What if interest rates don’t go as high as the market is predicting?

With many market watchers expecting the Reserve Bank of Australia (RBA) to keep raising interest rates, high growth companies with no current earnings, but with potential for strong growth, have been heavily sold off. But, due to the economic impact, I’m not so sure the RBA will raise interest rates by as much as predicted. And if I’m correct, investors will be able to pick up (some of) these high growth companies at more favourable prices.

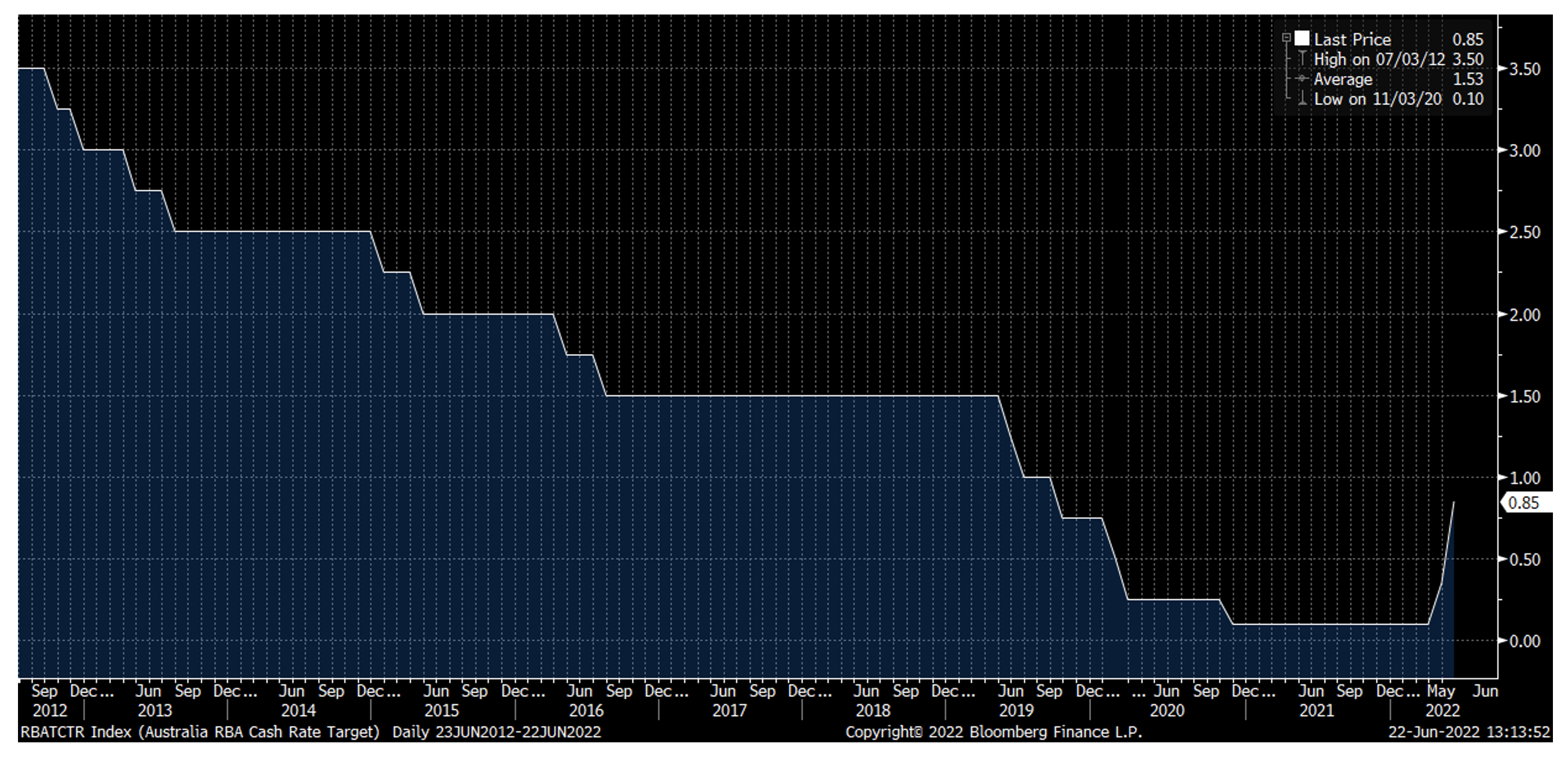

Reserve Bank of Australia’s cash interest rate

Source: Bloomberg

The chart above shows the Reserve Bank of Australia’s cash interest rate over the last 10 years. Readers will undoubtedly be aware that we have recently seen a 75 basis points increase in rates to 0.85 per cent as the RBA is finally waking up to the prospects of rampant inflation. As can be seen from the chart, 0.85 per cent is still very low in a historical perspective and given that Phil Lowe and other RBA officials have clearly stated that they will continue to raise interest rates to rein in inflation, the market is predicting a lot of further increases, it is interesting to see what the market is currently pricing in in terms of future rate hikes.

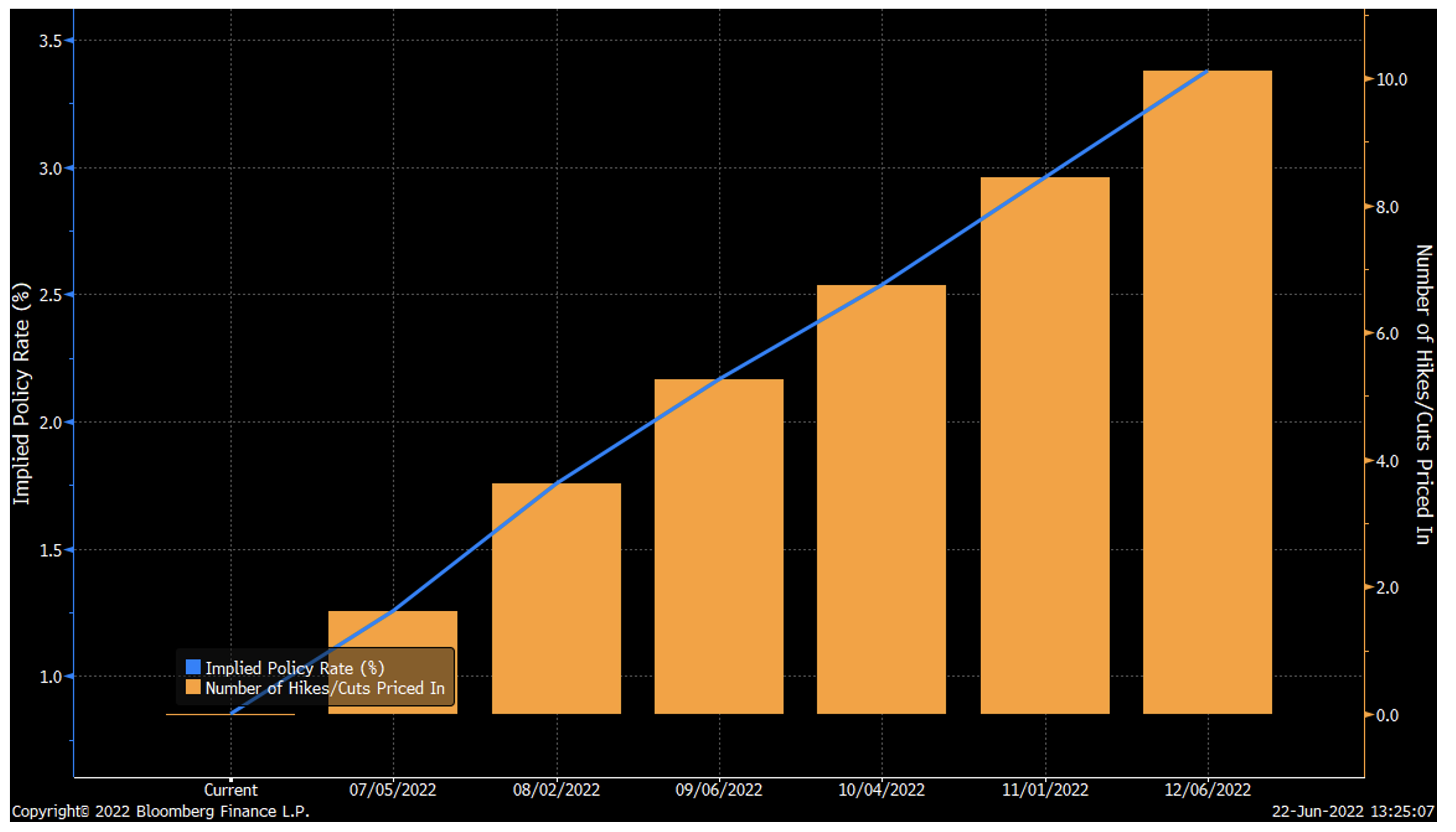

Bloomberg provides a function for this and from the chart below, we can see that the market is currently pricing in 10 interest rate hikes of 25 basis points each (they do not necessarily need to come in 25 basis point increments as the recent 50 basis points increase shows) for a total of 250 basis points increase taking us to a cash rate of 3.35 per cent by December this year which would take us back to interest rates last seen in 2012.

Interest rate hikes

Source: Bloomberg

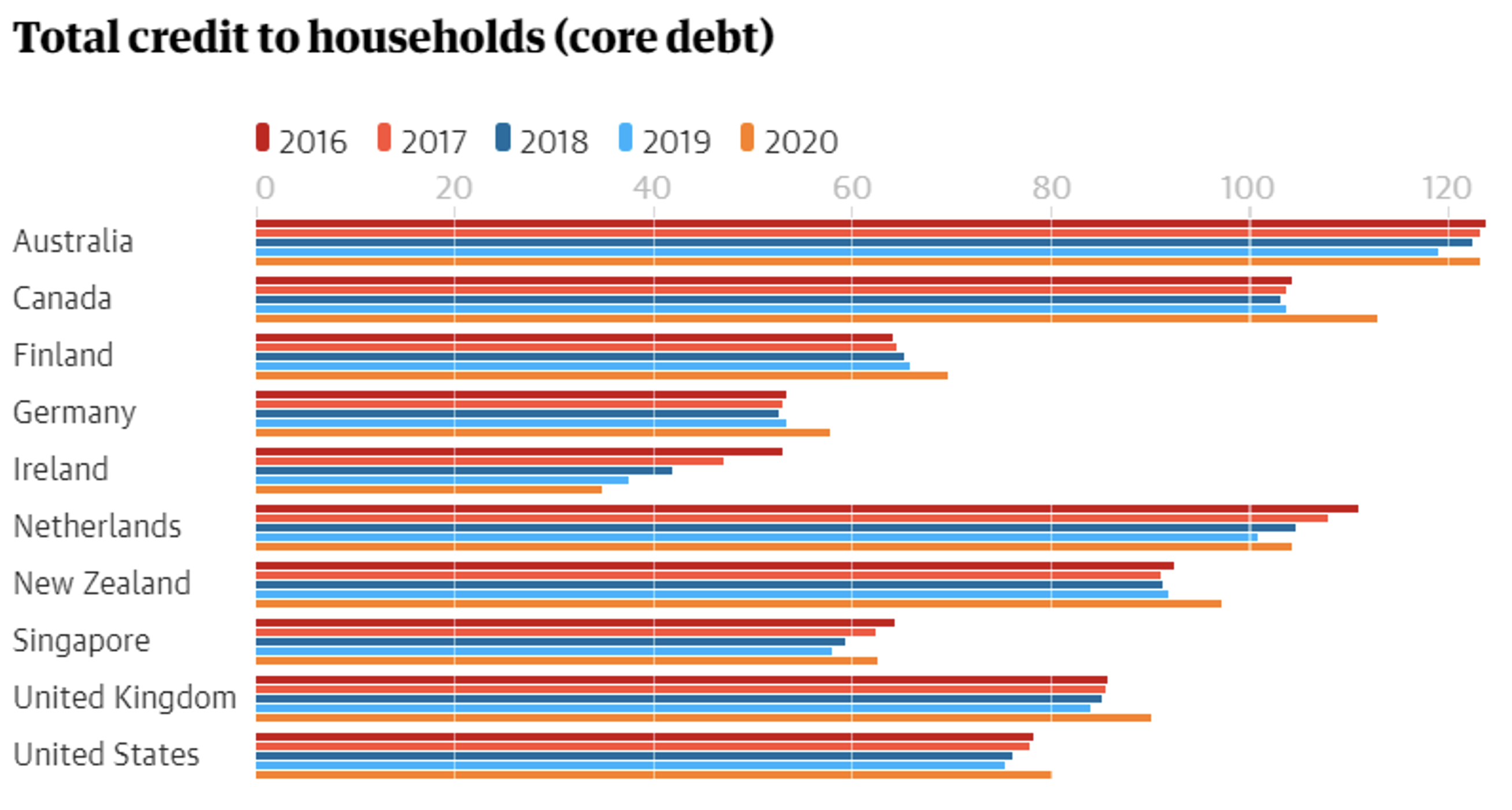

Given that Australia is amongst the world’s most indebted nations as this chart shows and with most of mortgages being variable interest rates, such an increase in interest rates would have a significant impact on the consumption patterns of Australian households:

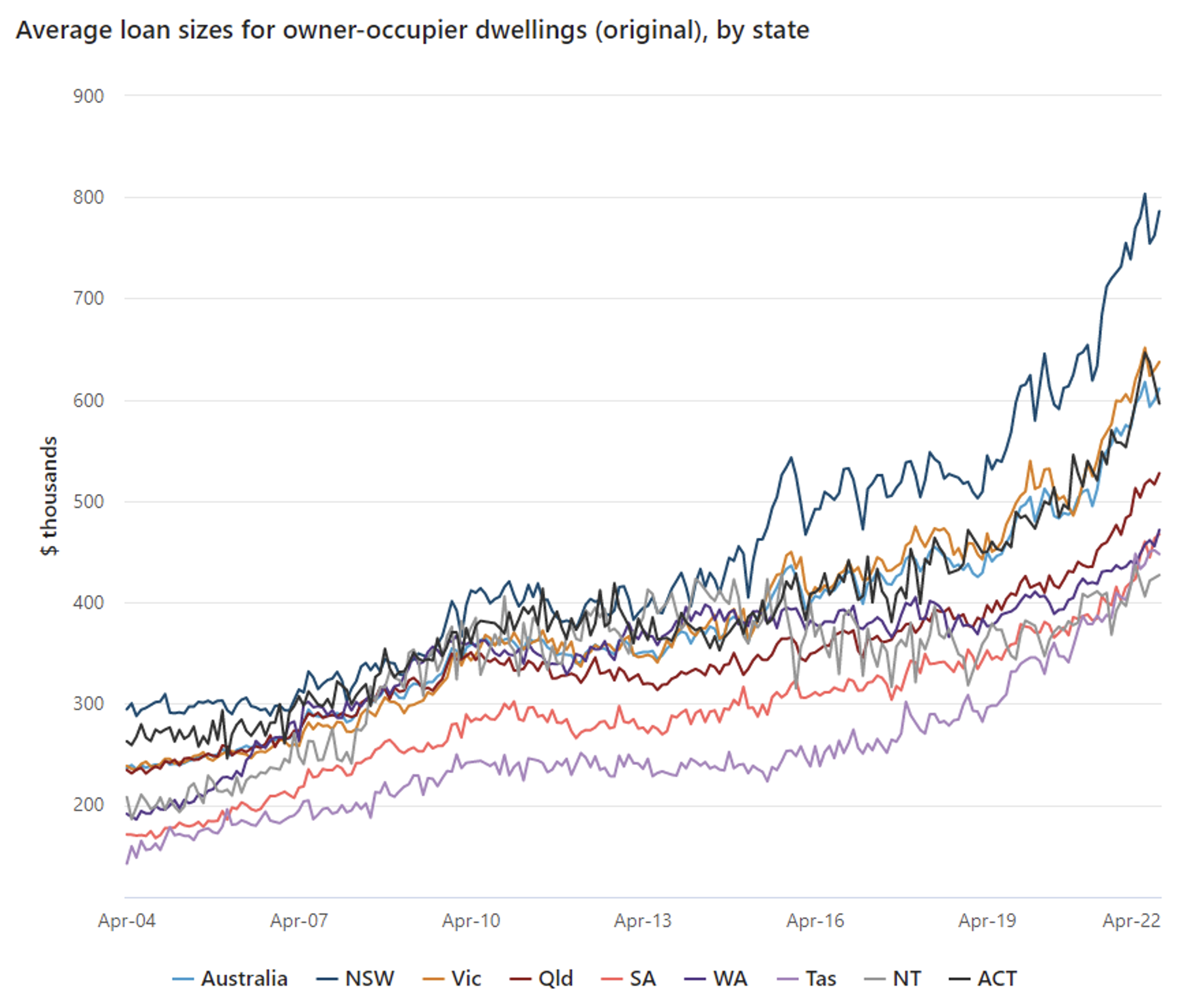

To try to assess the impact, we can first establish that the average mortgage balance in Australia is about $611,000 according to the chart below.

Source: Australian Bureau of Statistics

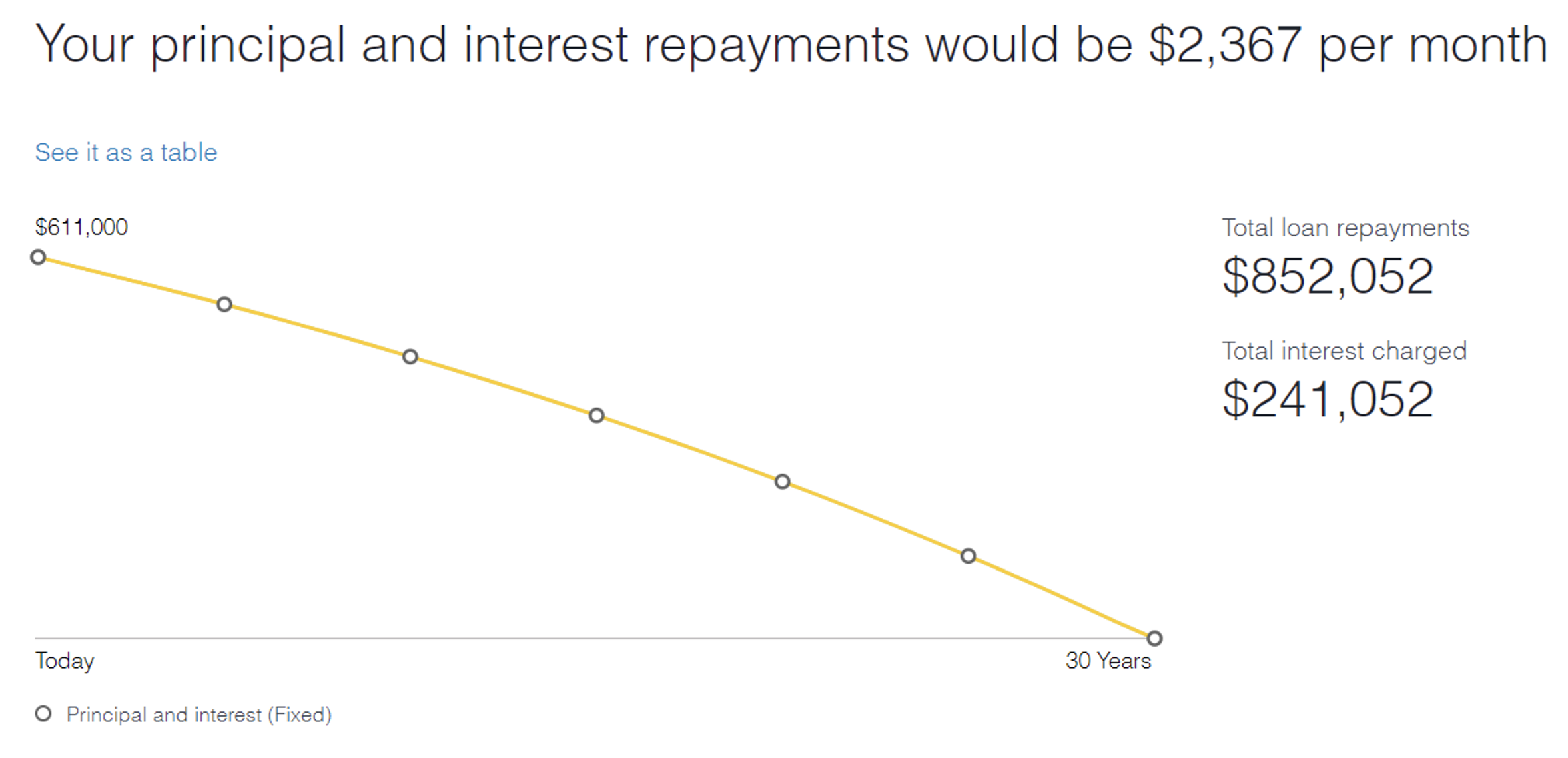

At the moment, the best variable interest rate you can get on your mortgage is about 2.35 per cent according to www.mortgagechoice.com.au. If I use that interest rate and the average loan balance of $611,000 and use the mortgage calculator on the Commonwealth Banks’s homepage, I get a monthly principal and interest payment of $2,367/month:

Source: Commonwealth Bank of Australia

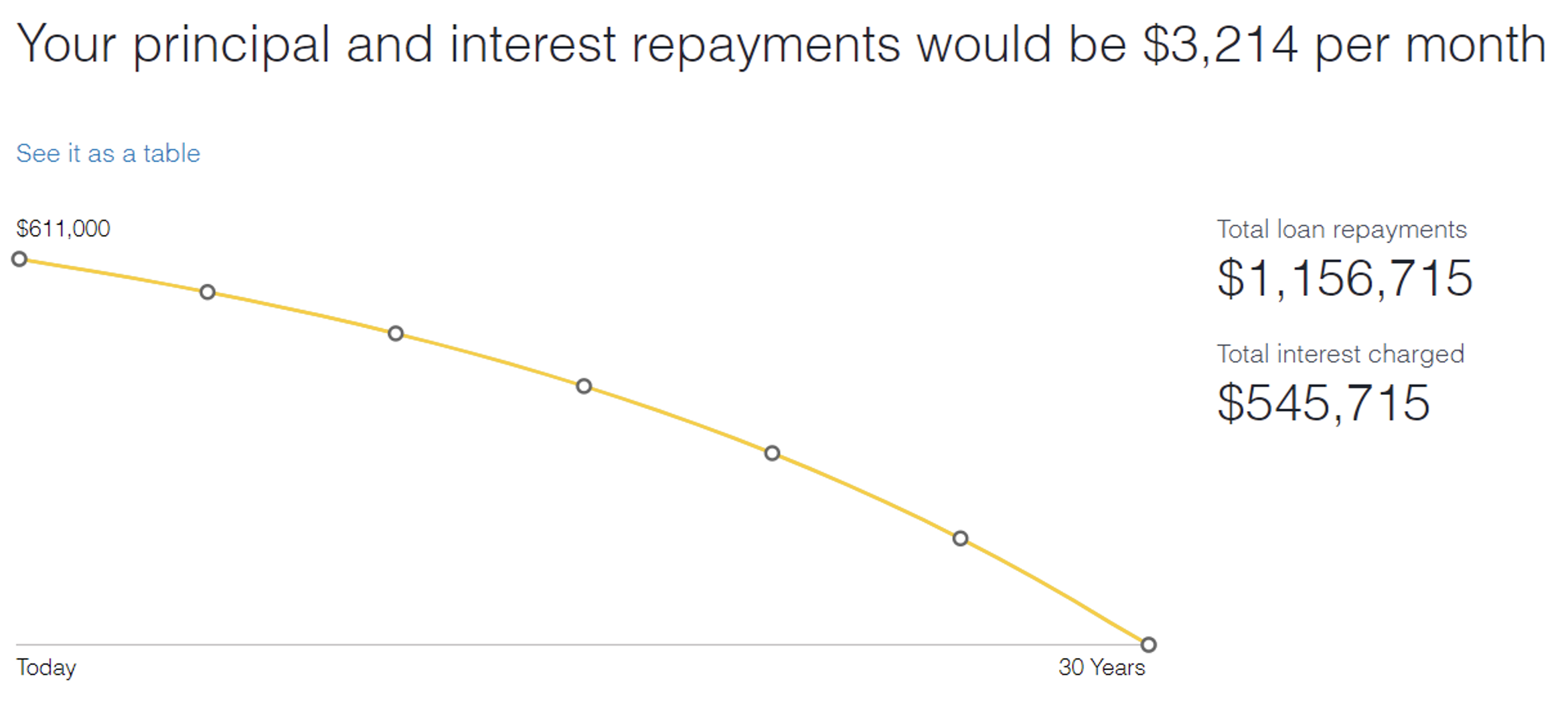

If I instead use an interest rate that is 250 basis points higher, or 4.85 per cent, I get a monthly repayment of $3,214/month or an increase of $847/month or in other words a 36 per cent increase in monthly repayments:

Source: Commonwealth Bank of Australia

Again, according to the ABS, the average household income for a family of four in Australia is around $111,000 per year or $9,250/month.

The $847/month in mortgage and principal repayments that would result from mortgage interest rates increasing as much as the financial markets are currently predicting would hence account for a reduction of 10 per cent in a typical family’s disposable income.

We should remember that this increase is projected to come at the same time as households are seeing significant inflation in other necessary costs like fuel, electricity and food, meaning that households budgets are already under stress from other increases.

My prediction is therefore that the RBA will get cold feet way before they put through anywhere near the level of increases in the cash rate that the market is predicting as we will see a real contraction in discretionary consumption from households as they come to terms with the inflationary environment we are in at the moment.

In terms of investment conclusions from this reasoning:

- In the short term, stay away from discretionary consumer stocks, especially the ones exposed to consumers with mortgages and other large necessary expenses. If you want to have any exposure to discretionary spending, look for companies catering to younger people who are less likely to have mortgages and be responsible for electricity bills and who are seeing good wage inflation due to minimum wage increases and current labour shortages. Companies catering to the older portion of the population should also be less impacted as these people are more likely to have paid off their mortgage and invested in solar panels insulating them from electricity price increases.

- The expectation of rapidly rising interest rates is the main reason that high growth companies with no current earnings but potential for strong future growth have been sold off aggressively as rising interest rates makes future profits relatively less valuable than current profits. The reasoning above is primarily for Australia but is also true for many other countries even if they do not have as a debt burdened population as Australia (as for example David Buckland has written about New Zealand which is leading the central bank pack in increasing interest rates). I therefore think that overall interest rates will not increase as much as the market is currently forecasting and when this realisation hits, there will be buying opportunity in the high growth stocks that have fallen a lot; the key will be to figure out which of them have a robust enough business model to survive a likely severe economic downturn before lower central bank rates increase economic activity again.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY