Bubble Watch #21

According to Montgomery Global Fund Portfolio Manager Andy Macken, living in New York City, just about every person almost every night orders their ‘takeout’ on Seamless – known as Seamlessweb before June 2011. Seamless is an online food ordering system that links people with local restaurants, caterers and onsite dining providers.

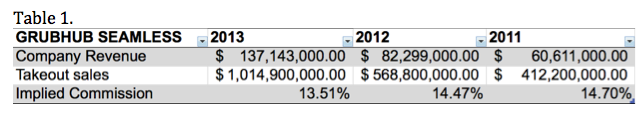

In 2013, Seamless merged with another online takeout ordering platform, GrubHub, to create a combined company with approximately 25,000 restaurants across the United States and in London. ‘Way’ back in 2013 the combined organization processed approximately 130,000 orders a day. That’s 47.5million orders per year, and based on the stats in Table 1. the average price per order was roughly $21.

Table 1 offers some insight into the growth and size of the operation. GrubHub is now listed on the New York Stock Exchange under the code GRUB.

The growth however continues to be extraordinary and GrubHub reported better-than-expected results for the first quarter of financial year 2015 with revenues at $88.3 million and Earnings Before Interest Tax Depreciation and Amortization at $28.2 million. Forecast revenue for 2015 is as high as $361 million and average daily orders exceed 234,000. The company also reported a 5.2 percent year on year increase in its average order size at $27.93 during the quarter.

The growth however continues to be extraordinary and GrubHub reported better-than-expected results for the first quarter of financial year 2015 with revenues at $88.3 million and Earnings Before Interest Tax Depreciation and Amortization at $28.2 million. Forecast revenue for 2015 is as high as $361 million and average daily orders exceed 234,000. The company also reported a 5.2 percent year on year increase in its average order size at $27.93 during the quarter.

The size of the prize is enormous – takeout is a $70 billion dollar market – and investors are excited by it’s size as well as the relative stability and defensive characteristics.

History shows that the network effect can be a powerful economic moat that results in a winner-take-all endgame. As a result, GrubHub’s two-sided network now across 35,000 restaurants is attracting some heady price multiples.

In the first quarter the company earned 12 cents per share. Assuming GrubHub earns the most optimistic analyst’s forecast of 64 cents per share, the stock is trading at 62 times earnings. Based on the most bearish forecast for earnings per share, the company’s shares are trading at 83 times earnings.

If GrubHub’s growth is not enough to get excited about, consider the growth of Yemeksepeti. Based in Turkey and operating across Greece, Qatar, Jordan and Saudi Arabia via the ordering platforms foodonclick.com and ifood.jo, Yemeksepeti processes 3.5 million orders per month and is growing at 60 per cent per year.

Assuming five per cent per month growth and a $25 average order size (on which it earns, say, a 12 per cent commission, the company will process 58 million orders in the next twelve months and earn revenue of $175 million. We are assured the company is profitable. That’s good to know because in early May, the company was purchased by Frankfurt-based Delivery Hero for $589 million or just over 3 times forecast revenue.

But first prize – and the inspiration for this Bubble Watch blog post – has to go to the owners of Australian-based food ordering platform Menulog. Menulog is an online service that allows users to order delivery and takeaway food from more than 5000 restaurants around Australia.

Menulog processed 6.5 million orders last year and according to my colleagues, the average order size is about $40 and Menulog takes a 10 per cent commission. Roughly speaking of course, the company earned revenues of A$26 million.

Back on May 4, The Australian Financial Review, speculated that Menulog might float via an IPO.

“Menulog is on the block, with the digital group expected to fetch a price tag of up to $500 million in a Goldman Sachs-run sale. It’s understood the company has revenue of around $40 million and could attract a multiple of 10 to 12-times sales, judging from overseas comparable businesses.”

Drum roll please….

Delivery Hero’s competitor, UK-Based Just Eat has “Just Bought” Menulog.

It’s mind-numbing then to think that Just Eat “Just Paid” A$859 million!

Suffice to say Delivery Hero reckons “that’s crazy”.

We do too.

As mathematician Herbert Stein noted; “If something cannot go on forever, it will stop.” And as the Persian adage observes; “This too shall pass.”

Just watch.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

Patrick Poke

:

33 times sales? I am dumbfounded. Especially for a business with very little presence (based on my own subjective experience) in its only market. I’m a millennial, very computer savvy, and I buy plenty of things online. While reading the article I kept thinking “I wish Australia had something like this”. I think I may have heard of MenuLog once, now that it’s been mentioned it seems familiar, but I’m right in their core demographic and I could not have named the website before reading this article.

Wayne A

:

Speaking of lofty multiples, perhaps a touch of unintentional irony in the branded pizza box above. Hope that drone doesn’t lose its grip or they might have a long way to fall….

Roger Montgomery

:

Nicely articulated!