Do our pollies have a vested interest in keeping the property bubble inflating?

In the last month or so, we’ve seen a big surge in news articles and commentary about Sydney and Melbourne’s housing bubbles. But to the consternation of many people, there has been a reluctance by our politicians to introduce meaningful reforms. Could the reason be that they are among the nation’s most aggressive property investors?

APRA, ASIC, RBA and Deloitte to name just a few have all been publicly warning about the levels of property prices and the level of indebtedness this has led to and the implications for risk regarding several aspects of the economy and the society, like banking system stability, social mobility and overall quality of life.

There has also been an increased focus on this in the political debate with a “public discussion” between the leading parts of the ruling Coalition regarding what the most appropriate measures are to tackle the issue in the lead-up to the upcoming budget.

We do not propose that we know the answers to what the most appropriate measures are but note with interest the data prepared by the ABC showing that the people who are tasked with deciding the most appropriate measures are not fully representative of the population as a whole.

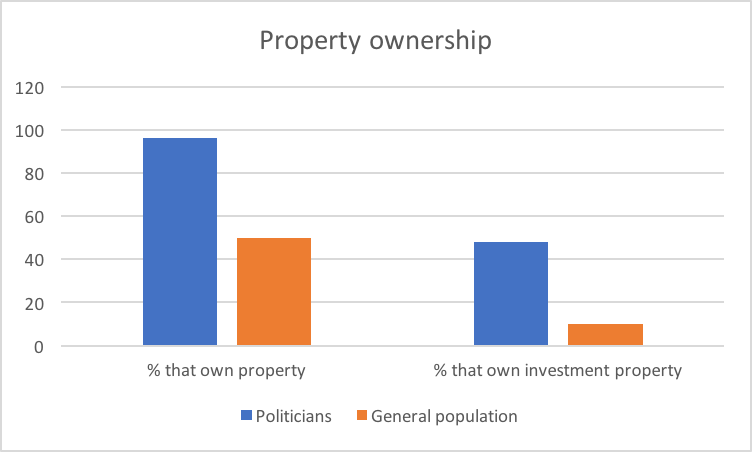

Some interesting facts from the ABC article from the 20th April which you can read in full here are:

- Politicians in parliament are much bigger investors in real estate than the general population

- 96% of the members of parliament own a property vs. 48% for the population as a whole

- 50% of the members of parliament own an investment property vs. 10% of the populations as a whole

- Politicians own (on average) multiple properties each.

- The average politician owns 2.4 properties

- The average Coalition politician owns 2.7 properties each, with roughly half of these being investment properties

- The average Labour politician owns 2.0 properties each, with 37% of these being investment properties

Now, we are aware that there are reasons for politicians having a different investment profile than the general population (e.g. it is a reasonably well paid job, owning shares in individual companies opens questions about preferential treatment etc.). We cannot though help ourselves to question if the reluctance to adjust some of the more bizarre (to this author at least) aspects of the Australian taxation system partly responsible for the investment-led rise in property prices we are currently seeing is at least influenced by vested interest amongst the policymakers.

In particular, the reluctance to adjust negative gearing rules seems like a policy point that could very well be influenced by the personal vested interest of politicians with a big personal exposure to investment property.

Investment in domestic real estate is, as Adam Smith noted in Wealth of Nations (quote below), a non-productive investment that does not contribute to the overall GDP of a country and hence this seems like an area prime for tax reform with the dual benefits of increasing housing affordability and to channel investments into productive assets.

“A dwelling house, as such, contributes nothing to the revenue of its inhabitant … if it is to be let to a tenant for rent, as the house itself can produce nothing, the tenant must always pay the rent out of some other revenue… though a house, therefore, may yield a revenue to its proprietor … it cannot yield any to the public, nor serve in the function of a capital and the revenue of the whole body of the people can never in the smallest degree be increased by it.”

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Kent Wong

:

The article fully explains why the politicians refuses to change the obvious reasons that cause the ever surging house prices. They are very selfish and should not hold their offices. They looks after themselves rather than the general public. It is insane that some investors, thanks to the generous negative gearing and tax concessions, that they can buy the 11th property while some poor first home buyers cannot even afford to buy one.

I also totally agree that investment in existing house does not contribute to the GDP growth.

I believe the ever spiraling house prices will eventually ends up with house price collapse. This happens when the interest rates go back to normal (to certain extent it is happening slowing) and/or the economy goes bad when people lose their jobs. We don’t have a recession for over 25 years but it does not mean that we never have one.

I feel very sad that more and more young Australians are unable to buy their home due to the self interest of the politicians. Equally I feel increasing worry about the economic consequences of the collapse of the house prices.

Andrew

:

I diversify my investments. I have stocks & I even have a sizable sum of my super invested in TMF. But I must say that I am a little offended that my ownership of a house that I rent to tenants is impugned as an unproductive asset that sucks value from the economy. The house is un-geared. The tenants pay less than they would have to pay to service the kind of mortgage that would normally be required to buy it. It was a new home that we built. This provided employment to the builder & his contractors. It is a quality property that I believe adds value to its inhabitants commensurate with the rent they pay me. I pay a management agency firm to manage the property for me creating more employment for the employees of this enterprise. I have paid a painter to re-oil the decks, and a pressure cleaner to wash the house; part of my service to my tenants whom I consider my customers. The property is on the Sunshine Coast where, at the moment at least, there is no bubble (but I’m sure the ripples are coming). I believe the provision of a service like this to be one of absolute integrity & I am disappointed to be dismissed as if I’m some kind of leach sucking value from the economy. Not every real estate investor is an unscrupulous speculator. Please don’t tar us all with the same brush.

Andreas Lundberg

:

Hi Andrew,

Thanks for your comment and it was definitely not my intention to offend!

What I really have an issue with is that negative gearing and other tax incentives are available on investment in existing properties. Investment into new properties are a positive as it provides an essential service for people who cannot afford or for other reasons don’t want to buy a property (you might be living somewhere for a limited time and the transaction costs are too high to make it worth buying something). Incentives that favours investment into existing properties are not attractive in my mind as it just results in a value transfer within the existing economy and not investment into more productive assets and also leads to asset price inflation meaning higher systemic risk which is not a positive for an economy.

ian bartley

:

Andreas

Don’t urge government to get more involved in our lives through taxation. We have enough of a nanny state already and governments don’t need any further encouragement to set rules and regulations to tell us where to invest our own money. Making taxation of rental property any different to any other commercial asset is nanny state social engineering using economic theory as a cover for government telling the people what’s good for them. The so-called property bubble is in two places -Sydney and Melbourne only – due mainly to these being international cities that international investors find attractive. For the rest of Australia, there has been no property bubble so why should we all suffer with cuts to negative gearing and restrictions to investing choices with our own superannuation.

If anything, government should be completely withdrawing from the commercial investment field by giving no capital gains tax breaks on the sale of any commercial asset after allowing for inflation i.e taxing only the real capital gain, not the nominal capital gain.

Adrian F

:

Andreas Lundburg, good try but unsuccessful. ken. lool is correct. technically housing is a capital good that provides a service to the tenant and the landlord is remunerated for the service in rental payments.

Whilst your line of reasoning is correct in that resources are taken away from other investments and allocated into housing, to say that this is unproductive is incorrect. for to go further would be to make countless value judgements about what should be considered productive and what shouldn’t. for example I have no interest in golf and consider the sport boring. if I could choose I would reallocate all resources from the sport of golf into healthcare. surely a much better allocation of resources for the welfare of the public. but some people (boring I would add haha) love golf, and want to play and see it played, and are happy to devote resources under their command (ie money) to the game. would anyone say the sport of golf is an unproductive way to satisfy the demands of golfers?! definitely not. if therefore golf is considered productive because it satisfies the demands of consumers (golfers) then surely housing is considered productive because it also satisfies the demands of consumers, the tenants.

Brett Edgerton

:

That quote, Andreas, is what I included in my letter to Mr Rudd circa 2007 when he was my local member and newly installed in the Lodge…

And when I shirt-fronted him with a question at a country cabinet meeting in March 2008 I got an advance glimpse of his now famous temper… http://www.brisbanetimes.com.au/news/national/rudd-grilled-on-housing-health/2008/03/02/1204402264032.html

And when I approached Mr Swan at the same meeting in an attempt to have a one-on-one discussion about ending the gaming of the system, he flat out told me the I was dreaming if I thought negative gearing would ever be wound up… a pretty arrogant thing to say to someone who had just had their rent raised by 30% over a 12 month period… (and not entirely wise for one’s health when the guy whose nose you are rubbing in $#!t is within arms length, is 110kg and your jaw is a big target!)

It’s interesting that Labor has now adopted almost everything that I had recommended on my website (homes4aussies) back then as their policy now – from ending NG (first curtailing to new builds), winding back CGT, ending SMSF borrowing in residential property, encouraging organisational investment in large-scale residential property to replace small scale investors (speculators), not using immigration to fund infrastructure but first building infrastructure to handle population growth, and improving tenancy laws to make long-term renting an equally viable and dignified way of living…

It never has been rocket surgery… It’s just a battle against their self-interest, specifically their own finances (including in their post-political careers – g’day Anna and Mike!), and their parties’ financial interests (through political donations)… And I have seen too much BS from both sides to trust either until I see some fair dinkum progress…

It really stumps me why young people are not on the streets… When they do get to that point, I will be marching with them! – proudly wearing the homes4aussies t-shirt I had made for our (mine and Mr Rudd’s) local 2020 summit (but that’s yet another – frustrating – story) !!

joe

:

I’m sorry Andreas but your logic is flawed – re: property is an unproductive asset

1. Property requires maintenance = hiring of builders, plumbers, electricians, maintenance staff etc

2. Rental properties “usually” get more maintenance than owned properties b/c they need it & b/c of the tax deductions provided

3. Rental properties also provide income to landlords => economy as whole increases b/c more money to spend elsewhere

4. Only when rental properties are without tenants are they less productive b/c of less maintenance & less revenue

5. Rental properties are more productive than owned houses b/c of (2) & (3)

6. Existing rental housing has less initial economic value but over the long term it ends up about the same as new housing since:

(i) maintenance costs are higher

(ii) eventually it will need replacing before a new house & b/c depreciation (as a tax break) decreases significantly

BUT there is no doubt that there is a huge conflict of interest for politicians with an interest in property; I’d argue equivalent to that in shares.

I don’t have any issues with politicians owning property or shares BUT any decisions made by them on a particular investment should have all disclosures listed. In that way an independent assessment can be made as to whether the decision was inappropriately influenced &, if so, the appropriate ramifications should be listed so that there are consequences to their actions.

Given the advent of advanced AI used in law firms I would suggest that the independent arbiter

be an incorruptible AI with fixed rules & that all decisions made by politicians re: work expenses, commercial dealings etc be run through the program to ensure that no misfilings, conflicts of interest etc occur. This would be in the form of an app on their phone & can be used without significant inconvenience.

Brett Edgerton

:

You better get a Ouija board and conjure the father of economics to argue that “flawed” logic, mate… While you are at it see if you can get a hold of Darwin – I bet you’ve noticed a few flaws there, too… wait a moment, perhaps you are on to something – maybe Orang-utans actually belong to our same sub-species and thus qualify for investment property loans – ooops, just been informed that a couple of Orang-utans at the Melbourne zoo own several apartments in Docklands and are thus adding to the productive capacity of Australia… Smart primates – and good looking, too… just kiddin ;) – TGIF …

Chris

:

Of course they do. It is common knowledge that:

There are financial donations made and corporate hospitality provided at events to which they get invited, from property developers and property development companies so that policy and legislation favourable to their interests is passed. Otherwise, why bother to make donations or invite them to the corporate box if you are not going to get anything for it ?

It should be like Singapore. If your company tries to win a tender or a contract with such sweeteners, you’re automatically disqualified because this behaviour is illegal; it’s effectively considered bribery of a public officer or official.

They own investment properties (often in the name of partners or spouses) and there was a story recently in the news about them being rented back out to them. Then, they were claiming the allowances that they were legally entitled to (but morally it’s not right to) and so, effectively, “double-dipping”. No “arms length” provisions there or any conflict of interest !

(In both of the above examples, if the coalface public servants accepted any form of donations / hospitality or were seen to be “double dipping”, there would be all hell to pay and they would lose their job)

Anyone (and their party) seen to be responsible for the value of housing going down would never get re-elected. It is the biggest source of wealth that most people own, being their house or investment properties, because culturally in Australia, people still see the stock market as ‘gambling’ or for ‘rich people’ and that property is somehow ‘safer’, hence, they put their money into what they know and think they understand.

ken.looi

:

A investment property is a capital good used by a landlord to provide a service (ie shelter); in the same way a barber provides a service (ie haircuts) using scissors. To say that property is an unproductive asset is as absurd as saying that tools used by tradespeople are unproductive.

Andreas Lundberg

:

Ken, the difference is that investment in tools for tradespeople make them more productive in their chosen line of work. I.e. they can produce more output per time unit because of the investment and hence the investment in tools is productive as the overall productivity of the economy is increased. The situation in Australia with domestic property being very expensive have 2 negative effects:

1. The investment that went into the investment property could have been directed into an investment that actually increased the productivity of the economy (both the investors equity and also the money he/she borrowed from a bank that could have been lent to someone else for another use).

2. The investment into the investment property, especially if it is an existing property, drove up the price of the overall property market making the service of “shelter” (which I agree is an essential service although not necessarily one with increasing productivity according to the price of the service) more expensive than it would otherwise have been. This means more resources will have to be directed to this service by the person seeking “shelter” leaving less resources available for investments in other areas (e.g. providing growth capital for a company that can provide future employment and pay taxes and increase GDP).