Wake up Australia!

We know economists have an unenviable task and can make sheep look like independent thinkers, but their ‘miss’ at the weekend in Canada stands out more for the warning it represents for Australia.

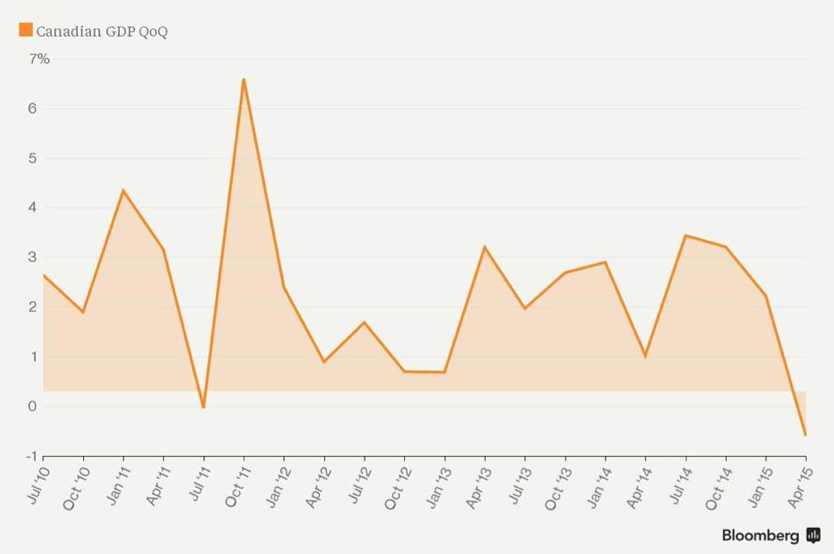

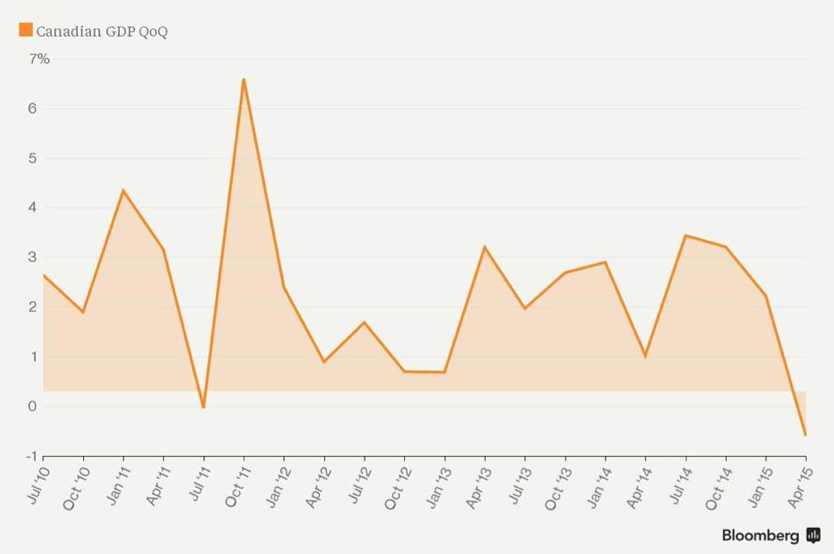

According to Bloomberg reports, Canada’s economy shrank between January and March.

Let’s not say ‘recession’.

The decline was the first in four years and the largest since the 2009 recession as collapsing energy prices produced a plunge in business investment.

Canada’s Gross Domestic Product (GDP) fell 0.6 percent annualised in the first quarter.

“The drop exceeded all 22 economist forecasts in a Bloomberg News survey, in which the median call was for an expansion of 0.3 percent.”

“Bank of Canada Governor Stephen Poloz predicted this week growth in the first quarter would be flat. He also held the bank’s benchmark rate at 0.75 percent, where it’s been since a quarter-point cut in January — a move he called “insurance” against the oil-price shock.”

“Bank of Canada Governor Stephen Poloz predicted this week growth in the first quarter would be flat. He also held the bank’s benchmark rate at 0.75 percent, where it’s been since a quarter-point cut in January — a move he called “insurance” against the oil-price shock.”

One of the economists who got it wrong was Avery Shenfeld, chief economist at CIBC World Markets in Toronto. He described the result as “clearly disappointing” but the report did not make it clear whether he was disappointed with the GDP number or his call.

A US GDP revision over the weekend had GDP for the first quarter there contracting at 0.7 percent annualised, compared to a previous report of a 0.2 percent gain.

Roger Montgomery is the founder and Chief Investment Officer of Montgomery Investment Management. To invest with Montgomery, find out more.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

“Bank of Canada Governor Stephen Poloz predicted this week growth in the first quarter would be flat. He also held the bank’s benchmark rate at 0.75 percent, where it’s been since a quarter-point cut in January — a move he called “insurance” against the oil-price shock.”

“Bank of Canada Governor Stephen Poloz predicted this week growth in the first quarter would be flat. He also held the bank’s benchmark rate at 0.75 percent, where it’s been since a quarter-point cut in January — a move he called “insurance” against the oil-price shock.”

R.P.Feynman does know the world and can see straight through the inadequate analysis from these leading economists. They really do not do the work necessary to actually forecast the economy nor do they have the necessary data base to correlate the complexity of every element that effects the markets. They are lucky if they have data back anymore than a few decades and of course because of that all they really offer is their opinion which is highly unreliable as Avery Shenfeld displayed. Most of them make their living writing opinion based articles and trying to predict interest rate movements of central banks. The scary thing about these people is that they also advise governments. These are the people who have come up with the negative interest rate policy. Well these genius’s are now finding out that this causes people to withdraw their cash and hoard it drastically reducing the velocity of money. And their response is to then call for the elimination of cash. Simply unbelievable. Have they ever thought of reducing taxes and therefore giving everybody a pay rise. How many of these economists were able to foresee any of the recent bubbles and crisis of the recent past. How many of them can see that they are helping to create the current bond bubble with negative interest rates? Roger are you calling for Australians to wake up because you feel that the economy is about to turn down. That a recession is close. Do you think that a recession would assist in alerting the public that there are some very real problems with the worlds economy?

Don’t believe central banks cannot continue to kick the can down the road for longer than you might have previously thought was possible. Having said that the situation can look precarious through a variety of lenses.

https://www.youtube.com/watch?v=IaO69CF5mbY

Thanks. Challenging for some?