Is negative gearing good for Australia?

The negative gearing debate continues to heat up. And well it might. It’s a classic argument between the ‘haves’ and the ‘have nots’, focusing on one of the things we hold most dear: affordable housing. If we take a dispassionate view, it’s not hard to see which side of the debate has more merit.

A while ago, I looked at the property holdings of members of parliament. In that post, I argued that the negative gearing tax incentive – and in particular for investment in existing property – is not a productive policy and indeed has clear negative effects:

- It enables investors to pay a higher price than they would otherwise have been able to without the tax incentives.

- The higher overall level of prices in the market puts home ownership out of reach for a higher portion of the population which in the longer term puts higher demands on the welfare state (and overall taxation levels) as more people will be relying on social security in their retirement.

- The incentives for investment properties vs. other asset classes leads to more money flowing towards property investment rather than being invested into productive investments such as providing capital for a start-up creating more jobs or R&D creating a competitive advantage for the nation.

- It increases the risk for speculative behaviour resulting in the creation of price bubbles (such as the current situation in Sydney and Melbourne). Market dynamics sort out bubbles over time, but they are generally undesirable as the pain when they burst can have very long-lasting negative effects.

Now, the counter argument to this view would be what Scott Morrison said on ABC on the 3rd of July.

“You’ve got a quarter of the investment property – the rental property in this country – is owned by mum & dad investors. Now, you need people to own rental stock otherwise people’s rents go up…

What Scott Morrison is saying is that if you do not incentivise people to own investment property and rent it out, the supply of rental properties will go down and rents will go up for the people who has/wants to rent.

This would be correct if and only if we are talking about additional properties but it is clearly an incorrect statement for 2 reasons:

- For each existing property that is bought by an investor, you remove a property from the stock of available properties for a potential owner-occupier. Supply/demand means that prices for properties will be higher due to more buyers and price potential owner-occupiers out of the market and force a potential owner-occupier to rent instead increasing the demand for rental properties by exactly the same amount as the supply has been increased.

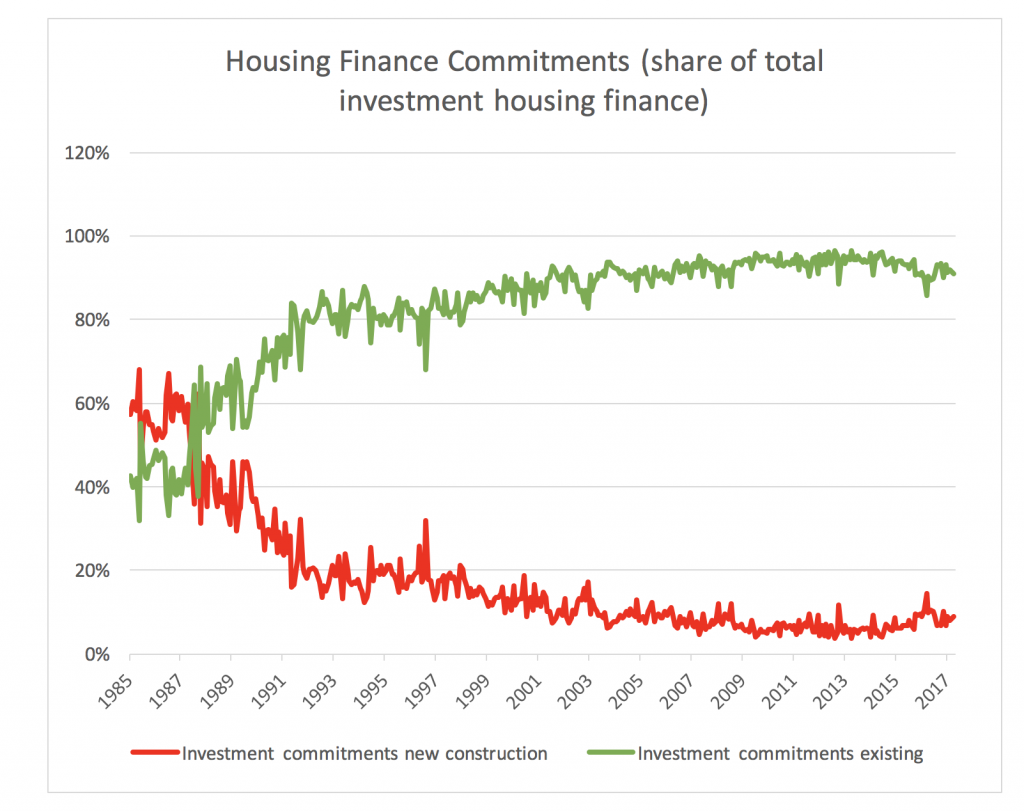

- Looking at statistics from the Australian Bureau of Statistics, we can see that over 90% of investment finance commitments goes towards existing properties and less than 10% of commitments goes towards new properties, and this has been the situation for a long time (the green line in the chart below).

Basically, 9 out of 10 investment properties are existing stock, which does not add to the available supply of rental properties one iota. It is this writer’s firm view that negative gearing tax incentives for investment into existing properties is a very misguided and straight-out detrimental policy and I continue to suspect that politicians’ reluctance to address this has something to do with their level of investment property ownership (please see my previous post linked above).

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Rod W.

:

We need to look at things in a much broader prospective!

Over the last 30 years of bad government policies Australia has lost much of its employment base in good stable high paid employment jobs. Young school leavers and many are University educated are finding it hard to obtain stable and high paid employment?

Saving for a deposit and qualifying for a loan is dependant on a persons ability to save and budget their personal finances. You have to feel for the young with dreams of owning a home but have been subject to Unemployment, poor paid casual work, been underpaid by dodgy business who pay lower than award wages and ignore compulsary Super contributions.

The Federal government is wanting older workers to work longer and locking out access to Super etc.

Why not let the older generation retire now with current tax concessions on Super / Investments and get the younger generation to take those jobs vacated by the older retiring workforce that own their homes with no debt.

Many young i know have 4 overseas holidays per year, a very high consumer debt position on consumer goods and expensive lifestyle choices. We need to educate the younger generations while still in school about saving and investing.

Tax on savings? The ATO and federal government needs to abolish tax on Term Deposits and cash in bank accounts, Australia has a low savings rate relative to income, when compared with many other developed nations. The amount on tax taken from Australians by way of tax on interest is very small when compared with, Income Tax, GST & Company Tax. Anyone with cash in the bank is saving up for something, Car, Holiday, first Home or Retirement. The money is spent stimulating the economy.

Its time the government got serious about looking after hard working Australians of all generations, from School Leavers, potential first Home buyers to Retired persons.

Tim

:

Thanks for the great article Andreas. I agree that negative gearing has been very bad for the Australian economy, pushing rental yields towards zero, and encouraged speculation from Mum and Dad investments into residential property.

What I would be interested in seeing from either yourself or Roger is an evaluation of a potential investment property purchase through the lens of a company value analysis. Ie. If an investment property were a listed stock on the asx, what would it look like?

Andreas Lundberg

:

Hi Tim,

That is a very good idea. Keep your eyes on the blog!

andrew ronan

:

I’m sure Roger explained exactly why there are no residential property investment vehicals in Australia that are traded on the asx the other day on radio, and I’m sure his reasons were because there are no returns and so therefore who would buy them ?and my guess is they would rapidly trade well below NAV which is a very telling proposition for the current situation in property. also Andreas do you think if interest rates for housing were circa 8/9 % which was the case when I was paying mortgages do you think we would have a big issue with negative gearing? I very much doubt it due to the fact that this situation would severely reduce the amount of capital mum and dads have access to when sticking their heads in the noose for an investment property or three which I’d say would also severely impact on demand and similarly devastate the insane valuations thereby reducing speculation on capital gains and in the process rewarding and incouraging discipline and saving. I’m not saying we should stick rates up to 9% tomorrow, im saying that should have been done a long time ago.

andrew ronan

:

Could I draw your attention to Stanley Fischer of the federal reserve in the USA and his comments regarding asset prices on 20/6/17

“House prices are now high and rising in several countries. Perhaps as a result of extended periods of low interest rates” and from memory ” the stock market is running on fumes” from another fed committee member and Janet Yellen herself has expressed concern at very high asset prices. And last week Goldman Sacs comments regarding their concern over Janet and co concerns regarding high asset prices. Well please correct me if I’m wrong but are these people not responsible for these very low interest rates in the first place and are they only just now becoming concerned about their very own asset bubbles? And were asset bubbles not the primary cause of not only the great recession but most other recessions in the past 200 years? Opps I did it again, is apparently the only line missing from the FMOC minutes in the last couple of months. So therefore my own view is that negative gearing is very much a side issue when it comes to affordability issues, as these people above have very recently outlined. And at some stage we must take a bit of notice of the very large bull elephant that is running a muck in the living room while we are trying to watch the 6 o’clock news.

stephen

:

Was it not true that negative gearing was set up to help the investor through a tough period with the ultimate goal of positive gearing the investment at some point.

Therefore how the hell did it become and investment strategy and maintaining a negative approach embraced on a permanent time line for selfless interests.

Very strange times

jimbo james

:

So much dogma, lies, lies and damn statistics! This should be required reading by all.

https://www.macrobusiness.com.au/2015/06/property-lobby-yells-negative-gearing-myths/

andrew ronan

:

It’s the negative gearing bogeyman again, and he has been framed again, but really it’s a case of can’t see the wood for the trees. The problem will quickly evaporate when the S H T F in the property Casio yet again , you see negative gearing means you are making a loss on an investment and in this case the so called investors or gamblers which may be a more accurate term are fully aware of this fact, therefore I’d say they a betting on capital gains and not much else,with much emphasis on the word betting and who could blame them when property markets regularly inflate by double figures and just maybe, very very loose monetary policy conditions along with fraudulent banking sales practices have something to do with this phenomenon, so until we have a system that puts an actual and realistic price on capital that reflects the real level of effort and discipline required to save that capital and therefore lend it at appropriately risk adjusted market rates. Is it not just obvious that we will be permanently stuck on the long term rinse and repeat cycle of capital creation out of thin air followed by the easy come easy go zero discipline approach to investing quickly followed by very poor allocation of capital followed by its inevitable destruction. So you see trees are made of wood, unlike money which is made of air. But maybe I’m just full of hot air to, guess we will find out.

Deon Kruger

:

Interesting that you write an article about removing negative gearing, but fail to mention what happened last time the Government removed it. Not did you mention that it was brought in to lessen the burden on the State supplied housing. Removing the reliance on the Government is the point to most incentive programs.

Cameron Hawkins

:

Interest expense deductability is a fairly fundamental taxation principle and applies in some form or another in most advanced economies – why shouldn’t it apply to investment in Australian residential property?

Kelvin Ng

:

Hi Cameron, it should apply – but that’s not what negative gearing is about. Negative gearing is about being able to deduct interest expenses against other sources of income, not just the rental. That is not a fundamental taxation principle.

More generally, the broader point is that existing properties are not a productive asset class and should not be treated more favourably than other asset classes. In fact, they should be treated less favourably. At the moment, they are treated more favourably than shares because of the CGT exemption on owner occupied houses. With regard to franking credits for shares, there is no equivalent issue of double taxation on rents.

Kelvin

Con Katsiouras

:

The recent changes / restrictions forced upon banks , by aPRA , will create structural changes not seen in this space for a long time. The reality is that moving forward investors will not be able to access IO loans as easily as they have in the past. A large portion of borrowers will, over the course of the next few years, find it difficult to roll over IO loans or extend IO loans. This will in effect , remove a lot of the incentives that have driven negative gearing and may go someway to reducing the reliance on negative gearing that investors have comfortably enjoyed in the past. If int rates continue to increase in this area, it will amplify the rate of change as principle reductions are not tax deductible. For those who abore NG you may find the result is essentially close to or similar to having NG removed all together.

Graeme

:

It should also be remembered that there are two powerful lobby groups that have a vested interest in high house prices. Firstly, financial institutions lend more money and so receive more interest, hence higher profits. Secondly, the real estate sales industry, who often charge commission based on the sale price, profit from the increased commission. They also benefit from collecting property management fees from the increased number of forced rentals.

Robert Toms

:

Andreas, I don’t understand your statement that” 9 out of 10 investment properties are existing stock, which does not add to the supply of rental properties one iota”. It must add to the stock of rental properties but subtract from the number of owner \/ occupier properties. I remember many studies done in the late 1990s that proved that paying rent and not buying properties was a better outcome over the longer period. Has that changed?

Andreas Lundberg

:

Hi Robert,

Thanks for your comment. It would probably be clearer if I had written “add to the NET supply…”. My argument is that for each existing property that is bought as an investment property, you have one potential owner-occupier that has to go on the rental market instead of owning their home so the NET effect on the supply of rental properties is zero.

The rent vs. own equation fully depends on the local market and what property prices are doing in that particular market. It is clear that as long as you have price appreciation high enough to compensate for the differential between mortgage costs and rent costs (if indeed renting is cheaper than mortgage costs included opportunity cost from your potential return on the equity tied up in the property) plus transaction costs (stamp duty and commissions etc.), owning is cheaper than renting. It has clearly been cheaper to own than to rent in Sydney and Melbourne the last few years with property prices increasing by double digits per year. The same equation would look very different in Perth for the last 5 years….

C

:

Brian, if negative gearing of property investment is so important, why does the rest of the world not have it, apart from Ireland.

Why not instead allow tax deduction on mortgage interest payments by HOME owners, as I have been told happens in some countries such as the USA.

The reason is because this country is obsessed with looking after property investors at the expense of young home owners, and the politicians have their snouts firmly in the tax rort trough

Andreas Lundberg

:

Hi C,

Thanks for you comment and I agree. I have lived in 6 different countries around the world and Australia is really the only country where domestic property is seen as an investment class for “mum and dad” investors and where there are specific incentives for it that makes it more attractive than other asset classes. it does not make sense to me as it is not a productive asset (i.e high value added).

Cameron Hawkins

:

Andreas

I am looking forward to a follow up article which addresses how we can prevent harmful distortions in the stock market by removing investment incentives.

Should we start with removing CGT discounts on shares held for more than 12 months?

How about removing the ability to claim interest expense deductions on margin loans. Or removing margin loans entirely. Why should people be allowed to borrow money to speculate on the stock market? And don’t get me started on derivatives.

Abolishing franking credits – there’s some serious low hanging fruit there which is ripe for the picking – and let’s face it, it might rein in the prices of those pesky banks we all hate, and stop them loaning so much money to property investors. In the era of big spending socialist governments, we get a big bang for buck here as company profits can be taxed twice. The principle of not double taxing is so last century.

To avoid another tech wreck, let’s regulate to limit P/E ratios to say 20, perhaps even prohibit investment in companies which are not actually making a profit – there goes 90% of the Australian market. Indeed there are plenty of stock market crash case studies to consider!

The point I am trying to make is that markets are not perfect. As investors we realise that markets can be distorted. We even accept that governments play a role in regulating out some of the harmful gyrations of free markets as unpalatable as that is to liberal thinkers.

In recent times housing has become less affordable – there are many reasons for this, not least supply constraints in some markets, an explosion in credit in the last 20 years, lower lending standards, dual income households etc. No doubt negative gearing and CGT exemptions have played some part.

The questions is how far are we prepared to go to make markets more efficient, or indeed as you intimate, to deliver socially laudable outcomes (in this case, more affordable housing). Is more government intervention really what we want? And if so, why stop with “fixing” the property market?

Kelvin Ng

:

I disagree with Brian. The reason why we single out negative gearing on existing properties is that the strength of an economy and indeed of a country comes from its industrial and technological base and that is built on productive businesses, both listed and unlisted. Negative gearing on shares in productive businesses lowers their cost of capital and helps them expand and compete. Higher prices for existing properties does nothing of the sort.

Kelvin

Simon

:

Agree with Brian.

Also why wasn’t negative gearing scrapped during the housing boom in Perth and Darwin?

I don’t believe Hobart is going through a housing price boom at the moment. Theoretically negative gearing should contribute to this?!

Don’t forget in the long term successful negative will end up with positively geared properties. If they sell down the track they are subject to CGT. Perhaps tax in rental income should be scrapped along with CGT if negative gearing is to be scrapped. After all, negative gearing is a result of cost of doing business

Pascal Marrot

:

Hi,

I tend to agree with Brian. The problem for Australia, and I think the western world as a whole including China, is that debt has become so pervasive that we are now subservient to it. That is, debt was and should be used to serve us, but there is so much debt in the ‘system’ that we now serve it.

In Australia, property has become too ‘financially significant’ to mainstream Australians, the economy and our store of wealth. Like debt, we are now very subservient to it and the debt required to fund it.

As such, I think a property crash is actually unlikely in Australia. The government, the banking system and associated building sector industries simply cannot, or maybe will not allow it to happen. Hence, any notion of removing negative gearing for property investments will be destructive and poses too many unknown risks.

And no-one wants to be on the wrong end of the stick on this one. If property does crash, you really want to be in cash!

Andreas Lundberg

:

Hi Pascal,

I agree and disagree at the same time. It is clear that it has become very “financially significant” and that is the reason Australia is having the current debt bubble.

I also agree with the notion that the government, the banking system (remember, ~70% of the banks assets are domestic mortgages) will do its outmost to prevent a crash and that is one of the reasons that nothing has been done about negative gearing. No politician who wants to be re-elected wants to crash the housing market.

Where I disagree is that I think the “powers that be” are not in complete control. The RBA cannot lower interest rates much more as they are already low. The banks cannot keep lending more and more as investors will not provide them with the additional capital as they can see the potential risks. The building industry has not for endless pockets to build on spec and fund buyers through incentives etc.

You are completely right that if the property market goes down significantly, it will have a real impact on the economy and general asset prices including shares. That is one of the reasons we have a very high cash portion of our portfolio and try to minimise our exposure to retail exposed companies and maximise our exposure to attractively priced export exposed companies.

Paul Audcent

:

Frankly Negative Gearing has been a useful tool for those who already have their own home and wish to invest in a rising market and not loose their capital. I however believe it does restrict the young from purchasing their first home. In this day and age many young couples live with their folks and save every penny for the deposit. The arguement is rental properties will exist to satisfy the need, yet the current rents keep rising as negative geared owners continue to sqeeze their renters for more. So round and around we go. Those renters will never be able to build up a deposit. Our society is not fair, it is built on basic greed. And its no suprise that some of our polies head the list. Perhaps this explains the block to do anything about the problem. Of course one answer is to cut out the tax benefits of this residential grearing and let the asset stand on its own feet in line with other assets.

Brian

:

Well why do we single out negative gearing on properties. Why not stop negative gearing on shares businesses and other income producing assets. Cut out negative gearing and you will damage the economy. Not as many properties will be built and also the retirement plans of many home owners will be destroyed. There are a lot more losers in this change than winners.

Andreas Lundberg

:

Hi Brian,

My argument would be that investment in an existing domestic property is not a productive investment from a total GDP perspective. The property already exists and provides its function of providing shelter to its inhabitants no matter who owns it. The effect of negative gearing tax benefits being available to an existing property investor means that the overall price levels of properties will be increased and absorb capital that could have been invested into productive avenues like capital for a start-up business which would have provided jobs and tax revenues to the economy. It also increases the overall price levels of properties which means that some people who would like to own their home cannot afford to do so.

I have some sympathy for the view that incentives for investment into NEW construction of domestic property can be reasonable as it provides additional shelter for people who are not in a position to own a property but I can see no reason at all why there should be any incentive for investment into existing domestic property as it does not provide any benefits to the society as a whole and indeed has some very negative effects.