What to expect from markets during the Russia and Ukraine war

In this week’s video insight Roger discusses the terrible events unfolding in Ukraine, resulting from Russian military action, which are above all else a human tragedy. There isn’t always a straight-line relationship between geopolitical shocks and financial market responses.

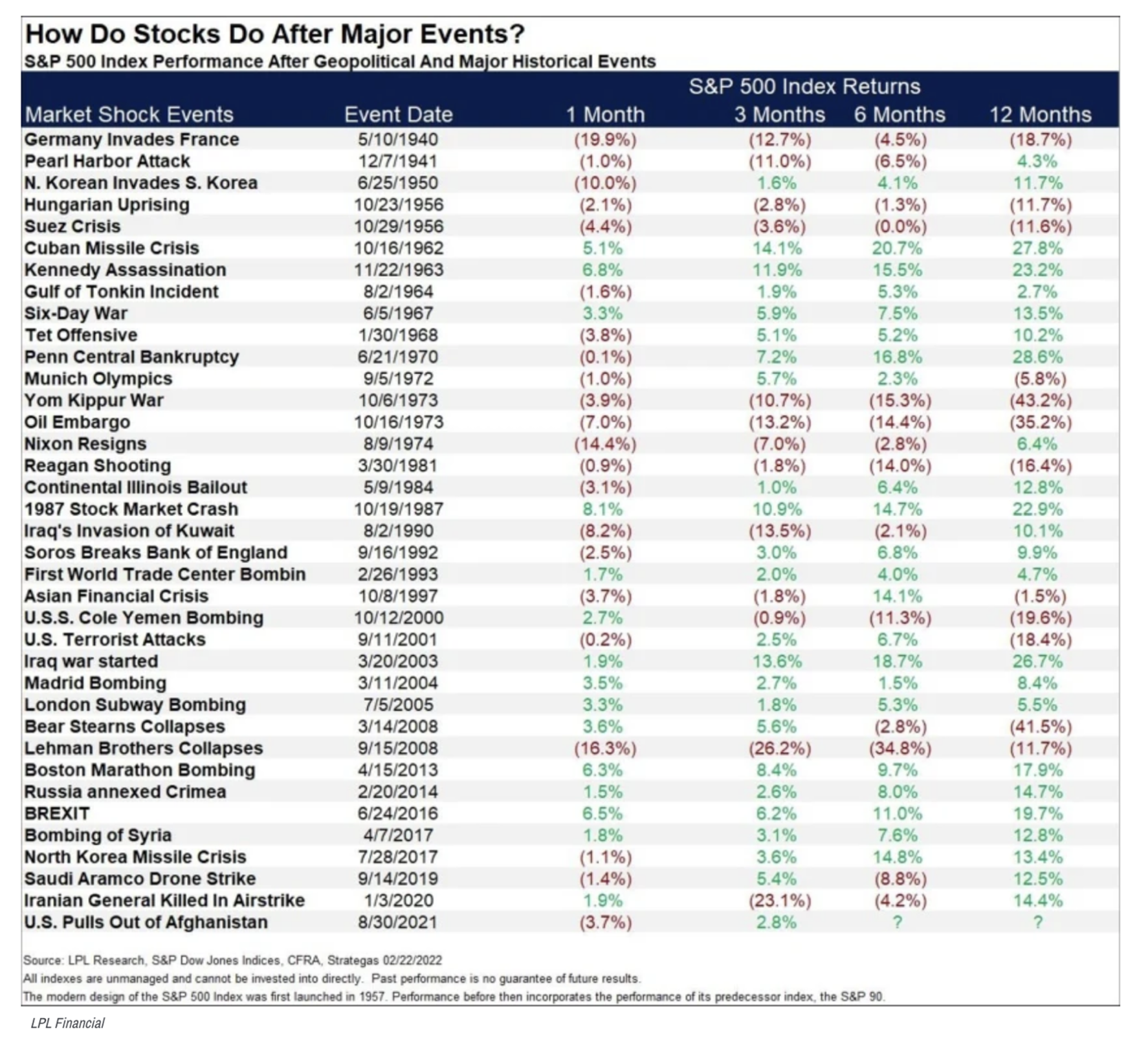

Roger reveals the past market performance following major geopolitical or historical events since World War II. A discussion on the economic implications invariably begins with energy markets. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared with Ukraine one of the world’s larger exporters of iron ore.

Transcript

Roger Montgomery:

A week or so ago we wrote about historical precedents with respect to the equity market returns amid war.

The summary; equities tend to decline in the prelude to war and rise when the first shots are fired. When we have seen divergence from that historical pattern it is because there was no prelude.

Between 1914 and 1918, the period that defines WWI and between 1939 and 1945 – defining WWII – the Dow Jones rose 8.7 per cent and 7 per cent per annum respectively. During the two periods that arguably define the worst military conflicts in modern history the markets rose.

Most-conflicts-since-then have been relatively short-lived. Have a look at this table courtesy of LPL Financial. It reveals past market performance following major geopolitical or historical events since WWII. The bottom line is, in the absence of a recession, the market appears to eventually shrug off conflict.

None of this is to diminish the very real horror of the humanitarian crisis unfolding in the Ukraine, the mounting loss of life and thousands of families and individuals displaced as they leave their homes and relationships for safety across the border.

For each conflict or crisis, investor uncertainty stems from the presence of elements that make it more unique (and worse) than those that preceded it.

With respect to Russia’s unprovoked invasion of the Ukraine, we have, according to various press reports, an unhinged kleptocrat, with a finger on a phalanx of nuclear weapons.

Maybe this time is indeed different. And let’s not forget investors were already nervous about inflation and rising interest rate before Putin’s aggression.

Indeed, the prevailing inflationary climate may have had something to do with his timing. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared. US inflation hit a four-decade high and perhaps, Putin seized the opportunity thinking the west might be loath to impose sanctions that drive prices higher.

But the Ukraine is one of the world’s larger exporters of iron ore and some 600 million people in Europe and elsewhere are fed by the country’s agriculture sector.

Conceivably, Putin underestimated the West’s determination to secure this important source of food and mineral commodities. But more important than letting commodity supply fall under Putin’s control, maybe it is the West’s determination to defend democracy that Putin has underestimated.

Keep in mind, the stock market can remain elevated for some time – even as a train wreck is obviously approaching. Eventually however it succumbs to a wave of panicked selling – much as a deer or rabbit transfixed by headlights succumbs to the vehicle careening towards it.

Investors need to watch for the point at which the Allied’s words, sanctions and the supply of arms to Ukrainian civilians is inadequate to defend democracy and the Ukraine.

Putin’s persistence – and it is clear his pride won’t tolerate anything less – and the failure of diplomacy, would be negative for risk assets. A consequent delaying, by central banks, however, of both quantitative tapering and interest rate increases is a positive.

If diplomacy does succeed, the focus will return to inflation, interest rates and the risk of a wage price spiral.

In either case the possibility of a pronounced correction is one investors should be ready to take advantage of. If I was to make one prediction it is that in a several years’ time, we will have seen a correction but we will also have seen peak inflation and the effect of automation on productivity and wages, which will be incredibly positive for high quality businesses, those with pricing power and those growing into their-potential-to-be-a-multiple-of-their-current-size.

The war in Ukraine is, appropriately, a major concern for all of us. And while we hope democratic western nations do everything possible to stop Putin in his quest to subjugate and vanquish Ukrainians, it is not the only issue for investors. Here are some of the other major issues to keep an eye on.

Great reference context and well delivered with the appropriate supporting historical facts. Lets hope that Russia can see some reason based on basic human decency, it is unfathomable how anyone could see the unprovoked shelling and brutality on civilians and children as a remedy for a territorial dispute, not to mention the immediate and future financial well being of their own citizens who will probably suffer in complete oblivion of the devastation their leader has initiated.

Personally, I am very glad I have the team at Montgomery Team guiding my investment future through these painful and crazy times.

Thanks for your kind words Mark, I will be sure to pass your comments on to the investment teams.

Roger do you have updated multipliers from you book? that go further out? could you email to me?

Hello Jason, they have been emailed to you already on March 4 around 10.30am