What can we expect from markets in 2023?

The calendar year of 2022 proved to be a tough one for most investors. In fact, it is only the third time in the last 100 years that both equities and bonds have recorded a down year together (those years being 1931, 1969 and now 2022). Bonds, which usually provide a cushioning effect for portfolios in times of equity market weakness proved ineffective as inflation soared, pushing bond yields higher and bond prices lower.

The collective rate rises delivered by central banks (NZ, AUS, UK, Canada and the US) around the world in 2022 on around eight separate occasions averaged nearly 4 per cent from historically low levels of close to zero.

The effect of these rate rises, coupled with other factors such as the war in Ukraine, an expected softening world economy, China’s zero COVID stance, supply chain constraints, a perceived weaking consumer and an expected deterioration in corporate earnings have contributed to a “risk off” environment and equities generally lower.

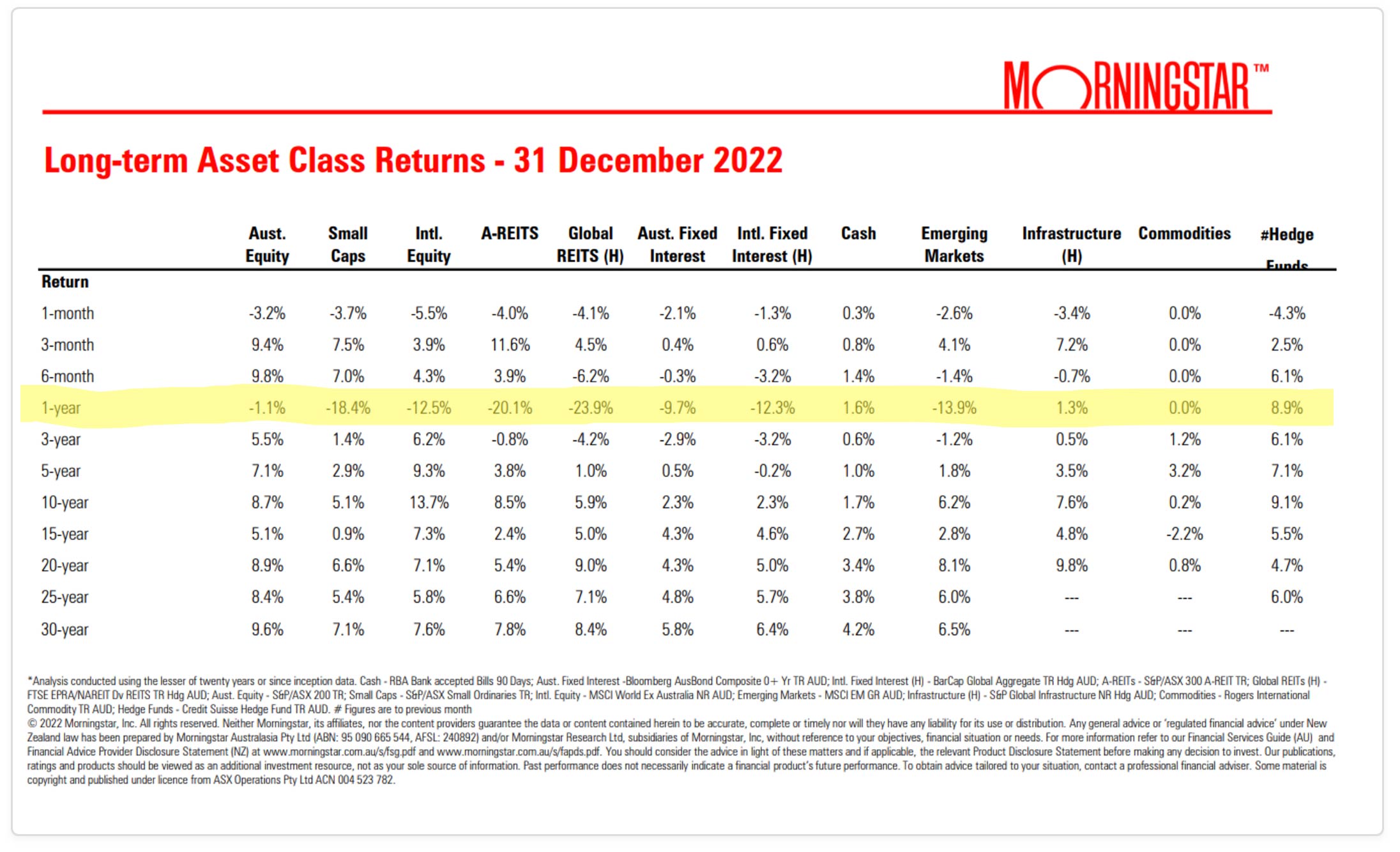

Morningstar produce a great table looking at the major asset class returns over various rolling periods, and you can see the corresponding returns over the last 12 months from these general portfolio building blocks were mostly negative and some deeply negative (< -15 per cent).

The Australian equity market as represented by the S&P/ASX 200 TR (Total Return) index faired very well when compared to International Equities over the last 12 months, but how does it compare to longer historical returns. Well, over the last 30 years the median one-year return for Australian equity market is 11.1 per cent, the worst 1-year return was -40 per cent and the best year 44.7 per cent. The percentage of 1-year returns which have been negative over this 30-year period is 25.4 per cent.

When we look at the returns from international equities, particularly over the last 12 months then one factor which investors don’t always consider is the role currency can play in the total return of your investment. For example, the return for International Equities (as represented by the MSCI World-ex Australia Net Return in AUD) over this last 12 months was -12.5 per cent, but this was assisted by the Australian dollar which generally fell against the basket of currencies from which stocks make up this international index. If you look at the return on a local currency basis then the International Equity index returned -18 per cent. When we compare this return against the Australian equity return of just -1.1 per cent then you can see the great disparity in returns over the last 12 months.

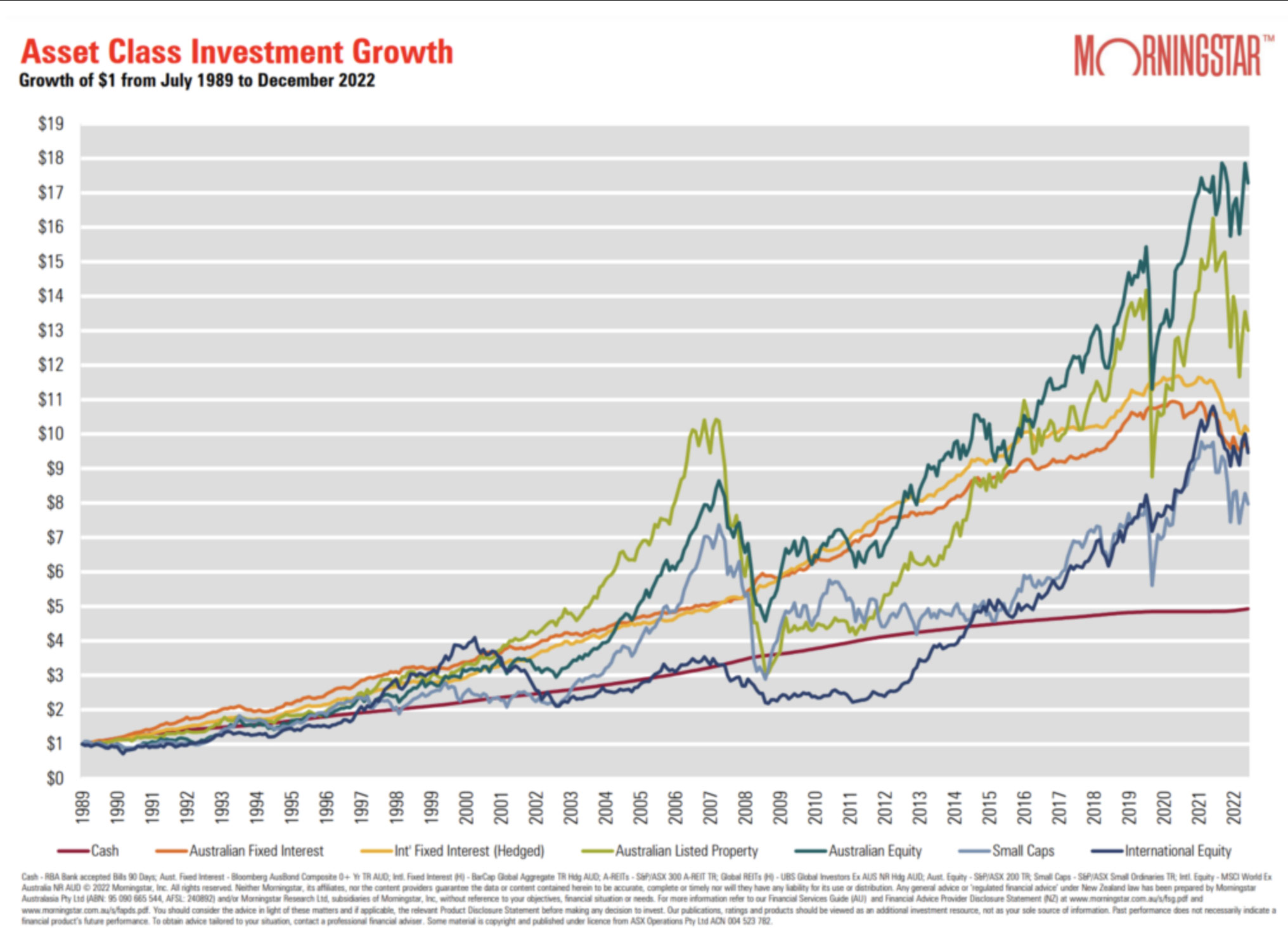

With the scoresheet now posted for last year’s returns it is worth considering what may be in store for investors in 2023 and Roger’s article provides some interesting historical examples of why it may be a good year for investors. His article “Why 2023 could be a good year for investors” is worth a read. Meanwhile, we know investing in growth assets requires a longer-term view and when we look at the charts below of the main asset classes cumulative returns over the last 32 odd years it paints a pretty compelling picture!