What! How much do you need for a comfortable retirement?

New spending figures published by the Association of Superannuation Fund of Australia (ASFA) define what it means to be comfortable in retirement. And while their numbers are well above the current age pension payments, I am not sure even those elevated numbers realistically measure up to what many, if not most, people would describe as comfortable.

The superannuation body defines a comfortable retirement as one that includes premium health insurance, regular leisure activities, occasional meals out, an annual domestic holiday, and an international trip every seven years.

According to ASFA, a couple aged 65 must spend $1382 per week or $72,148 per year to be comfortable. The numbers are 3.5 per cent higher than a year ago thanks to inflation, but the amounts haven’t risen as much as inflation because items such as school fees, university fees and tobacco were deemed irrelevant to the retirement standard.

Figure 1. The ASFA comfort standard

ASFA also reported that to reach the ‘comfortable’ level of spending, a couple required a combined super balance of $690,000, and a single person required $595,000 combined with the aged pension.

Table 1. A comfortable retiree’s weekly budget

| Monthly | Comfortable | |

| Expense | Single | Couple |

| Housing – ongoing only | $139.37 | $145.49 |

| Energy | $51.54 | $63.92 |

| Food | $141.76 | $246.38 |

| Clothing | $28.26 | $52.63 |

| Household goods and services | $85.24 | $105.69 |

| Health | $112.94 | $211.63 |

| Transport | $179.02 | $193.91 |

| Leisure | $221.33 | $332.71 |

| Communications | $22.88 | $29.78 |

| Total per week | $982.34 | $1382.14 |

| Total per year | $51278.15 | $72147.71 |

Table 2., represents the same expenses on a monthly basis.

Table 2. A comfortable retiree’s monthly budget

| Monthly | Comfortable | |

| Expense | Single | Couple |

| Housing – ongoing only | $600.22 | $626.58 |

| Energy | $221.97 | $275.28 |

| Food | $610.51 | $1061.08 |

| Clothing | $121.71 | $226.66 |

| Household goods and services | $367.10 | $455.17 |

| Health | $486.39 | $911.42 |

| Transport | $770.98 | $835.11 |

| Leisure | $953.19 | $1432.87 |

| Communications | $98.54 | $128.25 |

| Total per month | $4230.61 | $5952.42 |

| Total per year | $51278.15 | $72147.71 |

The first observation you might make is that a comfortable couple aren’t going to any extravagant restaurants on their food budget. Not in Sydney, anyway.

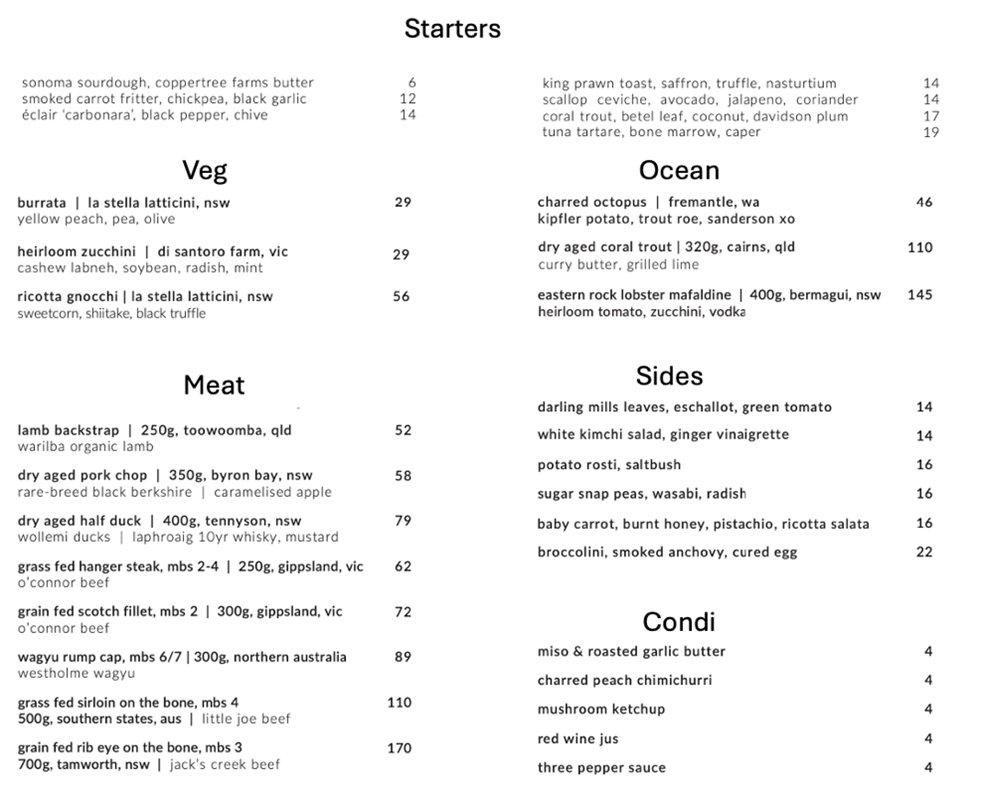

I randomly selected an upmarket new Sydney CBD restaurant and looked up the menu to see how far that $610.51 monthly food budget would go on a romantic, albeit extravagant, night out in the city.

Figure 3. A comfortable dinner?

Order a little bread for two, a starter each, share a vegetarian and beef main course with garlic butter and two sides and you’ve enjoyed a glamorous meal for $150. But you haven’t had anything to drink. At these establishments, you can add $9 per bottle of water, $25 for a glass of champagne, $30 for a cocktail, and hundreds for a bottle of wine marked up threefold or even fourfold above retail prices for the same bottle. Try buying wine by the glass; that first glass will pay the restaurant for the entire bottle cost. We’ll say $30 for a glass of wine to accompany the scotch fillet and vegetables. You’ve spent $273, or 45 per cent of your monthly food budget. You’re not doing that! And if you do go out monthly for a date night, you will need to count your pennies at Coles and Woolies for the rest of each month.

According to Yahoo Finance, a grocery shop at those two supermarkets could feed a family of four for a “couple of days” for $56. Presumably, the same shop could feed a couple for four days, there are 30.14 days in the average month and taking one day off for the monthly date night, you’ll need $407 (way over ASFA’s budget) to pay for food for the rest of the month. According to Canstar, the average weekly grocery bill for a two-person household is $155. Again, it’s much higher than the budget provided and while I know people who can live on less, the proposed budget is supposed to provide for a ‘comfortable’ retirement.

And what about communications? I looked up affordable mobile phone plans and discovered Dodo offers 50GB monthly data and unlimited national calls and text plans for $25/month, so there’s $25 if you’re single or $50 for a couple immediately taken from that $98.00/$128.00 budget gone. If you are single, you have just enough for a $69 per month Foxtel subscription, but you don’t have anything left to pay for the internet to be connected! The cheapest I found is supplied by iinet for $59.99 per month. With the budget suggested, even a couple can’t afford two mobile phone subscriptions, a basic home internet plan, and Foxtel.

Now, at this point, someone will respond by pointing out they could bundle their phone, internet and Foxtel and perhaps make it fit into the budget if they take the first-month free deal, etc. You can subscribe to Foxtel for $25/month provided you are on one of Telstra’s post-paid subscriptions for phone and internet, but these are relatively more expensive to begin with, and the ASFA-proposed $98 per month communications budget for a single retiree is simply not going to give you internet, mobile and entertainment.

It is also possible to take advantage of retiree discounts, but I am not sure these will go far enough to make much difference to the level of ‘comfort’. And watch out if you have kids or grandkids living overseas. You will have to refrain from calling them and wait until they call you.

It seems to me that both the food and communications budgets are relatively ‘uncomfortable’. While we could perform the same examination of all the other categories, we don’t need to. Retirees can’t afford to eat comfortably nor stay connected with family and friends with the budget provided.

So, what’s this all about? It seems official definitions of a comfortable retirement aren’t comfortable at all. Given the real cost of living comfortably, retirees must consider how to maximise their income.

As you might have already guessed this article isn’t written completely altruistically. The Aura Private Credit Income Fund (for wholesale investors only) has been running since August 2017 and has generated a 9.62 per cent compounded annual return (distributions reinvested), no loss of capital and no negative months to 29 January 2024. If you are aiming for a truly comfortable retirement, you need to aim higher when it comes to generating income. That’s been the Aura Private Credit Income Fund’s aim too, and it has achieved it for more than 6 ½ years.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Private Credit Income Fund (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

The Aura Private Credit Income Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery and Aura Group do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Jeez, Roger you have an expensive lifestyle! You should have a read of the rootofgood.com website. This is a family of five in the USA who live a good life on less than US$40,000 per year. The guy retired at 33 in 2013 with US$1 million, which included his house. He does a lot of travelling too.

Hey John, there’s always a risk in writing about someone else’s definition of comfortable that the author will be labelled by it. The point of the article is to raise the question of defining what is ‘comfortable’. This is, of course, entirely subjective. It is reasonable, however, to assume that ‘comfortable’ is a level above the ‘average’.

Good article Roger

We have done our own sums based on our actual expenditure and 70K doesn’t cut it.

That would include one modest car and an overseas holiday (economy) once every 2-3 years.

However, I doubt that those who qualify as wholesale investors need to worry too much.

That’s good performance for the fund though. I doubt many annuity funds have that return.

Thanks for the encouraging feedback Julian, I hope you are well.

Interesting article, however quoting investment returns ‘generated a 9.62 per cent compounded annual return (distributions reinvested)’ is not useful in this instance to retirees who require the income to meet living expenses.

Hi Harry,

Agree. The same needs to however be done for the ASX200 accumulation index. See this link for wholesale and sophisticated investors who want the return of entirely distributed monthly cash income. The return is approximately 9.2% per annum currently if an investors withdraws all the monthly cash income generated. Monthly income may be more appealing to some investors than semi-annual dividends, for example.