Why 2023 could be a good year for investors

Without a doubt, 2022 has been a tough year for equity investors. As I write, the S&P500 is down around 16.5 per cent, and the ASX200 is down around 5.5 per cent. But don’t despair – 2023 could see a return to sharemarket gains. Because history suggests that, after a negative year, the odds improve of a better subsequent year.

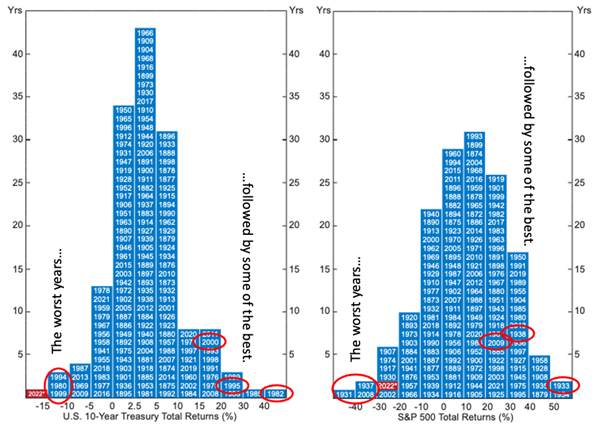

Back in early November, I highlighted why adding to an investment in equities might be wise. I revealed the normal distribution of S&P500 annual returns since 1872, which is repeated below in Figure 1., for convenience. The histograms shown in Figure 1. reveal 150 years of annual returns for both U.S. bonds and stocks – as measured by the annual total returns for US 10-year treasuries and the S&P500 since 1872. Figure 1. also shows this year’s returns (in red) have fallen into the far left tail of the return distribution. The chart has a reliable habit of effectively indicating mean reversion. The timing can’t be foretold by Figure 1., of course, or by any other means, but it shows that years in which the market falls by as much as it had then, by early November, are rare, and better returns than these are highly likely, indeed probable, in the future, if history is anything to go by.

Figure 1. Distribution of annual returns in U.S. S&P500 and 10yr bonds to 28 October 2022

Source: Alpine Macro / Montgomery Investment Management

By way of example, take the worst year for equities – 1931, when the market fell by more than 40 per cent. The following year, the market fell again but by less than 10 per cent. The year after that, however – 1933 – was one of the two best years for equities since 1872, with the market rising by more than 50 per cent.

The year 2008 was one of the second-worst years for equities and it was followed, in 2009, with returns of 20-30 per cent. By way of another example, 1937 was the other second-worst year for equity performance, generating a return on the S&P500 of negative 30-40 per cent. It was followed by 1938, which generated a return of +30-40 per cent.

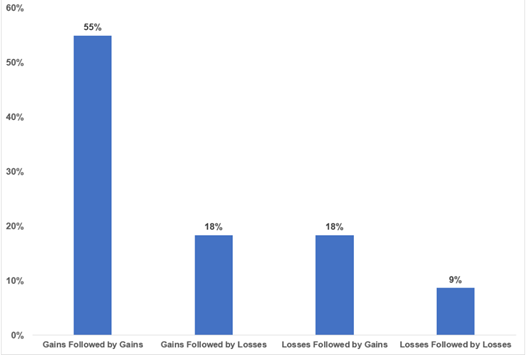

Building on this theme, analyst Ben Carlson has examined S&P500 returns over the last 95 years and discovered two consecutive years of losses has occurred only nine per cent of the time.

Of course, statistics are dynamic, and with each year the percentages will change. The nine per cent figure, just quoted, may be a higher number next year if we do have another negative performance from the S&P500. There is no reason last year’s return should have any meaningful impact on next year’s. And there is no reason slicing and dicing the data by calendar years should have any meaning – other than to the extent the end and beginning of a year might influence investor behaviour.

Having noted all the caveats, however, I believe Carlson’s scan of annual performances may help to provide some comfort for investors who are otherwise disconcerted by the meaningfully negative returns of 2022.

Carlson notes, since 1928, the S&P 500 is up roughly 55 per cent of the time following a positive year immediately prior. Given the market is up approximately three of every four years, we shouldn’t be too surprised by that statistic.

Figure 2. S&P500, 1928-2021. Gains and losses

Source: Ben Carlson, December 13, 2022

If the S&P500 finishes the year with double-digit negative losses it will be the 12th time in the last 95 years. And we can add to Carlson’s findings by noting (from Figure 1.) it will also be the 19th annual loss of greater than 10 per cent in the last 150 years.

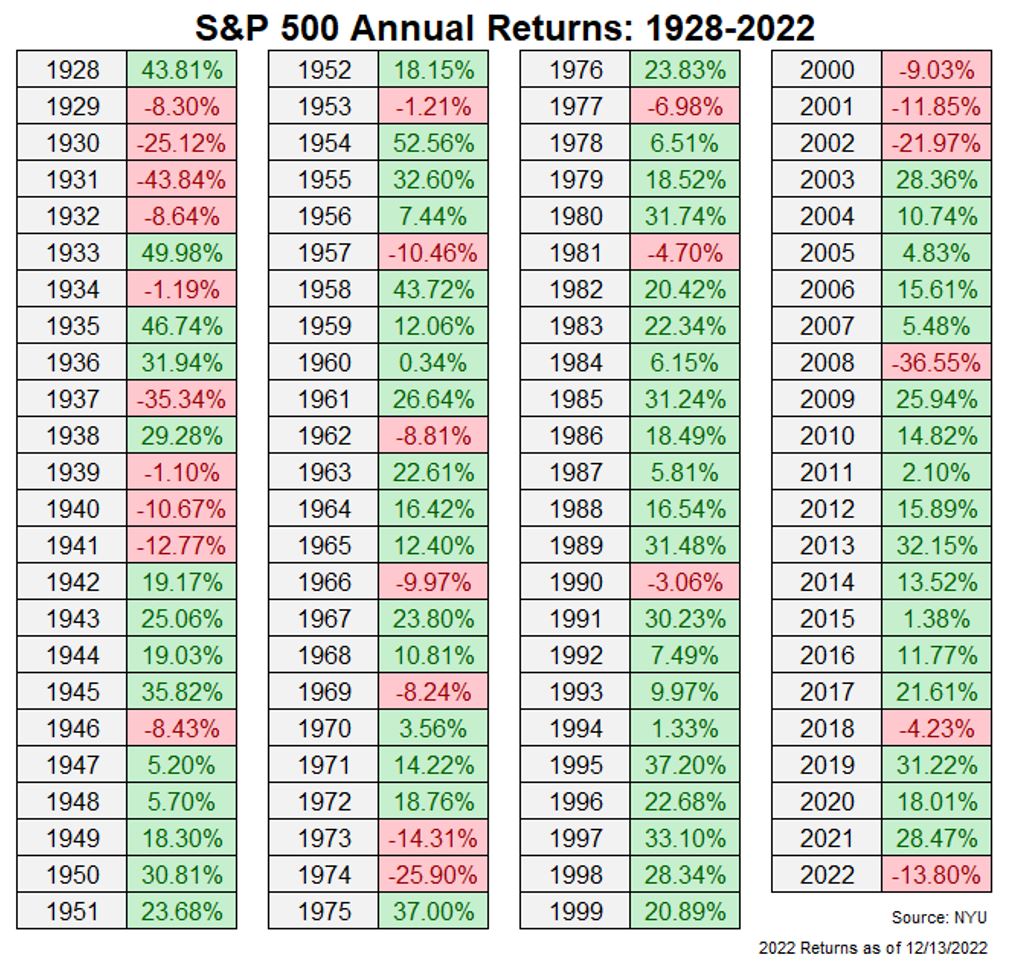

Importantly, as Table 1., reveals, losses can cluster but clustering annual losses are less common than standalone annual losses.

Table 1. S&P500 annual returns

Table 1. reveals there were four years in which annual losses occurred consecutively during the Great Crash of 1929-1932. The S&P500 also produced three annual years of negative returns in the 1939-1941 period and also during the tech wreck of 2000 to 2002. Two consecutive negative years prior to 2000-2002 occurred in 1973 and 1974.

Nobody can successfully predict what next year’s return will be. History, however, suggests with each negative year, the odds of a better subsequent year improve.

Marty_Jarvis

:

Hi Roger

Yes, 2023 should be an interesting year – many opposing economic factors in my opinion.

Joost Daalder

:

Although there is much insight in what we are offered in this comment, it should also be noted that we are shown three “blocks” of three or more consecutive negative years, as well as just the one block of two. It cannot therefore simply on statistical grounds be assumed that negative years will pretty well automatically be followed by positive ones.