What can Origin’s earnings result tell us about the importance of cash-flow conversion?

One area of investing that is often overlooked or underappreciated by the market is a company’s ability to generate cash-flow rather than earnings in a Profit and Loss statement. This fact may seem obvious to small business owners, but it is cash-flow that is the lifeblood of a business that allows a company to make profit, reinvest into the business and provide a return to the owners and shareholders.

There may be a number of reasons why the market chooses to focus on earnings; in my opinion, it is largely due to the ease of comparison when assessing the relative merits of investing in a business compared to a peer – or even across industries – as encapsulated in an earnings multiple.

Also, it is generally accepted by the market that EBITDA (less interest and tax) will be a good proxy for a company’s operating cash-flow over the course of time, especially for a company with a rapid growth trajectory (even the rating’s agencies are willing to use net debt/EBITDA and EBITDA/net interest ratios as measures of financial indebtedness rather than actual cash-flow). Given the time investment required to reconcile operating cash flow to earnings and movements on the balance sheet can be significant, cash-flow tends to be an area of lesser focus especially when “close enough is good enough”, given the sheer volume of financial results during reporting season.

However, with the increasing proliferation of companies using “one-offs” and “underlying earnings” as their preferred measure to benchmark their own performance – and the market’s willingness to accept these definitions for the most part – a company’s ability to convert reported earnings to cash is increasingly valued as a feature of a quality company.

While the market may overlook poor cash-flow reconciliation for a time – in some cases over many years – it is difficult to predict when sentiment will turn and questions around cash generation surface. These concerns become more acute for a company with debt, both in terms of a company’s ability to repay financial liabilities and the impact on equity values.

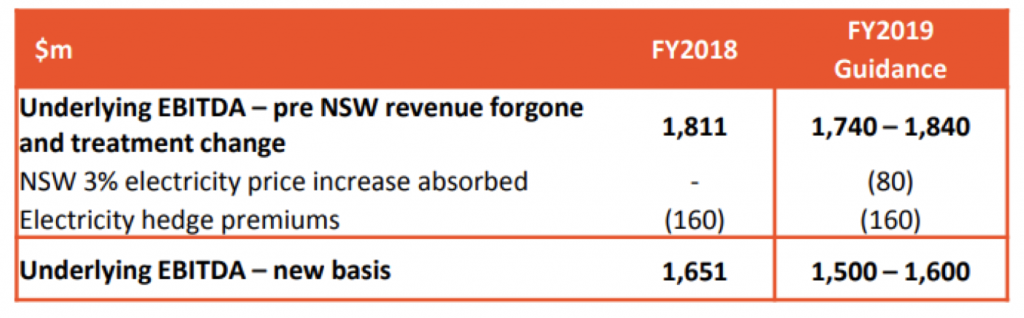

Consider Origin Energy, an integrated energy company with a portfolio of energy retailing (where it is the market leader), electricity generation (renewable and non-renewable) and integrated gas (domestic and export sales), and one of the largest 30 companies listed on the ASX by market capitalisation. In its guidance for FY2019, the company informed the market it will commence expensing $160 million of electricity hedge premiums to the Profit and Loss statement that were previously capitalised. Along with absorbing an electricity price increase in NSW, this led to Origin’s guidance in its Energy Markets division declining ~$250 million relative to previous expectations.

Origin Energy – Energy Markets Guidance

Source: Company presentations

While the $160 million is only 10 per cent of Origin’s Energy Market EBITDA, the market now considers this as “lost earnings”, despite the hedge premiums being a necessary cash impost for the business (one that admittedly has grown with the business). On the positive side, transparency of its financial accounts and cash-flow reconciliation should improve in coming years as the $160 million was confirmed by the company to always reside in operating cash-flow.

In terms of the market’s assessment of lost “value”, the Origin’s Energy Market division is frequently compared to AGL’s business which is currently trading at ~7x EV to EBITDA for FY2019. Applying the 7x EBITDA (rightly or wrongly, as we have explained in this post) to the hedge premium expense of $160 million equates to just over $1.1 billion of capitalised value, or ~65 cents per share. This helps to explain a significant portion of the ~A$1.50/sh decline (-15 per cent) the shares have endured since releasing its FY2018 result last Thursday, despite the company unveiling a 110 per cent uplift in underlying Net Profit to $838 million and a $1.6 billion reduction in net debt for FY2018.

The dramatic share price fall underlines how difficult it is to predict when sentiment may turn on a company’s inability to consistently generate operating cash and serves as a reminder to focus on operating cash flow metrics as well as reported earnings when analysing a company’s financial results.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Max Zan

:

Hi Joseph

Good to see that you are one Analyst that places importance on Operating Cash Flow when assessing a Business – there are many that don’t. Some even use Underlying EPS as a proxy for Free Cash Flow ( Operating Cash Flow less Capex) when it’s very rare for the two numbers to ever be the same.

My comments (27/8) on this very issue (see Tim’s recent article ) and your comments here all make sense.

We should all keep in mind that – “Revenue is vanity, profit is sanity but Cash Flow is reality. ”

Cheers

Max