Where are my valuations Roger?

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.

Bipolar markets appear to be the anticipated outcome for the next few years. Investors seem to be in the middle of a tug-o-war between inflation and deflation, recovery or double dip recession.

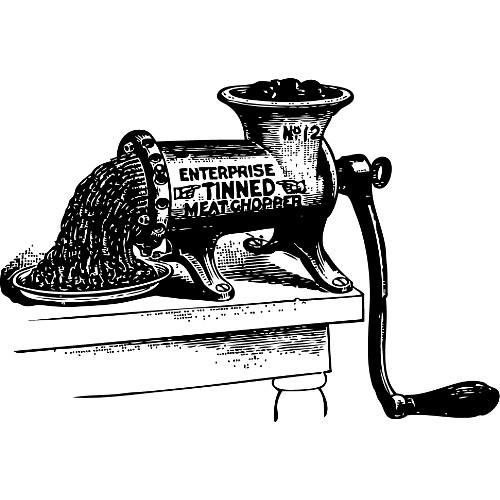

Pimco’s Bill Gross says we have entered the era of the “new normal’ – expect low aggregate returns. Jeremy Grantham at GMO says that attributing the chance of recovery at 25% is “generous” and the US will be lucky to achieve 2% economic growth over the next seven years. And David Rosenberg at Gluskin Sheff says deflation is more likely than inflation, describing the stock market as meat grinder – “No return for a decade and yet plenty of sleepless nights on this roller-coaster ride.” Keep in mind David is a perennial bear. I remember during my days as trader being told; listen to the bears but don’t sell until they turn bullish!

Over at the bullish camp PuruSaxena says “the ongoing range trading should conclude with a bullish resolution” and cites Intel’s best quarter ever and JP Morgan’s analyst estimates-beating performance as justification.

At Montgomery Inc. ‘we’ don’t claim to know how the world’s debt issues will be resolved. What we do know is that you cannot solve them with more borrowing.

In Australia many ‘analysts’ are pointing to the fact that the recent rally has not been accompanied by much volume. Indeed, one of my friends who is a broker said they can “hear pins drop” in their office. But before you rush out and sell in anticipation of some imminent correction (I am not forecasting anything), have a look at the volume that accompanied the beginning of the bounce from the March 2009 lows. They were relatively light too. Perhaps that means the whole thing will indeed end in a massive correction that will see even lower lows! (I am not forecasting anything).

Stock market investing however need not be so mysterious and confusing. Instead of focusing on stocks, focus on businesses. Instead of focusing on prices, focus on values. When bargains are available it is obvious. When the banks were at their lows, there was no justification and large discounts to intrinsic value were evident for three of the big four. Their prices were following the pattern of their global peers that were each losing billions and being bailed out or nationalised. While their prices were on their knees, their values were being driven by the fact they were reporting multibillion-dollar profits. Focus on the business – don’t take your cues from share prices.

More importantly, when bargains are available you are writing to me with requests to value high quality companies. “What is the value of CBA Roger?” “What do you think of CSL and Cochlear at these prices?” “They’re pricing QBE like it is going out of business, that’s just crazy.”

Today, value is not so obvious and once again that is reflected in the general quality of the companies that you are asking me to value for you. While you have requested a few decent businesses, there have been a few raised eyebrows at Montgomery Global.

With those thoughts in mind, I offer another Value.able update from Montgomery Inc, along with the relevant MQRs – “Montgomery Quality Ratings”. At some point I will publish, somehow, the entire universe with the A1, A2, A3, to C3 C4 and C5 MQRs.

Don’t forget that the valuations you are seeing here are based on inputs that include analyst estimates. As some of you have indicated, analysts are notoriously bullish and particularly at the beginning of a reporting period tend to have estimates for earnings that need subsequent downward revision. I will discuss this and my observations and insights in a future post.

For now, know that the studies conducted by McKinsey, for example, into the persistent excess bullishness among analysts, aggregate and average the data which can produce a result that does not reflect any particular year. Stick your head in an oven and your feet in the freezer and your ‘average’ temperature will be about right, but of course you won’t be feeling so good!

The point I should make however is that my valuations for CBA, WBC, NAB, ANZ, QTM, CAB, HZL, FLT, SOL, MMS, CPU, AXA, BLD, CFU, DYE, DMX, ISF, VLA, QHL and CLQ (especially the 2011 estimates) will be revised over time. They will change. And having just been calculated they may also have changed from any previously published valuation and supersede them.

WARNING: Not recommendations or advice. Didactic exercise only. Seek personal professional advice before doing anything!

* Quality Score shown for last full year results. May change dramatically. May have been one good year – a flash in the pan. There is more to know. If for example, a company makes a debt-funded acquisition, its quality score could change.

++ 2009 Valuation. No forecast information available

+++ No forecast information available

^ US Company listed in the US

Your copy of Value.able will be delivered soon. I’m looking forward to comparing you’re valuations here on my blog.

Posted by Roger Montgomery, 22 July 2010.

Hey Roger

I was initially shocked when i saw the W.A soon to be N.S.W Areo space company on one of your lists, i have a personal interest in this company and have been watching it with great interest and will for sometime to come.

I can see where you are going with the competitive advantage and i know what the barries to entries are into the industry so they will not have any real competition in (Australia) and i think more importantly they are an independent from the likes of air bus and the rest which will give them access into the industry as a whole. +

they have government support which is good to have pretty rare these days

There technology however still needs to be proven in a HIGH RATE manufacturing environment as this normally is where you find out if all the numbers do stack up in comparison to Autoclave high volume loads or single piece flows (Quick tec.)

They do have 2 Autoclaves at the moment, so it’ not going to make a great deal of difference to their production of parts.

And even if there Technology was not used at all they have made enough in roads into the industry that they would do well with Autoclaves,

Not sure however to value future I.V as they have not delivered any shipsets of parts or at what rate, also the price and margin per shipset.

The only other comparable Australian business listed was Hawkers d e Hav i l land back in the 90s which was part of the Haw ker grp.

Interested to see your insights into this.

Do you believe the high competitive advantage would also lead to High I.V High ROE businesses

Think i answered my own question somewhat :)

Mate,

When I saw Quantum Energy on the list my first reaction was – who? Then I eyeballed the tearsheet and my next reaction was – huh? Plenty of red ink, some of it recent, negligible cash flow per share, share certificate printing press running full steam in the background, margins are erratic, etc. And, oh yes, “it’s a manufacturer and distributor

of advanced renewable solar energy hot water…products” and “distributed high-end medical products

to the growing markets of oncology and women’s health services”.

Right then, solar hot water with a dash of oncology on the side.

Maaaate, what’s up with this one being A1? c.f., say, Flight Centre at B4, and I really don’t get that rating at all. Some kind of business-changing transformation going on in the background there? Yes, I know, I should pull out a decade of ASX disclosures and figure it out. It’s a business that under other circumstances just would not come close to making a short-list in my world to even be worth a day’s effort reading the historicals. How does a business with a decade of, seemingly, low quality results make it to an A1 status?

Seriously though, love your work.

Obsequiously yours,

JD

Hi JD,

You left out one other option – Flash in the pan? Quantum has been a C5 since 2004. Only the 2009 results produced an A1 score. You do need to look at the quality scores across time to get a feel for consistency. So far here there is none. AT some point I will put up a list of companies that have only ever been A1.

Hey Roger,

Your book is a great read so far!!! I skipped to the section on working out the intrinsic value of a stock and put your multi-step formula in a spreadsheet.

I tried the formula on QBE and I got the valuation of $20.56 using their 2009 results. Have I done it correctly and what’s your valuation on this stock?

Thanks

Hi Boutros,

Great work. You need to read that section though and the section on selecting a discount rate. Invariably our valuations will differ based on the discount rate we use. Importantly, you need to look at the future rather than the past. Go back and read that section Boutros.

Roger

I note that a US company is included in the above table.

How do you approach the currency issue? Does that risk require a greater margin of safety?

Hi David,

We have had some really helpful discussions here about currency risk and reached the conclusion that there is no perfect way to hedge the currency risk. For the purposes of the international stocks I mention and value, there are no adjustments made for the currency. I present than just as I would a local company.

Hello Roger I will never look at a $1 coin the same way again. I work for Flight Centre I was interested as to your rating. As employees the company appears to be in good shape. I was advised by an adviser that these shares can be hard to monitor because they are an emotional stock. This helps reinforce the info i was given. Kind Regards Jamie.

Hi Jamie,

I was having a good look at Flight Centre over the weekend while I was in Melbourne enjoying the fine weather (!) and company of friends following a couple of short talks for the Investors Expo. I know the company reasonably well having been quoted in the press about it many years ago. I revisited it and ran my new valuation approach over the last decade and what stood out, was the fact that the value did not have a nice north easterly trajectory. Over ten years the value was slightly higher but it had tracked a very cyclical and lumpy path.

Hi Roger, great shows last night and I am anxiously waiting your book. I can see myself calculating my own intrinsic values to the thousands of companies on the market for many days and nights to come. Im after what broking facility or market analysis program you use to get all your stats, (Im sure you have found the most efficient way). On the show you seem to be able to look up most stocks in a second and can give us detailed information on how much money the company has raised and the shares on issue over a long period of time. Is this just an excel spreadsheet that you’ve put hours piling stats into…

Thanks mate, (are you interested in Atlas or happy to wait)

Hi Patrick,

One of the most powerful programs around is Microsoft’s Excel and Apple’s Numbers programs

Hey Roger,

Give the not so great annoucement on WOW, has your valuation changed thus far? I notice its looking pretty attractive but clearly i dont really know where the buttom is, any insightful target range? My father is nagging me to buy some but I dont feel its cheap yet as the company growth clearly has stunted and could remain below 5% as a going concern. Eamon!

I’ve also notice you stop talking about blackmores, has it stop growing too?

The rally following the GFC Eamon, has put the shares well above intrinsic value.

Hi Eamon,

Listen to your father. Seriously, the negative press around Wooiles is a function of the lower price as well as its cause. Do you think you get the opportunity to buy high quality businesses cheap when all the news is positive? If you wait for the robins to sing, spring will be over. Having said that the bigger the margin of safety, the lower the risk. By the way, I do not know where the share price is going either. I saw an article today that said the company’s buy backs suggest it has run out of growth options. On the flipside, if a company cannot find anything cheap to buy, if its shares are at or below intrinsic value, perhaps it should buy itself. Buying your own shares below intrinsic value will add value to the remaining shareholders holdings.

I’am still waiting on the sidelines for this one, WOW has came out with some surprising downgrades of late. I just want to see what the full report is before I have a stab at buying some. On a technical side it’s currently ranges trading at the moment. The bulls and bears are undecided where the stocks is going to go. The full year report will shine some light soon. In the mean time……

I’ve my bazooka armed and loaded to fire, at the right oppotunistic moment.

Hi Roger,

I thought I might offer some of my experience with the “green tech” sector. I hold a degree in Environmental Science and as such got interested in green tech stocks, so I bought many books regarding how to profit from the green sector. I bought CFU and DYE among others. I watched them go up and then down and I eventually got out with my capital intact but that was about it.

I then remembered Buffett’s “the internet wont change the way people shave”. So after reading some more, I discovered that although I am a fervent believer in the coming green revolution, the issue as an investor is which companies will be the winners.

If you utilise Greenwald’s Competitive Strategy (from Competition Demystified) then there are 2 types of companies. Those with some kind of moats or competitive advantage and those without (which he states must focus on cost reduction as the only way to survive).

Many of the green tech companies such as CFU and DYE appear very exciting and both are wonderful companies that are among the cutting edge in their fields. But this does not make them great investments. I recall in the GFC that CFU lost $13 million due to bad investments. So while their products are exciting their money management may not be as good. They were then forced into undertaking a capital raising.

Greenwald also states that most moats or competitive advantages are local. DYE and CFU are currently seeking to expand into global markets where building a moat will be a challenge because all the energy companies of the world are trying to do the same thing. In addition to this, there are many types of alternative energies and at this early stage there is little chance that any one or two will dominate. Solar? Maybe. Wind? Maybe. Geothermal? Maybe. You get my point.

Quantum Energy is the same. They are in the “right industry” but do they have a moat? Will their earnings grow consistently? Maybe, but if you cant be sure then there are better places for your investment dollar.

regards

Steve

Great perspective Steve,

I make a comment further on, about the source of Quantum’s valuation, and the unlikely event of its sustainability due as it is to renewable energy certificates. See my comments further on. In support of your comments Steve, remember Buffett’s advice about avoiding fast changing industries.

Hi Roger,

I was fortunate enough to buy the banks when they were at or near rock bottom in late 2008 early 2009. I have made large capital gains (CBA – 90%, WPC – 70% ANZ – 60% and NAB – 25%). I have reinvested all dividends. My question is although they are not A1, because I bought them so ‘cheap” their annual returns are high (roughly about 21%), so I figure that even with a less than stellar performance I can expect to make good returns (via dividends) from them over the long term future and considering their oligopoly status they will probably continue to deliver reasonable returns. Therefore I should not be too concerned about selling them at any time in the future (barring of course a disaster)?

I suppose my question is – if you buy a less than great company at a very cheap price and the dividend return is high because of the cheap price it makes no sense to sell??

regard

Steve

Hi Steve,

According to my quality scoring method, which I have applied to the banks going back ten years, the banks have scored B1s and B2s in most years. Since 2006 however their performance has deteriorated but the strength of their balance sheets (quantitatively only – I am not willing to start a debate about whether owning Australia’s residential housing stock is ‘strong’ or otherwise) has improved thanks to substantial capital raisings. The result is that B1 and B2 has become A4 and A5 today. Of course they are not going anywhere and neither are their customers. Your purchase price is indeed excellent and unlikely to be replaceable. There is an argument that it is not the price you paid but the price today that should determine your strategy. For mine, provided prices don’t go to extremes compared to value…

Of course, I am not able to predict share prices. I will leave that up to you and your adviser.

It seems that the question will probably be answered in the book.. but i’ll ask away anyway,

Do you you employ a DcF valuation?

Hi Ben,

Yes, all in the book. Not a standard DCF.

Hi Roger

I was wondering about the selection of stocks you have included in your latest post for valuation estimates. Are these stocks the ones you have been getting the most enquiries about?

Also, there are a couple of companies listed which you say there is no forecast information available. At the risk of sounding silly, does this mean that it is actually not possible to estimate certain companies’ value because those companies have not released the required information to do so into the public arena?

I ask because I hold CFU & DYE and would love to attempt to value them when your book arrives. However, if you cannot through lack of information complete the task, then I wonder how can a novice like myself expect to? As for many smaller cap stocks, there always seems to be far less information available.

Cheers

Hi Martin,

You are not precluded from using historical information to estimate your value. You can adopt any return on equity figure that you like, however I am trying to use the latest estimates. Where estimates are unavailable, I will give a historical valuation. if historical returns on equity are negative, then even the historical valuation is zero.

Hi Roger,

I manage a portfolio of clients and am interested in the divergence of opinion between experts such as yourself and the broader research community.

For instance, as I stare at recommendations from 8 brokers on the top 100 stocks in the market i see no less than 58 consensus ‘buys’ and 3 (THREE!!) sells, and we are talking leading research houses here…. safety in the herd??

Dont get me wrong I am not necessarily in the bear camp but I have always struggled with basing recommendations on consensus or analyst reports. While they do provide valuable information (and I do feel for those guys sometimes, after all they need to make a call) the more short termism that creeps into the market the more I find myself needing to step back and refocus on the long term. Using a value based approach means unfortunately I cannot invest on the sort of timeframe a large part of the investment community of focussed on at present.

You have said before dont buy part of a company if you are not prepared to own the whole thing therefore this implies that we need to understand timeframes required for management to successfully deliver on their strategic vision.

While we can debate the finer points of earnings forecasts etc, etc it seems this (possibly too simple??) process resonates strongly with my clients and provides an insight into why we come to the decisions we do.

Look forward to the book!!

Cheers

Hi Brian,

Thanks for your perceptive comments. Buffett said, never ask a barber whether you need a haircut. As your post suggests; think about businesses not stocks and think about values not prices. Over longer periods of time and provided you are not in too much of a rush, you should do reasonably well.

Roger

Looking forward to your book coming out so I can have a chance to do my own valuations.

Have just had a look at Quantum as it stands out. At a share price of 7.3c and assuming a similar year’s results one would think this is a screaming buy!

Hi Peter,

I wonder whether anybody else would care to share their views or knowledge…Don’t forget to seek and take personal professional advice before doing anything.

Hi Roger and Peter,

I just had a look at Quantum too and agree it looks cheap, it is also an interesting little business with lots of potential but I can’t believe it’s an A1 rated company.

Profits have been very inconsistent over the past 10 years, 6 of which were losses and the past reporting period saw a decline.

I was wondering if Roger popped this one into the list as a test or am I completely wrong.

When compared to Sirtex I don’t think they are in the same league – Sirtex screams potential and it’s balance sheet is definitely A1. Quantum looks more like SRX circa 2005 and I think it needs a few more years to prove itself.

Sorry to disagree and I hope I haven’t over stepped the mark.

Hi Craig,

Read my qualifying comments further on about Quantum. I agree with you. The issue is that the valuation is ultimately based on renewable energy certificates. See my comments below. The quality score is a snapshot for one year. I also look at the quality scores going back up to 10 years which provides a picture of consistency.

Personally I feel that the government ” decisions” to delay the emission scheme clearly demonstrated lack of conviction for this sector. Hence the outcome for these great stock in a terrible sector has seen there share prices crumble. So technically you can say the sector is out of fashion and no one really dares to hold them anymore. If you want proof of this go and check out all the geothermal businesses and you’ll see a substantial decline. So unless you are willing to hold very long term there are green pastures on the other side so please look else where for now unless you’ re a very brave contrarian, Eamon!

Yes i would very much like to add my view, and hopefully Roger you could go into some detail.

This really really has me stumpted.

Firstly as you keep highlighting, lets forget about market price for the moment and concentrate on the business.

(a) inconsistent year to year ROE, this makes it impossible to extrapolate into the future. Even if we ignore the first few years as reflecting ‘start up operations’, 2006-2009 shows ROE ranges of -61% to +67%. Ok lets assume for a moment that the -61% was during the GFC what then?

Well we can look at the latest half year reports ending in december.

Half year to Dec 09 shows revenue increased by 12% yet profit from ordinary activities decreased nearly 50%. The unproportional profit drop seems to be caused mainly through an increase in the cost of manufacture (from 43% of revenue to 64% of revenue).

Net profit attributable to members of the parent entity in Dec09 was $6.5 million on equity of $39 million. This equates to an extrapolated June2010 full year ROE of (6.5×2)/39= 33%. A respectable result but only because of accumulated losses from prior years. On Issued capital of $83 million it drops to 15% (and this company has issued heaps of additional capital)

(b) sales revenue.

How much can ‘trust’ these figures.

We saw rapid growth in the 2009 financial year (350%), yet in the latest half year sales growth has dropped to only 12%.

(c) debt: the company has debt, if we back out accounts receivable/accounts payable, obligation liabilities (not including tax, provisions etc) is reasonable, but its close to zero.

My conclusion: the company warrents further research, but is it an ‘A1’???????

Hi Rici Rici,

Generally I concur however I would warn against the straight line approach to extrapolating half year or quarterly profits.

the above text should read:

not close to zero in regards to debt

Furthermore if we look at the april quarterly cash flow statement, there is a significant drop in customer receipt revenue ($9.9 million in march qtr2010 compared to $11.9 million in march qtr2009).

This could suggest that revenue growth is now becomming negative.

Sorry Rici Rici,

What company are you referring to?

Hi Roger

Any thoughts on the CAB litigation with the ACCC in terms of a worse case outcome for CAB’s valuation or moreover a cost to Cabcharge?

Cheers

Brad

Hi Brad,

Typically if a case is settled quickly and it is truly a one-off then the bearish sentiment tends to represent an opportunity. I vaguely recall such a situation many years ago with a car dealership called Adtrans. The opportunity to buy cheaply was presented because of negative sentiment around the cost to the company of a settlement. On the other hand, if the settlement reveals a systemic ethical problem for example, then at no price are the shares good value.

According to the ACCC, Cabcharge breached the Trade Practices Act by refusing to allow Cabcharge cards to be used in EFTPOS terminals provided by other suppliers.

Cabcharge also allegedly breached the Act by supplying free and/or below cost taxi meters, and in a deal with Townsville Taxis replaced 130 existing EFTPOS terminals with Cabcharge EFTPOS terminals.

Investors of course are concerned that the company’s >90% market share is under threat and so this is not a one off settlement situation.

Cabcharge’s half-yearly revealed turnover through payment terminals was $536million. Growth came mostly from bank-issued credit and debit cards, then Cabcharges own cards and third-party cards (Amex and Diners) fell.

Cabcharge charges a 10% service fee on all these transactions, earning a big portion of its revenue from its payment system business. A successful ACCC action could hurt the company if either the service fee is reduced, or taxi drivers and owners are given more freedom to use other terminals.

The ACCC’s may also fine cabcharge and that fine could be calculated as either a percentage share of excessive profit or revenue for the period it is alleged to have engaged in the behaviour.

Whatever the outcome, there should be enough time to assess the impact on intrinsic value and so take advantage or ignore the circumstances after they unfold.

Very interested in your assessment of QTM Roger. by the looks of you valuation, there is a huge margin of safety at the moment? I read some of the news feed and it looks very reliant on government rebates? Are regulatory risks very substansial to the company?

Hi FC,

The medical side of the business is. Note that the QTM valuation is a 2009 valuation. It is a now a year old. The 2009 valuation is a function of a substantial increase in sales in the Heat pump business. Consolidated group revenue rose from $28 million in 08 to $107 million in 2009 and net profit from negative $7.7 million to a profit of $30.3 million. But cash flow from operations rose from negative $1.3 million to $4.0 million. My estimate is that the business generated about $2 million of cash after all changes. The difference between profit and cash flow is due to substantial jumps in receivables and inventories. In turn inventories include renewable energy certificates acquired at cost. Lets start a conversation about the true value of renewable energy certificates. But the main point is that in order for a profit-based valuation in 2010 to be as high as the 2009 valuation, there would need a similar increase in inventories again. Is that possible? There is a reason for the “++”

Roger, maybe a stupid question, but what exactly are the meanings of the A1, A2, A3, A4, A5 etc. all the way through ? I’m looking for some literal point of reference, like “C5 – a lousy business with rubbish management and lots of gearing. Avoid like the plague”, or “B1 – A good company in a fledgling (or conversely, mature) industry, maybe a turn-around story but watch Balance Sheet strength”.

For me, it is a bit unclear as to just how you describe (in words) the ratings…like films, one man’s “rubbish” is another man’s blockbuster.

Hi Chris,

For now, A1 have the lowest chance of recording a default event as well as the lowest chance of there being a justifiable reason for the shares being out-of-favourable.

This informations is one of the topics followers on this blog are waiting for in conjunction with the upcoming release of Valua.able.

The valuations provided will serve as a guide if readers of the book can come up with the the same or close to the information provided.

This can also help determine how effective the book is in guiding readers to come up with their own valuations.

Roger, you can expect more clarifications and questions once readers start digesting and disecting the informations from Value.able

Hi Atlinus,

You will inevitably discover some differences in our valuations. Buffett and Munger have both noted that even when they look at the same set of facts, they inevitably come up with slightly different valuations. I have not disclosed the variables used to come up with these valuations, so you will also have to be using identical inputs to even get close. The book however clearly lays out the steps with examples.

Just a bit more on this Roger….. How close is close? difficult I know as it will depend on the individual anaylst forcasts we both use, but can you give an acceptable margin of error to your valuation just to confirm I am using the info in the book as you have set out?

I am not looking for specifics and won’t hold you to anything you say but would like some comments as to whether I am on the right track.

I have just got the book and valued WBC coming up with fy10 24.91, fy11 27,40. roughly 5% diff.

Enjoying the read.

jb

Hi Jeff,

If you are trying to buy at a 20% discount to intrinsic value, then a 5% difference in valuation, shouldn’t make any difference.