What do I think these A1 companies are really worth?

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.

If you recently ordered my book Value.able, thank you and welcome! You have joined a small band of people for whom the inexplicable gyrations of the market will soon be navigated with confidence and far more understanding. If you have ever had an itch or the thought; “there must be a better way”, Value.able is your calamine lotion.

Its hard to imagine that my declaration to Greg Hoy on the 7.30 Report that Myer was expensive as it listed at $4.10, or elsewhere that JB Hi-Fi was cheap and Telstra expensive has anything to do with the 17th century probability work of Pascal & Fermet.

The geneology of both modern finance and separately, the rejection of it, runs that far back. From Fermet to Fourier’s equations for heat distribution, to Bachelier’s adoption of that equation to the probability of bond prices, to Fama, Markowitz and Sharpe and separately, Graham, Walter, Miller & Modigliani, Munger and Buffett – the geneology of value investing is fascinating but largely invisible to investors today.

It seems the intrinsic values of individual stocks are also invisible to many investors. And yet they are so important.

My 24 June Post ‘Which 15 companies receive my A1 status?’ spurred several investors to ask what the intrinsic values for those 15 companies were. You also asked if I could put them up here on my blog so you can compare them to the valuations you come up with after reading Value.able. Apologies for the delay, but with the market down 15 per cent since its recent high, I thought now is an opportune time to share with you a bunch of estimated valuations.

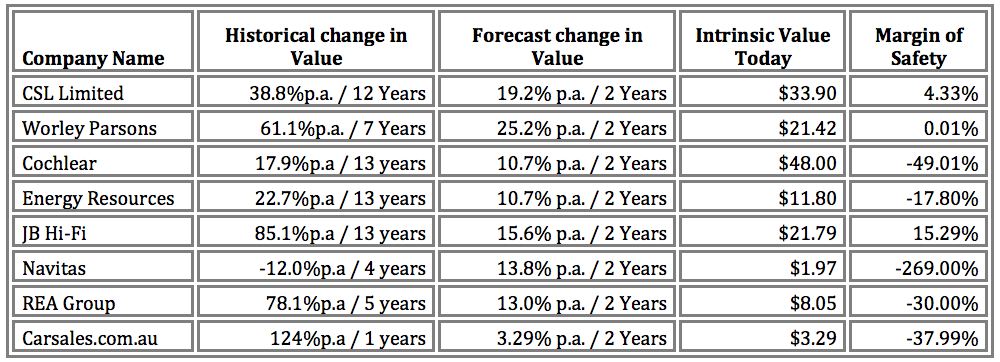

I have selected a handful from the 15 ‘A1’ companies named in my 20 June post and listed them in the table below. The list includes CSL Limited (CSL), Worley Parsons (WOR), Cochler (COH), Energy Resources (ERA), JB Hi-Fi (JBH), REA Group (REA) and Carsales.com.au (CRZ).

If you are surprised by any of them I am interested to know, so be sure to Leave a Comment. And when you receive your copy of my book (I spoke with the printer yesterday who informed me the book is on schedule and will be delivered to you very soon), you can use it to do the calculations yourself. I am looking forward to seeing your results.

The caveats are of course 1) that the list is for educational purposes only and does not represent a recommendation (seek and take personal professional advice before conducting any transactions); 2) the valuations could change adversely in the coming days or weeks (and I am not under any obligation to update them); 3) these valuations are based on analysts consensus estimates of future earnings, which of course may be optimistic (or pessimistic, and will also change). They may also be different to my own estimates of earnings for these companies; 4) the share prices could double, halve or fall 90 per cent and I simply have no way of being able to predict that nor the news a company could announce that may cause it and 5) some country could default causing the stock market to fall substantially and I have no way of being able to predict that either.

With those warnings in mind and the insistence that you must seek advice regarding the appropriateness of any investment, here’s the list of estimated valuations for a selection of companies from the 15 A1 companies I listed back on 20 June.

Posted by Roger Montgomery, 6 July 2010

thanks for your valuations, one question i have that could be important when considering to invest in these companies is

could the historical change in value be misleading for example csl is 38% for 13 years which sounds great and is great depending when you bought. it may be that this stock had huge valuation growth over a 2 year period (eg 120%) and then a lot lower growth in subsequent years so it would depend when you bought the stock as to how well you did

( im not sure if this is the case for csl just using it as an example) but on the other hand if it had around 30% growth every year for 13 years this would this be a good indicator that it will most likely to repeat that performance

Hi Tony,

Its important from the perspective of identifying businesses and their managements that have a demonstrated track record of adding value. It is however the future increase in value that will determine your risk and return.

Hi All

With only days to go before we receive our books. I would like to say thanks to Roger and all who have submitted to the blog.

like everybody have learnt by reading and submitting the odd comment

I encourage all to work on improving their techniques, we can all improve. A book I recently read is Value Investing, author Glen Arnold,a Financial Times Guide book, easy reading and a nice companion for Valuable. Not sure if available in Australia.

Great stuff William,

Thank you or the encouragement. I am crossing my fingers that there aren’t any more delays. I have just sent an email to the printers because one of the milestones was today and it passed without delivery of the agreed item. I have been given a 26 July date for delivery to the distribution house. They will take a few days to get through the orders but if we assume end of July and give or take a day or two we should be ok. Any more delays and it will be a Christmas stocking item!!!

Roger

The intrinsic value helps provides an entry point for the share purchase…. and with a Buffett approach we would be looking at longer term holdings (as in if the Share market closed down we would still be happy holding the share for 10 years):

but… do you get concerned when the A1 company Share Price gets so far ahead of the intrisnic value e.g Cochlear

Peter

Hi Peter,

Yes I get very concerned. If you have a look at Buffett’s behaviour in recent years, you will notice lots of sales in order to raise capital for other purchases. He sold JnJ and Amex and Petro China when it hit intrinsic value. I discuss this in my book and explain five justifications for selling.

Hi Roger

Love your value strategy! and look forward to recieving your book. I just wanted to ask what is a good margin of safety % to adopt, or should we just keep accumulating anytime price is below intrinsic value

Regards

Adam

Hi Adam,

With respect to Margin of Safety, it is as Mae West said; “too much of a good thing is wonderful”. The bigger the margin of safety the better.

Hi Roger,

I’m wondering about companies like Carsales.com.au. Fantastic companies with massive ROE. However, now that the market has well and truly caught on, how does the company rate in terms of a future investment?

You point out that future growth in intrinsic value is low. It strikes me as being analogous to a store roll out; the roll out has been completed for a couple of years, the company is still very profitable, but their period of explosive growth has ended. When a company is at this point, and about fair value price wise, is it a good investment?

Roger,

Now we’re done with the A1’s how about listing your ten biggest dogs (the D5’s or whatever you call them) of the ASX 200? Those to avoid at all costs. I’m sure this list would engender some great discussion.

Regards

Lloyd

Excellent idea Lloyd. I will get onto it it coming weeks.

Great question Lloyd, I would love to see those too

Pete

Roger,

It is only last week that I started reading your blog. Thank you it is great reading. What an incredibly interesting range of respondents you have.

It was “does charting really work” that go me in, what an amazing topic that turned out to be, over 100 replies.

Fascinating as at that subject is, personally I found this value based subject more interesting, but seemingly attracting fewer responses.

There seems be something different about those replying to this topic (eg nearly all eagerly await your book) to those replying to the charting one. (hardly a mention of the book)

Thanks again

Pete

Hi Roger,

Just wanted to let everyone know on your blog, if you register to play the asx public share game (http://www.asx.com.au/resources/education/games/index.htm) before 28th July you are given free access to the Eureka report during the game period. This way we can read more of your thoughts.

Can’t wait for your book to arrive, hopefully there will be no more delay.

Regards

Paul

Thanks for letting everyone know Paul. I know Alan Kohler well and he is passionate about making sure you get the best insights.

My valuation(s) for COH, based on my personal required return.

Based On June 09 Financials:

100% Payout = $23.89

Actual Return on Funds Employed = $36.20

Return on Funds Employed (excluding indefinite life intangibles) = $47.86

Based on Average of last 14 Years

100% Payout = $25.92

Actual Return on Funds Employed = $40.82

Return on Funds Employed (excluding indefinite life intangibles) = $52.80

I don’t use valuations based on forecast projections at all.

What each valuation estimates tell me:

Firstly a comparison between latest financials and average tells me if we are diverging from the mean. Then it’s a matter of determining if we are likely to revert or has there been a paradigm shift.

‘100% payout’ gives me an idea of the value if a company has reached saturation and is better off returning capital in the future than trying to reinvest it itself.

‘Actual Return on Funds Employed’ provides the valuation based on historical activity – including any growth by business combination.

‘Return on Funds Employed (excluding indefinite life intangibles)’ gives a theoretical valuation based on organic only growth at current returns and retention.

From the 6 valuations I make a subjective estimate on buy price, based on how I perceive the business qualitatively, i.e. life cycle maturity, barriers to entry, management calibre, use of capital, trends in profitability ratio’s etc etc.

This method doesn’t allow me to generate a precise figure – but I can generally get within the roughly right ball park. ‘Precise estimate’ is an Oxymoron anyway.

Gavin,

This is great stuff. A range of valuations based on what if scenario analysis. The usual caveats around management doing the right thing with capital applies obviously.

Hello , just loving it already.thankyou.

I have held shares that disapoint me and what to do.

AJl AJ lucas and GBST are 2.

I already guess you wont like them but I missed the highs and they dont seem in a hurry to get there again . I see IRess is more popular now which I dont have so what to do.?

Hi majorie,

Cannot give you any recommendations Marjorie, but I can put them on the list to cover in a future blog.

Hi Roger

Intrinsic Valuations can only be an estimation at best.

For them to be accurate you would have to know exactly what the future holds and that is impossible.

Additionally values are subjective. The value of the stock does not inhere in the stock itself. It resides in an individual’s perceptions, judgements, calculations and their preference to consumption now as opposed to the future.

I assume your book will contain the mechanics of the valuation models you use. Touch on the importance of selecting quality businesses that have a chance of providing resilience into the future and discuss some of the subjective issues when picking the level of model variables, such as the discount rate.

Your book can educate on how you estimate intrinsic value. ‘Estimation’ by its very nature however dictates the potential for error to exist – that is why it makes sense to buy with a margin of safety.

What is normally required to buy with a margin of safety is Patience. Perhaps the patience of waiting for your book is a lesson in itself.

“The stock market is designed to transfer money from the active to the patient.”

Warren Buffett

“Price is what you pay. Value is what you get.”

Warren Buffett

“Time is the friend of the wonderful company, the enemy of the mediocre.”

Warren Buffett

Couldn’t agree more Gavin. Thanks for resetting the compass for everyone. Don’t get too caught up in whether the estimate of value (I do believe I have always impressed upon everyone that it is an estimate) is $2.55 or $2.35. You want to buy at $1.50! Charlie Munger was asked what made him such a great investor and he replied; ‘my guesses are better than yours”. Yes they are guesses but they must be educated ones. Let me say, having the right intrinsic value model however can make a huge difference in avoiding the major errors of commission. In answer to your questions about the content of the book, yes, yes and yes.

I am surprised at the inclusion of ERA, having read your comments in the past regarding resources companies. I even double checked the ASX code of ERA when you first mentioned it. I am interested in hearing what you see different in ERA that you do not see in other diversified resurces companies such as BHP or RIO. I can perfectly understand some of your concerns concerning the resources companies as I am a resource company professional (metallurgical engineer) and a student of MSc in Mineral Economics, which I enjoy a lot studying. It adds a different dimension to my technical expertise.

Hi Yavuz,

ERA meets the criteria of an A1 business, but as you rightly point out, its commodity based and for some there are moral/ethical issues associated with the company’s activities too. That aside, I have not owned ERA nor would I, because the estimates required to generate a valuation are based on a commodity whose price I am not able to predict. Moreover I believe there should be some debate about whether there is sustainability to the company’s competitive advantage. Some might say it doesn’t have one. I think what would be more interesting are your thoughts on ERA. Would you be happy to share?

Ben Graham is regarded as one of the greatest investment theorists and the father of ‘value investing’. He outlined his approach in the 1949 book The Intelligent Investor, which was updated in collaboration with Warren Buffett – one of his most famous students – in 1973. At the heart of his theory is the idea that companies whose share prices do not reflect their asset backing and dividend streams must eventually rise in price as the market comes to recognise their intrinsic ‘value’.

My question is looking at JBH with its Margin of Safety @ 16%, does the market ignore the intrinsic value predominately in “bear” markets and only then “catch-Up” during more Bullish conditions? If so JBH could stay below its recent highs for another 12 months!

Indeed Simon, JBH may never reach its intrinsic value. Forget 12 months. It might be 18 or even 24. Buffett said he would not be concerned after buying a wonderful company, if the stock market were closed for three years! Not everyone likes to wait that long and that is one of the reasons other fund managers require an identified ‘catalyst’ that will close that gap in a short period of time. I don’t need a catalyst to buy a great A1 business but I do want a very large margin of safety (Chapter 20 of Grahams 1949 book).

As a “buy-and-hold’ investor, I find your blogs really helpful.

I have no idea what CSL is worth – I assume that is a question that someone wanting to take it over might ask.

However, for CSL shareholders like me I suggest the real questions are

1. What is the price at which I should accumulate more

2. What is the bubble price at which I would sell.

If CSL has ceased to grow at 30%+ pa, and will now instead have a few years of 5-10% pa, then the buy price is under $25 – maybe $20. That is based on current pay-out ratio, yield, low franking and low growth.

I will be interested to learn in your book how you get to your big number. Or perhaps you factor in much higher growth rates.

Hi Martin,

Thank you for sharing your thoughts. Your valuation may indeed be the right one. I do believe however that it is returns on equity rather than earnings growth that are important. Google the words “buffett and not earnings growth” and have a dig around.

Hi Roger,

Looking forward to the book. Holding off entry to the market until I get it and understand the mechanics of calculation. In the meantime, would you mind explaing what you mean by “Margin of Safety”

Thanks

Steve H

Hi Steve,

I am going to save myself some time, with your permission. Google “Chapter 20 The Intelligent Investor Ben Graham margin of Safety” That will be a good primer.

Roger, you’ve raised some interesting points in your post; you have no way of knowing whether share prices will double, fall etc. You also mentioned the issue of countries defaulting on debt obligations. Under those cicrumstances, and in the current market especially, is there a case for holding a higher percentage in cash rather than being fully invested in equities (regardless of being A1 companies)? None of those forecasted changes in values above present adequate return for the risk of the market going the other way in the next 6 months in my opinion. Would the current global risk environment impact which of those companies you would invest in?

Hi Steve,

I made exactly that point a couple of months ago in the Eureka report, that portfolio has had 50 per cent cash now for many months (and still outperformed).

G’day Roger,

Would you be able to provide your updated valulations of MND and NCK for now and 2 years out?

Cheers (and looking forward to receiving my book!)

Hi Adam,

You will have to give a little time to get around to those and I will post them on the blog.

Thanks Roger

I bought Worley Parsons at $22 and sold them all at $29, on an analyst’s warning that they were over the top, and would like to own them again. I’ll be patient though and wait a little longer.

Someone should have advised against gold for the book cover. It sticks well to ladies’ fingers, wrists, ankles and necks, not so well to glossy paper. Go to black if you have to. None of us will mind a bit. I’m sure I speak for your other waiting customers when i say we know the wait will be worthwhile.

Hi David,

Thanks for that advice. Please understand my comments however are not advice. Be sure to seek and take personal and professional advice.

Dear Roger,

I’ve noticed from reading the blog lately that there’s a number of posts where people seem to be searching more for a valuation on the companies you’ve chosen, rather than them doing their own research, coming up with a company (e.g. WPL) and then saying “What do you reckon to their valuation, based on this logic and maybe even my own valuation that I came up with ?”

I would really hate to see it degenerate into a ‘hot tip fest’, but there seem to be some posters who are just after a valuation for your top, A1 companies, so that they can go and buy them at that price (if that is the prevailing market price), without actually doing any analysis or work themselves on the company first. That annoys me, because it’s lazy.

Personally, I think of it like this. The A1 companies that you’ve chosen will be the first place that people will look. Why ? Because no one wants ‘second best’, even a little bit, if they can afford it and everything is ‘equal’. Their logic seems fairly inane – X > Y, so therefore, stock price becomes irrelevant because (for example) BHP is ‘better’ than WBC; but if they were in a department store, they’d opt for the Chinese made leather couch, not the Italian leather couch.

Plus, there are most likely some institutional players who read your blog, and they have the weight of money to shift the price accordingly.

It’s really dangerous logic, because each business is individual, especially mining companies (where an asset – a mine – can be completely different in terms of grade, distance to port, geology etc) and so a comparison of ‘bestness’ is a bit dumb.

I would therefore be looking where other people aren’t. Buffett has said himself that it is very difficult to do well in something when it is very popular.

Although you do take a long term view, I believe that there are A2 businesses that could easily become A1 businesses, and that there are even lower class businesses that if a variable changed – like the management – that it could be a turnaround story very quickly, because fundamentally, there is nothing wrong with the assets, and so worth keeping an eye on. I also believe that in the same breath, some businesses are handicapped in the same way because their management leave a lot to be desired. TLS was one of them but I will see what Mr. Thodey can do – a new broom can sweep clean. There is a particular stock in the gaming industry which (in my opinion) is another one – because I do not believe that current management have the necessary experience.

A prominent media company is another one, because I’ve had no end of problems with changing my subscription address and then got sent a letter three weeks later asking why I wasn’t a subscriber – but I am, since 2007 ?! They then told me that their magazine and newspaper divisions don’t actually talk to each other….but it’s the same business !

Things like this – simple things – damage the brand of a business.

Like Donald Trump said “I hate the phrase ‘location, location, location’. You could give Trump Tower to a complete moron, and he would ruin it. Likewise, I’ve seen some people take some very challenging pieces of land – some people have said “Are you out of your mind ?” and they have done great things with it.”

Thank you Chris,

An excellent post. Everyone should be reading it carefully.

Roger,

I look forward very much to receiving your book and the disclosure of intrinsic value formula that you have developed.

Based on your comments to date, it is evident that a significant input into your intrinsic value calculation is that of equity analysts consensus estimates (forecasts) for a company. On this point, I note that any calculation of intrinsic must make an assumption of the future performance of the business. Therefore, the issue comes down to the confidence in and accuracy of the the forecast used in in any calculation. It is here that a potential problem (uncertainty and intrinsic valuation volatility) arises, particularly with equity analysts consensus estimates or forecasts.

The potential problem is amply demonstrated by a recent McKinsey study titled “Equity analysts: Still too bullish” published in McKinsey on Finance Issue 35 Spring 2010 pp 14-17 (refer particularly to the data plots on pp 15-16). The finding are best summarized in the quote “Moreover, analysts have been persistently overoptimistic for the past 25 years, with estimates [of earnings growth] ranging from 10 to 12 percent a year, compared with actual earnings growth of 6 percent. Over this time frame, actual earnings growth surpassed forecasts in only two instances [2005 and 2006], both during the earnings recovery following a recession. On average, analysts’ forecasts have been almost 100 percent too high.” Without doubt, the results for equity analysts in the Australian market would demonstrate a very similar optimistic bias.

So here is the problem:

An intrinsic value calculation in using consensus analysts forecasts is more than likely projecting the future performance of a business based on forecasts that are up to 100% optimistic at the start of any forecasting period. You cover this with your caveats 2 and 3 stating that “the valuations could change adversely in the coming days or weeks (and I am not under any obligation to update them)” and “the valuations are based on analysts consensus estimates of future earnings, which of course may be optimistic (or pessimistic, and will also change).”

However, my experience is that there is a better (and less volatile) approach than using analysts’ consensus estimates. It involves more work and deeper understanding of the business, reality checked and constrained to some degree by the historical reality of the previous five to ten years, plus an overlay of top down economic factors.

I’d welcome you views and personal experience on the uncertainty and volatility attached to the calculation of intrinsic values based on input from analysts consensus estimates.

Regards

Lloyd

P.S. If you want a copy of the McKinsey paper, let me know and I will email a PDF copy.

Hi Lloyd,

Thanks for the offer Lloyd, if permitted, do send through the article. I am a bit of a connoisseur on the ‘persistence of optimism’ issue. And I agree entirely with the proposition that absolutely nothing can replace a deep understanding of the business. You cannot have confidence in any forecast – neither yours nor someone else’s – unless you understand the main drivers of the economic performance of a business. Trying to reach this nirvana on every listed company in a way that simultaneously allows one to take advantage is however impossible without some devices to narrow the universe. Once narrowed, work can commence on gaining a deeper understanding. The application of cash flow analysis (working capital impacts and outcomes) and the break down of returns on equity and tangible assets are important. I like two devices. The first provides for the adjustment of expectations down (such as right now in many resource companies) and the second provides for the application across all 1900 companies. A final list of a handful of companies is then produced and from this list further work can begin.

Lloyd,

very interested to see that you have picked up on what has always seemed to me to be a weak point in the otherwise invaluable valuations Roger provides ie analysts’ consensus forecasts of companies’ performance. It has always struck me as disappointing that an otherwise original valuation method relies for such an important input on outside estimates, although in mitigation Roger’s response is also accepted.

It is for this reason that I use caution in applying even Roger’s valuations.

Anne

All investing should be done with caution Anne…Keep in mind the name of Jim Chanos’s company – Kynikos, which is Greek for cynic and do remember I am under no obligation to disclose the earnings estimates I use. ‘Consensus’ is a simple way of filtering the vast universe of stocks. If you would like me to continue providing valuations, I can only do so in volume if I input existing numbers. There are 1888 stocks I cover. Building a ‘revenue-down’ model for every company would be a waste of time with some many that did not even make a profit last year. And in reality, everyone in my field knows that there are analysts that are better than others. Indeed there are those that the company’s management themselves will tell me are better at covering their company than others. I trust the practice of ‘selective briefing’ is dead but one never knows. Most fund managers however will pay at least some attention to the estimates of other analysts. We cannot help taking a peak at what ‘they’ came up with. In any event, it is essential that more analysis is done or one must be much more conservative and/or seek a very wide margin of safety – this will knock out a large number of opportunities but still, with the right valuation metrics, one can find bargains. Alternatively, do as Buffett suggests and seek only businesses with very stable characteristics that are simple to understand – this should ensure predictions are not absurd. Finally, remember that a study of analysts predictions will not only show that they are optimistic and revise down, but that they are usually wrong and more so, the further out the prediction required.

Anne (and Roger),

I think the problems inherent in using analysts consensus estimates can most readily be accounted for by requiring a much larger margin of safety of price relative to the calculated intrinsic value (IV) based on consensus estimates. This is particuarly so for IV calculated at the start of analysts forecast period, before the analysts start the inevitable downward spiral in estimates towards the point of company guidance in the final weeks of any financial year.

For screening purposes, Roger is pragmatic in his approach to utilizing consensus data. However, I turn it around and only bother to calculate IV once I’ve determined that a business in “investment grade” (i.e. Roger’s A class businesses). This means I don’t rely on analysts forecasts. Rather, my forecast for business performance, which is input to my IV calculation, derives from an analysis of prospects for the business plus a business specific macro overlay. Small in number are those businesses that meet my criteria, so that I can take the time to develop the forecast, rather than rely on consensus estimates. As a result, the margin of safety I require, against my calculated valuations is probably lower than those Roger would sanction against his consensus influenced valuations.

That said, I am not in the public position of Roger, who repeatedly has to justify his opinion of the 1,800 listed, lower quality, frequently non-investment grade businesses, with reference to price data. Unfortunately, for Roger, most of his audience focus on price alone. To paraphrase someone “they know the price of everything and the value of nothing”. As a result, it is only by comparing share price to his consensus estimate based IV that can Roger make the point that, more often than not, a lot of money is at risk in these lower quality businesses.

By all means, use analyst consensus estimates in IV calculation. Just be aware of the issues that attach to the approach and increase the margin of safety accordingly.

Regards

Lloyd

P.S. Roger – a PDF copy of McKinsey paper was emailed yesterday. I am sure your readers would be enlightened by Exhibit 1 in the paper!

Hi lloyd,

Yes thanks for sending it through. I now have a collection of those downgrade charts! The guys at Macquarie put one together recently too. I am delighted that you have seen the initial screening advantages of a consensus approach. As I mentioned before, the analysis starts there. It doesn’t end there.

Hi Roger, I have just retired from professional life but have had an obscession with shares and the markets for 25years. I read all the books I could from Ben Graham to Fisher to Neff. Peter Lynch etc and discovered Buffet before the media did. I have made and lost money in the markets but finally realised that you arrive at great stocks by filtering them.Vagg with his fantastic charts of the stockmaret from day 1 to the present day and extrapolated beyond, are available through the Australian Invesors association, tell you when to buy and we are outside the lower 90th per cent percentile for the second time since 1900!!!!

I don’t want to give away all the secrets but I have filtered all the stocks on the stockmarket with a colleague and come up with 12. we ended up with 8 of your 15 A1 stocks. I refiltered the other 7 of your stocks and was only able to get three more suspects.

Our chosen stocks have to have 10 years data demonstrating steady increase in dividends and earnings ( Ben Graham) Some of your stocks like MMS and NVT have only 5 years data.

Monadelphous outperforms Worley Parsons so we dropped the latter. We dropped the .coms i.e. carsales.com and REA as Buffet rejects companies that have no assets other than goodwill.

However we do have LEI WOW BHP MTS REH but their strike prices are lower than current levels except for LEI.

When you come to Perth later in the year to AIA I will show you the criteria used for filtering but the highest points are for low debt, high ROE and straight line LOG growth EPS.

Thanks for your great insights. There is always something to learn

Hi Brian,

Great work and thanks for sharing the information too. One point is that Buffett doesn’t like accounting goodwill but positively adores companies with economic goodwill. Very high rates of ROE suggest balance sheet accounting goodwill is understating the economic goodwill.

Roger which do you see as being more valueable to an investor having a company, lets call it Company A which is $20.00 a share and has an intrinsic value of $21.00 and a Forcast change in value of 25% over the next two years,but a Margin of Safety of 0.1% versus Company B which is $19 a share, has an intrinsic value of $21.80 and a Margin of Safety of 15% and a Forcast change in value of 15% over the next two years.

In otherwords when buying a stock is buy a A1 with a higher Margin of Safety more important than buying a stock at/close to its intrinsic value but has a sig. greater Forcast change in value?

Hi Simon,

Given the choice of only these two and under duress to make a decision, I would go for the A1 with the bigger margin of safety. But that is just my preference.

Hi Roger,

I noticed that you said (in the text) that you would give an intrinsic value of Energy Resources (REA). The ticker code for them is ERA but you also said REA group (REA). Anyway, I am interested in buying ERA long term since I see uranium demand increasing over the next decade. However, ERA was omitted from the list.

Either way, I am looking forward to your book – it should be in the post any day now.

Cheers.

P.S. I had to proof read this post because I confused myself between REA and ERA! Apparently, we are as dyslexic as each ohtre!

Thanks Luke for bringing the typo to my attention. I will correct.

Hi Roger,

Thank you very much for this list. I eagerly await the arrival of your book so I can have a go at this myself. Might be a nice time as well with share prices set to fall somewhat (thanks to Alan K for his thoughts on this) and possibly creating some nice buying oppurtunties.

I am interested in your thoughts on QBE. Earlier in the year you wrote an article in the Eureka Report (Why I like QBE) where you listed the intrisic value at about $19.83. With the share price reaching a 12 month low of $17.11 today, they seem to be reaching a nice buying price. Unless….I am missing something??

Thanks Roger. Keep up the great work.

Cheers,

Lee

Finally domes valuation if coh is near to mine of $35

Hi Tyler,

Could you retype please?

finally someons valuation of cochlear is near to my buy price of Cochlear @ $30-35

Hi Tyler,

Remember ben Graham’s quote; “you are not right or wrong because others agree with you…”

Finally someones valuation of cochlear is at least decent. my buy price is $35

Thanks Tyler. If you are happy to and if you are permitted, can you share a little about how you came to be interested in investing and a little about your models for calculating intrinsic value.

Hi Roger,

I think you meant to write “The list includes CSL Limited (CSL), Worley Parsons (WOR), Cochler (COH), Energy Resources (ERA), JB Hi-Fi (JBH), Navitas (NVT), REA Group (REA) and Carsales.com.au (CRZ)”

– ie Energy Resources code is ERA and the inclusion of Navitas (NVT)

Thank you for this list, I look forward to comparing valuations when I receive my copy of the book.

Thank you Matt. That is correct.