You don’t need to forecast to be a successful investor.

With all the talk about a bubble in equities at the moment (I think we are a long way from the euphoria that typically defines bubbles), I thought it would be prudent to take a look at the recent forecasting track record of some of the biggest names in funds management and investment banking.

Sadly, their record reveals they’re no better at forecasting than the rest of us. So, if being a centimillionaire or even a billionaire and serious, well-connected ‘insider’ doesn’t confer on these experts the ability to accurately predict what’s going to happen next, we should look elsewhere for a source of success.

On 1 June 2022, CNBC quoted JP Morgan Chase’s CEO Jamie Dimon, stating, “You know, I said there’s storm clouds, but I’m going to change it … it’s a hurricane, ” adding, “You’d better brace yourself.”

To emphasise the point that the U.S. federal reserve was mistaken in its policy settings and that the impact on markets would be memorable, Dimon noted, “We’ve never had quantitative tightening (QT) like this, so you’re looking at something you could be writing history books on for 50 years.”

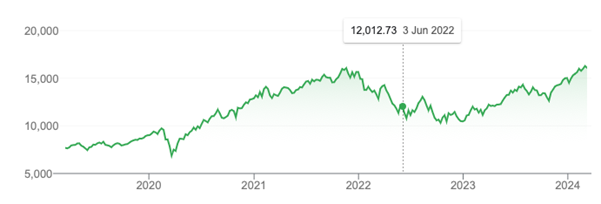

Figure 1. Nasdaq post–Dimon’s “hurricane” forecast

With the Nasdaq at 16,085 points at the time of writing this, the index is almost 34 per cent higher than at the time made is bearish prediction.

One of the biggest hedge fund managers in the world and arguably its most prolific high-profile forecaster is Bridgewater & Associates founder, Ray Dalio.

On 11 October 2022, at the Greenwich Economic Forum, and shortly after Jamie Dimon predicted a ‘hurricane’, Ray Dalio referred to “ridiculously stupid” economic policy settings and said that the U.S. economy’s paradigm shifts away from the era of low-interest rates and “free money”, amid a “perfect storm” of crises, is going to be “painful.”

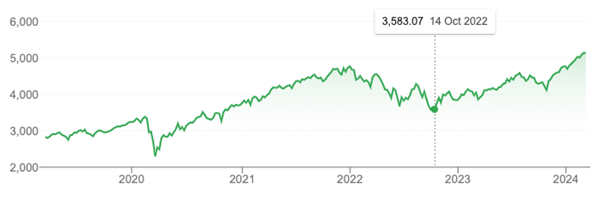

Figure 2. S&P500 post-Dalio’s “perfect storm” prediction

The S&P500 is up 43 per cent since Dalio warned investors of impending doom.

Shortly after Dalio’s warning, billionaire bond fund manager Jeremy Grantham published his 2023 stock market outlook letter on 24 January 2023. He began by describing the bear market during 2022 as the “first leg” of the “bursting of the bubble”. And while Grantham warned, “investors should have far less certainty about the timing and extent of the next leg down”, he said that his “calculations of trendline value of the S&P 500, adjusted upwards for trendline growth and for expected inflation, is about 3200 by the end of 2023”, adding, “3200 would be a decline of just 16.7 per cent for 2023 and with 4 per cent inflation assumed for the year would total a 20 per cent real decline for 2023 – or 40 per cent real from the beginning of 2022. A modest overrun past 3200 would take this entire decline to, say, 45 per cent to 50 per cent, a little less bad than the usual decline of 50 per cent or more from previous similarly extreme levels.”

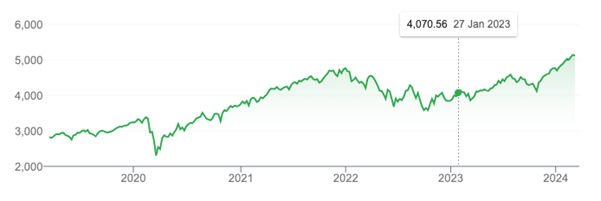

Figure 3. S&P500 post-Grantham’s 50 per cent crash forecast

The S&P500 was at about 4070 points at the time of Grantham’s concerns for investors. And far from falling to 3200 or below, it has since climbed to 5,123.7 points, a gain of almost 26 per cent.

Now, the fact remains the market can pull back at any time. In fact, Charlie Munger and Warren Buffett once warned investors to stay out of the stock market if they were unable or unwilling to stomach declines of 50 per cent from time to time.

But a pullback today should not confer any kind of kudos on our billionaire forecasters. Even a stopped clock is right twice a day! All one must do is say the market is going to fall, and eventually, one will be right. However, what gains have been missed by eschewing equities and waiting for a correction?

And more importantly, bear markets are followed by bull markets that historically have lasted longer than the period of the bear market and have soared above previous highs. That’s just a function of inflation and growing populations, which result in economic growth, as well as improving productivity for the better businesses, which, as they outperform, command ever greater weights in the broad market indices.

We can learn a lot from the forecasts of billionaire investment insiders. We can learn that they’re no better than any of us at distilling economic and market factors into usable tactical investment decisions. We can also learn that being a billionaire or a deeply entwined institutional market ‘insider’ doesn’t help either. And we can, therefore, learn that there’s not much point in trying to forecast in the first place.

But it’s what we cannot learn from these investment giants that is most important, what we cannot learn where the market is going next.

Chris

:

The biggest question is, “People always call it when they get it right. Why does no one ever call out these people – Gary Shilling, Jeremy Grantham etc. – for getting it fantastically wrong when they do (and far too often), because maybe if they did, they’d stop making these wild predictions that don’t come right until they do ?”.

They say there’s a bubble in AI; well, I’m waiting for every stock out there and especially those that have nothing to do with AI, to call themselves an “AI stock” or that it will somehow disrupt their business and rivers of gold will flow…same as when companies changed their names to .com and said that they would sell things on the internet, resulting in a 10x share price; search “K-Tel’s Stock Goes on Internet Ride” (NY Times). Then you’ll know it’s time to hit the ‘SELL’ button, or at least, zip up your wallet.

There’s a huge risk to people’s finances if they go along with and believe what these people say, like Milton Berg (8 days ago) saying that the S&P 500 might crash 60%, a recession is looming, and speculation is rife. There’s a lot of people who don’t question “why ?” and will blindly go along with it, possibly selling up or moving their super to cash / lower risk options, based on claims that are themselves, based on things such as ‘technical analysis’ (such a fantastically inexact science that it makes weather forecasters look good) and assertions that monetary policy is loose at the moment (it’s not) or that the market has got ahead of itself, just because it’s at a new high (it was actually more expensive in fundamental terms back in 2021 than it was today).

Roger Montgomery

:

Thanks, Chris. You and I are on the same page regarding identifying when to sell. Thanks for adding Milton Berg to the list. I would love to be able to find all my old floppy discs and CDs so I could reveal the results of all the algorithms I built in the ’90s and early 2000s to test every classic technical analysis indicator – showing that none of those indicators work. Not in backtesting, not in out-of-sample and not in actual trading. It’s somewhat disappointing that a new generation (this time, they’re called ‘Fininfluencers’) is promoting technical analysis nonsense to another generation of unsuspecting people.

paul norris

:

The S & P 500 only returned 8% for 2023 if you exclude the so called magnificent seven.