What’s the forecast?

When asked for an opinion about where equity markets might be headed, it is common practice for expert commentators to start with some insightful comments on the economy. This is a natural place to start, as the economy is big and important, and some insightful comments can quickly establish that the commentator is as similarly big and important.

It’s also accepted wisdom that the equity market cares about what is happening in the economy, and so it makes a lot of sense to build the market narrative on a sound footing of GDP growth rates, terms of trade, exchange rates and what have you.

In recent times, however, it seems as though the equity markets might have lost interest in the economy: despite lacklustre economic growth globally, markets have been delivered some spectacular returns in recent years.

The explanation for this rests with interest rates. Governments and central banks have sought to stimulate aggregate demand with very low rates, and this has translated into low discount rates for financial assets. Low discount rates equals higher valuations and, before you know it, weak economic growth leads to more expensive equities and a very chipper housing market.

So should we still pay attention to the economic narrative that prefaces market forecasts? If the GDP outlook remains gloomy does that call for caution in the way we invest?

The answer is that we should probably never have been paying any attention to the economic narrative to begin with. There are a couple of reasons for this. Firstly, somewhat counter-intuitively, the equity market has never much cared what was happening in the real economy. In a 2005 paper[1], Jay Ritter published a study analysing the relationship between per capita GDP and stock market returns for 16 countries representing the bulk of world GDP for the period from 1900 to 2002. He found there was, if anything, a negative correlation between the two. There are different explanations for why this is so, but in summary it seems that much of the benefit of GDP growth finds its way to consumers, rather that benefiting the owners of shares in existing corporations. In short, the evidence shows that the equity market is just as likely to rise in a weak economy as a strong economy.

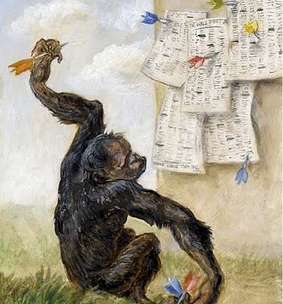

The second reason for ignoring the economic narrative is that it is most likely useless as a guide to what might happen in the economy itself. In his 2005 book, “Expert Political Judgement: How Good Is It. How Can We Know?” Philip Tetlock set out the results of a long-term study into the accuracy of more than 82,000 predictions made by people who made their living “commenting or offering advice on political and economic trends”. In both politics and economics, he found that the experts could have been beaten by dart throwing monkeys. It seems the economy is too subtle and complex to yield to the insight of even high profile economic specialists.

So, when it comes to investing, you can listen to the macro commentary which will probably be not only wrong but also irrelevant…or, you can roll up your sleeves and look for companies that are worth more than you have to pay to own them.

The former may be fashionable, but the latter stands a much better chance of working. As Ritter succinctly put it:

“Countries with high growth potential do not offer good equity investment opportunities unless valuations are low”

[1] J.R. Ritter, 2005, “Economic Growth and Equity Returns,” Pacific-Basin Finance Journal 13, p. 489-503.

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To learn more about our funds please click here.