the world.

Conclusion

It seems that during the last 13 years, investing in Australian property has produced a return that is slightly less than the expected return from investing in the S&P 500 over the long term (unless you significantly geared your property investment). We should though note the fundamentals for property prices have been extraordinary during this period with falling interest rates and easy access to credit through very expansionary policies by central banks. Property is, by its very nature of providing an easily accessible security to the lender, the easiest way that a “mum and dad” investor can get access to leverage and it seems like Australian investors have taken full advantage of this.

If we, during a period of unprecedented interest falls and domestic debt expansion have not been able to match the long term expected equity return by investing in the property market (on an ungeared basis), we would not expect the relative attraction of investment properties to increase in a rising interest rate environment which we are likely to see over the coming years. If banks are actually forced to reduce the growth in lending due to tightening money supply by central banks, it is very hard to see property prices increasing and, as direct rental yields are very low, returns from an investment in an investment property are likely to be very low going forward.

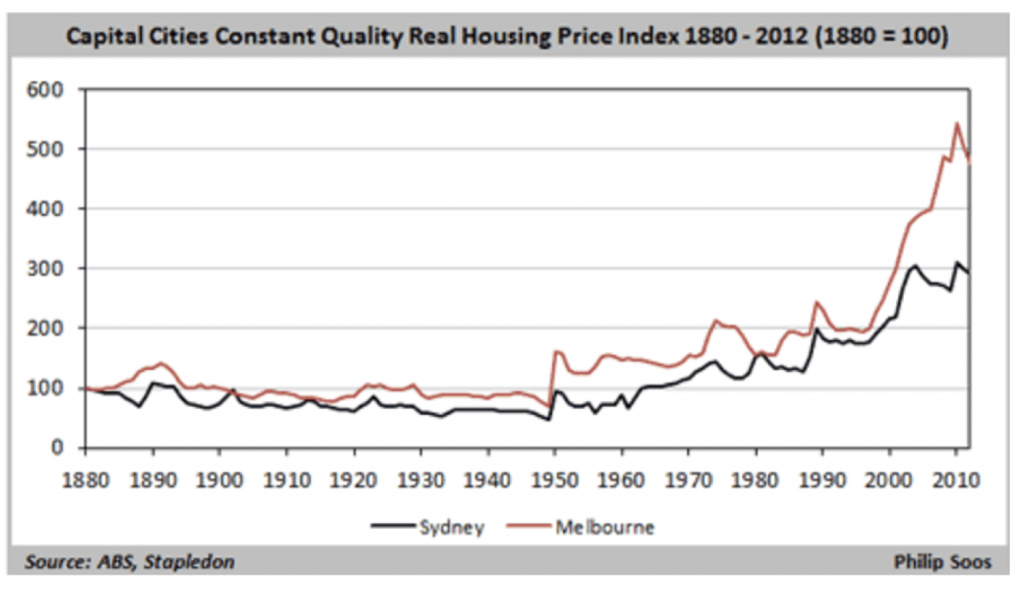

After all it is not a law of nature that property prices always go up even though that has been the case for the majority of time that anyone in Australia below the age of 47 has seen in their working life. If we look at a very long-term chart of Australian property prices, we can see that there have been several occasions of property prices going down by significant amounts. Most notably after the crash in 1896 when it took about 60 years before property prices recovered to their previous levels in real terms…

Please note that we are not arguing that investing in the S&P500 over the coming years will produce a much better return as we are likely to see a low return environment overall once central banks start to tighten credit policies (see Stuart Jackson’s recent blog post).

At Montgomery, we are at the moment defensibly positioned with a large cash position in reserve to take advantage of opportunities that the market presents over the coming months/years and we also offer a market neutral equities product domestically and a long/short equities product internationally.

Please note that we are not arguing that an investment property necessarily doesn’t make sense for some people as part of a diversified portfolio of investments or if you have particular needs (for example you want to buy an apartment your kids can use in the future etc.). What we are saying is that we see a high risk that the potential returns from an investment property in the future will be significantly below what they have been in the recent past.

Please also note that the above analysis is a bit simplified as it disregards potential depreciation tax benefits that might be available with an investment property investment but also disregards that it might be possible to get a higher expected return from an equities investment if you are willing to take on slightly higher risk by having part of your portfolio in, for example, an emerging markets fund.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Property does not make money, businesses do.

Otherwise all the ASX listed companies would buy residential, commercial or rural property.

In fact most ASX listed companies sell their properties and lease them back to get them off their balance sheet.

Look at what happened at Westfield when they combined their management business and the trust that owned property. Its like trying to run with led weights in your pocket.

As far as volatility of share prices, this is a function of liquidity. If your house was as liquid as shares it too would be volatile and seem risky!

Also, as far as security of property is concerned vs businesses, there is an abundance of land in the Sydney Basin and Australia and indeed most of it is low density. As a small example, it would be very difficult to compete with the 4 major banks and other well established businesses and indeed if we stopped using them you wouldn’t worry about your portfolio you’ll need a gun.

Interesting article. However, I’m not sure why you used the S&P500 – I would have thought the ASX 200 or 500 would be a more accurate comparison.

If you take these indexes at say June 2007 and then June 2017 – you will see they have decreased by around 10% over that 10 years. No doubt a good fund manager would outperform that return but money in the bank would have been better.

I personally prefer property over shares because:

a) I control it, not some pin striped executive getting paid $10 mil a year (who does not have my interests at heart)

b) through my own endeavor, I can improve both the return and the value of my properties

c) if the world goes pear shaped my land and the bricks and mortar will at least provide shelter for someone but the piece of paper proving my ownership of XYZ Co will not be of much use.

LYNTON has made more sense than anyone else here /expert or amateur !

the wisest thing you could possibly do would be to have investment in both property and shares

the hard part is how to properly balance both investments

buy your own home to live in and invest in shares through Super ??

sometimes kISS ????

Rather than creating the hysterics and attempt to grab attention by calling the property collapse (wrong) for the last 5 years, Roger should stick to his knitting and focus 100% on avoiding the next ISD or HSO !!

The contention that “there is not much reinvestment that can significantly increase the value of the property directly” again shows that you guys do not own an investment grade asset in Syd or Melb. You can add material capital value to an existing property via structural renovation (i.e. adding a fourth bedroom, second bathroom, renovating existing kitchen etc.) which can propel a property into an entirely new blue chip segment, re-setting the ceiling price. Call it the Greater Fool Theory if you will, but the law of supply of scarce, quality land and increasing demand from segments with strong purchasing power (investors and homebuyers with significant and generational equity), plus continued elevated levels of skilled immigration and HNW overseas demand for the premium enclaves have and will continue to drive prices upward in these investment grade markets over the next ten years and beyond, despite what happened in 1896!! Shanghai, Moscow, London, New York, Hong Kong, Paris, Singapore, Geneva, Monaco. You might find it hard to believe down under but pound for pound Sydney and Melbourne have joined the global elite as a premium place to park (and grow) real estate wealth. There will be ups and down but this is not cyclical.

Andreas/Roger,

Isn’t this really a pointless argument?

Broadly speaking, people can only offer a true unbiased comparison if they don’t have a vested interest. You’re fund managers, so why would you ever say property is a better asset class to invest in, rather than the stock market?

Conversely, if you’ve a vested interest in property, you’ll usually detail why property is a better investment than shares.

This too often becomes the Labor vs Liberal debate. It all really depends on your personal circumstances and your investment appetite for one or the other.

It’s actually been proven over time, an investment in the right property and the right shares equals a more rounded investment portfolio.

In saying that, I’d much rather a dollar of property equity growth, than a dollar of growth in my share holdings. A bank will allow me to leverage a higher percentage of equity growth in a property, than growth in shares. That resolves the argument for me. There’s also the fact that property is a necessity whereas a company is not. They can be wound up or shut down at any point.

Dave

P.S. The property “bubble” has been referenced for well over 50 years in Sydney, Melbourne etc when things seem to get expensive, yet this really only exists in mining towns, largely. Using “property bubble” in your article, proves how little you know about property and it’s cycles.

100% agree David. This is why I invest with Monty and also leverage into investment grade property to take advantage of the imperfect market in can represent and how you can manipulate the value of the asset. Its not one or the other.

What bunkum. You’ve all obviously been short on Syd and Melb property and never been an investor these past 10 years. How can you simultaneously argue that shares have outperformed property when the stock market has gone sideways (inc mining bust) whilst arguing there’s an enormous capital city property bubble? Dear oh dear!

which is addressed Lynton by Andreas’s comment “an overlay of the potential for capital gains if either external conditions change that makethe asset more attractive (e.g. interest rate reduction or lack of alternative investments etc.).”

Great article Andreas, I do agree with you. One would struggle to see housing appreciating for much longer when considering the amount of debt involved. What skews the returns on property is the fact that homes are generally for shelter and security and people will chase this to their financial capacity, which in turn happens to favour any investor who owns a house. So what happens is, these occupiers keep pushing prices ever higher even though that from an investment point of view these prices aren’t justified.

Hi Paul,

Thanks for you comment. What we are seeing is though that homeownership is declining signficantly at the moment (see the latest census for example). This means that it is indeed investors owning more and more investment properties that is driving the market upwards. Of course it comes down to overall supply/demand so people looking to buy to live contributes but the main driver for price increases is investors.

Hi Roger, Impressive article. What if we compare owner occupied property vs shares. In what circumstances you can just rent and invest in shares. In the end even owner occupied property is also an investment. If rent yield is so low why not keep renting.

Hi Asif,

The analysis is theoretically the same. As long as you are getting better expected returns from shares than the yield you are paying the owner of a property you rent, you should theoretically rent and invest your money in shares rather than own. There are though of course other considerations like security and stability to take into account when it comes to the decision to own or rent the place you live in, especially with the very owner friendly rental laws in Australia with no cause terminations etc.

I couldn’t agree more with Andrew Ronan. Maintenance costs and tenant difficulties make being a landlord a ‘labour of love’.

You would need to compare the returns of some of the better funds, Montgomery’s being well placed amongst them, with the REAL net return from property.

Its an interesting look at all things property, but it doesn’t mention a ‘mistake’ of share investing like buying the S&P in 2006 /2007 right before a 50% GFC drop or buying growth stocks at the ‘wrong time’ like ISD, HSO, VOC, TPM, BKL, BAL, NVT, DMP, TLS, SGH, etc and losing 20,30,40,50% or 90% of your investment in a short space of time with little of no chance of recovering that money.

Ive only been around 47 years like the article mentions so haven’t seen a major downturn in property, but what about the statistics pointing to Australia’s population increasing to 40 million by 2050 ?

Do you really think Sydney and Melbourne populations will increase or decrease?>

Hi Simon,

We are not proposing that there is no risk for a stock market correction, indeed we are very defensively positioned with large cash balance to be able to take advantage of any such correction should it occur.

Also, the point of a diversified portfolio is that your winners will (hopefully) compensate for your losers. As fundmanagers, we know that we are never going to get all stocks correct and that is why we always follow a rigorous risk framwork to make sure that the impact of a bad investment on the overall portfolio is limited.

Regarding the population forecasts. It is correct that with the current political consensus for a “Big Australia”, the population growth is forecasted to be significant, particularly in Sydney and Melbourne. What is though important to remember is that over time affordability is very important. For a property to go up in value, you need someone to be able to afford to pay a higher price than what it was previously valued at. For this, we need either:

1. Increases in real wages which we are not seeing (indeed, real wage growth actually very close to zero) or

2. Lower cost of debt and/or ability to borrow more. At the moment we are seeing out of cycle interest rate increases and tighter availability of credit and it is hard to see that this will reverse in an environment where other countries have started to raise interest rates.

This article should be compulsory reading for every budding property investor, and share investor also..And dammit central banker. Ithink people are paying way to little attention to the interest rate cycle ,and from looking at that very scary debt to income graph people clearly have no idea of the dramatic effects this cycle will have on all asset prices once it normalises from the extreme record lows of today. Also the numbers in the tables above are very much a perfect world scenario from my experience with investment properties and exclude the unforseens, eg maintenance, all buildings will be eventually demolished and many dollars spent on maintenance before that happens. Also rental properties spend time as vacant properties providing no income at all at times. Those numbers in the insurance and council rates look less than 1/3 of what I pay on a very modest property. Give me a well managed share investment fund any day over any investment property as my returns from your own funds over the last 6/7 years have clearly shown without the stress of debt and gearing etc.

Thanks for your comment Andrew,

You are completely correct, the analysis ignores both periods of vacancy and an allowance for repairs and maintenance, both of which could have signficant impact on the results. This was on purpose as I wanted to show a “best-case” scenario for property and even in that scenario, it is hard to see the numbers stack up.