Watch out for rising bond yields (Part 2)

In my blog dated 6 May 2015, I cautioned investors on the recent increase in ten year sovereign bond yields. Unsurprisingly interest rate sensitive and yield driven stocks have reacted negatively.

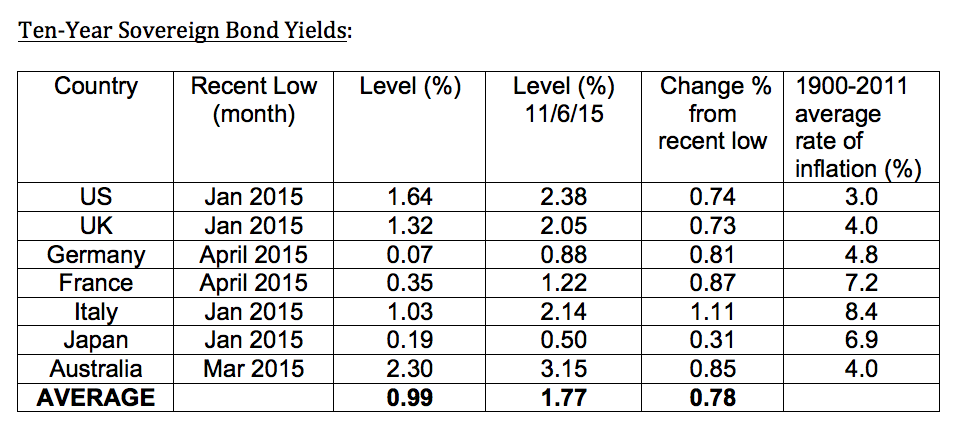

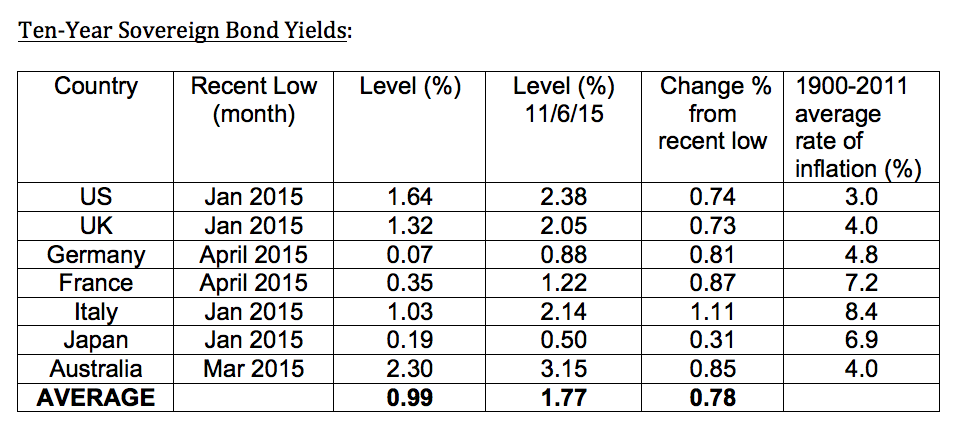

I took seven countries; the US, the UK, Germany, France, Italy, Japan and Australia, and noted their record low ten year sovereign bond yield was, on average, 0.99 per cent.

The sell-off to 1.53 per cent, on average, by 5 May has continued to 1.77 per cent. I would be less concerned if this 0.78 per cent retreat was accompanied by a stronger global economy, but I am just not sure if that is the case.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

Thanks for the update David. At what point do we start to see soveign interest rate increases impacting interest rates on “main street” ie. is there a level where the RBA stops having influece over the cost of credit in Aus ?

Thanks Con,

I think that is beginning with a couple of the Banks either not passing on all the recent decreases in monetary policy (to 2.25% in February and 2.00% in May) and also cutting all discounting.